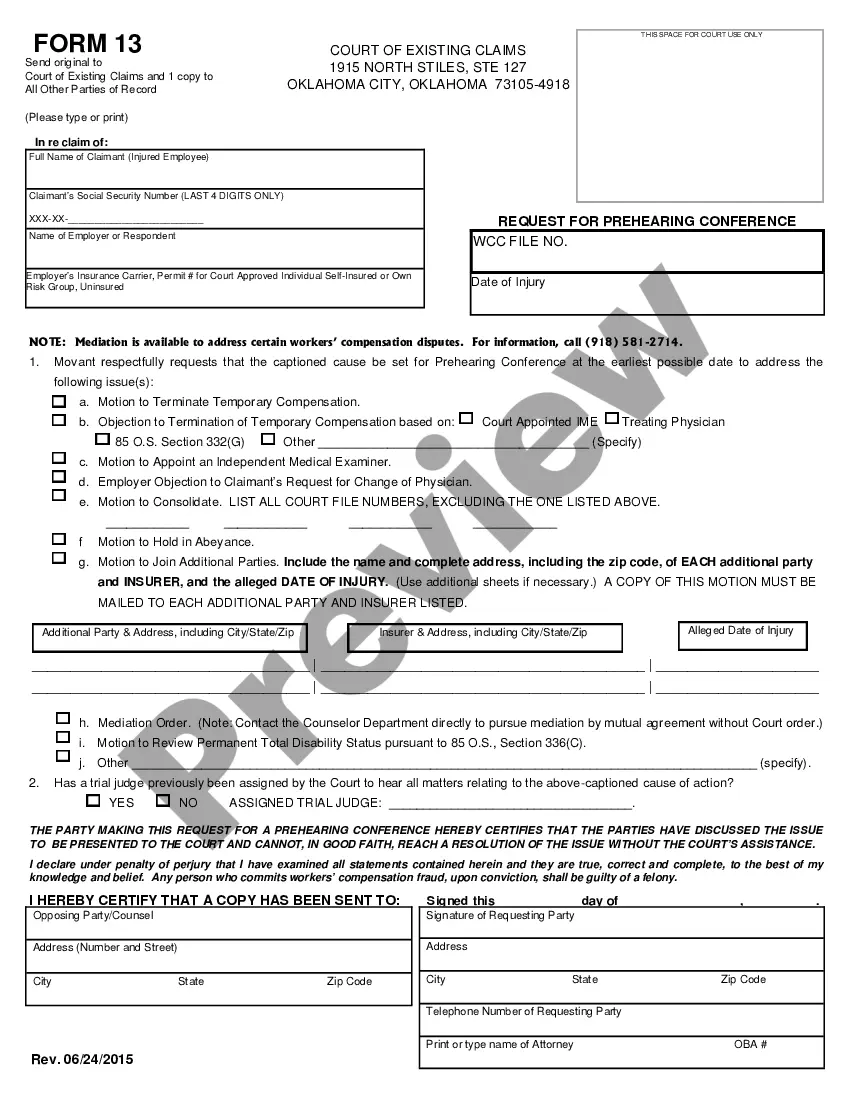

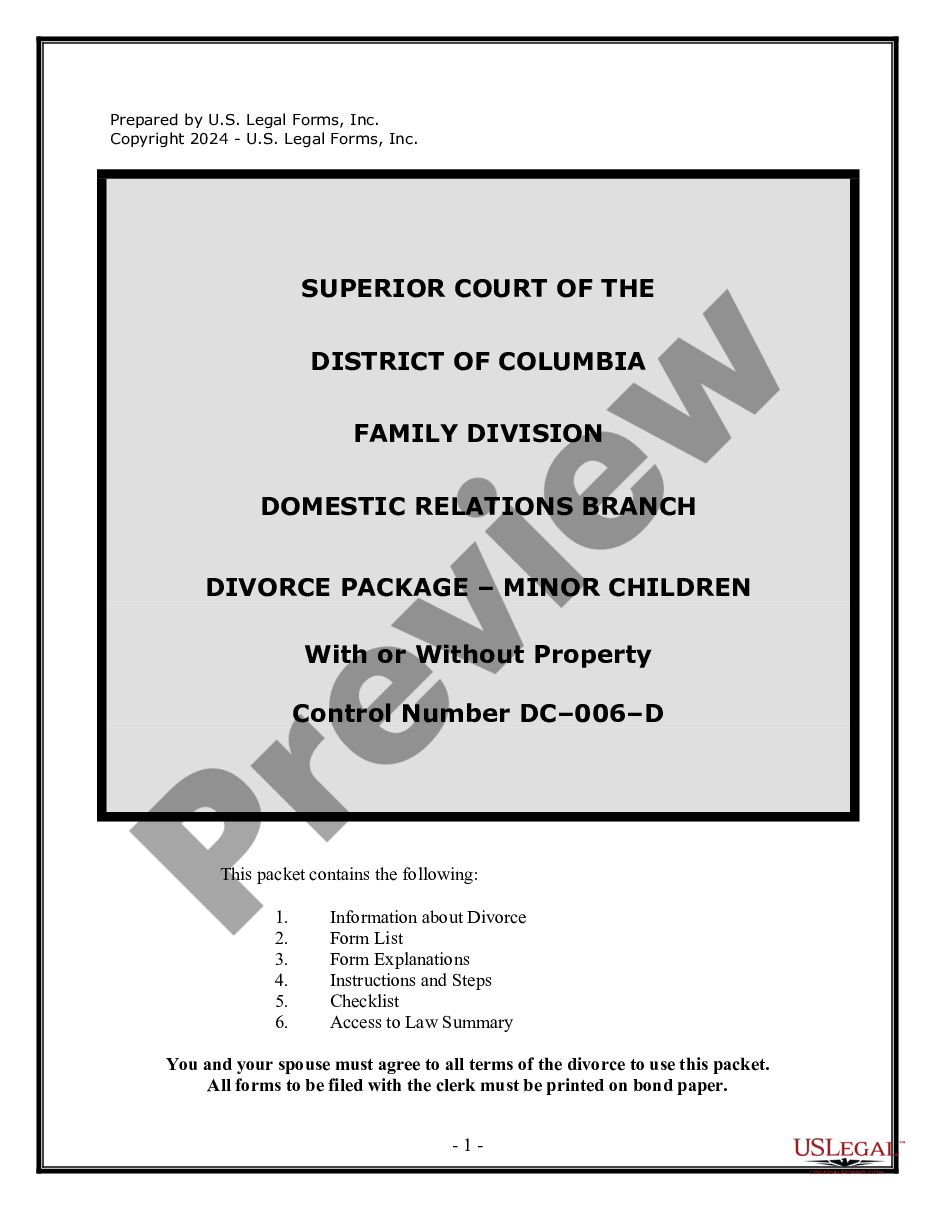

This is an official form from the Utah State Courts, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Utah statutes and law.

Utah Child Support Table For 2022

Description

How to fill out Utah Base Combined Child Support Obligation Table And Low Income Table 78 - 45 - 7 . 14 For Reference?

Creating legal documents from the ground up can occasionally be overwhelming. Some situations may entail extensive research and significant financial investment. If you’re looking for a more straightforward and cost-effective method for producing the Utah Child Support Table For 2022 or any other documents without unnecessary complications, US Legal Forms is always available to assist you.

Our online library of more than 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal needs. With just a few clicks, you can swiftly obtain state- and county-compliant templates meticulously crafted for you by our legal experts.

Utilize our platform whenever you require a trustworthy and dependable service through which you can effortlessly locate and download the Utah Child Support Table For 2022. If you’re already familiar with our site and have previously created an account with us, simply Log In to your account, select the template, and download it immediately or access it again later in the My documents section.

Not registered yet? No worries. It only takes a few minutes to sign up and browse the collection. But before proceeding to download the Utah Child Support Table For 2022, consider these tips.

US Legal Forms boasts an impeccable reputation and over 25 years of expertise. Join us now and make form completion a simple and efficient process!

- Review the document preview and descriptions to confirm that you are on the correct form you are looking for.

- Ensure that the form you choose adheres to the regulations and laws of your state and county.

- Select the appropriate subscription option to acquire the Utah Child Support Table For 2022.

- Download the form. Then complete, sign, and print it out.

Form popularity

FAQ

There are two ways to ask the court to change child support ? a Motion to Adjust and a Petition to Modify. A motion is simpler and usually faster, but can only be used in limited circumstances. Usually, you must file a petition.

(1) As used in the guidelines, "gross income" includes prospective income from any source, including earned and nonearned income sources which may include salaries, wages, commissions, royalties, bonuses, rents, gifts from anyone, prizes, dividends, severance pay, pensions, interest, trust income, alimony from previous ...

Up to 50% of a person's income can be withheld from the paycheck for child support. This is the legal maximum under Utah state code 62A-11-320, which is subordinate to Section 303(b) of the Consumer Credit Protection Act, 15 U.S.C.

Child support is calculated using the gross monthly income of both parents and the number of overnights the child spends in each household.

A new spouse's income isn't included in the child support calculations. But if the new marriage results in a substantial change in the parents' relative wealth or assets, a judge might modify child support based on that change.