Affidavit Of Surviving Spouse Pvao Form In Alameda

Description

Form popularity

FAQ

An Affidavit of Survivorship is a legal document that can be used to claim property that you co-own with a person who has died.

The simple transfer process is a simplified version of the probate process that allows for faster estate settlement. To qualify for this simplified version, the estate assets must be worth less than $166,250. If it is worth more than that, the estate must go through the full probate process.

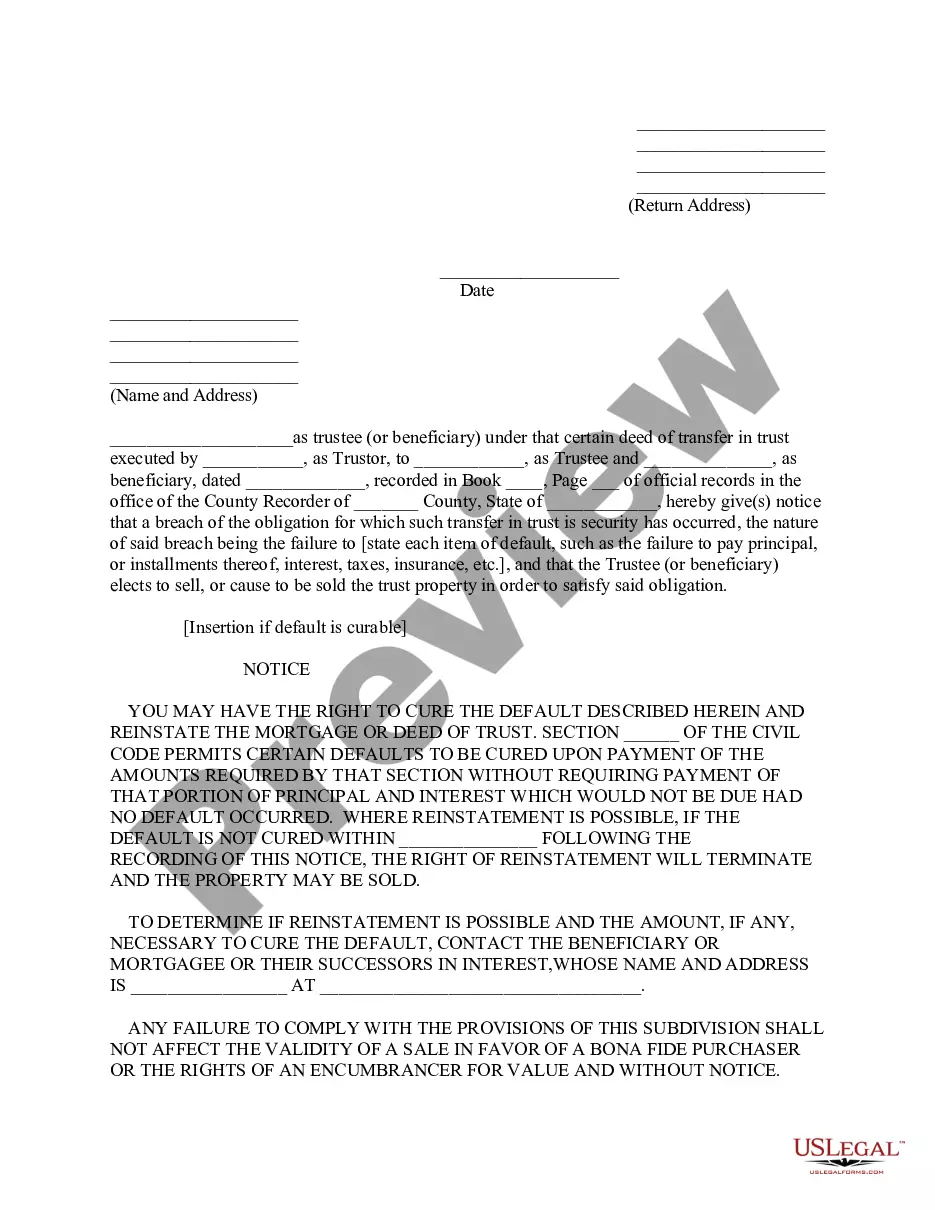

How Do I Record an Affidavit? Take a certified copy of the death certificate of the deceased joint tenant and your affidavit to the recorder's office in the county where the real property is located. The recorder's office also requires a Preliminary Change of Ownership Report (PCOR) when filing the affidavit.

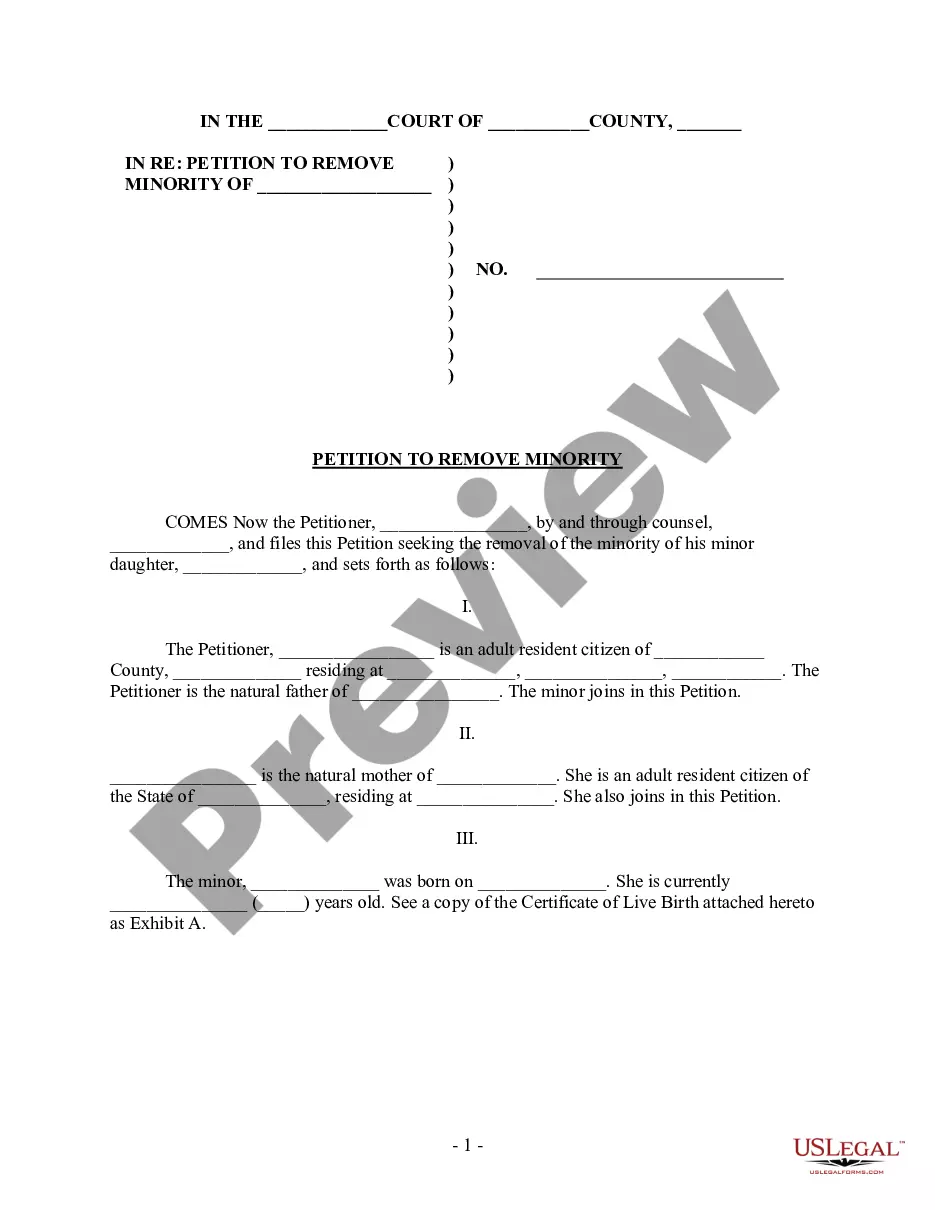

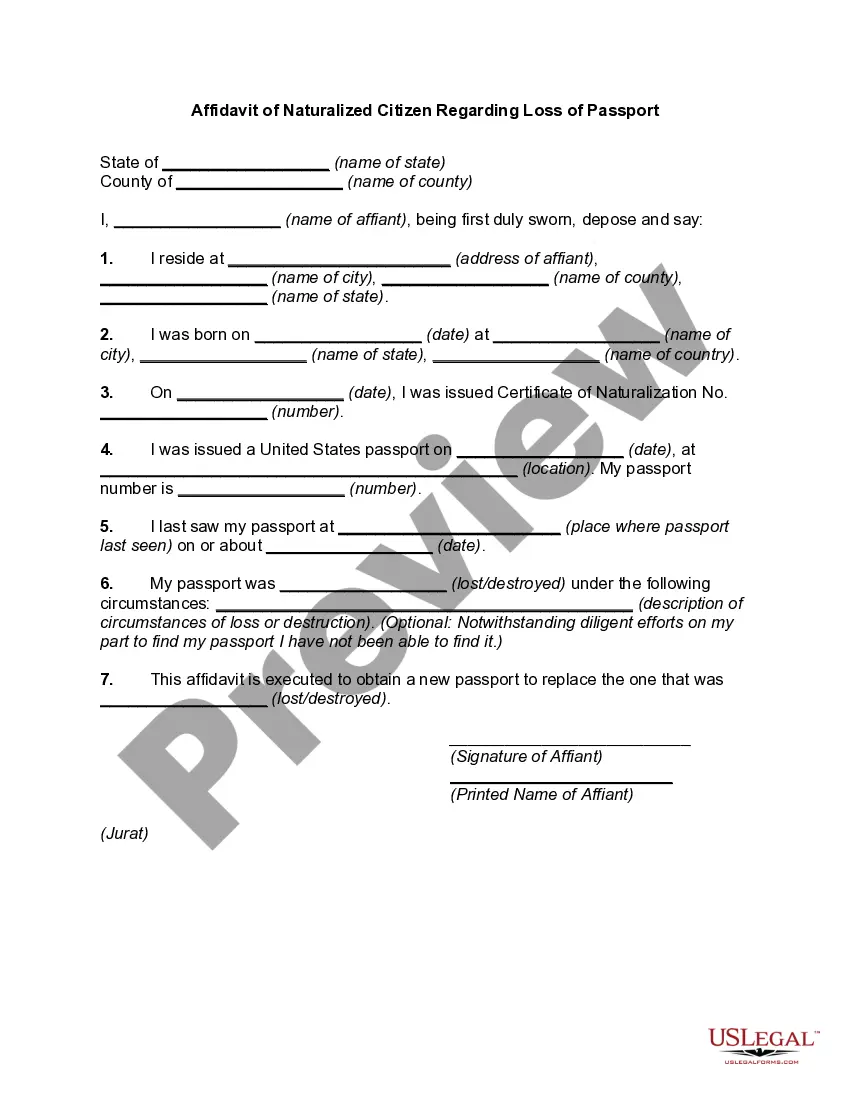

You may find this form on your state court website or through the court clerk's office, or you may need to have an attorney or legal services firm create one for you. The form is fairly straightforward and requires the following information: Name, address, and date of death of the decedent.

In non-community-property states, a formal right of survivorship agreement or deed is required to give a spouse survivorship rights. You'll need to request the form from your county clerk or draft a document detailing the following about the property: Whether right of survivorship exists.

A survivorship affidavit can only be used if two or more people are listed as owners and one of them is deceased. It is filed by the surviving party to remove the deceased owner.

The simple transfer process is a simplified version of the probate process that allows for faster estate settlement. To qualify for this simplified version, the estate assets must be worth less than $166,250. If it is worth more than that, the estate must go through the full probate process.

California has "simplified procedures" for transferring property when the estate is worth under a certain amount (from $20,000 to $150,000 depending on the circumstances and the kind of property).

California law mandates that probate be completed within one year of an executor or administrator being appointed to their role by the court. Typically it takes 12 to 18 months, though, and large or complex estates can take even longer. Executors or administrators can file extensions to resolve any complications.

If your joint owner predeceases you and you do not record a new deed or have any other estate plan, then your property would be required to go through probate. Another simple method that could be used to avoid probate of your property would be to execute a revocable transfer on death deed (“TOD”).