Liability Company Online Formal Demand

Description

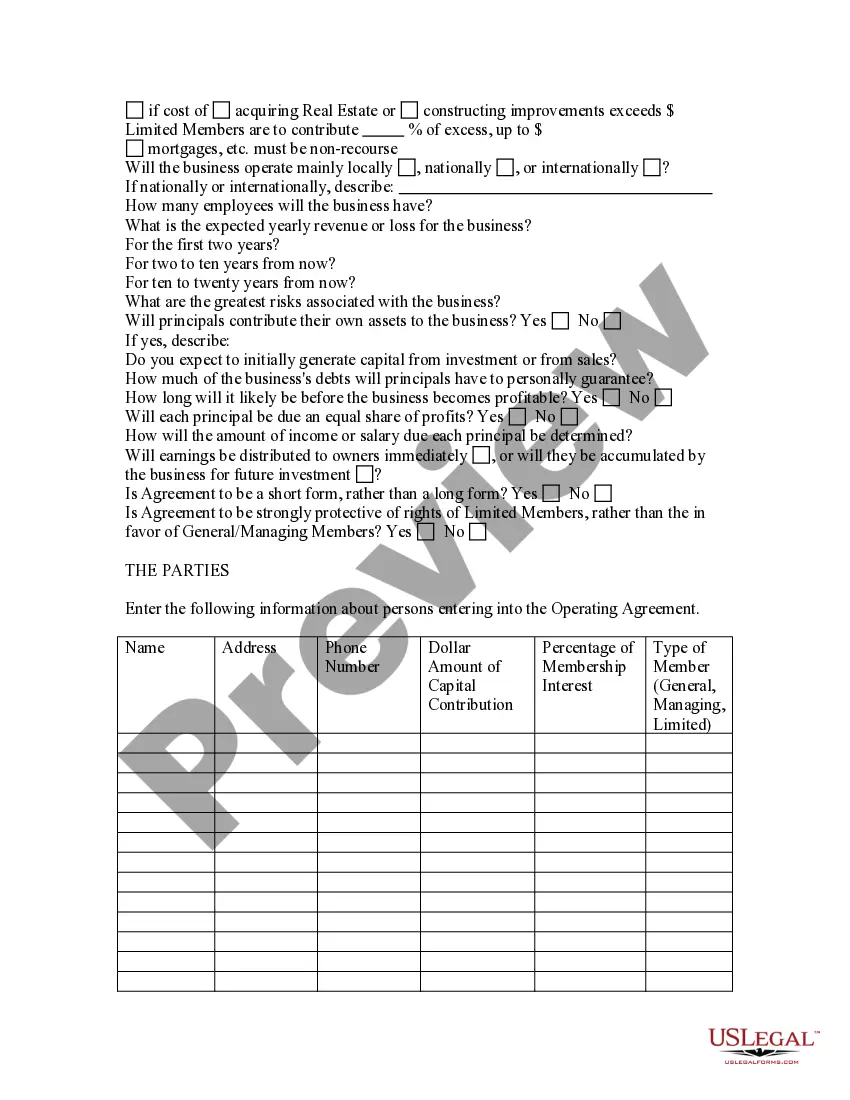

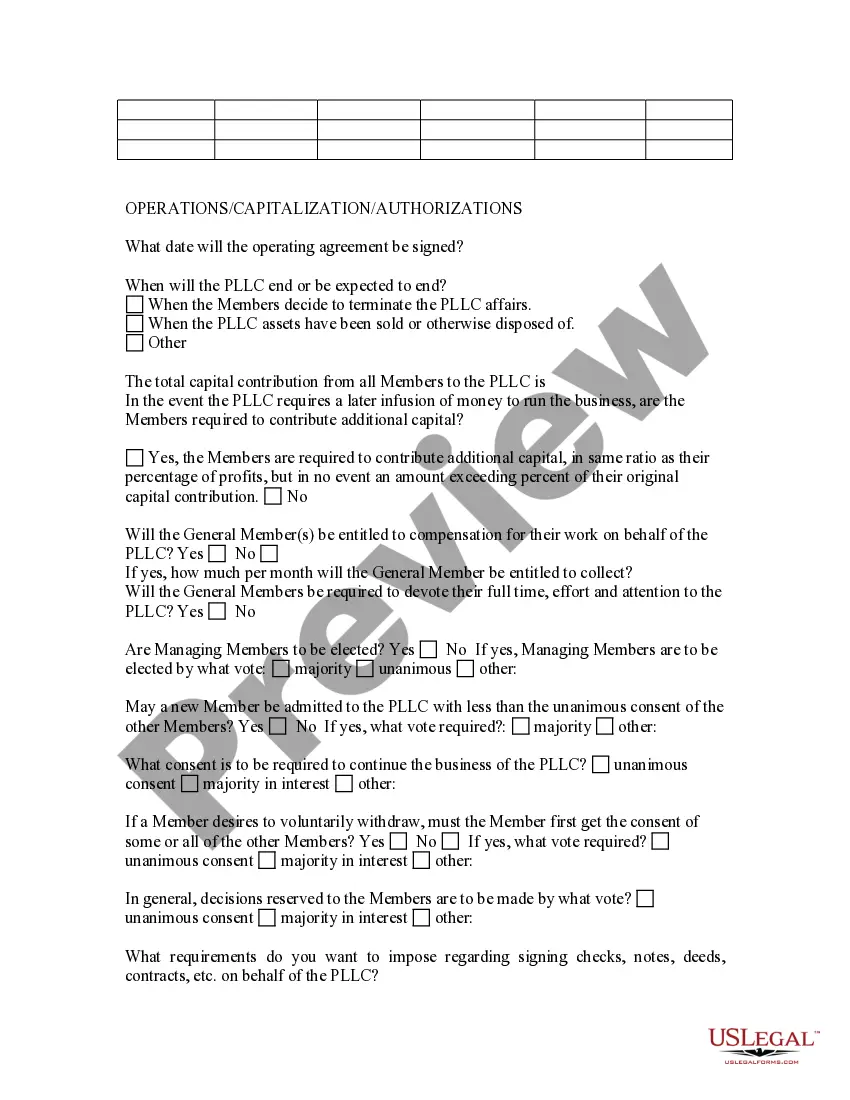

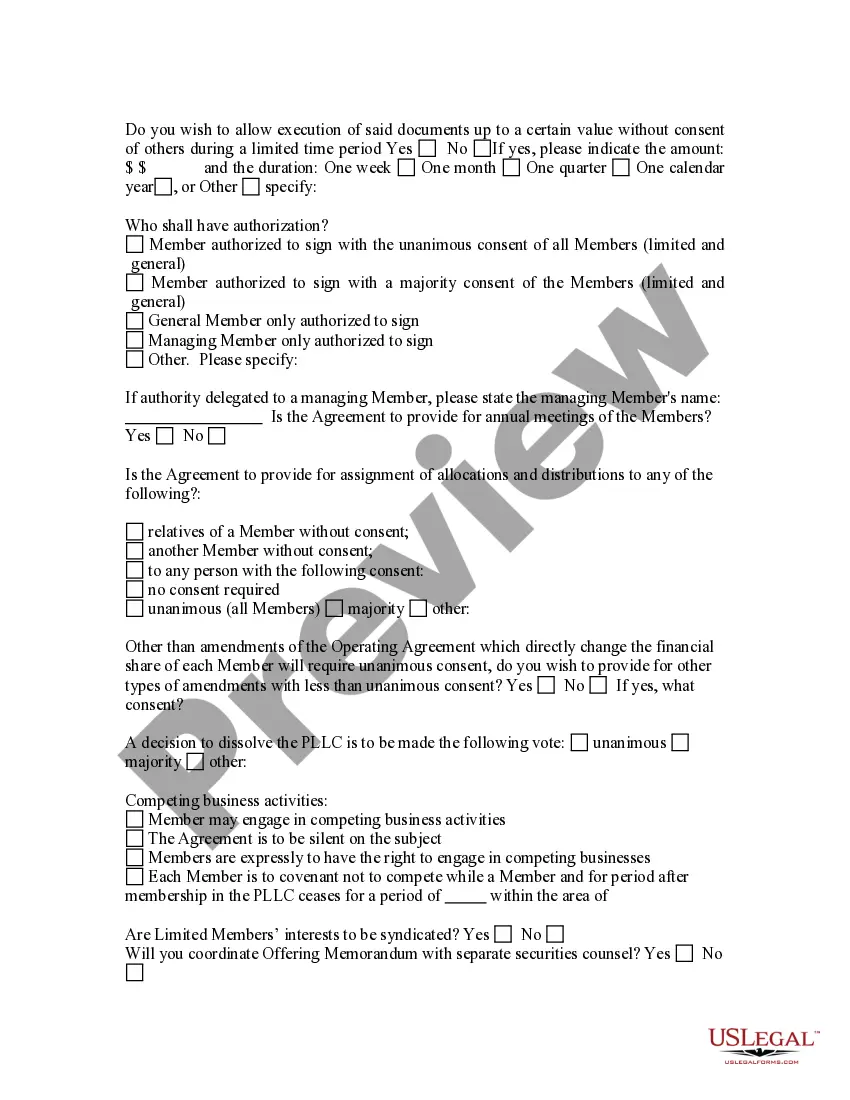

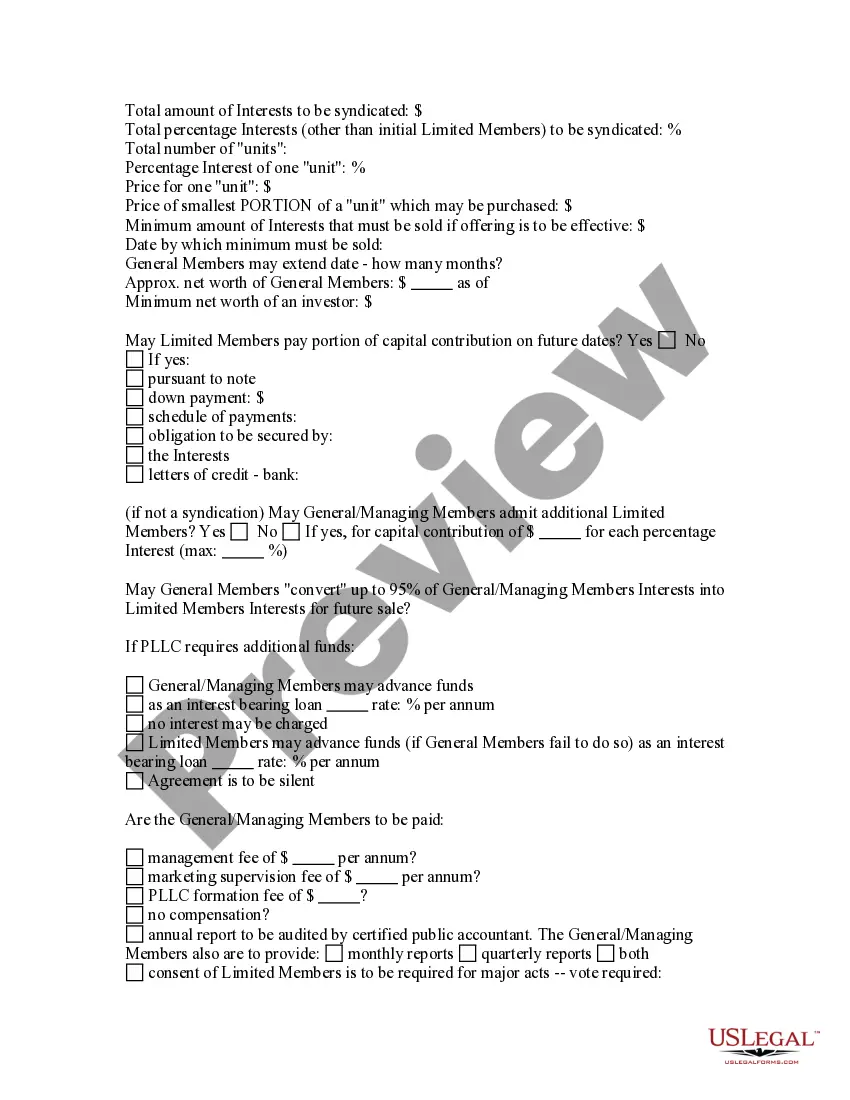

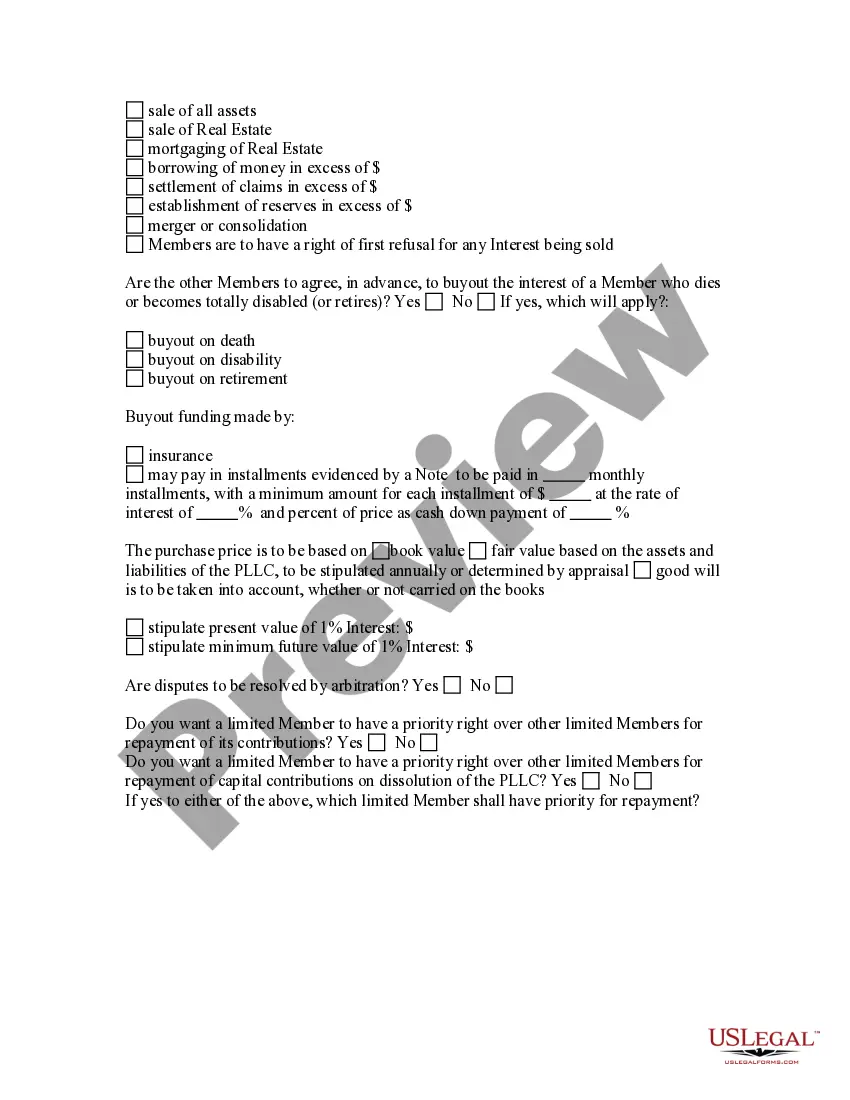

How to fill out Professional Limited Liability Company - PLLC - Formation Questionnaire?

Handling legal documents and procedures could be a time-consuming addition to the day. Liability Company Online Formal Demand and forms like it often require that you look for them and navigate how you can complete them effectively. For that reason, if you are taking care of financial, legal, or personal matters, having a thorough and hassle-free web catalogue of forms when you need it will go a long way.

US Legal Forms is the top web platform of legal templates, boasting over 85,000 state-specific forms and a variety of resources that will help you complete your documents quickly. Explore the catalogue of appropriate papers available with just one click.

US Legal Forms offers you state- and county-specific forms offered by any moment for downloading. Protect your papers management procedures having a top-notch services that allows you to prepare any form within a few minutes without extra or hidden charges. Just log in to the profile, identify Liability Company Online Formal Demand and download it right away in the My Forms tab. You may also gain access to formerly saved forms.

Is it the first time utilizing US Legal Forms? Sign up and set up a free account in a few minutes and you’ll gain access to the form catalogue and Liability Company Online Formal Demand. Then, adhere to the steps below to complete your form:

- Be sure you have discovered the proper form using the Review option and reading the form information.

- Select Buy Now once all set, and choose the subscription plan that meets your needs.

- Select Download then complete, eSign, and print the form.

US Legal Forms has twenty five years of expertise helping consumers manage their legal documents. Obtain the form you need today and improve any process without having to break a sweat.

Form popularity

FAQ

Every LLC that is doing business or organized in California must pay an annual tax of $800. This yearly tax will be due, even if you are not conducting business, until you cancel your LLC. You have until the 15th day of the 4th month from the date you file with the SOS to pay your first-year annual tax.

Disadvantages of creating an LLC Cost: An LLC usually costs more to form and maintain than a sole proprietorship or general partnership. States charge an initial formation fee. ... Transferable ownership. Ownership in an LLC is often harder to transfer than with a corporation.

How to form an LLC Step 1: Choose a state in which to form your LLC. ... Step 2: Choose a name for your LLC. ... Step 3: Choose a registered agent. ... Step 4: Prepare an LLC operating agreement. ... Step 5: File your LLC with your state. Step 6: Obtain an EIN. ... Step 7: Open a business bank account.

If you have an LLC, here's how to fill in the California Form 568: Line 1?Total income from Schedule IW. Enter the total income. Line 2?Limited liability company fee. Enter the amount of the LLC fee. The LLC must pay a fee if the total California income is equal to or greater than $250,000.

If you have an LLC, here's how to fill in the California Form 568: Line 1?Total income from Schedule IW. Enter the total income. Line 2?Limited liability company fee. Enter the amount of the LLC fee. The LLC must pay a fee if the total California income is equal to or greater than $250,000.