Sale Auto

Description

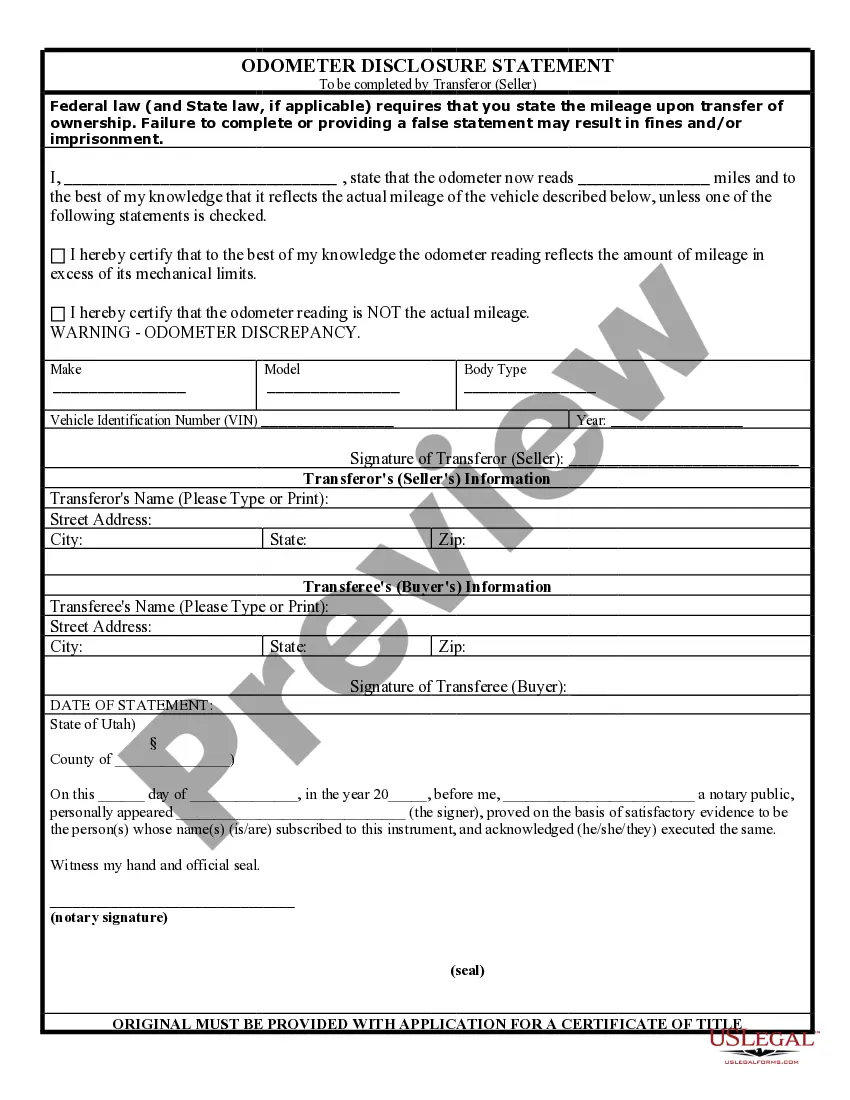

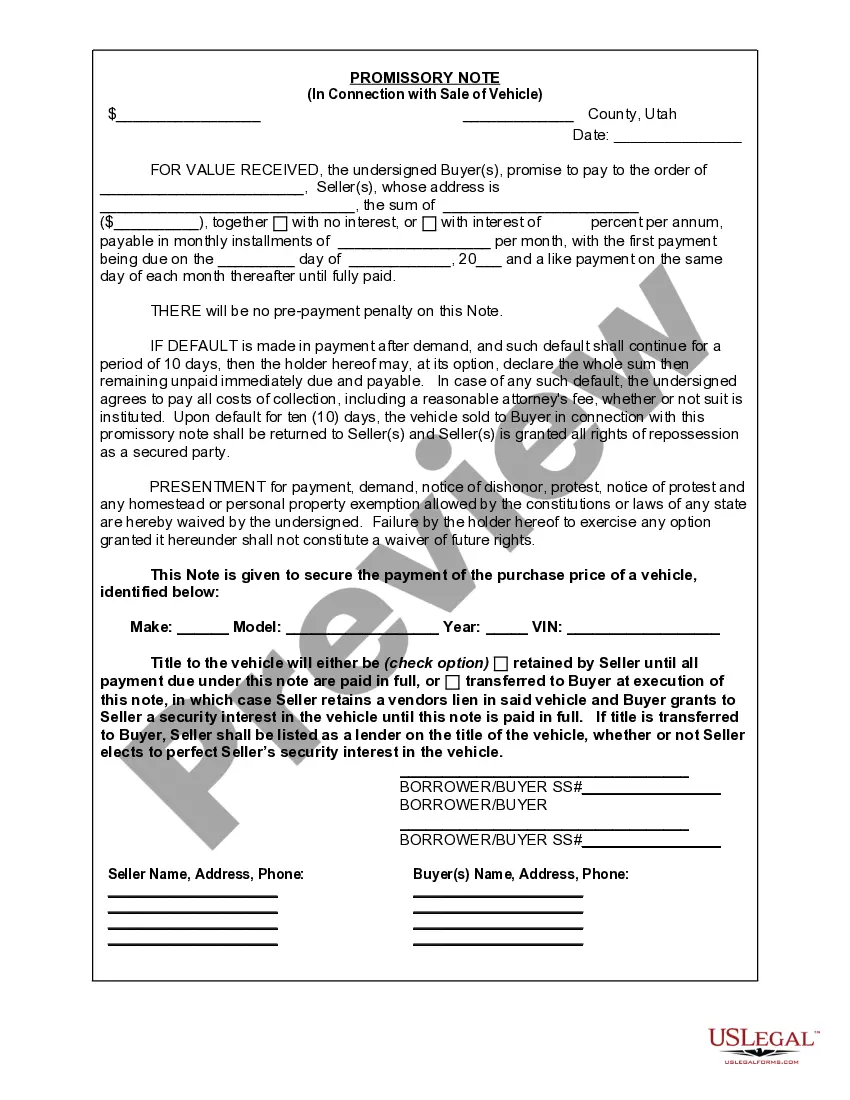

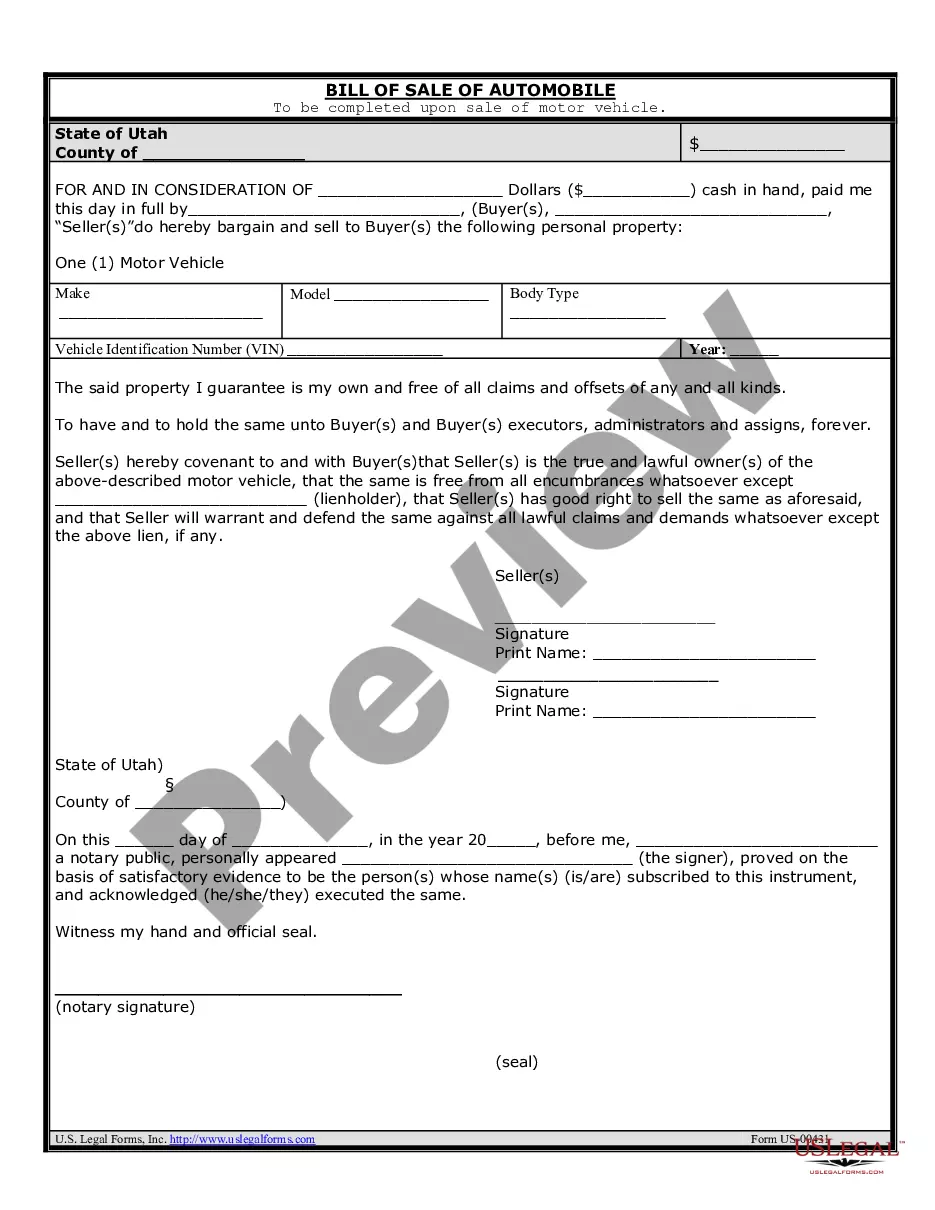

How to fill out Utah Bill Of Sale For Automobile Or Vehicle Including Odometer Statement And Promissory Note?

- If you are a returning user, log in to your account and verify your subscription is active. If it’s expired, renew it based on your chosen payment plan.

- Preview available forms and descriptions to ensure the selection meets your legal requirements. Take time to review that it adheres to local jurisdiction needs.

- If you don’t find the right document, utilize the Search feature above to look for alternate templates. Select an appropriate one to move forward.

- Purchase your chosen document by clicking the Buy Now button. Choose from various subscription plans and register for an account to access the full library.

- Complete your transaction by entering payment details using a credit card or your PayPal account.

- Download the form to your device. You can also access it later anytime from the My Forms section in your profile.

By leveraging US Legal Forms' robust collection of over 85,000 legal forms, users can ensure they are filling out accurate and relevant documents. Additionally, premium support is available to assist with form completion, which enhances the precision of your legal dealings.

In conclusion, obtaining legal forms doesn't have to be complex. By following these steps, you can simplify your documentation processes. Start accessing legal templates now and empower yourself with the knowledge of US Legal Forms!

Form popularity

FAQ

To transfer a car title in Virginia, you need the signed title from the seller, a completed application for a new title, and payment for any applicable fees. It's also essential to have proof of identity and residency. Additionally, ensure that all lien information is cleared if applicable, making your car sale smooth and transparent.

When crafting a car sale description, focus on clarity and detail. Start with basic information such as make, model, year, and mileage. Highlight the vehicle's condition, any recent maintenance, and additional features. A well-written car sale description captures the interest of potential buyers and helps them make informed decisions.

The 20% rule suggests that you should spend no more than 20% of your annual income on your vehicle, including financing and ongoing expenses. This approach helps you make conscious financial decisions and avoid overspending on a car. By adhering to this guideline, you'll ensure that your investment in a sale auto aligns with your overall budget, protecting your financial health.

Getting into auto sales involves a mix of training and networking. Start by researching your local automotive market and taking introductory courses that focus on selling techniques and customer service. Additionally, consider connecting with existing auto sales professionals for mentorship. Remember, a successful sale auto relies on understanding your customers’ needs and building lasting relationships.

To sell a car in California, you need to provide several key documents. First, you must have the vehicle's title, signed over to the new owner. Additionally, complete a bill of sale and report the sale to the DMV. Using platforms like US Legal Forms can streamline this process, guiding you through the necessary paperwork for a successful sale auto.

The 20/4-10 rule is a guideline for purchasing a vehicle, emphasizing a manageable financial approach. First, aim for a 20% down payment to reduce your financing amount. Next, finance the car for no more than four years to avoid excessive interest costs. Lastly, your monthly car payments should not exceed 10% of your gross monthly income to ensure financial stability while engaging in a sale auto.

Generally, car sales do not automatically get reported to the IRS unless you earn a profit. If the transaction results in significant gains, you should report it as income. Resources from US Legal Forms can help you understand your obligations and provide you with the right tools for documentation related to sale auto transactions.

In most cases, you must report the sale auto on your tax return, especially if you earned a profit from the sale. The IRS requires you to disclose any income generated from vehicle sales, which may affect your overall tax liability. To make this process easier, utilize US Legal Forms to access the necessary tax documents and to ensure compliance with IRS regulations.

Yes, when you complete a sale auto in Texas, it is important to notify the DMV. This action updates the ownership records and protects you from any future liability associated with the vehicle. Failing to notify the DMV could lead to complications if the new owner does not register the vehicle promptly. You can use the forms available on the US Legal Forms platform to ensure you handle this process smoothly.

To achieve the highest value for your car, focus on its condition, maintenance history, and market timing. Clean your vehicle thoroughly and complete necessary repairs before listing it for sale auto. Gathering documentation, like service records, can also boost buyer confidence. Lastly, research market trends to select an optimal time to sell, ensuring you maximize your car’s value.