Utah Law Death Without Will

Description

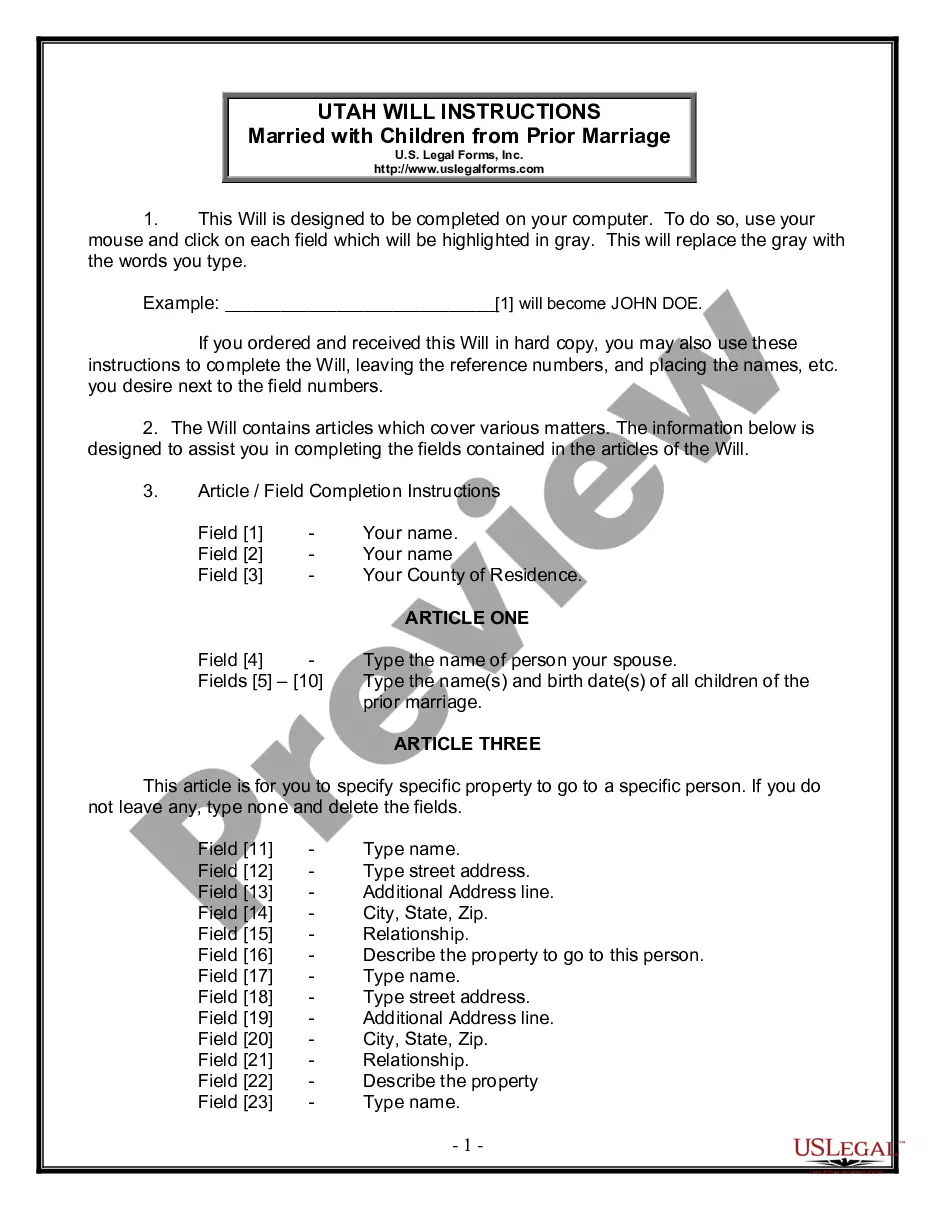

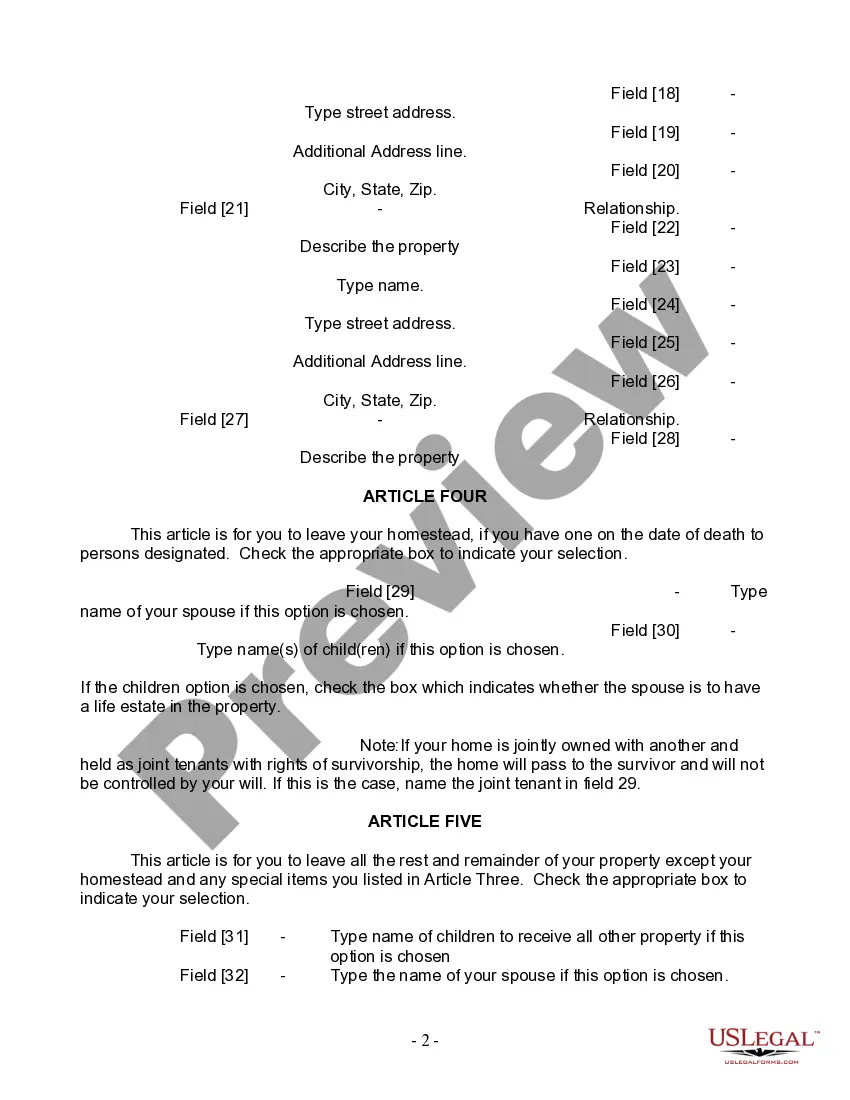

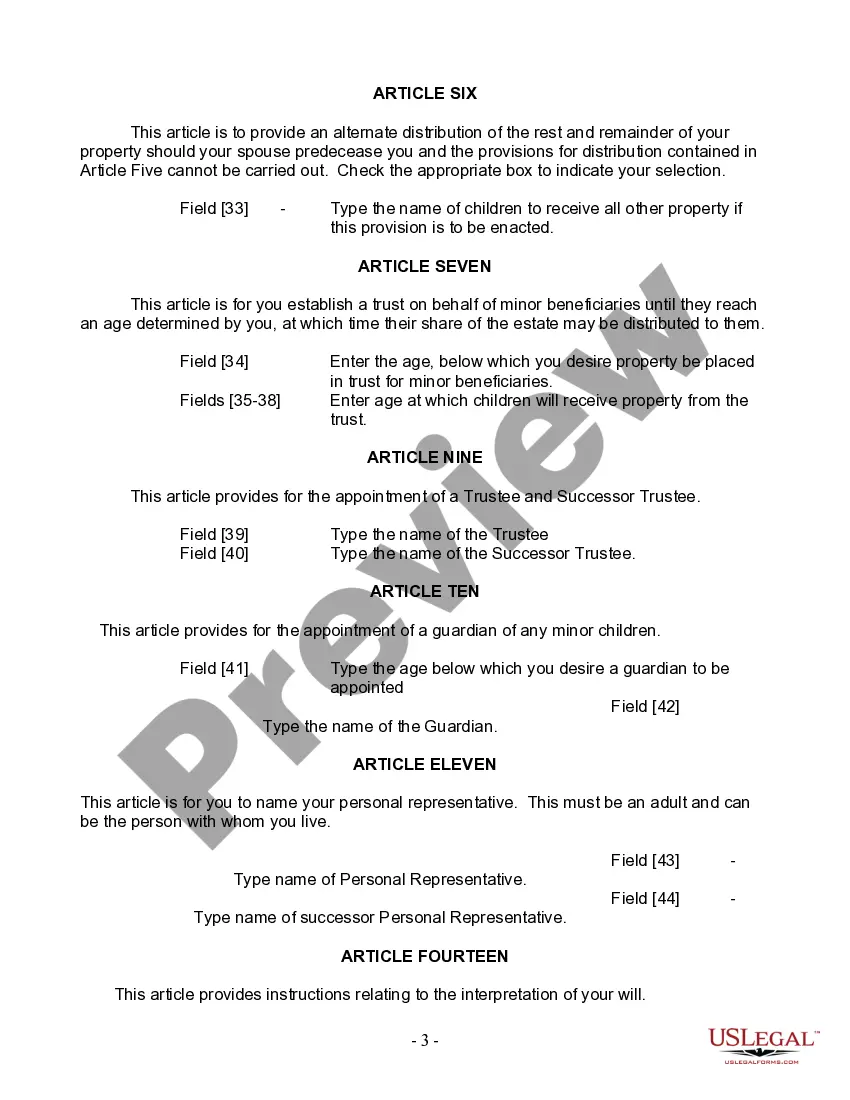

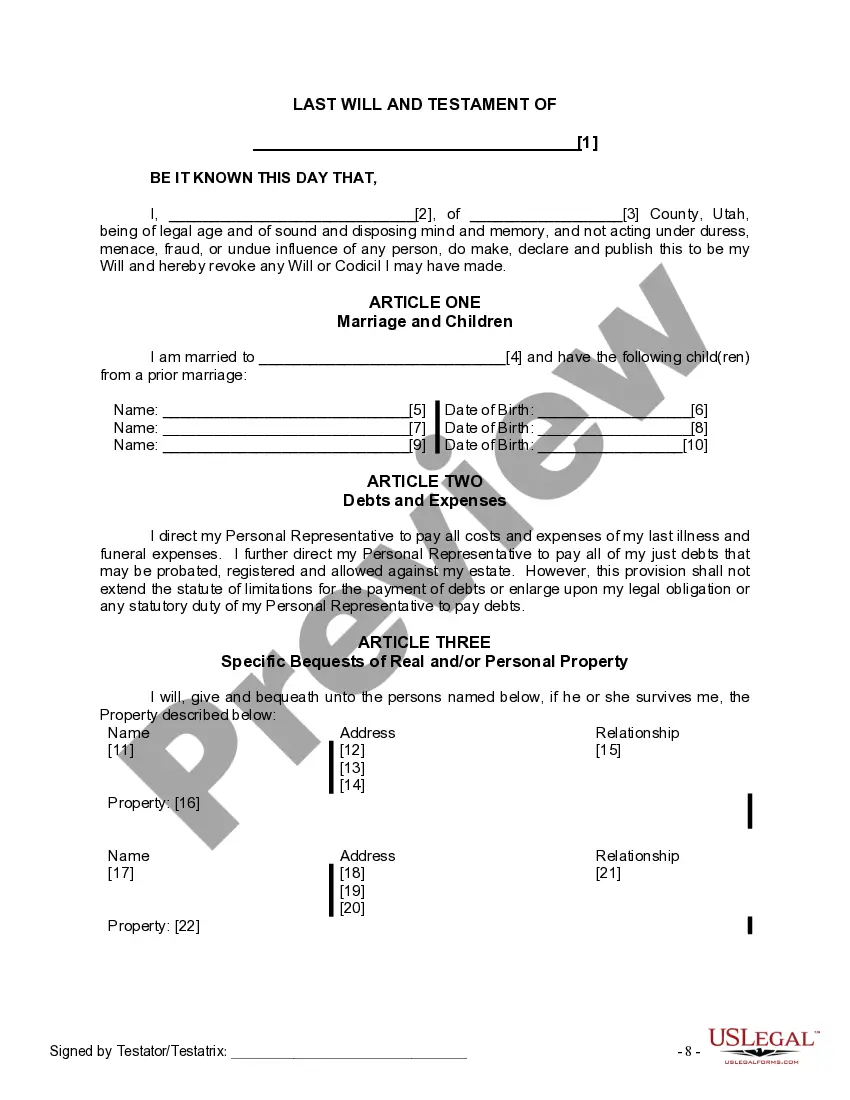

How to fill out Utah Last Will And Testament For Married Person With Minor Children From Prior Marriage?

Obtaining legal document samples that comply with federal and local regulations is essential, and the internet offers numerous options to pick from. But what’s the point in wasting time looking for the correctly drafted Utah Law Death Without Will sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the largest online legal catalog with over 85,000 fillable templates drafted by attorneys for any professional and personal situation. They are easy to browse with all files arranged by state and purpose of use. Our professionals keep up with legislative updates, so you can always be confident your paperwork is up to date and compliant when obtaining a Utah Law Death Without Will from our website.

Obtaining a Utah Law Death Without Will is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the right format. If you are new to our website, adhere to the instructions below:

- Examine the template using the Preview feature or through the text outline to ensure it meets your requirements.

- Browse for a different sample using the search tool at the top of the page if necessary.

- Click Buy Now when you’ve located the right form and select a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Select the best format for your Utah Law Death Without Will and download it.

All documents you locate through US Legal Forms are multi-usable. To re-download and complete earlier obtained forms, open the My Forms tab in your profile. Take advantage of the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

Property that is held in a revocable trust will avoid probate. However, it is not sufficient to just have a revocable trust. The deceased person's property must be held in it when she dies. Once a person signs a revocable trust, she should immediately transfer her property to the trust.

To inherit under Utah's intestate succession statutes, a person must outlive you by 120 hours. So, if you and your brother are in a car accident and he dies a few hours after you do, his estate would not receive any of your property. (Utah Code § 75-2-104.)

Living trusts A living trust is often the best choice for a large estate or if there are many beneficiaries. To avoid probate, most people create a living trust commonly called a revocable living trust.

If the deceased individual wasn't married, their estate would be inherited by their descendants, children, or grandchildren. If there are no descendants, then their estate would be passed on to their parents. If their parents aren't alive, then their assets would pass to their siblings.

The estate has assets (other than land, and not including cars) whose net worth is more than $100,000.