Limited Business

Description

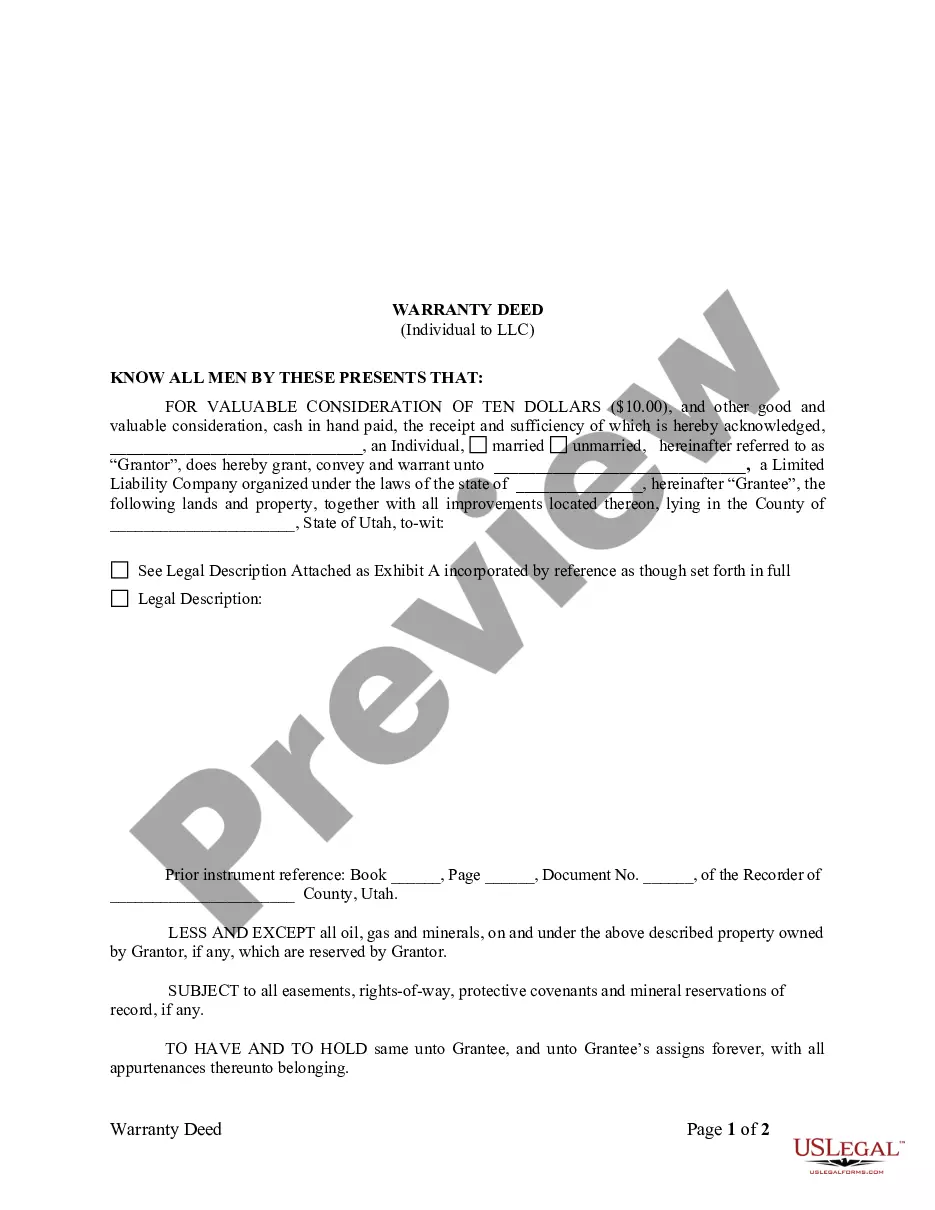

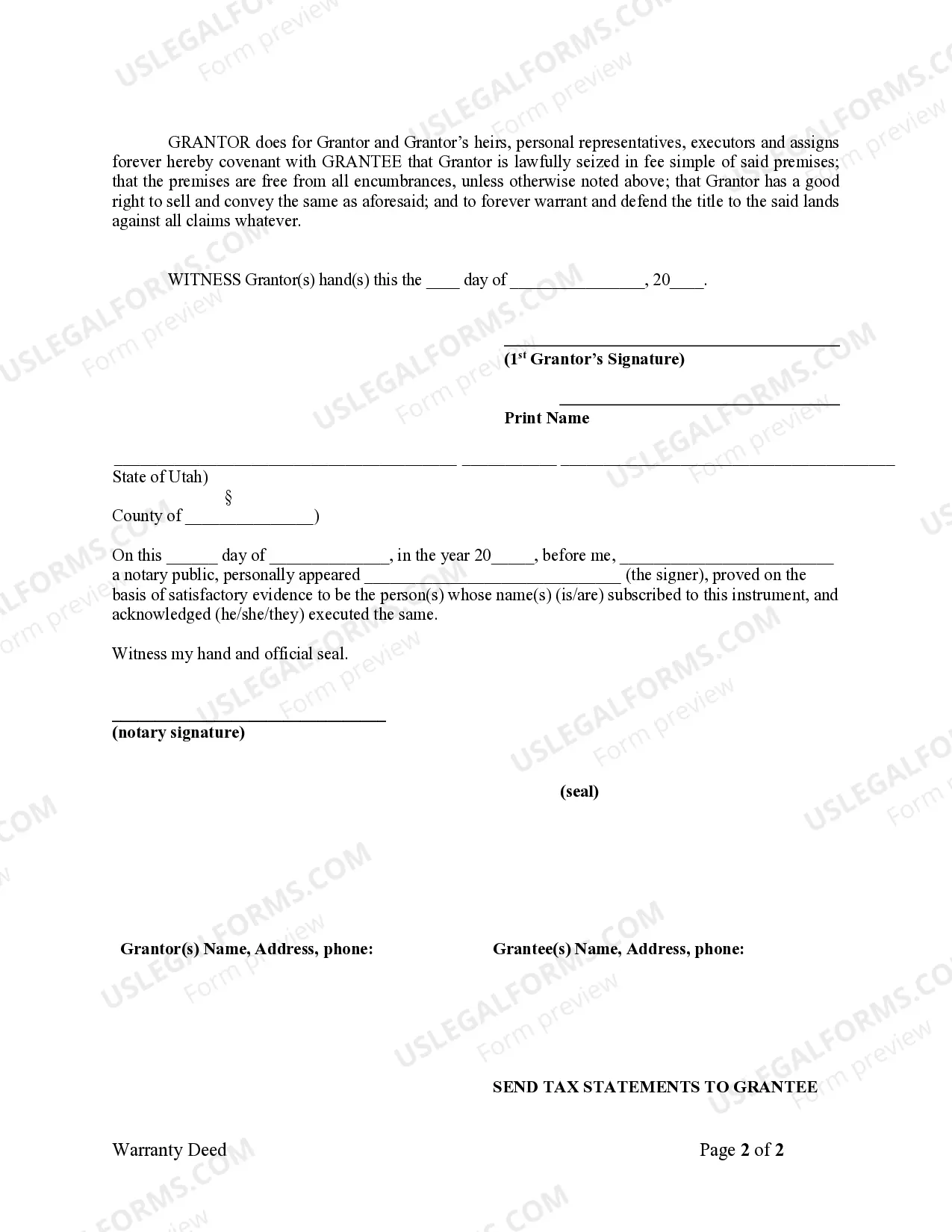

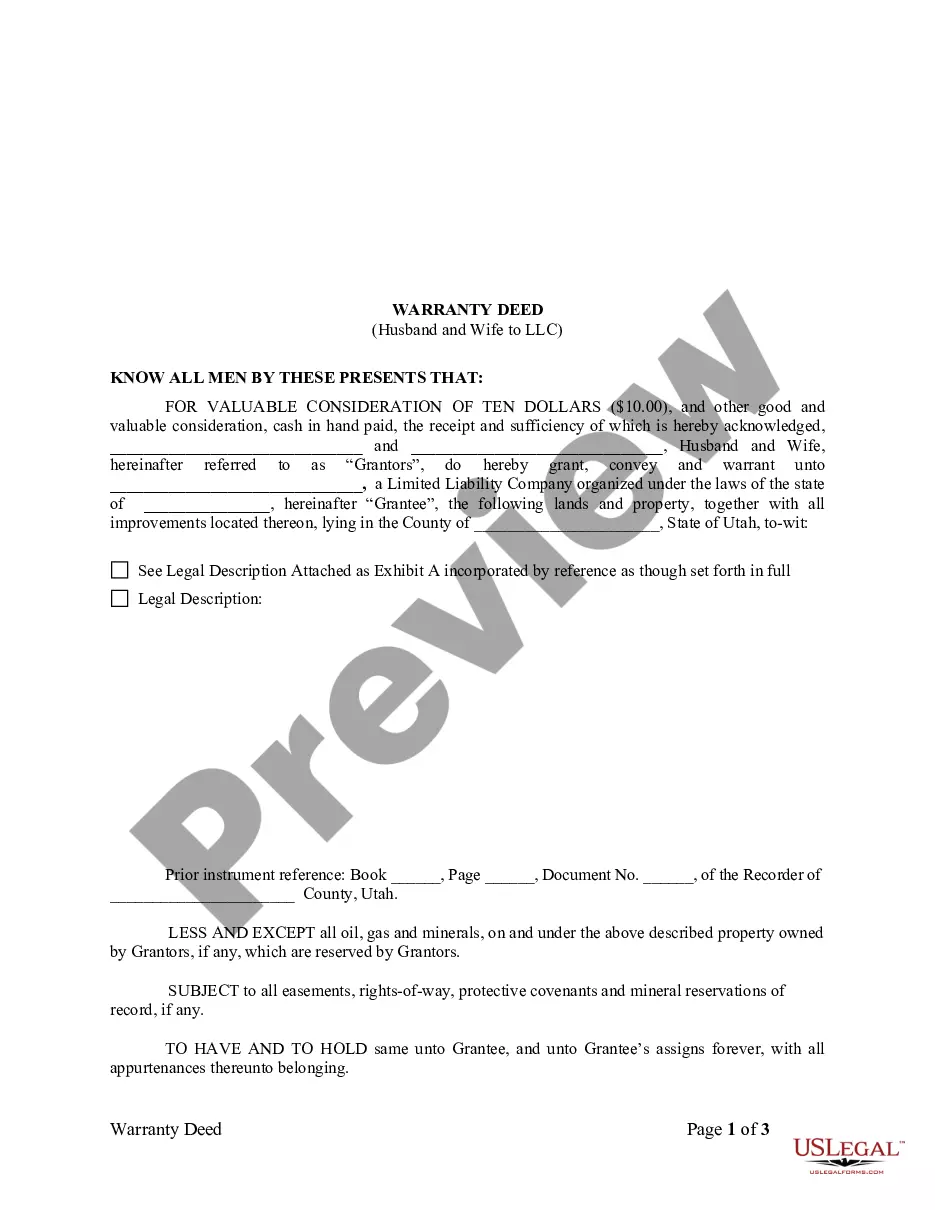

How to fill out Utah Warranty Deed From Individual To LLC?

- If you are a returning user, log in to your account to retrieve the desired form. Ensure your subscription is active; if not, renew according to your plan.

- Begin by checking the Preview mode to review the form description. Confirm that it aligns with your specific needs and local jurisdiction requirements.

- If the form is not what you need, utilize the Search feature to find an alternative that better suits your requirements.

- Once you’ve selected your form, proceed by clicking the Buy Now button and choosing your preferred subscription plan. Be sure to create an account for full access to the library.

- Finalize your purchase by entering your payment details, either with your credit card or through PayPal.

- After the transaction is successful, download the form to your device. You can always access it later in the My Forms section of your profile.

In conclusion, US Legal Forms simplifies the process of accessing legal documents for limited businesses, offering a robust collection that surpasses competitors and access to expert assistance. Take advantage of this resource to ensure your legal needs are met efficiently.

Start your journey today by visiting US Legal Forms and discover the benefits for yourself!

Form popularity

FAQ

A limited business typically includes limited liability companies (LLCs) and limited companies (Ltd.) which restrict personal liability for debts. These structures are common among small enterprises and startups, providing a platform for entrepreneurs to grow their endeavors. By leveraging these limited structures, you can minimize personal financial risks associated with running a business.

In business, 'limited' refers to the restriction of personal liability for the owners and shareholders. When a company is labeled as limited, it signifies that financial obligations and liabilities are confined to the company's assets. This limitation is crucial for protecting personal wealth while pursuing business activities.

To qualify as a limited company, a business must register with the appropriate state authority and meet required regulations. It should also have a formal structure that includes directors and shareholders. Furthermore, the company must file annual reports and adhere to financial transparency standards.

An example of a limited business could be an online retail store registered as an LLC or a corporation. This structure helps keep personal and business finances distinct, thus providing liability protection. By choosing this route, business owners can focus on growth without the stress of personal financial risk.

An example of a limited liability company, or LLC, might be a small bakery owned by a couple. In this setup, the bakery operates as a limited business, separating personal assets from company liabilities. If the bakery faces financial challenges, the owners’ personal savings, home, or other properties stay protected from creditors.

A limited company is a separate legal entity that protects its owners' personal assets from business debts. This structure means that, in case of failure or debts, only the company's assets are at risk, not the owner's personal wealth. Instead of individual ownership, a limited business often involves shareholders who own shares in the company, making it easier to raise capital.

The choice between LTD and LLC depends on your specific business needs and structure preferences. An LTD often follows different regulations, usually in the UK, with stricter governance compared to the flexibility of an LLC in the United States. Assessing your business goals, liability concerns, and management style will help determine the best option for your limited business. Consulting uslegalforms can provide you with the information needed to make an informed decision.

You cannot interchangeably use 'limited' and 'LLC' as they serve different legal functions. An LLC provides liability protection and flexibility in management, while 'limited' typically designates limited partnerships. If you're considering forming a business under a specific structure, understanding these terms is crucial. Uslegalforms can guide you through the terminology and legal requirements.

A private limited company and an LLC are distinct entities despite some similarities in liability protection. While both limit personal liability, their regulations and tax treatments differ significantly. In the US, an LLC offers flexibility in management and taxation, following state-specific rules, whereas a private limited company operates under different guidelines. To explore the benefits of each type for your limited business, check out uslegalforms.

Legally, you cannot simply replace LLC with 'limited' in your business name as they represent different entities. An LLC, or Limited Liability Company, offers specific protections and operational guidelines that a limited partnership does not. If you are transitioning from an LLC, or starting a new limited business, it's essential to understand these differences fully. Our platform can help you navigate these options.