Last Will In Spanish With Spanish

Description

How to fill out Ultima Voluntad Y Testamento - Last Will And Testament?

Dealing with legal documents and procedures can be a lengthy task that adds to your daily workload.

Last Will In Spanish With Spanish and similar forms usually necessitate you to search for them and comprehend how to fill them out correctly.

Thus, if you are managing financial, legal, or personal issues, having a comprehensive and accessible online library of forms will be extremely beneficial.

US Legal Forms is the leading online platform for legal templates, providing over 85,000 state-specific documents along with various tools to assist you in completing your paperwork effortlessly.

Is this your first time using US Legal Forms? Sign up and create a free account within minutes, granting you access to the form library and Last Will In Spanish With Spanish. Then, follow the steps outlined below to complete your document.

- Browse the collection of suitable documents available to you with just a single click.

- US Legal Forms provides you with state- and county-specific forms accessible anytime for download.

- Protect your document management processes with top-notch support that enables you to create any form in minutes without extra or hidden fees.

- Simply Log In to your account, search for Last Will In Spanish With Spanish, and download it instantly from the My documents tab.

- You can also access previously saved forms.

Form popularity

FAQ

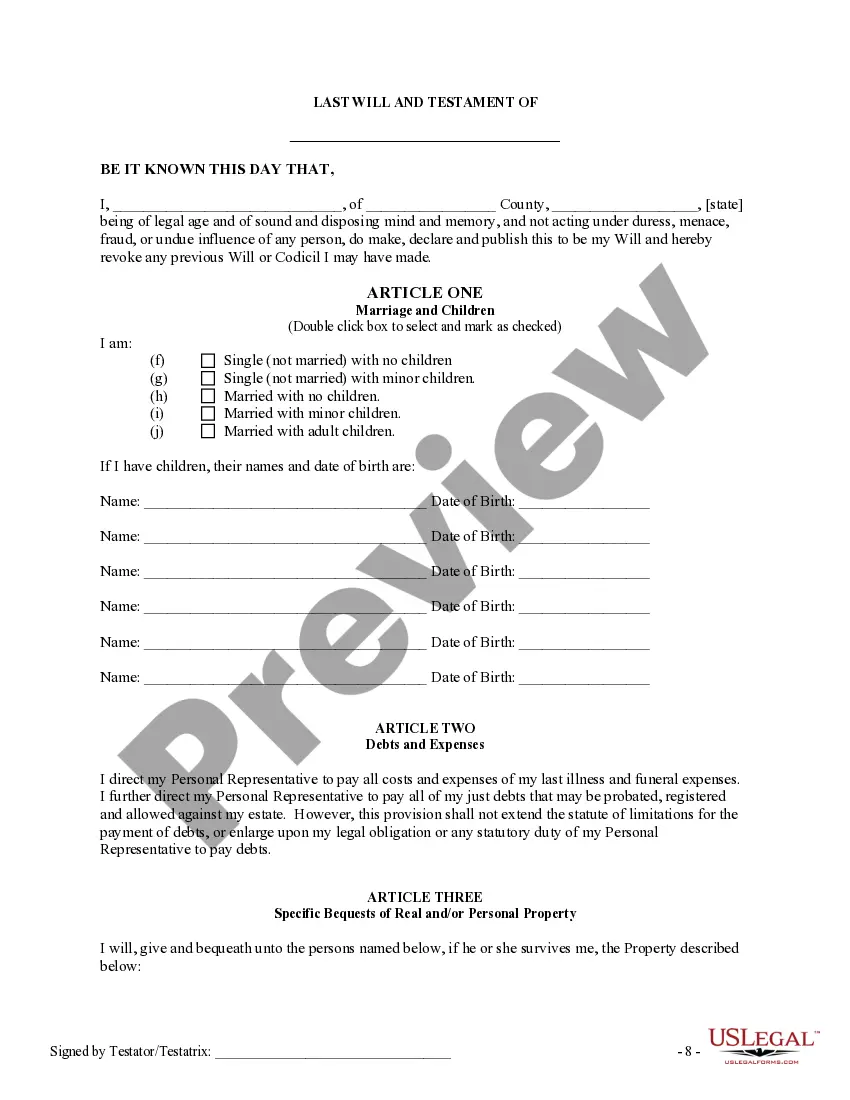

Spanish Inheritance Tax & Wills Spanish Wills and Inheritance Tax are both important considerations if you have Spanish property and/ or investments. It is normally recommended that you draft a Spanish Will to cover assets located in Spain and a foreign Will to cover any assets in other countries.

To make a will in Spain you must be over 14 years old, have your wishes in writing and it must be signed and certified before a 'notary'. It will then be registered at the central registry in Madrid, known as 'Registro General de Actos de Ultima Voluntad' (Central Registry of Wills).

Anybody can make an appointment with a Notary public, who will assist in drawing up the basic paperwork and sign it. However, if you are a foreign national with Spanish assets you are advised to take independent legal advice to ensure that your will is properly drawn up in ance to your wishes.

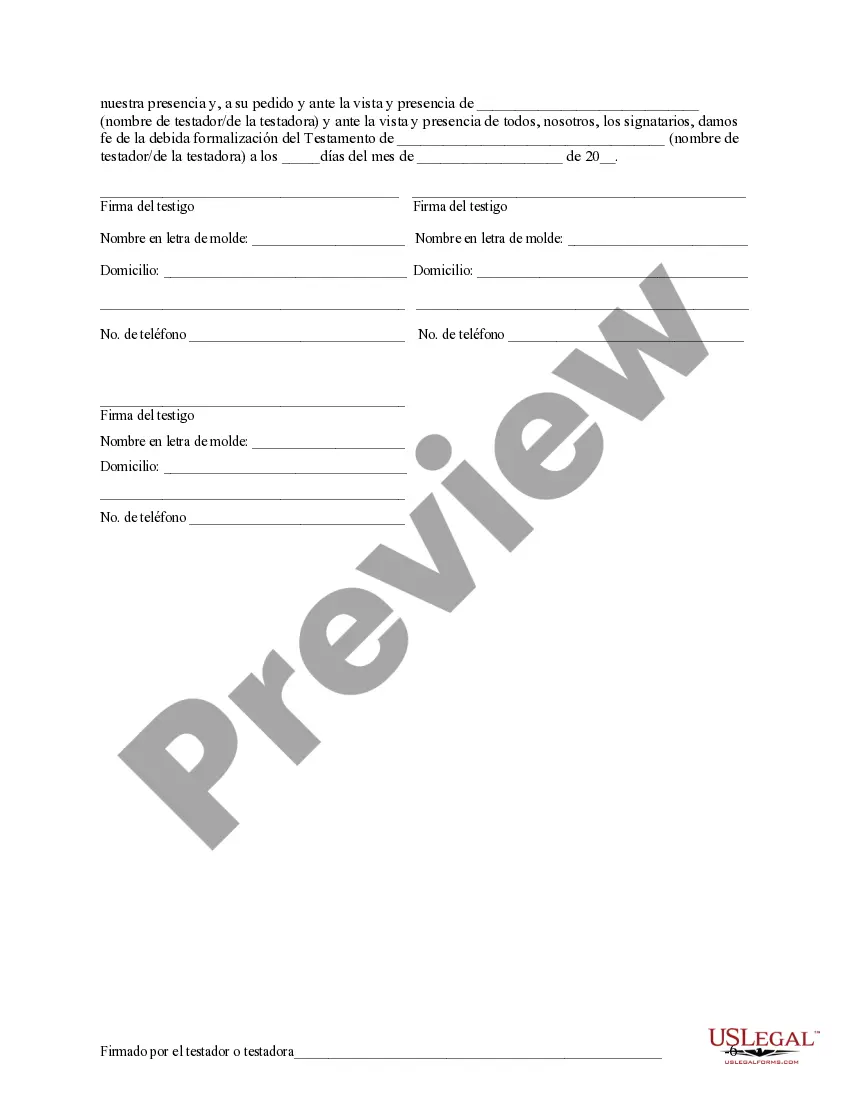

An open will is the most usual testament in Spain. It is granted before a notary and 3 witnesses. All of them must sign, and the testator will receive a copy of the will. Another copy will go to the General Registry of Wills in Madrid. The original will be kept by the notary.

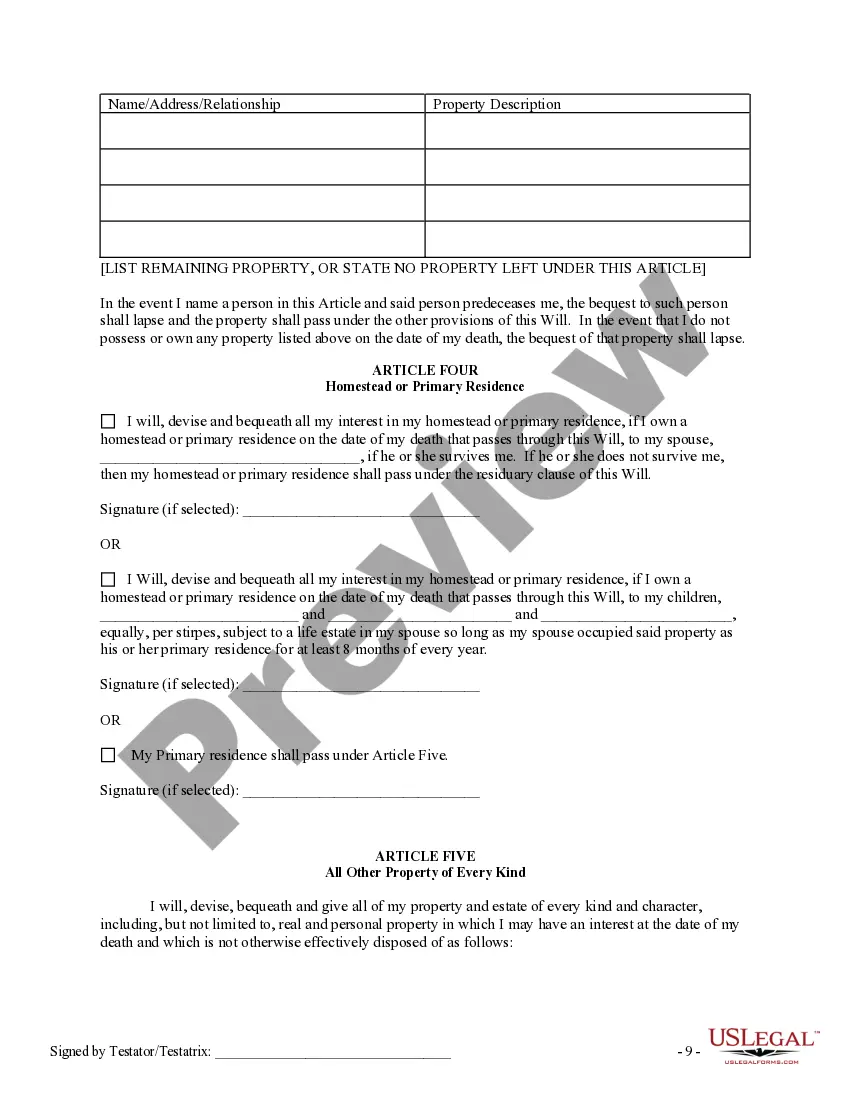

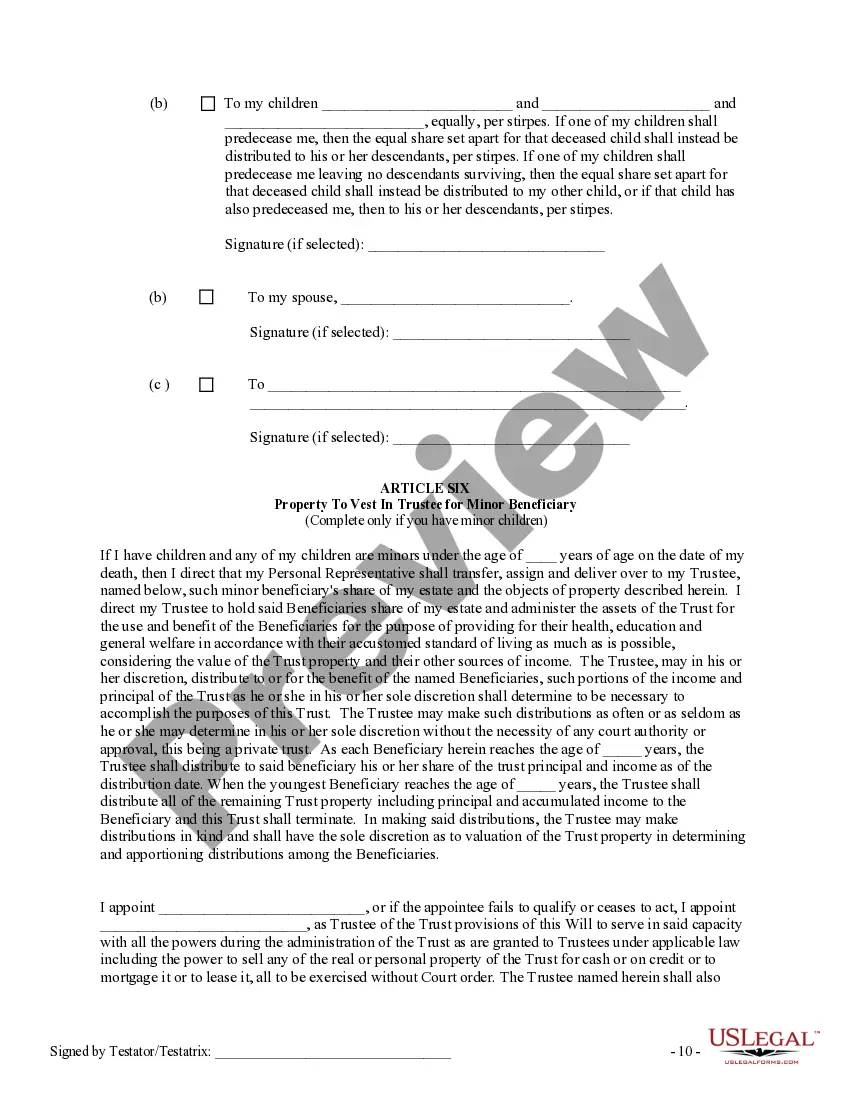

How to make a will in Spain. Drawing up a will is simple: you just need to stipulate how you want your assets to be distributed on the notary. In that sense, there are two different steps: preparing the testament and going to the notary to sign it, so it can become effective.