Utah Llc Formation Documents

Description

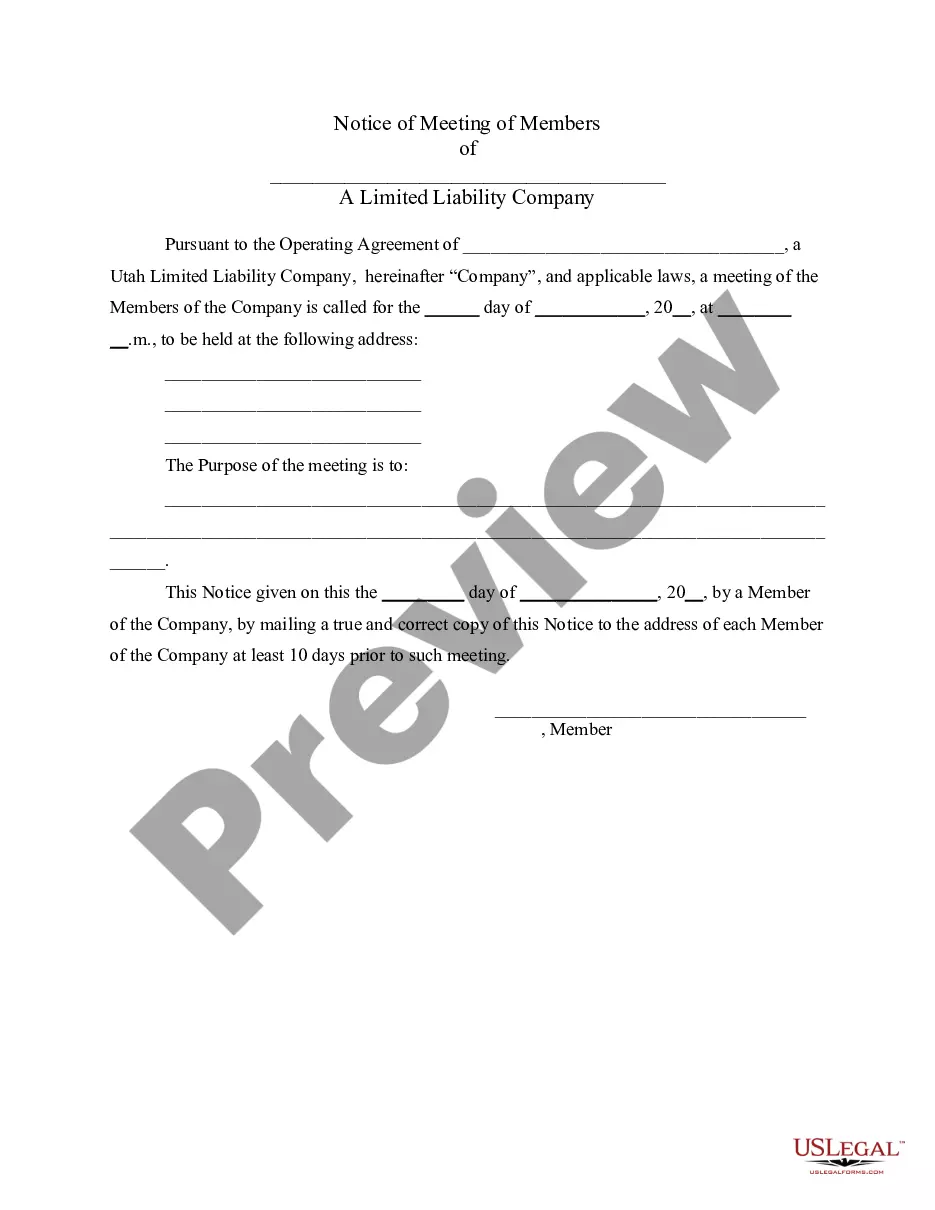

How to fill out Utah LLC Notices, Resolutions And Other Operations Forms Package?

Acquiring legal document examples that comply with federal and local laws is essential, and the web provides numerous alternatives to select from.

However, what is the benefit of spending time hunting for the accurately crafted Utah Llc Formation Documents example online if the US Legal Forms digital library already compiles such templates in one location.

US Legal Forms is the premier online legal repository featuring over 85,000 editable templates created by lawyers for any commercial and personal matter.

Utilize the most comprehensive and user-friendly legal document service available!

- They are straightforward to navigate, with all documents categorized by state and intended use.

- Our specialists stay informed about legislative changes, ensuring that your documentation is always current and compliant when acquiring a Utah Llc Formation Documents from our platform.

- Securing a Utah Llc Formation Documents is quick and easy for both existing and new users.

- If you possess an account with an active subscription, Log In and save the document sample you need in the desired format.

- If you are a first-time visitor to our site, follow the steps below.

Form popularity

FAQ

To get a Certificate of Organization in Utah, complete the application process through the Utah Department of Commerce. You will need to provide essential business information and submit the appropriate Utah LLC formation documents. Using uslegalforms can simplify this process, ensuring you have all required forms ready for submission.

A Utah certificate often refers to the certificate of organization, which officially establishes your LLC in the state. This document outlines important information about your business, such as its name and registered agent. To obtain this certificate, you'll need specific Utah LLC formation documents. Make sure to gather all necessary paperwork before proceeding.

Your LLC must file an IRS Form 1065 and a Utah Partnership Return (Form TC-65). LLC taxed as a Corporation: Yes. Your LLC must file tax returns with the IRS and the Utah State Tax CommissionSTC to pay your Utah income tax. Check with your accountant to make sure you file all the correct documents.

Utah LLC Processing Times Normal LLC processing time:Expedited LLC;Utah LLC by mail:3-7 business days (plus mail time)2 business days ($75 extra)Utah LLC online:2 business daysNot available

Starting an LLC in Utah will include the following steps: #1: Name Your LLC. #2: Nominate Your Registered Agent. #3: File Your Certificate of Organization. #4: Get Your Business Licensed. #5: Create Your Operating Agreement. #6: Get Your EIN. #7: Keep Your LLC Active.

Utah requires LLCs to file an annual report on or before the anniversary date of the incorporation. The filing fee is $15. Taxes. For complete details on state taxes for Utah LLCs, visit Business Owner's Toolkit or the State of Utah .

To form your LLC or corporation, you will need to file your documents with the Utah Division of Corporations and Commercial Code.