Utah Odometer Waiver Withholding

Description

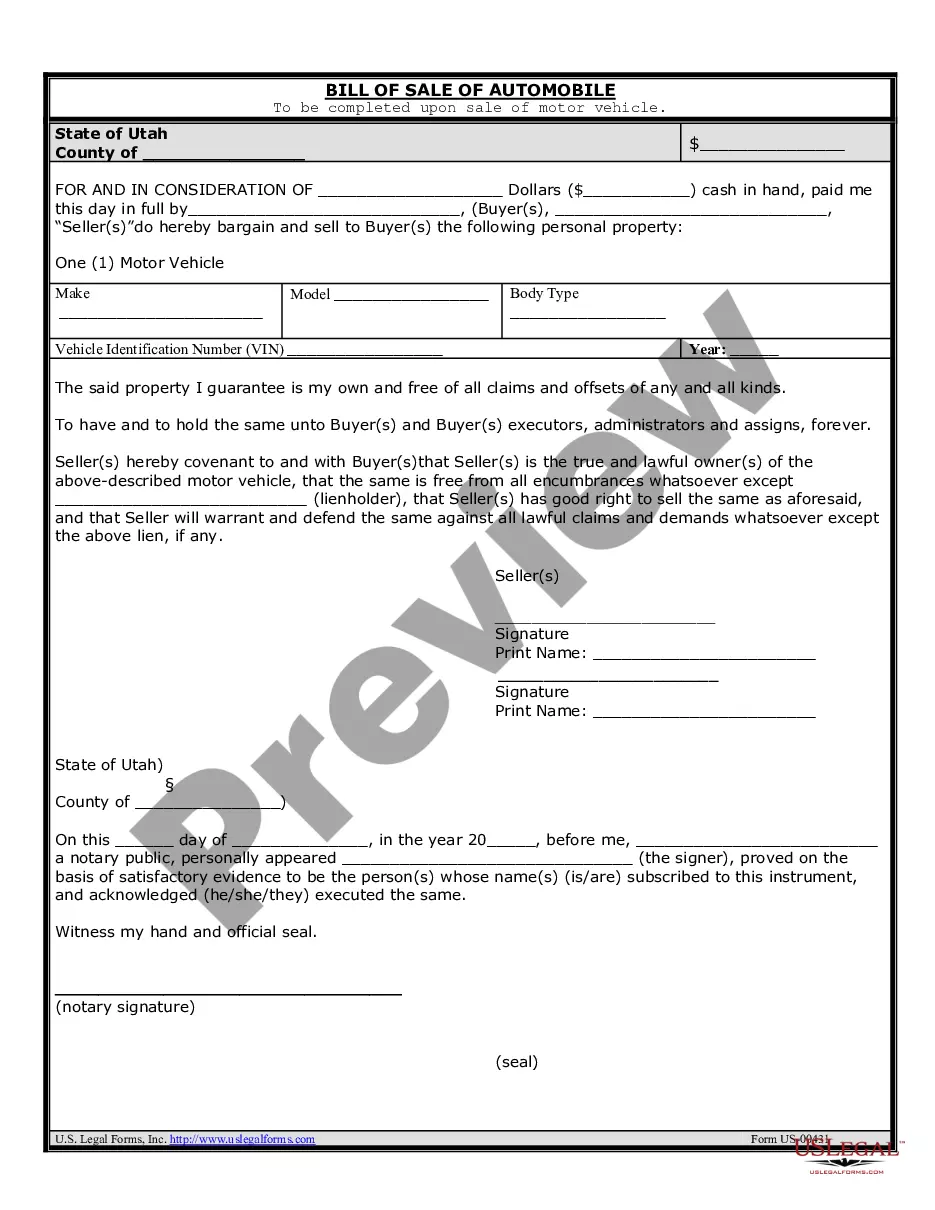

How to fill out Utah Bill Of Sale Of Automobile And Odometer Statement For As-Is Sale?

Acquiring legal document examples that comply with national and local regulations is crucial, and the internet provides numerous alternatives to choose from.

However, what’s the benefit of expending time hunting for the appropriate Utah Odometer Waiver Withholding example online when the US Legal Forms digital library already houses such templates gathered in one location.

US Legal Forms is the largest online legal repository with over 85,000 fillable documents created by lawyers for various professional and personal situations. They are user-friendly with all documents categorized by state and intended use. Our experts stay current with law changes, ensuring your documentation is relevant and meets requirements when acquiring a Utah Odometer Waiver Withholding from our platform.

Press Buy Now when you’ve found the ideal form and select a subscription package. Set up an account or Log In and complete your payment via PayPal or a credit card. Choose the most suitable format for your Utah Odometer Waiver Withholding and download it. All templates you discover through US Legal Forms can be reused. To access and fill out previously acquired documents, navigate to the My documents tab in your profile. Take advantage of the most comprehensive and user-friendly legal documentation service!

- Obtaining a Utah Odometer Waiver Withholding is quick and straightforward for existing and new users.

- If you possess an account with an active subscription, sign in and save the necessary document sample in the appropriate format.

- If you are a newcomer to our site, adhere to the steps provided below.

- Evaluate the template using the Preview option or through the text description to confirm it meets your requirements.

- If needed, find another sample using the search feature located at the top of the page.

Form popularity

FAQ

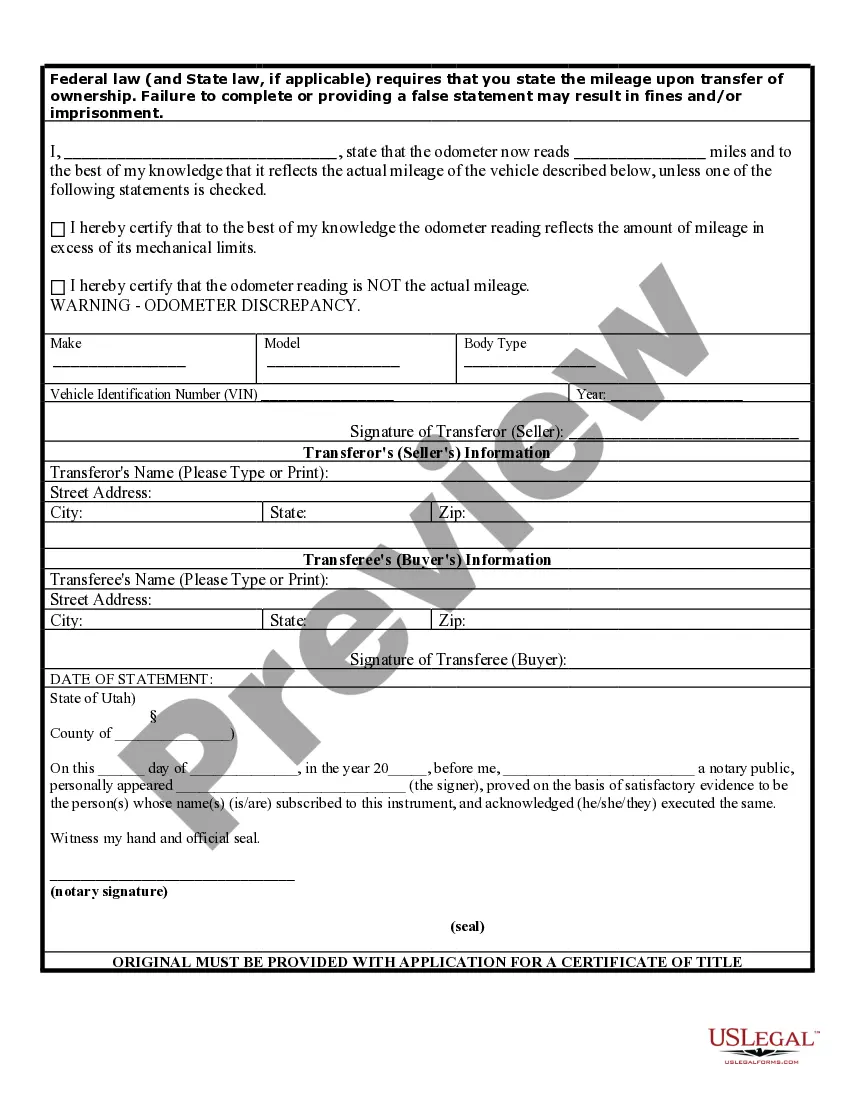

Filling out an odometer disclosure statement in Utah involves entering the current mileage, the date of sale, and details of both the seller and buyer. Be sure to sign the document, as it validates the attestation of the odometer reading. Using uslegalforms may streamline this process and help ensure all necessary information is accurately captured.

Free legal advice Call toll-free at 1-888-201-1014 - if you are under 60 and low-income. King County residents should call 206-464-1519 for information and referral. If you are over 60 at any income level call CLEAR toll-free at 1-888-387-7111.

Individuals seeking legal assistance should first complete an online application or call the KLS Statewide Client Intake at 1-800-723-6953.

Indianapolis Office Intake: (844) 243-8570. Office: (317) 631-9410.

Kansas Legal Services gives free or low cost civil legal advice and representation for persons whose incomes make them eligible. You will find out if you are eligible for legal assistance by talking with an Intake Specialist, whether you apply online or call our intake line.

Access to Justice Advice Line (run by Kansas Legal Services): 1-800-675-5860 (ATJ advice line provides free brief advice to court patrons whose incomes are at or below 400% of the federal poverty level.)

Matt Keenan - Executive Director - KANSAS LEGAL SERVICES, INC.

Kansas Legal Services: 800-723-6953 The toll-free number operates from a.m. to 5 p.m., Monday through Friday.