Auto Vehicle

Description

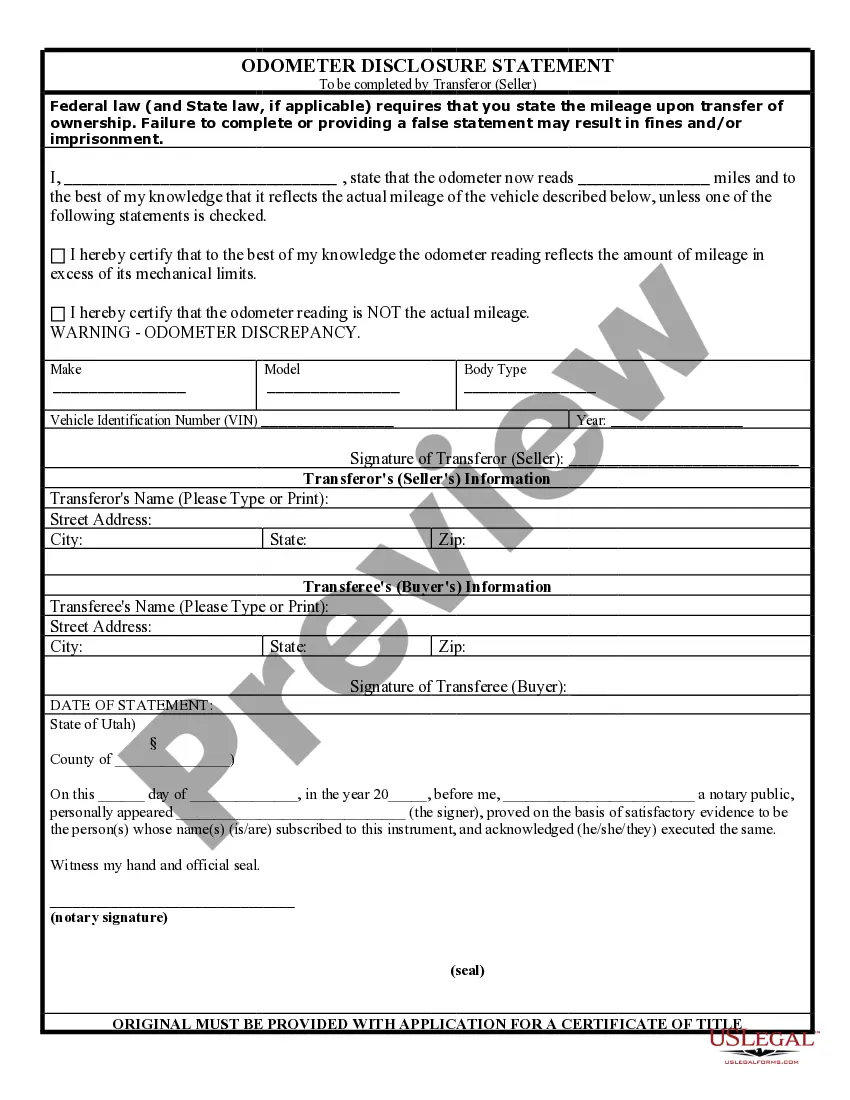

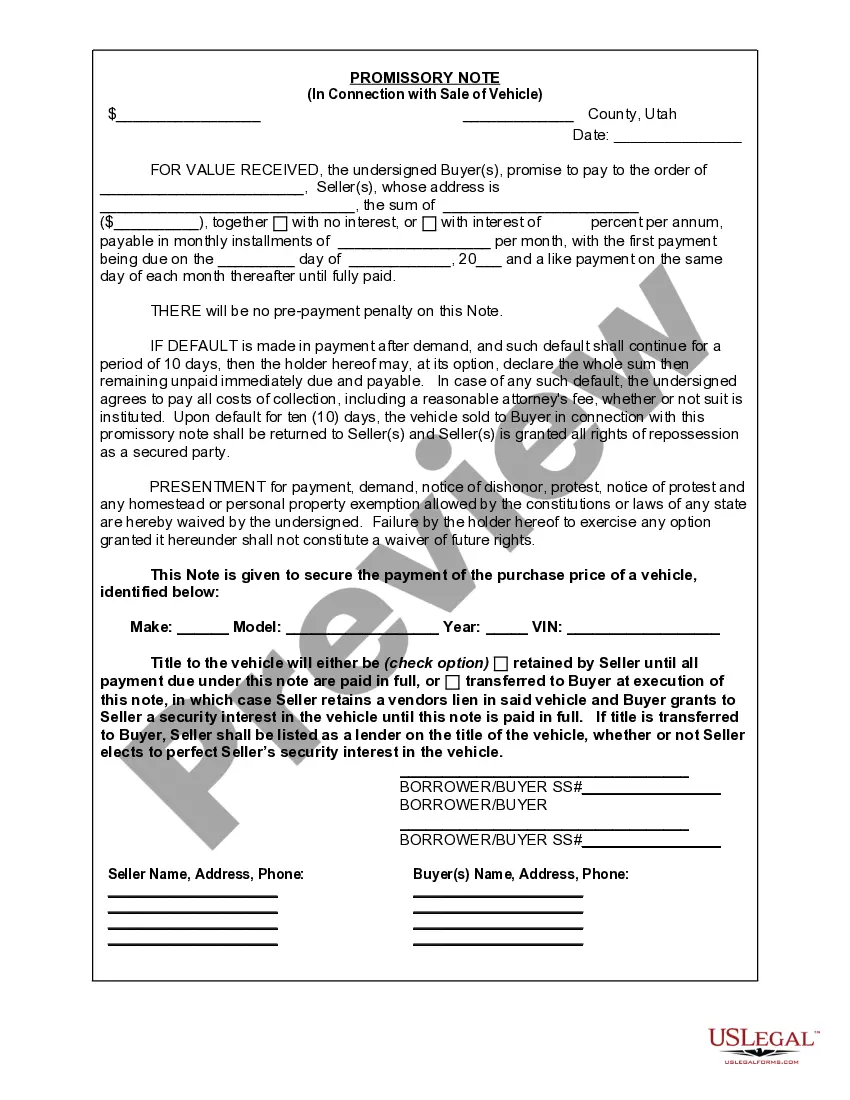

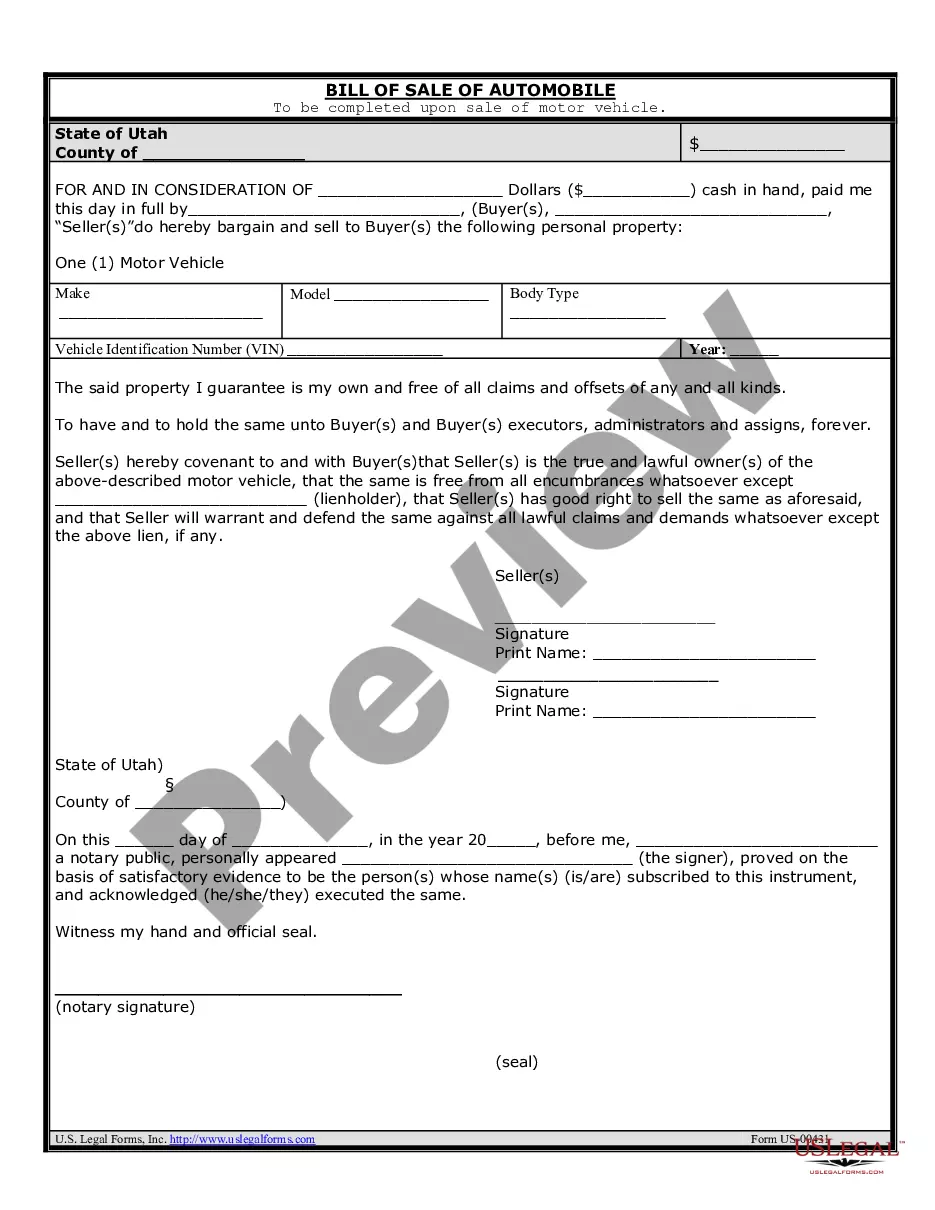

How to fill out Utah Bill Of Sale For Automobile Or Vehicle Including Odometer Statement And Promissory Note?

- If you are a returning user, log in to your account and check your subscription status to ensure it's active. Then, easily download your required form template.

- For first-time users, begin by browsing the Preview mode and descriptions of the forms available, ensuring you select the appropriate auto vehicle form that conforms to your local jurisdiction.

- If the desired form isn’t available, utilize the Search tab above to locate a suitable template. Once found, proceed to the next step.

- Click on the Buy Now button to purchase your document, selecting a subscription plan that fits your needs. You will need to create an account to access the library.

- Complete your purchase by entering your credit card details or using your PayPal account to finalize the subscription.

- After payment, download your form and save it to your device. You can find it later in your My Forms section.

US Legal Forms provides a robust collection of over 85,000 legal forms, empowering users to complete their legal needs with confidence. Even if you're uncertain, premium experts are available to assist you in completing forms correctly.

Don’t let paperwork overwhelm you. Start using US Legal Forms today and streamline your legal document process!

Form popularity

FAQ

The ability to file a claim after an accident can significantly depend on various factors, including state laws and your insurance provider's policies. In many cases, you can still submit a claim weeks or even months after an incident. However, act promptly to ensure you do not miss any deadlines that could affect your auto vehicle claim process.

The time limit for accident insurance claims depends on the state where the accident occurred and your insurance policy. Common limits range from one to three years. It's crucial to be vigilant about these deadlines, as waiting too long can jeopardize your ability to recover any damages for your auto vehicle.

You generally have a limited window to file an auto insurance claim after an accident, often ranging from a few days to several months. Check your specific policy to understand the timeframe, as this can vary by insurer and state. The sooner you file, the better chance you have of a smooth claims experience.

Filing a car insurance claim usually involves reporting the accident to your insurance provider as soon as possible. After that, they will assess the damages to your auto vehicle, gather details from both parties involved, and determine the extent of your coverage. This process may include an investigation, but you will be kept informed throughout.

Yes, there is typically a deadline to file an insurance claim, which varies by state and insurance policy. Generally, you have a few months to file your claim after an accident involving your auto vehicle. It's essential to be aware of your specific policy terms to avoid losing the right to your claim.

While there is no universal time limit, filing a car insurance claim as soon as possible is crucial. Most insurance companies accept claims within a few weeks after the incident, but delays may complicate the process and impact your coverage. If you're unsure, check your policy or consult with your insurer for specific timelines related to your auto vehicle claim.

Yes, when someone hits your auto vehicle, it's advisable to contact their insurance company to report the incident. They will guide you through the claims process and may request information about the accident. It's important to exchange insurance details at the scene to ensure you have all necessary information for your claim.

To file a claim after an incident involving your auto vehicle, insurance companies typically require specific information. You'll need the details of the accident, including the date, location, and contact information of other parties involved. Additionally, having your policy number and any relevant photographs or documentation will expedite the process.

The term 'auto' in the context of a vehicle highlights its self-propelling capability. It emphasizes the vehicle's independence from direct human control, allowing it to operate efficiently on roadways. This characteristic is what makes auto vehicles an essential part of modern transportation. For anyone looking to understand the legal aspects of auto vehicles, US Legal Forms provides comprehensive informational resources.

An example of an auto vehicle is a sedan, which is commonly used for personal transportation. Other examples include trucks, motorcycles, and buses, which also fall within the auto category. Each type of auto serves different purposes and meets various transportation needs. If you're considering purchasing an auto vehicle, it's wise to review your options and the associated legal documentation available through US Legal Forms.