Utah Closing Disclosure Form

Description

Form popularity

FAQ

To count the three days for the Utah closing disclosure form, start from the day the lender provides you with the document. This includes Saturdays but excludes Sundays and public holidays. If the document is provided electronically, the counting begins the following day. Always check with your lender to ensure you understand the timing and receive your disclosure promptly.

You cannot generally waive the three-day waiting period for the Utah closing disclosure form. This waiting period is required by law to give borrowers time to review the terms and conditions before proceeding to closing. However, specific circumstances might allow for a mutual agreement between parties, but these situations can be rare. Always consult with your lender or real estate professional to ensure you are following the necessary regulations.

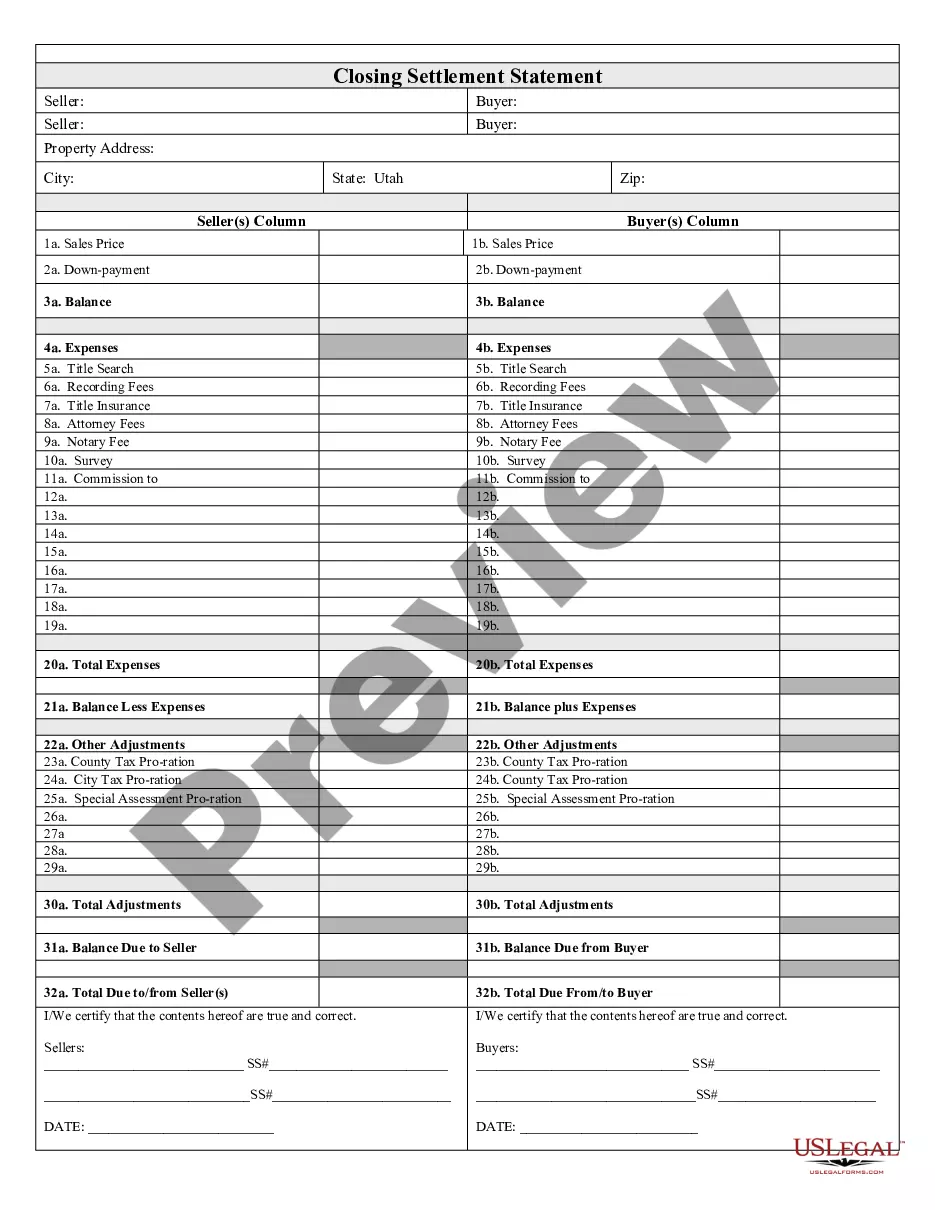

The closing disclosure is provided to the buyer before closing, outlining the final terms of the mortgage agreement. In contrast, the final disclosure is a record that confirms all transactions after closing, including any changes made during the process. Understanding both documents, particularly the Utah closing disclosure form, is essential for a smooth transaction.

The 3-day rule for closing disclosure refers to the requirement that borrowers must receive their closing disclosure at least three business days before closing. This rule ensures buyers have enough time to understand the terms and make informed decisions. The Utah closing disclosure form is essential in adhering to this regulation.

After you receive the initial closing disclosure, you will have three days to review it. During this period, you can ask questions and clarify any doubts regarding the information. If changes occur, a revised closing disclosure may be issued, and you could receive additional time to review.

Yes, Utah is considered a full disclosure state. This means that all parties involved in a real estate transaction must provide accurate information about the property. The Utah closing disclosure form is essential in ensuring that buyers receive complete details regarding costs and terms involved in the transaction.

The closing process typically involves several key steps. First, you will review and sign various documents, including the Utah closing disclosure form. Next, you will make the necessary payments, such as closing costs and down payments. Finally, ownership is officially transferred once all legal documents are recorded.