Utah Business Corporation With The Following Consideration

Description

How to fill out Utah Business Incorporation Package To Incorporate Corporation?

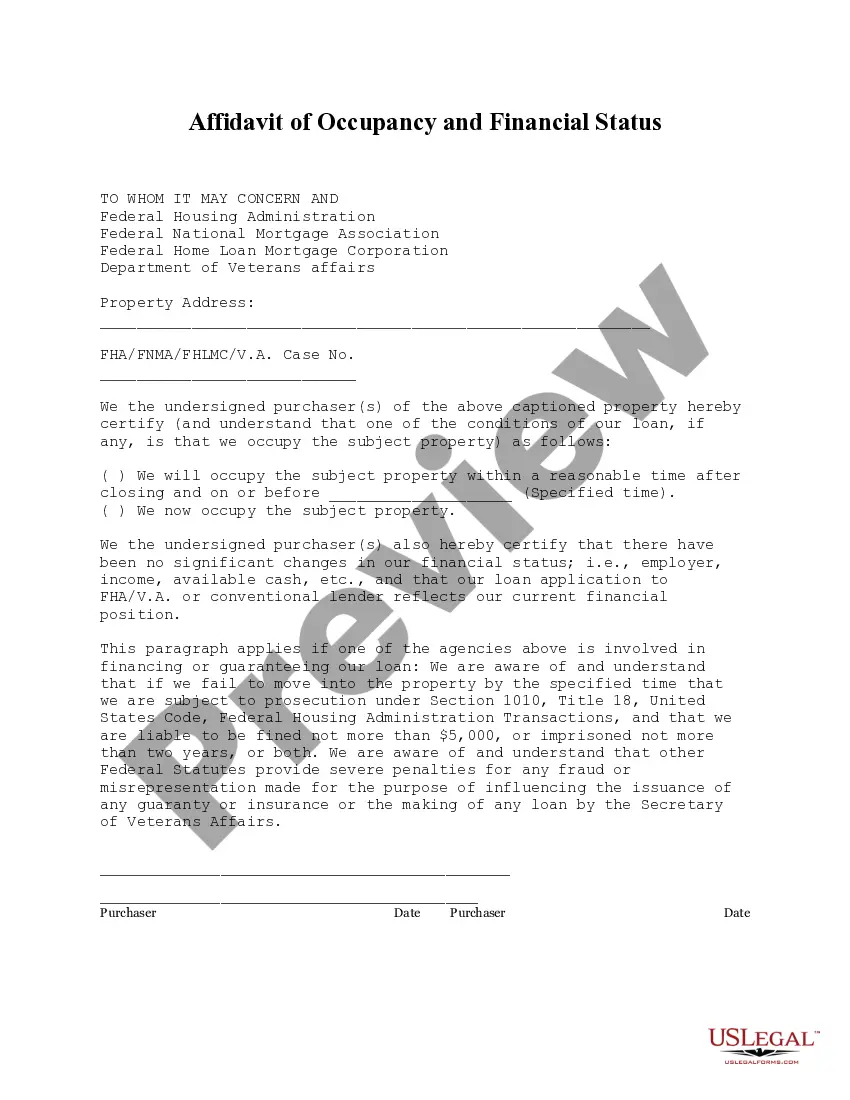

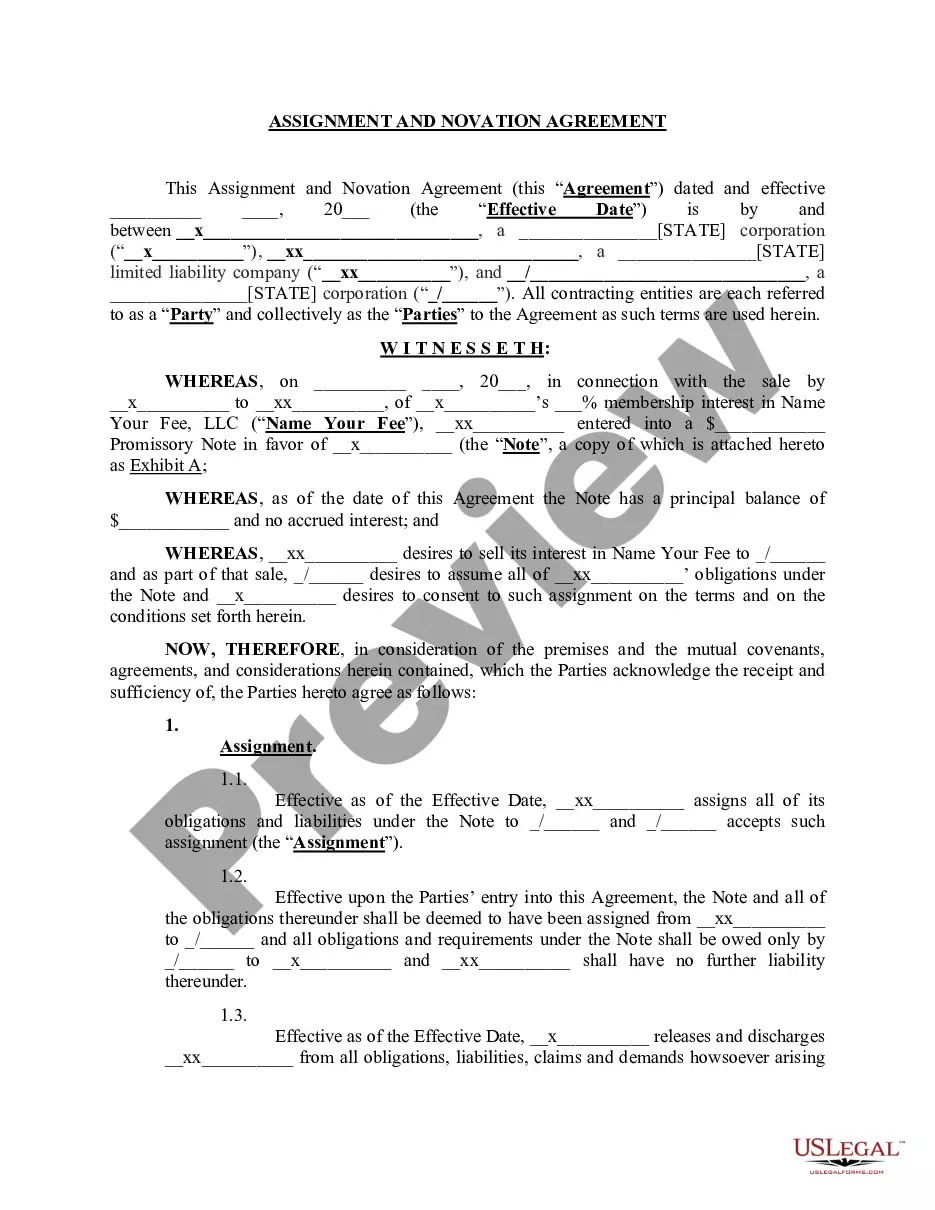

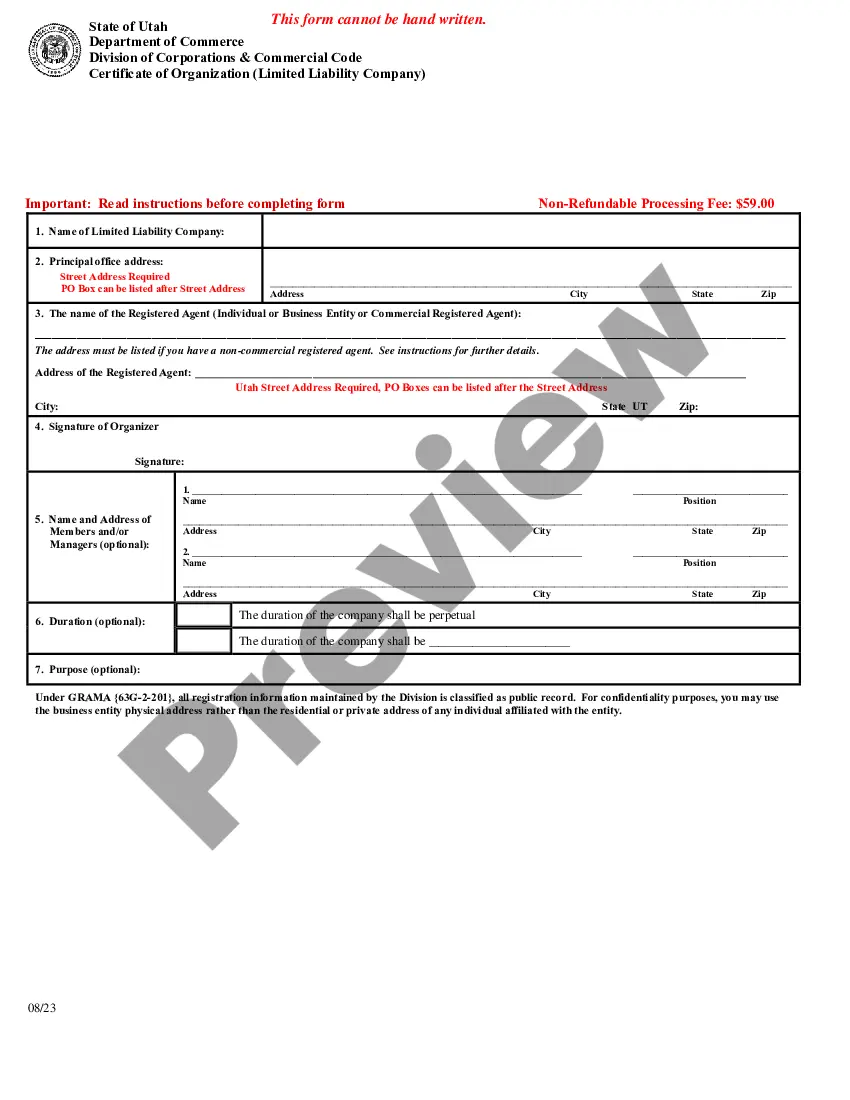

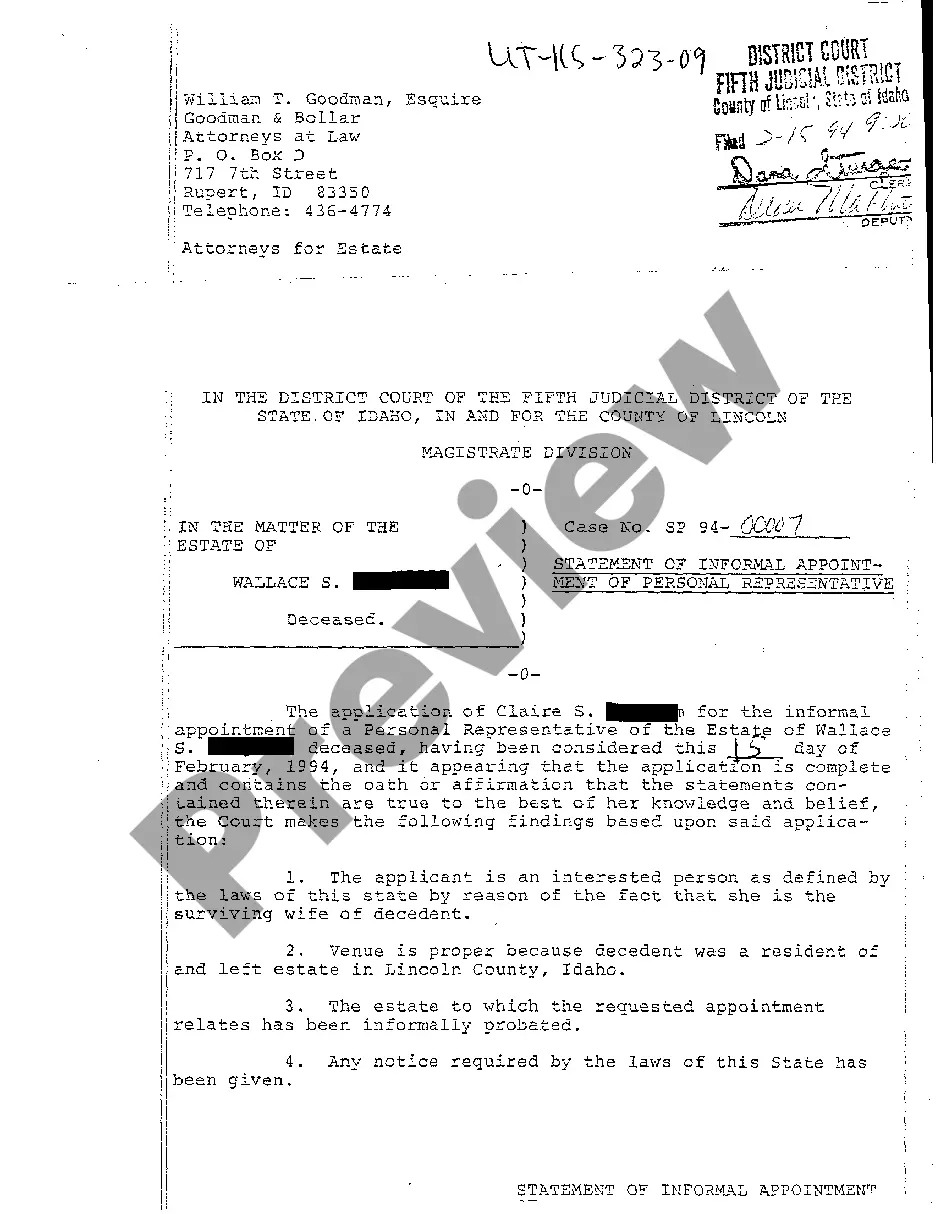

Whether for business purposes or for individual affairs, everyone has to deal with legal situations sooner or later in their life. Filling out legal paperwork requires careful attention, starting with picking the correct form sample. For example, if you pick a wrong edition of a Utah Business Corporation With The Following Consideration, it will be declined when you send it. It is therefore essential to get a dependable source of legal papers like US Legal Forms.

If you need to obtain a Utah Business Corporation With The Following Consideration sample, stick to these simple steps:

- Find the template you need using the search field or catalog navigation.

- Check out the form’s description to ensure it suits your case, state, and county.

- Click on the form’s preview to examine it.

- If it is the wrong form, get back to the search function to find the Utah Business Corporation With The Following Consideration sample you need.

- Get the file if it meets your needs.

- If you already have a US Legal Forms account, simply click Log in to access previously saved documents in My Forms.

- In the event you don’t have an account yet, you may obtain the form by clicking Buy now.

- Choose the proper pricing option.

- Finish the account registration form.

- Select your payment method: use a bank card or PayPal account.

- Choose the file format you want and download the Utah Business Corporation With The Following Consideration.

- When it is saved, you can complete the form with the help of editing applications or print it and finish it manually.

With a vast US Legal Forms catalog at hand, you never have to spend time looking for the right template across the internet. Utilize the library’s easy navigation to find the right form for any occasion.

Form popularity

FAQ

States generally require that the legal name of your LLC or corporation include certain words indicating your business structure. Corporations: A corporation's name typically must include words like Corporation, Incorporated, Company, or Limited; or abbreviations, like Corp., Inc., Co., or Ltd.

Starting a Corporation in Utah File Utah Articles of Incorporation. Pay the filing fee: $54. Hold an organizational meeting and create bylaws. Get an EIN from the IRS. File mandatory Beneficial Ownership Information report. Apply for licenses. Open a Utah corporate bank account.

Here are the 10 things you need to do before starting a business Develop a powerful message. Focus on the customer and fully understand the market. Start small and grow. Understand your own strengths, skills, and time available. Learn from others. Get a mentor. Write a business plan. Know your numbers.

Tax and liability issues, director and ownership concerns, as well as state and federal obligations pertaining to the type of entity should be considered when making your determination. Personal and personnel needs and the needs of your particular type of business should also be considered.

Ultimately the type of business organization selected comes down to the owners' level of concern over management control, liability exposure, tax issues, and business transfer issues.