Last Will In Spanish With English

Description

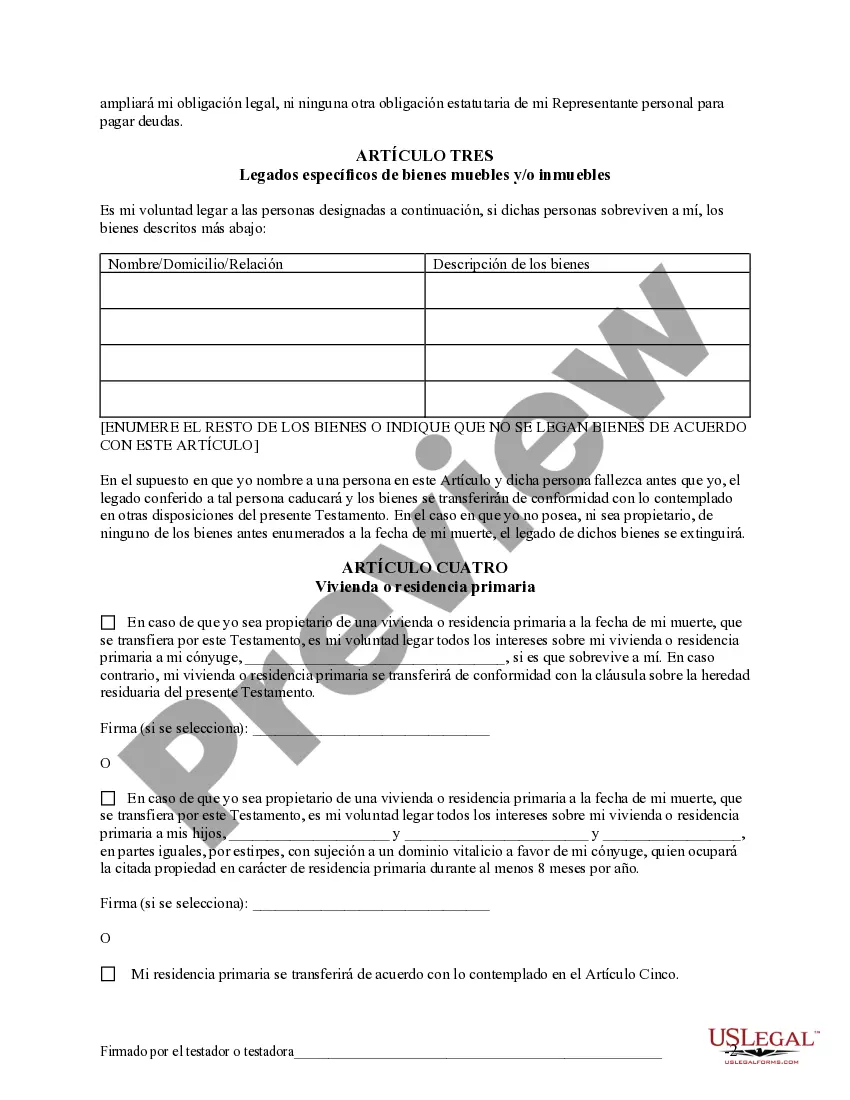

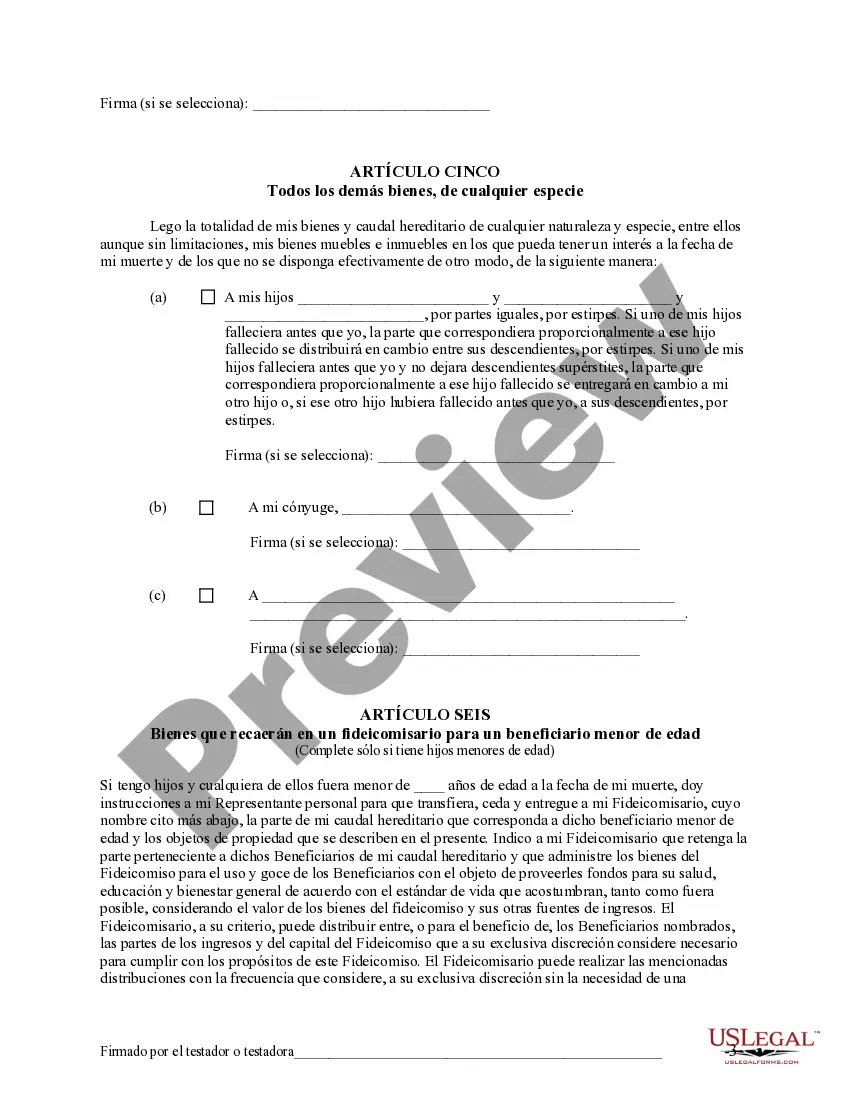

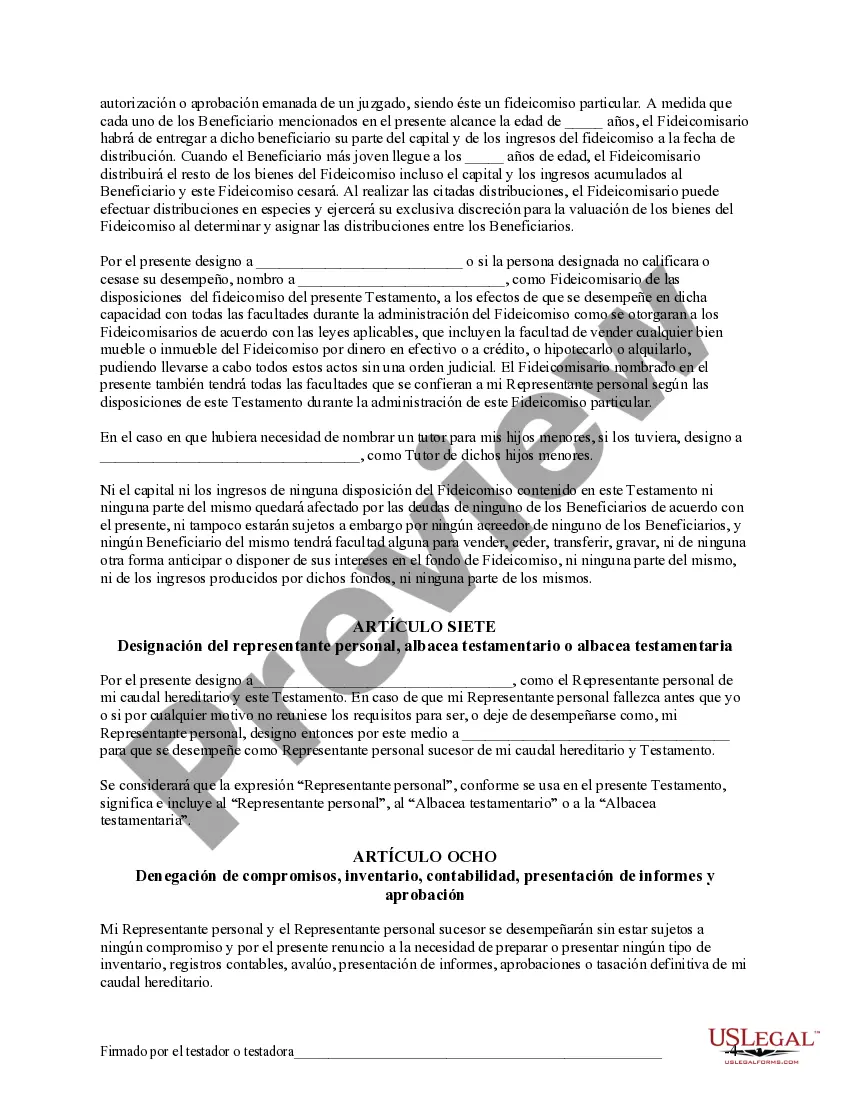

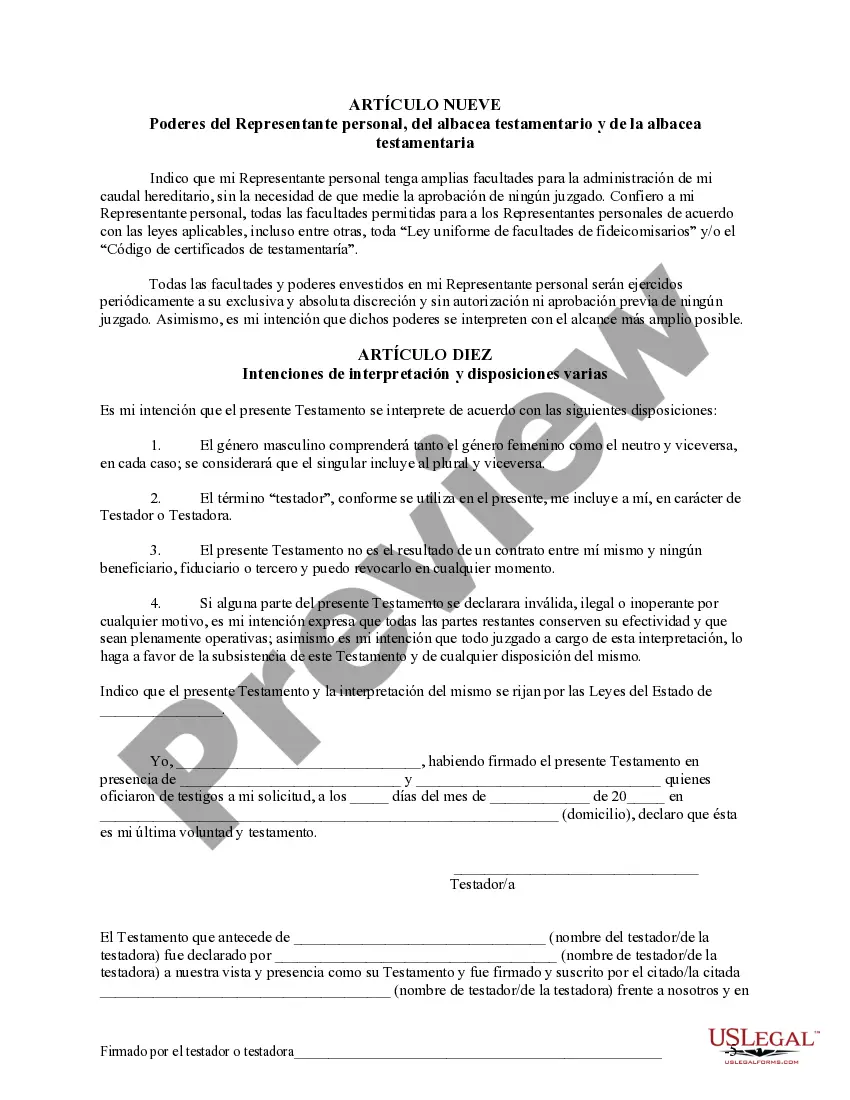

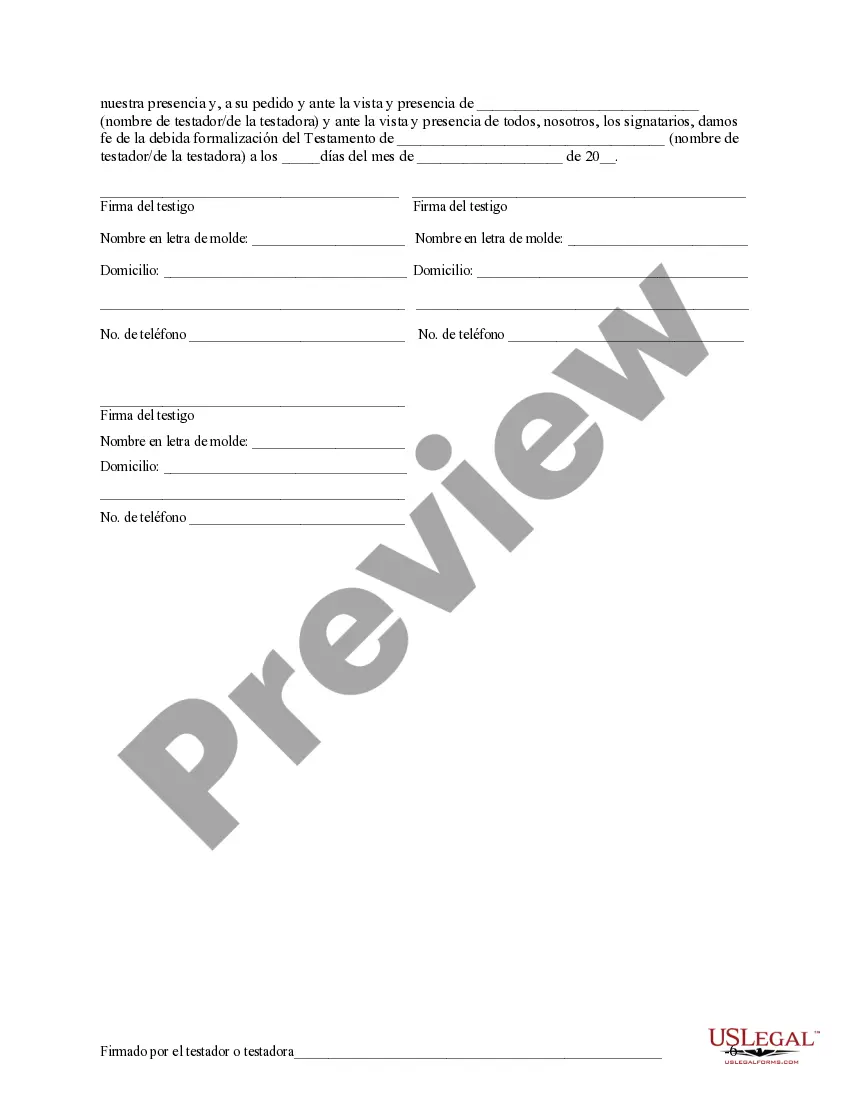

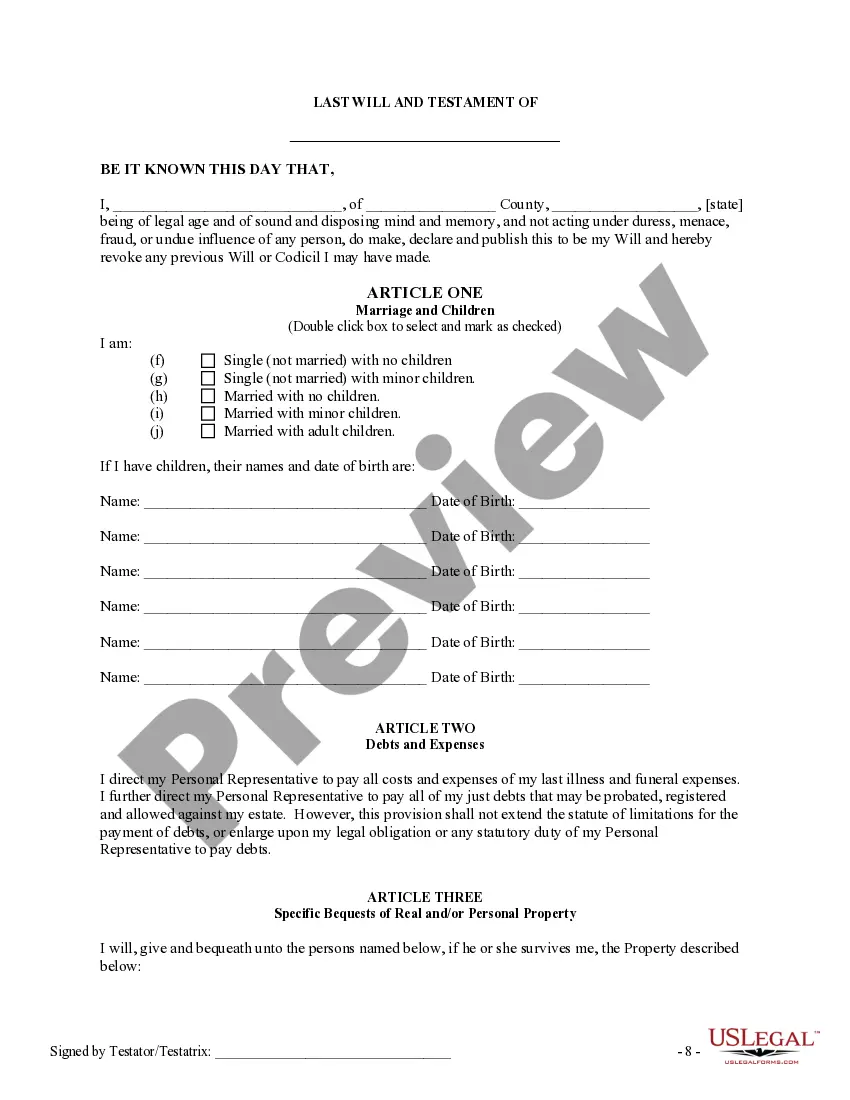

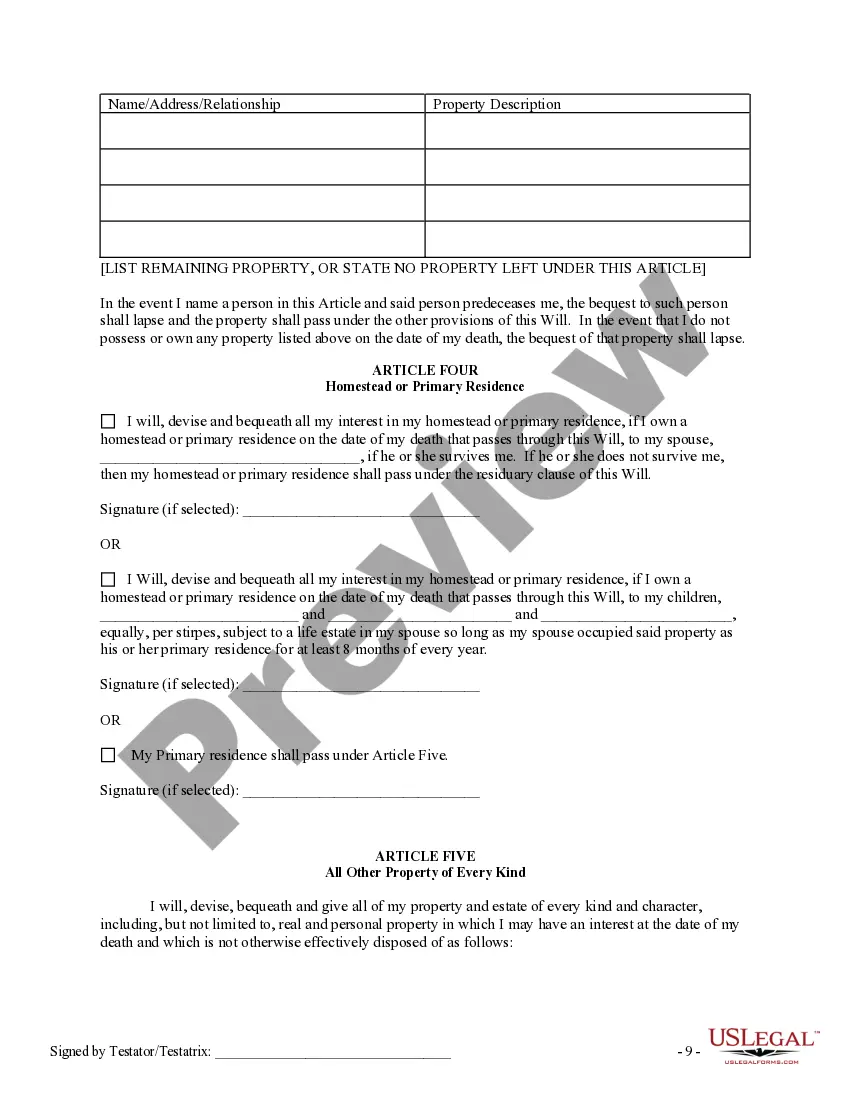

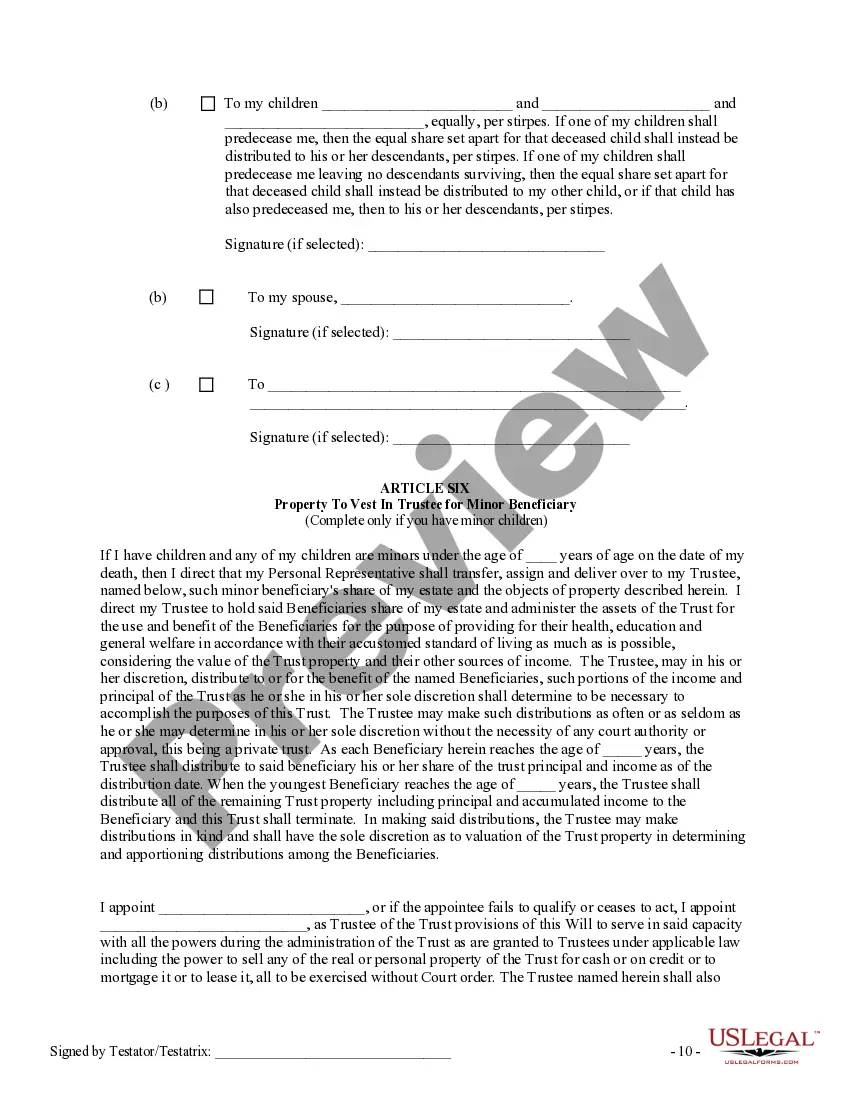

How to fill out Ultima Voluntad Y Testamento - Last Will And Testament?

It’s widely understood that you can’t quickly transform into a legal expert, nor can you learn how to swiftly prepare Last Will In Spanish With English without possessing a specialized education. Drafting legal documents is an intricate task that demands specific knowledge and competencies. So why not entrust the drafting of the Last Will In Spanish With English to the professionals.

With US Legal Forms, which boasts one of the largest libraries of legal templates, you can discover everything from court documents to templates for internal office communication. We comprehend how vital it is to comply with federal and state regulations. That’s why all forms on our site are jurisdiction-specific and current.

Here’s how you can initiate your journey on our platform and acquire the form you need in just minutes.

You can access your documents from the My documents section anytime. If you’re an existing user, you can simply Log In and find and download the template from the same section.

Regardless of the nature of your documentation—whether financial, legal, or personal—our site is equipped to assist you. Explore US Legal Forms today!

- Find the document you need using the search bar located at the top of the page.

- View a preview (if this feature is available) and examine the description to assess if Last Will In Spanish With English meets your requirements.

- If you need a different document, restart your search.

- Create a free account and select a subscription plan to purchase the template.

- Click Buy now. After the transaction is completed, you can download the Last Will In Spanish With English, fill it out, print it, and send or mail it to the appropriate individuals or organizations.

Form popularity

FAQ

In Spanish, 'last will and testament' is translated as 'testamento final'. This phrase encapsulates the essence of the document, which governs the distribution of assets after someone passes away. Including a last will in Spanish with English serves to assist those who might be more comfortable in either language.

Spanish Inheritance Tax & Wills Spanish Wills and Inheritance Tax are both important considerations if you have Spanish property and/ or investments. It is normally recommended that you draft a Spanish Will to cover assets located in Spain and a foreign Will to cover any assets in other countries.

Your last will and testament is a legal written document that specifies where and to whom you wish your property and possessions ? known as your 'estate' ? to be distributed in the event of your death. At least one executor must be appointed in your will, who is responsible for managing your estate to its conclusion.

If you have never made a will in Spain before . Solicitors fee 200 euro plus V.A.T each will and notary fee aprox. 60 euro each will. This fee will be slightly more if your assets in Spain are worth more than 500.000 euro or you require complex clauses.

To make a will in Spain you must be over 14 years old, have your wishes in writing and it must be signed and certified before a 'notary'. It will then be registered at the central registry in Madrid, known as 'Registro General de Actos de Ultima Voluntad' (Central Registry of Wills).