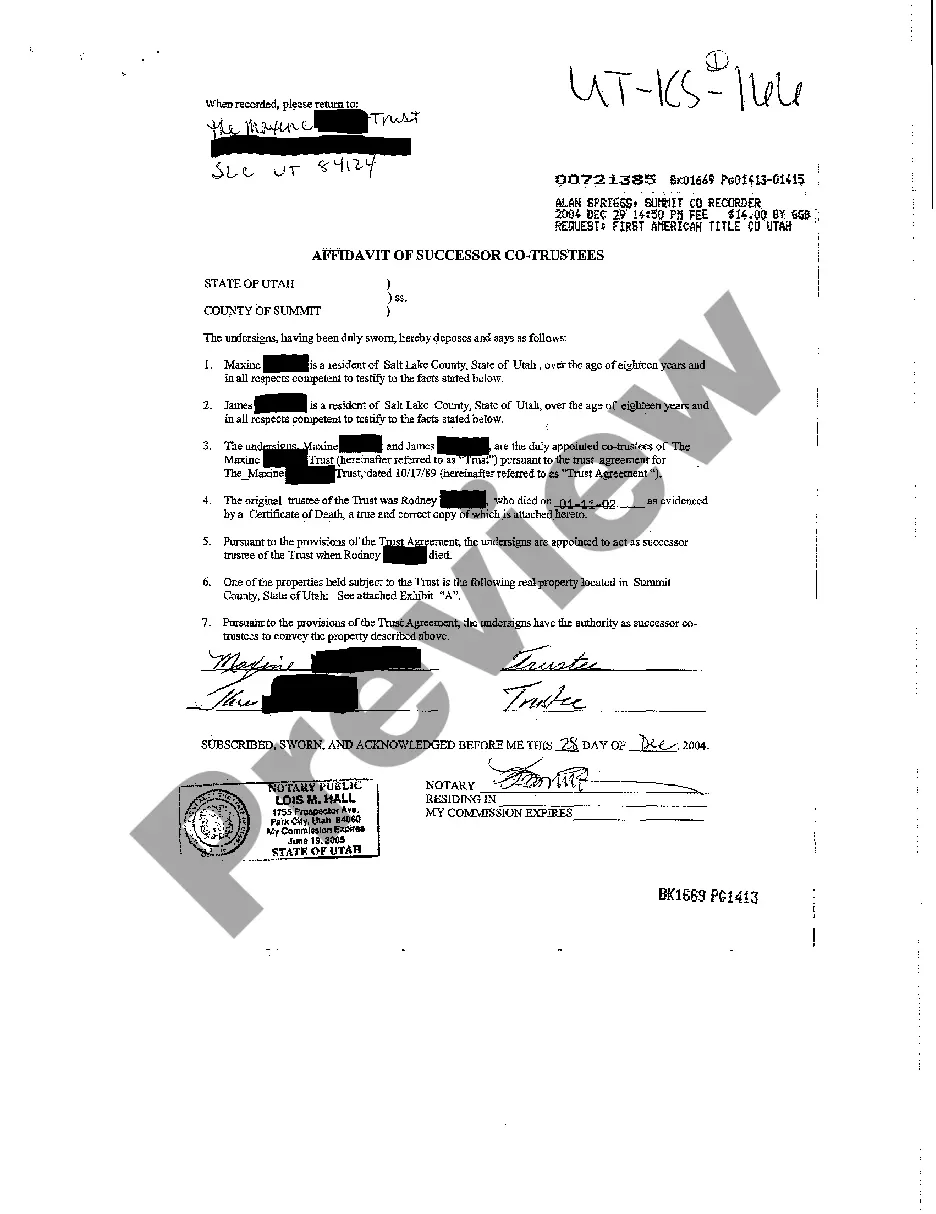

Affidavit Of Successor Trustee Form

Description

How to fill out Utah Affidavit Of Successor Co-Trustees?

There's no longer a need to spend hours searching for legal documents to satisfy your local state regulations. US Legal Forms has compiled all of them in one location and made them easier to access.

Our platform offers over 85,000 templates for any business and personal legal situations categorized by state and area of use. All forms are properly drafted and verified for accuracy, ensuring you receive an up-to-date Affidavit Of Successor Trustee Form.

If you are already acquainted with our service and possess an account, you need to verify that your subscription is active before accessing any templates. Log In to your account, select the document, and click Download. You can also revisit all previously acquired documents anytime you need by accessing the My documents section in your profile.

Print your form to complete it by hand or upload the sample if you prefer to edit it in an online editor. Preparing formal documents according to federal and state regulations is quick and easy with our platform. Try US Legal Forms today to keep your paperwork organized!

- If you've never utilized our service before, the process will require a few additional steps to complete.

- Here’s how new users can find the Affidavit Of Successor Trustee Form in our library.

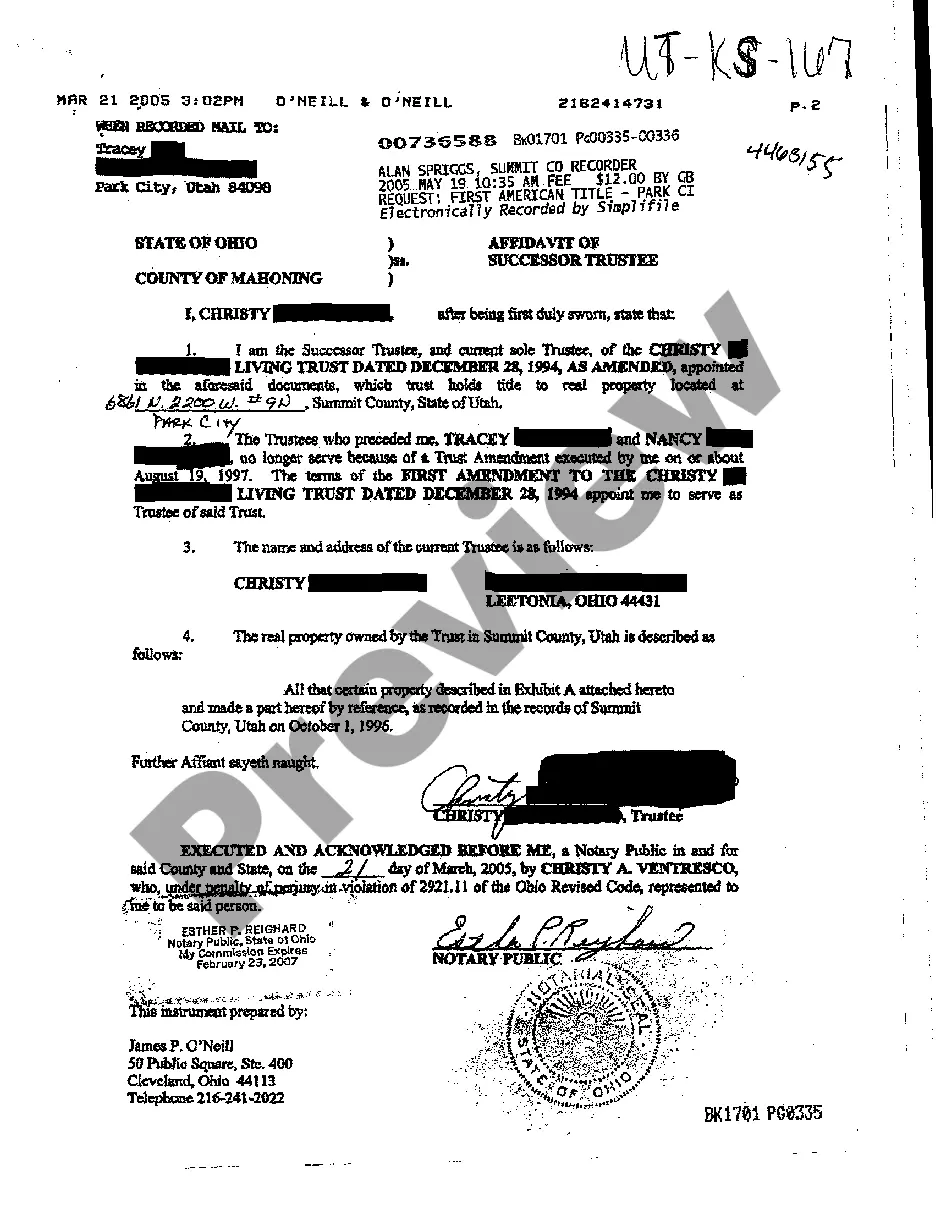

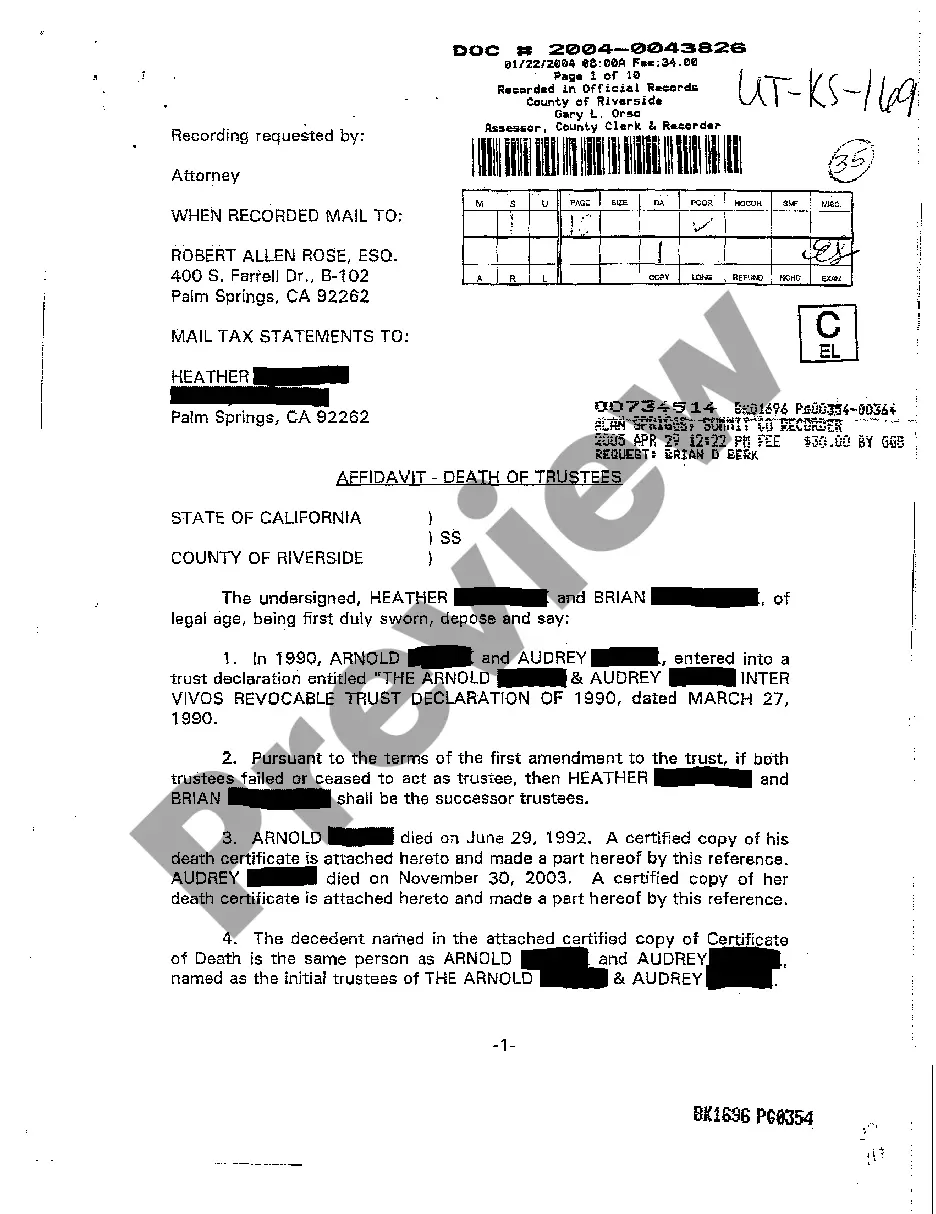

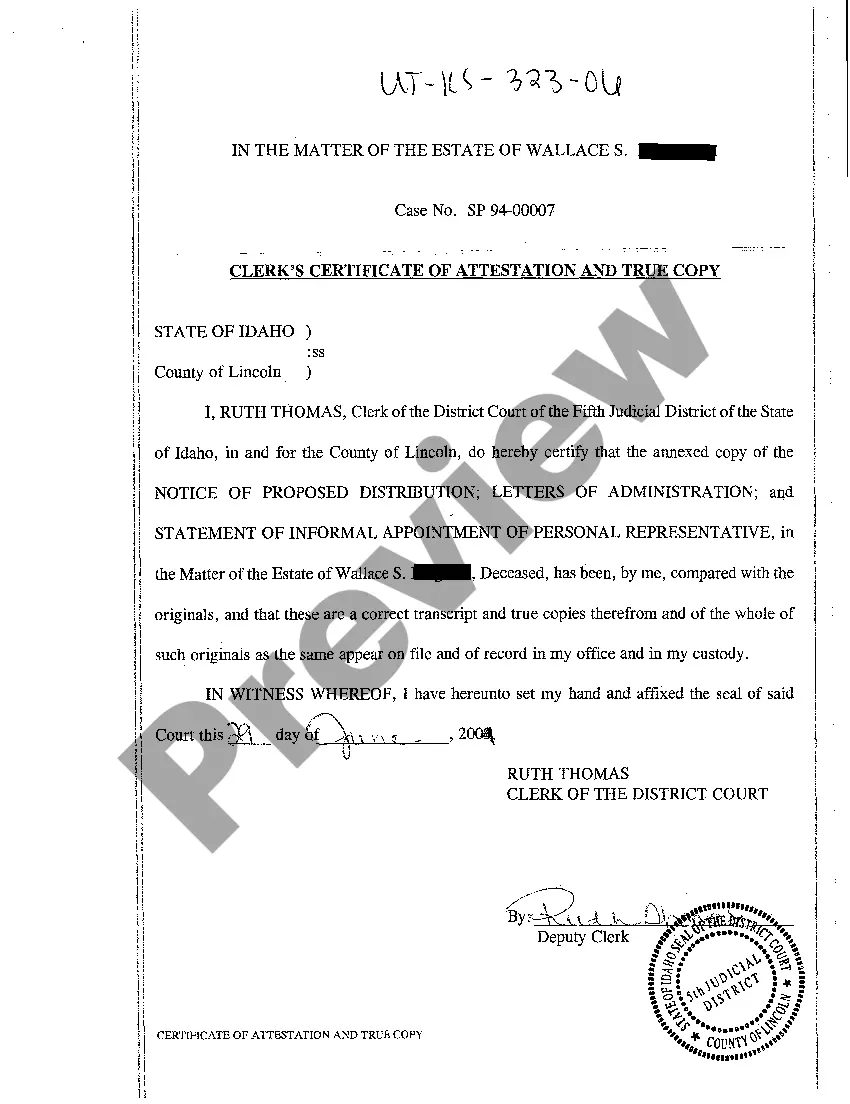

- Examine the page content thoroughly to ensure it includes the sample you require.

- To do this, use the form description and preview options, if available.

- Use the Search field above to find another template if the previous one does not meet your needs.

- Click Buy Now next to the template title when you discover the suitable one.

- Choose your preferred pricing plan and either register for a new account or Log In.

- Make your payment for the subscription using a credit card or via PayPal to proceed.

- Select the file format for your Affidavit Of Successor Trustee Form and download it to your device.

Form popularity

FAQ

You also need to understand that there is a distinction to be made between who inherits a trust when someone dies (the beneficiaries) and who shall have the responsibility of administering the trust, paying the bills and taxes, and distributing what's left to the beneficiaries (the successor trustees).

The Trustee should include the following information in the notification package:The name of the Grantor and the date that the trust instrument execution date.Contact information for each Trustee, including name, address, county of residence, and phone number.Certified copy of the death certificate of the Grantor.More items...

If title to an interest in real property is affected by a change of trustee, the successor trustee may execute and record in the county in which the property is located an affidavit of change of trustee.

HOW DO I RECORD AN AFFIDAVIT? Take a certified copy of the death certificate of the deceased joint tenant and your affidavit to the recorder's office in the county where the real property is located. The recorder's office also requires a Preliminary Change of Ownership Report (PCOR) when filing the affidavit.

It's perfectly legal to name a beneficiary of the trust (someone who will receive trust property after your death) as successor trustee. In fact, it's common. EXAMPLE: Mildred names her only child, Allison, as both sole beneficiary of her living trust and successor trustee of the living trust.