Liability Non Profit Statement With Join

Description

How to fill out Waiver And Release From Liability For Adult For Nonprofit?

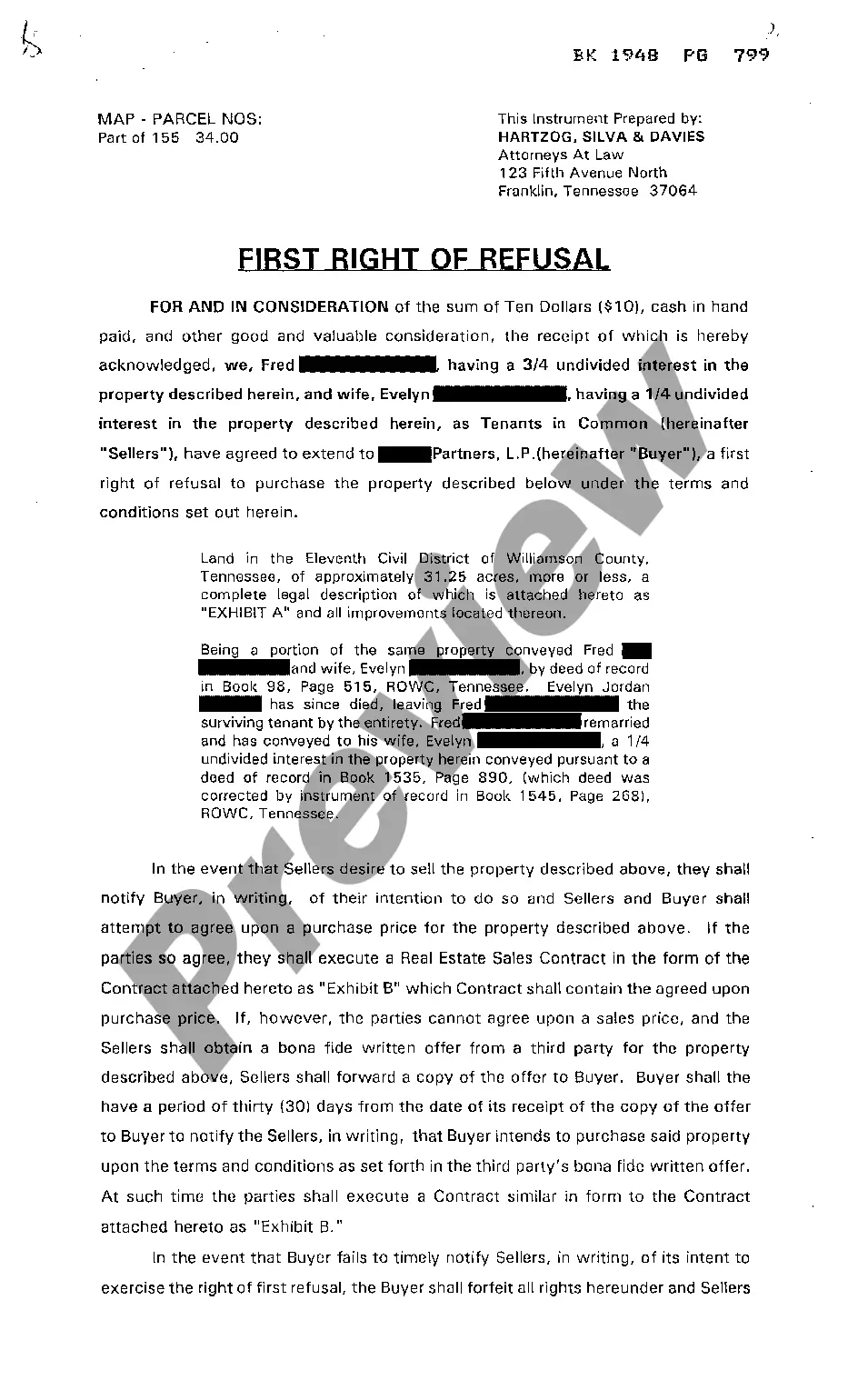

Utilizing legal document exemplars that adhere to national and local statutes is essential, and the internet provides countless alternatives to choose from.

However, what is the purpose of spending time hunting for the suitable Liability Non Profit Statement With Join template online when the US Legal Forms digital library already houses such forms gathered in one place.

US Legal Forms represents the largest online legal repository with more than 85,000 editable templates created by legal professionals for any business and personal circumstance.

Explore the template using the Preview feature or via the text description to confirm it aligns with your requirements.

- They are user-friendly to navigate with all documents organized by state and intended use.

- Our specialists stay informed about legal advancements, ensuring you can always trust that your form is current and compliant when obtaining a Liability Non Profit Statement With Join from our platform.

- Acquiring a Liability Non Profit Statement With Join is quick and easy for both existing and new clients.

- If you possess an account with an active subscription, sign in and download the document template you require in the correct format.

- If you are unfamiliar with our site, follow the procedures outlined below.

Form popularity

FAQ

Yes. Nonprofit corporations must submit their financial statements, which include the salaries of directors, officers and key employees to the IRS on Form 990 as mentioned above. Both the IRS and the nonprofit corporation are required to disclose the information they provide on Form 990 to the public.

But a nonprofit can also enter into a joint venture with a for-profit company. Overall, joint ventures can increase your impact by allowing you to take on more than you might be able to normally.

The four essential nonprofit financial statements are statements of financial position, activities, cash flows, and functional expenses.

Liabilities. In a nutshell, the liabilities section of your nonprofit statement of financial position sums up what your organization owes. This will include your accounts payable, debt, and other expenses.

Some nonprofits require specific financial disclosures to the members in its bylaws, while others don't address this. Check the bylaws of the nonprofit you belong to or serve as a board of director member to determine what access the membership has to financial records.