New Hire Agreement With Guarantor

Description

How to fill out New Hire Agreement?

Administration necessitates accuracy and exactness.

If you do not manage completing documents like New Hire Agreement With Guarantor regularly, it may result in some miscommunications.

Choosing the appropriate sample from the outset will ensure that your document submission proceeds smoothly and avert any hassles of re-submitting a document or redoing the same task entirely from the beginning.

Obtaining the correct and current samples for your documentation is just a few minutes away with an account at US Legal Forms. Eliminate the administrative uncertainties and enhance your efficiency in handling forms.

- Discover the suitable template utilizing the search feature.

- Confirm the New Hire Agreement With Guarantor you’ve found pertains to your state or jurisdiction.

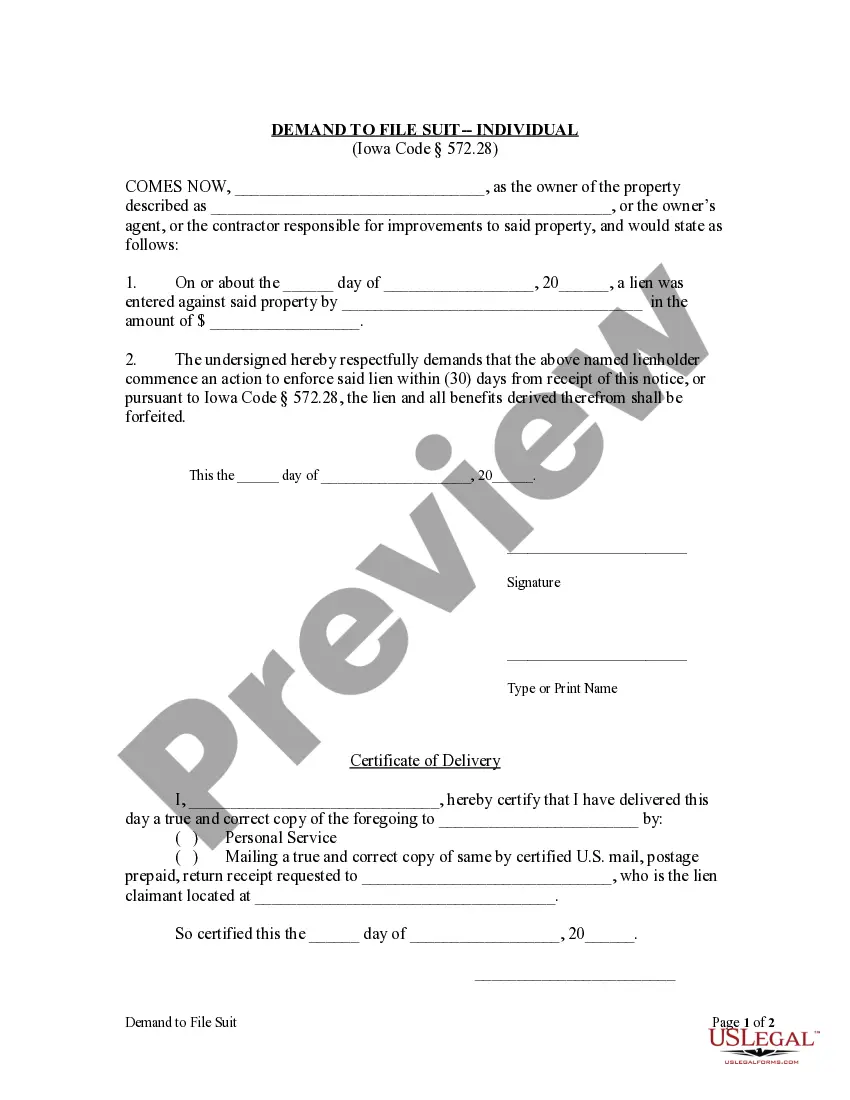

- Examine the preview or review the description detailing the specifics regarding the application of the template.

- When the outcome aligns with your query, press the Buy Now button.

- Select the appropriate option from the proposed pricing plans.

- Sign in to your account or create a new one.

- Complete the transaction utilizing a credit card or PayPal payment method.

- Download the document in your preferred format.

Form popularity

FAQ

A guarantor's form should include a space to fill in the home address, work address, phone number, and email address. The contact details are what will be used to contact the guarantor in the future if the principal fails to meet agreement terms. This is a very important feature of the guarantor's form.

What Is a Guarantor? A guarantor is a financial term describing an individual who promises to pay a borrower's debt in the event that the borrower defaults on their loan obligation. Guarantors pledge their own assets as collateral against the loans.

Write out your qualifications as a guarantor -- your income, assets and other personal details supporting why you would be able to take responsibility should the tenant or borrower fail to do so. You can also list your accountant to testify to your financial state, as well as other character references.

To write a guarantor letter, start by writing the date at the top of the paper, followed by your full name and address. Below your information, address the letter to the company you're dealing with and begin the letter by identifying yourself and the person you're guaranteeing.

In this regard, I guarantee that the said person is having good moral character. I also ensure that he would not be doing any illegal activities inside or outside the company's premises. Also, (mention other guarantee). You may consider this letter as an employment guarantee of the said person.