Utah Limited Partnership With Law

Description

Form popularity

FAQ

The distinction between an LLP, or Limited Liability Partnership, and a standard partnership is significant. In an LLP, all partners have limited liability protection, meaning personal assets are safer from business creditors. However, in a traditional partnership, partners share equal liability and risk. Choosing between these structures often depends on your business goals and the level of risk you are willing to assume.

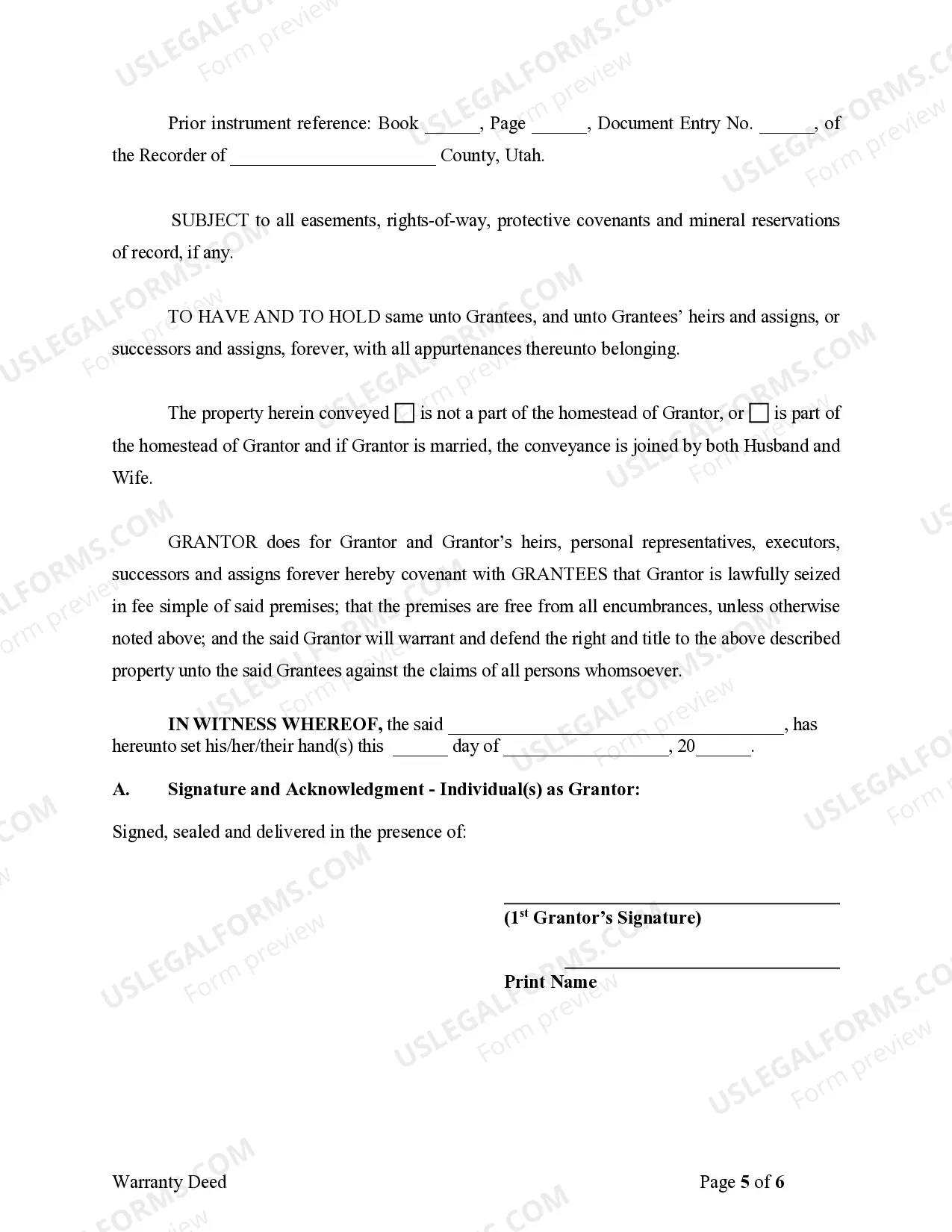

Limited partners in a Utah limited partnership with law face restrictions primarily related to their involvement in management activities. They cannot take part in day-to-day operations without risking their limited liability status. Additionally, they must adhere to the terms laid out in the partnership agreement. Understanding these restrictions helps limited partners protect their investment while enjoying the benefits of limited liability.

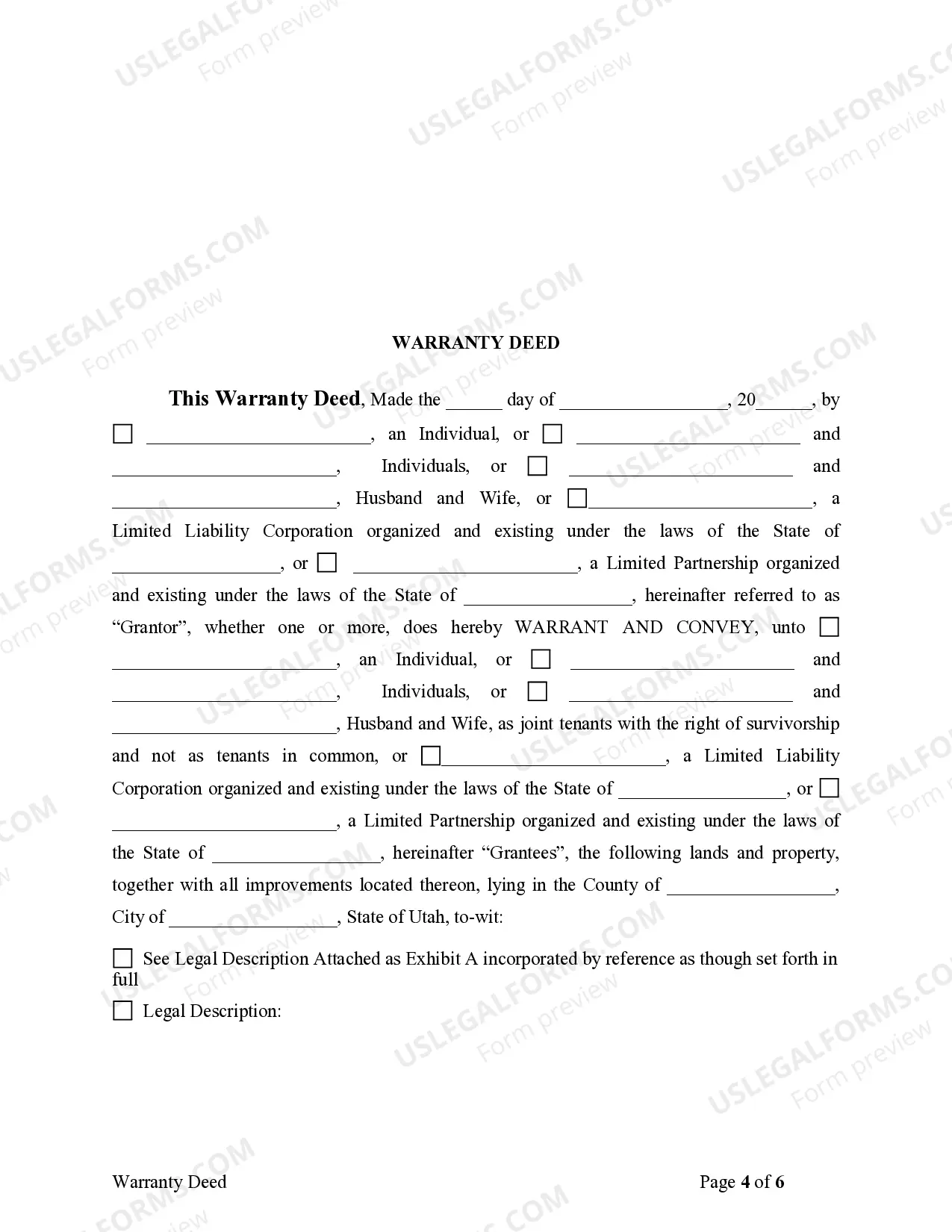

In a legal context, a limited partnership in Utah is recognized as a separate legal entity, distinct from its partners. This means the partnership can own property, enter contracts, and sue or be sued independently of its partners. The legal structure allows limited liability for certain partners, protecting their personal assets from business debts. This entity designation is essential for anyone considering business formation.

Rules for a limited partnership in Utah, as dictated by law, include registration requirements, maintaining a defined partnership agreement, and adhering to state regulations. The partnership must file a certificate of limited partnership with the state to operate legally. Compliance with operational rules is crucial, including proper reporting and fulfilling tax obligations. Understanding these rules can help ensure your partnership remains in good standing.

The primary difference between a partnership and a limited partnership lies in liability and involvement. In a standard partnership, all partners share equal liability and responsibilities, whereas, in a Utah limited partnership with law, some partners have limited liability based on their investment. Limited partners do not partake in managing the business, ensuring they protect their personal assets. This distinction can significantly influence your choice of business structure.

Limited partners in a Utah limited partnership with law must fulfill specific obligations, primarily related to their financial contributions. They are required to invest agreed-upon amounts and adhere to terms outlined in the partnership agreement. Additionally, while they do not manage day-to-day operations, they must remain informed about the partnership's activities. Failing to meet these obligations can lead to losing their limited liability status.

The limits of a limited partnership center around the roles and responsibilities of its partners. In a Utah limited partnership with law, general partners have unlimited liability, while limited partners enjoy limited liability, meaning they are only liable for amounts they invested. This structure encourages investment without exposing personal assets to business debts. However, limited partners cannot participate in daily management decisions, which is a key limitation.

A limited partnership is formed by filing the Certificate of Limited Partnership with the Utah Secretary of State. This document must outline the names and addresses of the general and limited partners. Additionally, establishing a clearly defined partnership agreement is crucial for smooth operations within your Utah limited partnership with law.

Yes, you can act as your own registered agent in Utah. This option allows you to receive legal documents directly, which can be convenient. However, keep in mind that you must provide a physical address for your registered agent as part of your business registration.

To form a partnership in Utah, begin by selecting a unique business name and drafting a partnership agreement. Next, file your Certificate of Limited Partnership with the state. Make sure to include all required details about each partner to ensure compliance with local laws.