This is a Corporate Record Maintenance Package for Existing Corporations. If the corporation is already formed but you need to update your corporate records, this package accomplishes your purpose. Corporations that do not follow certain corporate formalities, including generally keeping corporate records, may lose corporate protection from personal liability.

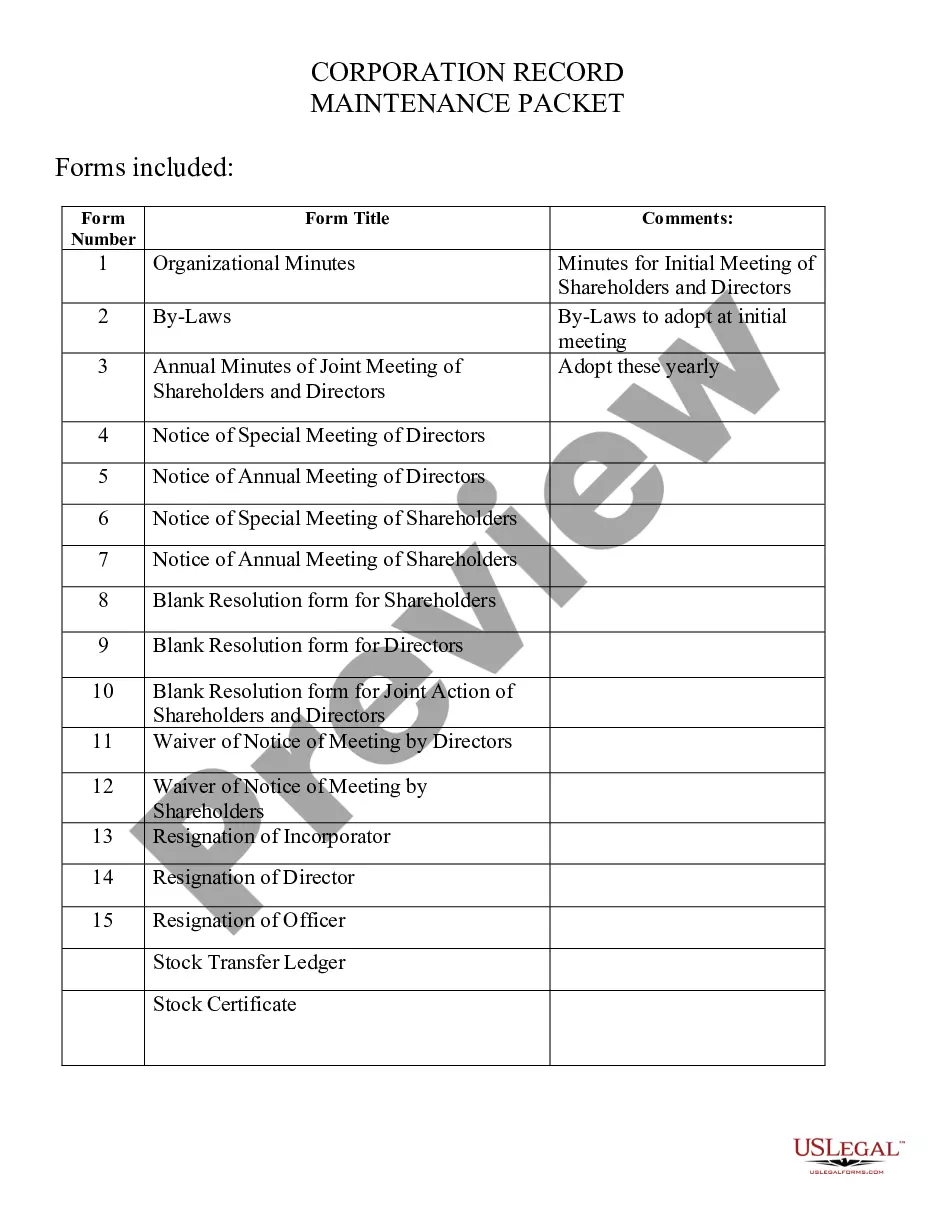

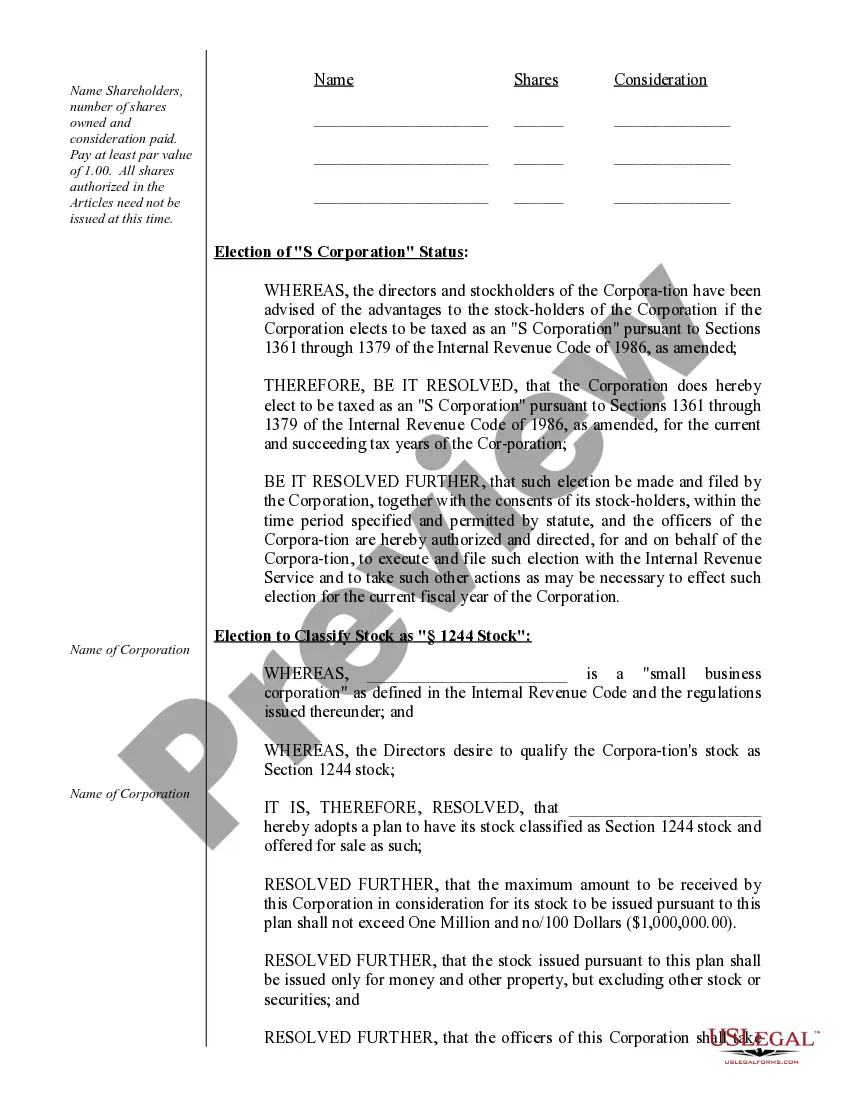

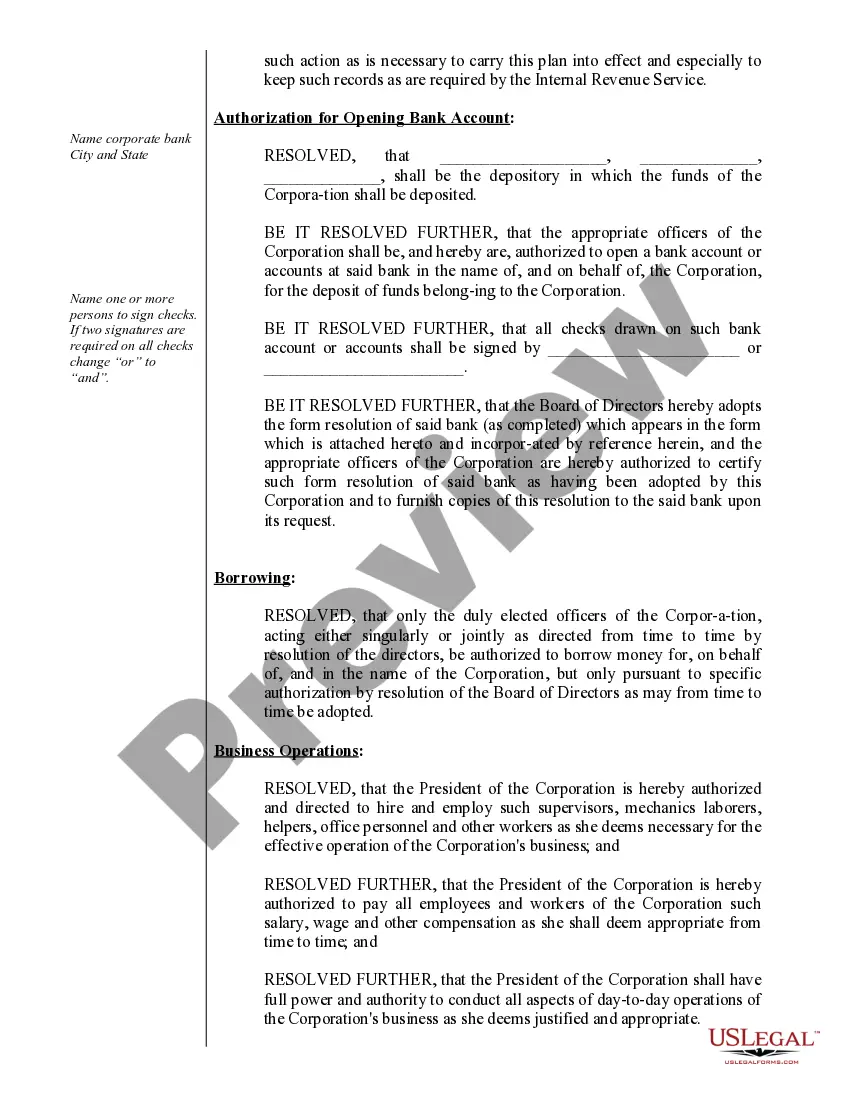

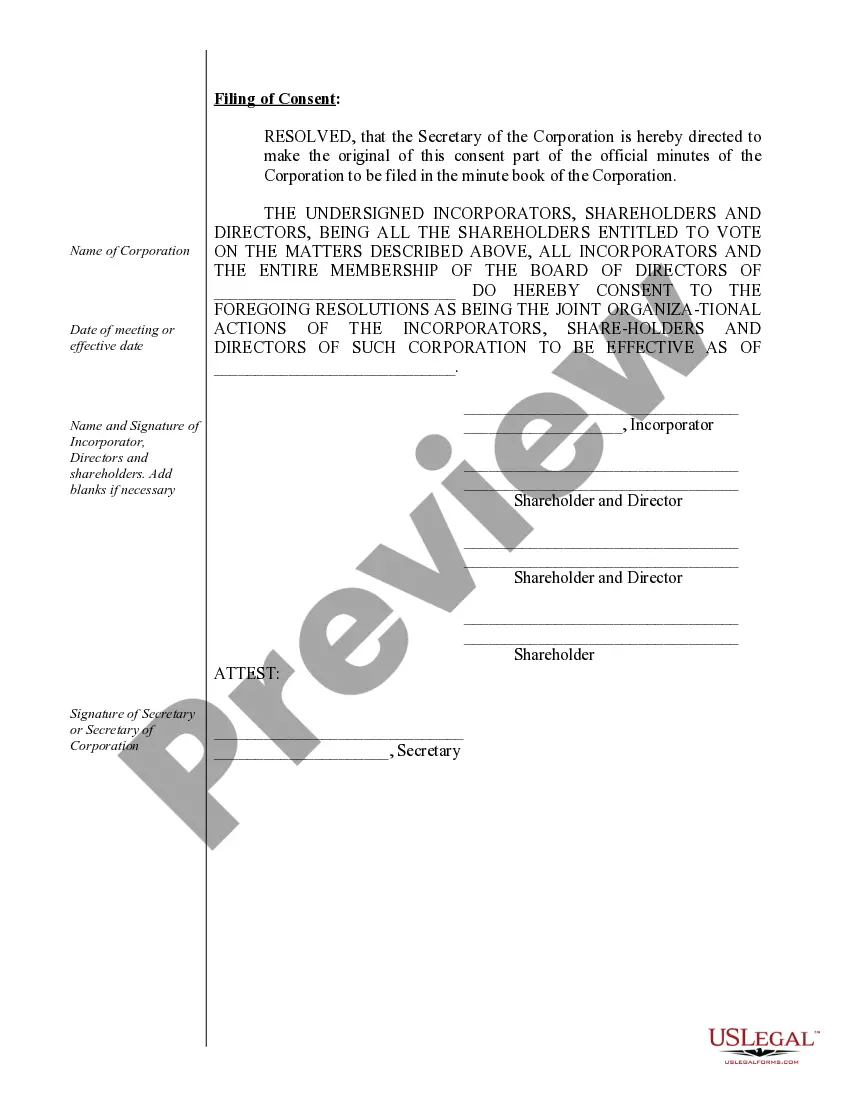

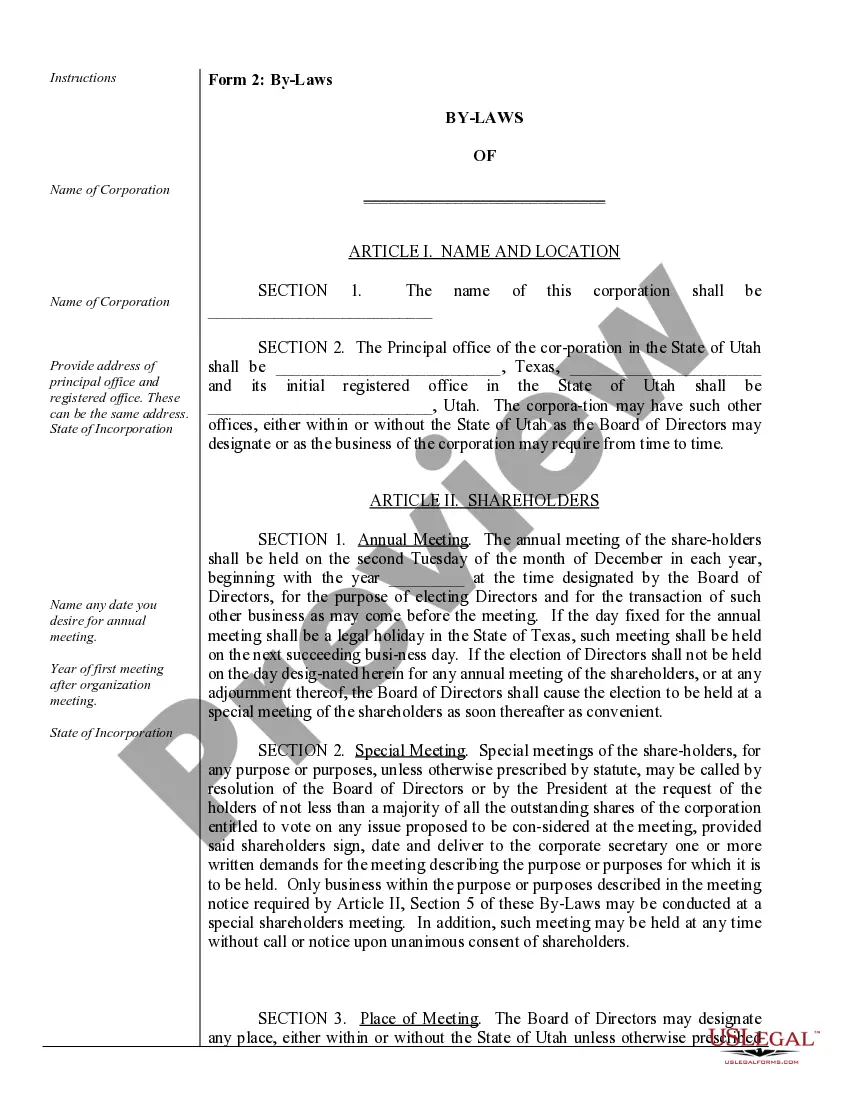

This package includes the following forms: Organizational Minutes, Minutes for Initial Meeting of Shareholders and Directors, By-Laws, Annual Minutes of Joint Meeting of Shareholders and Directors, Notice of Special Meeting of Directors, Notice of Annual Meeting of Directors, Notice of Special Meeting of Shareholders, Notice of Annual Meeting of Shareholders, Blank Resolution form for Shareholders, Blank Resolution form for Directors, Blank Resolution form for Joint Action of Shareholders and Directors, Waiver of Notice of Meeting by Directors, Waiver of Notice of Meeting by Shareholders, Resignation of Incorporator, Resignation of Director, Resignation of Officer, Stock Transfer Ledger and Simple Stock Certificate.