Gift Real Estate With Services

Description

How to fill out Virginia Deed Of Gift?

The Gift Real Estate With Services displayed on this page is a reusable legal template created by qualified attorneys in accordance with federal and local laws and regulations. For over 25 years, US Legal Forms has offered individuals, businesses, and lawyers more than 85,000 validated, state-specific documents for any commercial and personal circumstances. It’s the quickest, easiest, and most reliable method to obtain the paperwork you require, as the service promises the utmost level of data security and anti-malware safeguards.

Obtaining this Gift Real Estate With Services will require just a few straightforward steps.

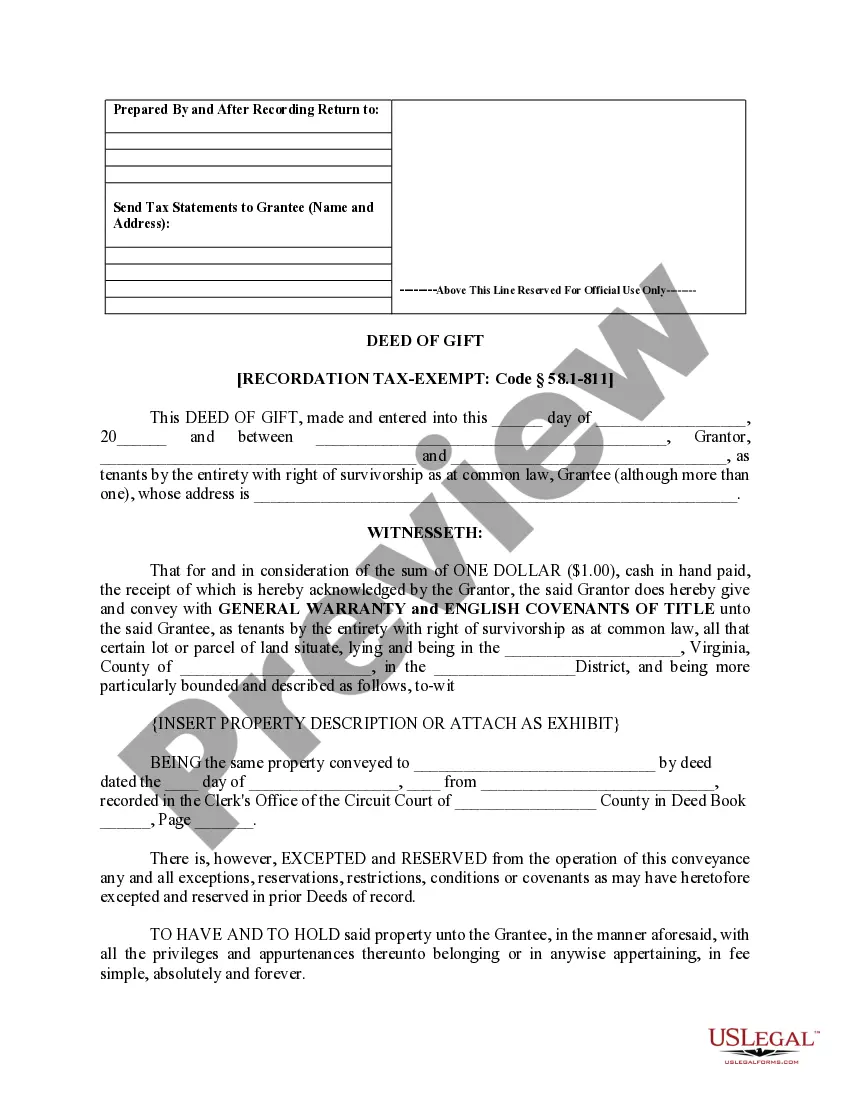

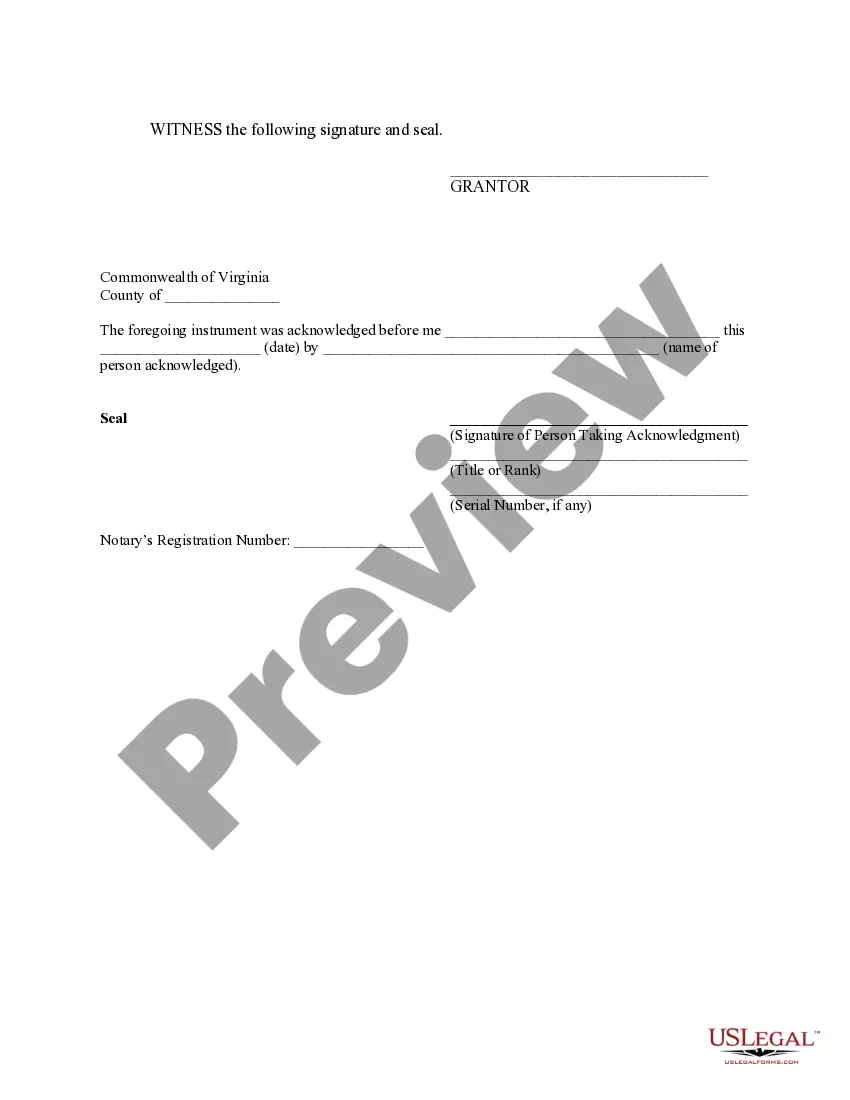

Choose the format you prefer for your Gift Real Estate With Services (PDF, Word, RTF) and download the sample to your device. Complete and sign the documents. Print the template to fill it out by hand. Alternatively, use an online multifunctional PDF editor to efficiently and accurately complete and sign your form with a valid signature. Download your documents again. Use the same document whenever necessary. Access the My documents tab in your profile to redownload any previously saved forms. Register for US Legal Forms to have verified legal templates for all of life’s situations readily available.

- Search for the document you require and examine it.

- Browse through the file you looked for and preview it or review the form description to ensure it meets your requirements. If it does not, utilize the search function to locate the correct one. Click Buy Now when you have found the template you need.

- Subscribe and Log In.

- Choose the pricing option that fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and verify your subscription to continue.

- Obtain the fillable template.

Form popularity

FAQ

Gifting a property involves several important rules that you should understand. First, the IRS has specific limits on how much you can gift without incurring taxes, which can affect your decision. At US Legal Forms, we provide services to help you gift real estate with services, ensuring you follow legal requirements. Consulting a legal expert can also clarify any questions you may have regarding the process.

You can certainly gift your real estate agent to show appreciation for their hard work. However, it is important to consider the value of the gift, as some agents have specific policies regarding receiving gifts. At US Legal Forms, we can help you navigate the rules around gifting real estate with services to ensure you stay compliant. Always check your agent's guidelines to avoid any potential issues.

To avoid paying capital gains tax on gifted property, consider using the annual gift tax exclusion, which allows you to gift a certain amount without incurring tax. Additionally, transferring property to a spouse or charitable organization can create tax advantages. Understanding the intricacies of property gifting can be complex; using services from uslegalforms can help you navigate the process effectively while ensuring you gift real estate with services in a tax-efficient manner.

It is generally seen as a kind gesture to give your real estate agent a gift, especially if they have provided exceptional service. However, it is essential to check the policies of the agency and local regulations regarding gifts, as some may have restrictions. A thoughtful gift can show appreciation for their hard work in helping you gift real estate with services. Always ensure that the gesture remains professional and within acceptable limits.

While you can file a gift tax return yourself, enlisting the help of an attorney is often beneficial. An attorney can ensure that all information is accurately presented and that you meet legal requirements. Moreover, they can guide you through complex aspects of the tax process, making it easier to gift real estate with services. This approach minimizes the risk of errors and ensures compliance with tax laws.

When you gift your son $75,000 toward a down payment, you may encounter gift tax implications. The IRS allows a certain annual exclusion amount, which for 2023 is $17,000 per recipient. If your gift exceeds this amount, you need to file a gift tax return, although you may not owe taxes due to the lifetime exemption. Consulting with professionals who offer services to gift real estate can help you navigate the tax landscape.

To gift real estate effectively, consider working with a qualified professional who understands the legal implications. You can transfer ownership through a deed, ensuring all paperwork is correctly filed. Additionally, explore options like gifting through a trust, which can provide more control over the property. Using services to gift real estate can simplify the process and ensure compliance with all regulations.