Odometer Waiver Utah Withholding

Description

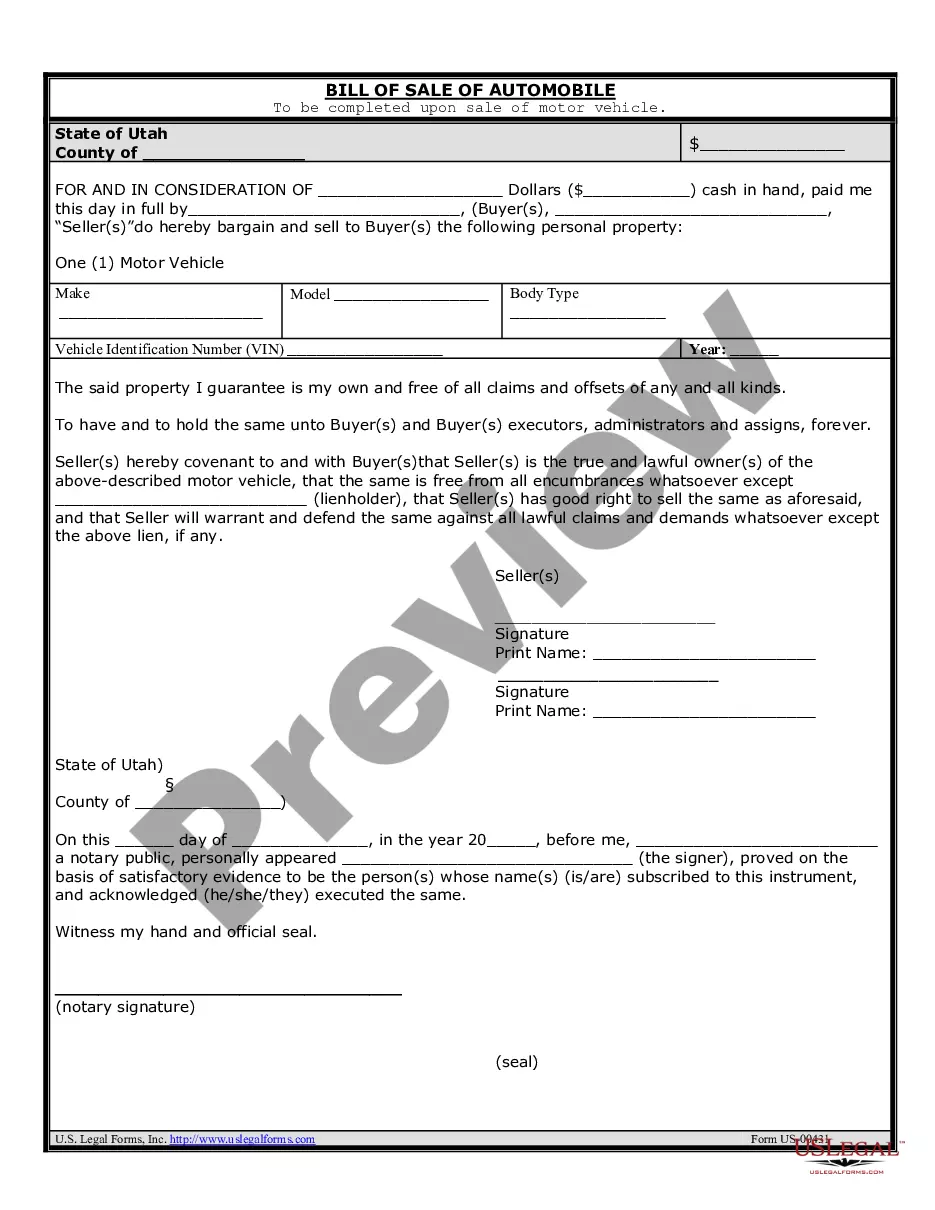

How to fill out Utah Bill Of Sale Of Automobile And Odometer Statement For As-Is Sale?

It's well-known that you cannot transform into a legal specialist in a day, nor can you swiftly learn to prepare Odometer Waiver Utah Withholding without having a specific background. Compiling legal documents is a lengthy endeavor that necessitates particular expertise and training.

So why not hand over the preparation of the Odometer Waiver Utah Withholding to the experts.

With US Legal Forms, which boasts one of the largest legal document libraries, you can find everything from court documents to internal corporate communication templates.

If you need another form, start your search anew.

Create a free account and select a subscription plan to acquire the template. Click Buy now. Once the purchase is finalized, you can download the Odometer Waiver Utah Withholding, complete it, print it, and send or deliver it to the appropriate individuals or organizations.

- We recognize the significance of compliance and following federal and state laws and regulations.

- That’s the reason why all forms available on our platform are location-specific and current.

- To get started, visit our website and obtain the document you need in just minutes.

- Utilize the search bar at the top of the page to find the form you require.

- Preview it (if this option is available) and review the accompanying description to see if Odometer Waiver Utah Withholding is what you're looking for.

Form popularity

FAQ

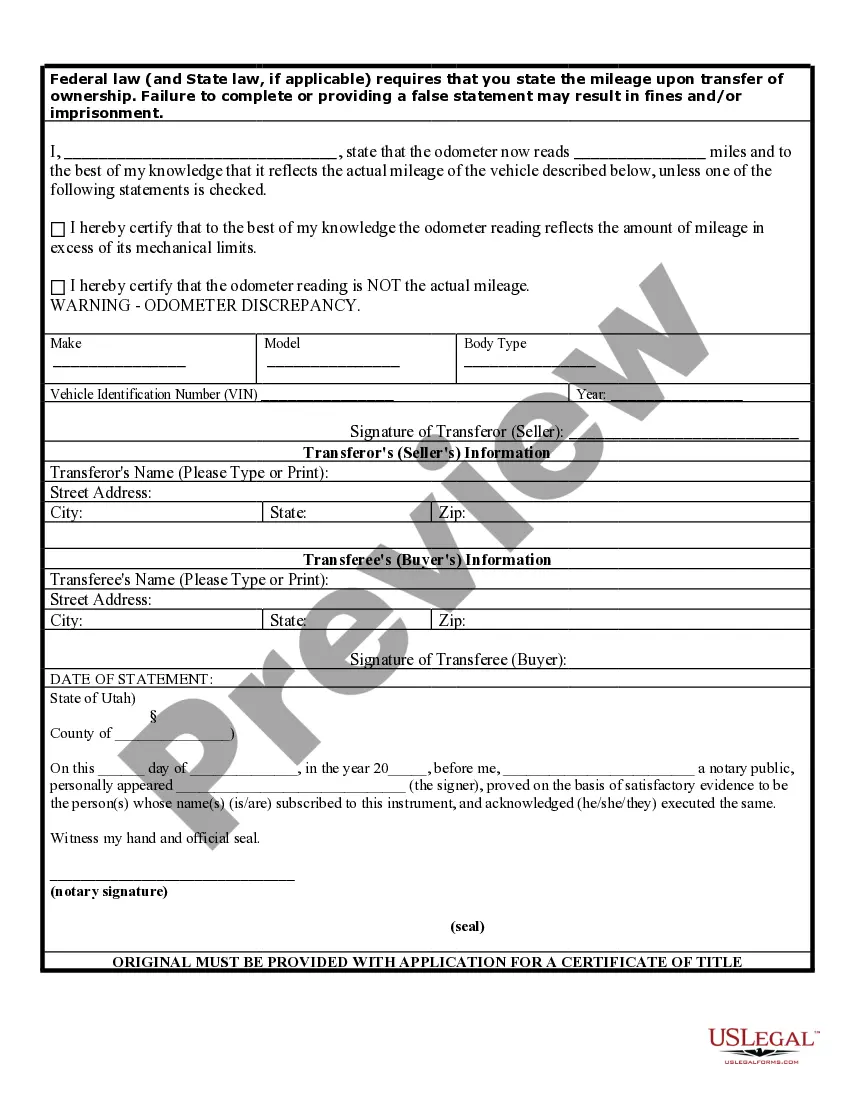

Getting an odometer disclosure in Utah is important when transferring vehicle ownership. You can obtain this disclosure form from the Utah Department of Motor Vehicles or download it from their website. This form ensures that the odometer reading is accurately reported during the sale. For convenience, US Legal Forms provides templates and guidance related to the odometer waiver and other forms needed for proper vehicle registration.

To obtain a Utah withholding number, you need to register your business with the Utah State Tax Commission. This process is straightforward and can often be completed online. Once registered, you’ll receive your withholding number, which is essential for handling payroll and taxes. If you're unsure about the process, consider using US Legal Forms to access easy-to-use resources that simplify registration.

Setting up a Utah withholding account begins with registering your business on the Utah State Tax Commission website. You'll need to provide basic business information, including your Employer Identification Number. After this, ensure you incorporate any specifics regarding odometer waiver, Utah withholding requirements. Consider using USLegalForms for easy registration and compliance guidance.

Determining how much to withhold for Utah state taxes depends on your income and tax situation. As a rule of thumb, it's wise to withhold enough to cover your estimated tax liability for the year. If you have an odometer waiver, Utah withholding specifications can affect your overall calculations. USLegalForms offers resources to help manage these calculations effectively.

The withholding percentage you select depends on your total earnings and financial situation. Generally, the Utah state tax rates range from 4.75% to 5%, but reviewing your financial goals is crucial. Using an odometer waiver, Utah withholding calculator can help you determine the appropriate amount to withhold based on your circumstances. Consider consulting with a tax advisor or using USLegalForms for tailored assistance.

Filing withholding tax in Utah involves completing the necessary forms and submitting them to the tax authorities. Typically, you will use Form TC-941, the Withholding Tax Reconciliation Return, as part of your filing process. Make sure to include all relevant details, including any odometer waiver, Utah withholding information. Using services like USLegalForms can simplify this process and ensure you're filing correctly.

To submit tax withholding in Utah, you can start by visiting the Utah State Tax Commission website. There, you will find detailed instructions and forms necessary for submitting your information. It's essential to ensure you accurately report the odometer waiver, Utah withholding details to avoid any discrepancies. Utilizing platforms like USLegalForms can help streamline the process and ensure compliance.

To obtain an odometer statement, you can create one through a template or fill it out manually, ensuring all required details are included. If you wish to ensure legality and clarity in the statement, platforms like USLegalForms can provide you with ready-made documents that meet the necessary legal standards. This is particularly important when you are navigating odometer waiver Utah withholding, as having a proper statement protects your interests.

To find your odometer history, you can check vehicle history reports through platforms like Carfax or AutoCheck, which aggregate this information. You may also reach out to your local DMV, where they maintain records of vehicle odometer readings. Having access to this history is beneficial, especially when dealing with odometer waiver Utah withholding regulations during a sale.

The odometer disclosure statement in Utah is a legal document that provides information about the vehicle's mileage at the time of transfer. It serves to confirm the accuracy of the odometer reading and protects both buyers and sellers. If you are working through the process of odometer waiver Utah withholding, ensuring this disclosure is accurately filled out is essential for compliance.