Power Attorney Form Template With Irs Verification

Description

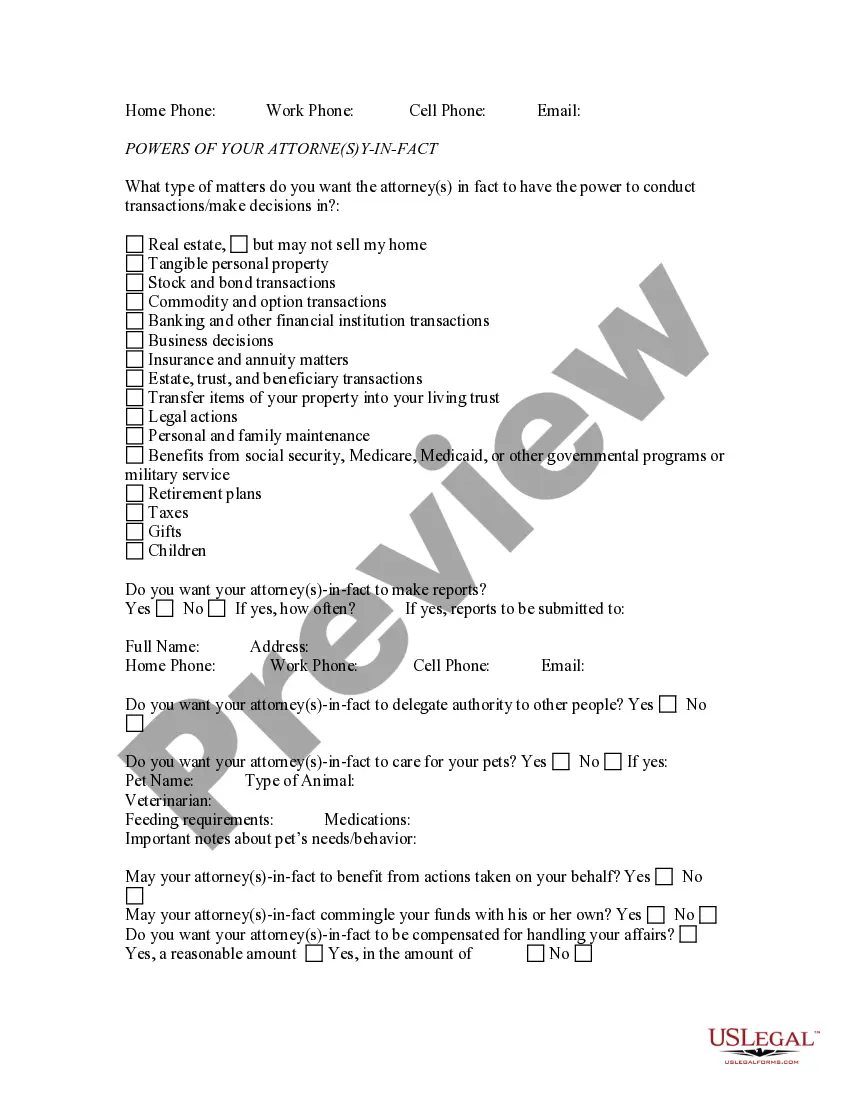

How to fill out Limited Power Of Attorney Questionnaire?

Managing legal documents and procedures can be a lengthy addition to your entire day.

Power of Attorney Form Template With IRS Verification and similar documents often require you to locate them and understand how to fill them out correctly.

Consequently, if you are addressing financial, legal, or personal matters, utilizing a comprehensive and user-friendly online repository of forms when needed will immensely assist.

US Legal Forms is the premier online platform for legal templates, providing over 85,000 state-specific forms and a variety of tools to help you complete your paperwork with ease.

Is this your first time using US Legal Forms? Register and establish your account in just a few minutes to gain access to the form library and Power of Attorney Form Template With IRS Verification. After that, follow the steps outlined below to fill out your form.

- Browse the collection of relevant documents at your fingertips with just a click.

- US Legal Forms offers state- and county-specific forms available for download at any time.

- Safeguard your document management processes with a premium service that enables you to create any form in minutes without any additional or concealed charges.

- Simply Log In to your account, find Power of Attorney Form Template With IRS Verification, and download it immediately from the My documents section.

- You can also retrieve previously downloaded forms.

Form popularity

FAQ

Learn How to Fill the Form 2848 Power of Attorney and ... - YouTube YouTube Start of suggested clip End of suggested clip If the standard form is acceptable. Leave box 5 blank. Box 6 is important as it states whether theMoreIf the standard form is acceptable. Leave box 5 blank. Box 6 is important as it states whether the taxpayer will allow the representing party to receive tax refund checks but not to cash them.

Use Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be a person eligible to practice before the IRS.

The taxpayer and the tax professional must sign Form 2848. If the tax professional uses the new online option, the signatures on the forms can be handwritten or electronic.

The Taxpayer First Act (TFA) of 2019 requires the IRS to provide digital signature options for Form 2848, Power of Attorney, and Form 8821, Tax Information Authorization. These improvements will help individual taxpayers, business taxpayers, and the tax professionals who serve them.

You can use Form 2848, Power of Attorney and Declaration of Representative for this purpose. Your signature on the Form 2848 allows the individual or individuals named to represent you before the IRS and to receive your tax information for the matter(s) and tax year(s)/period(s) specified on the Form 2848.