Lemon Law Document With Appliances

Description

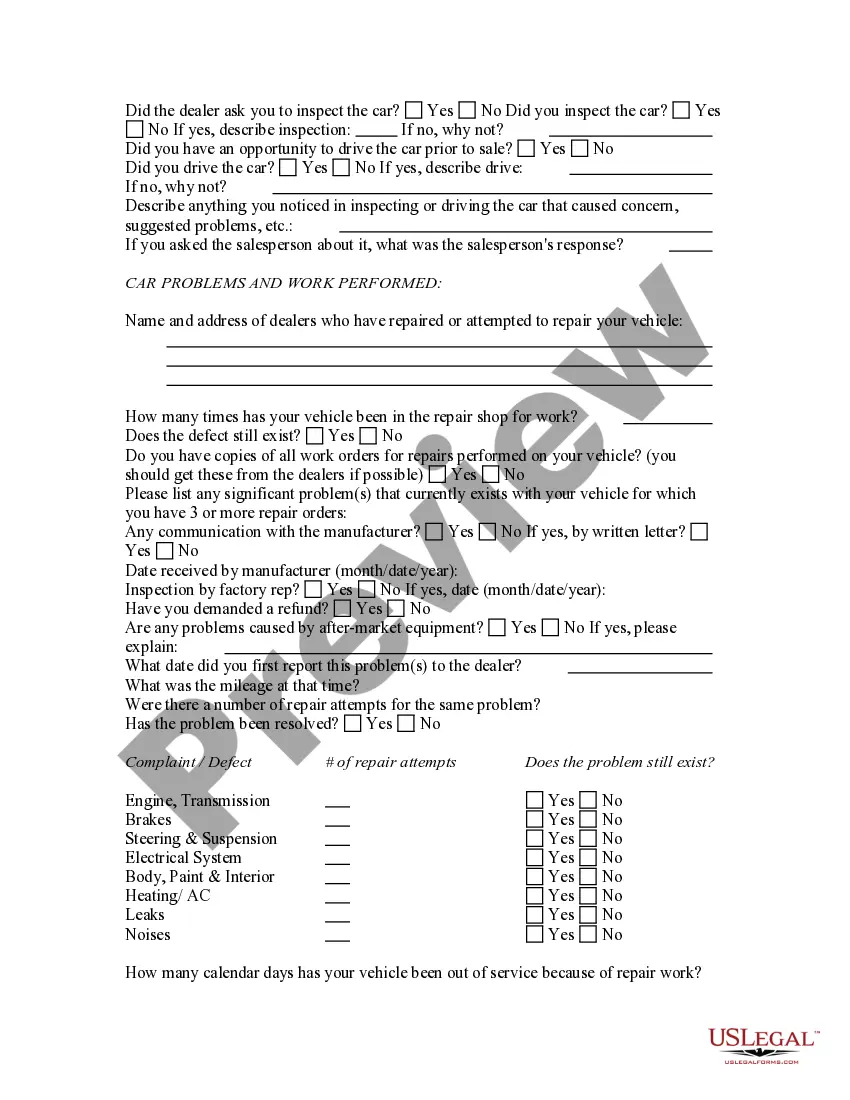

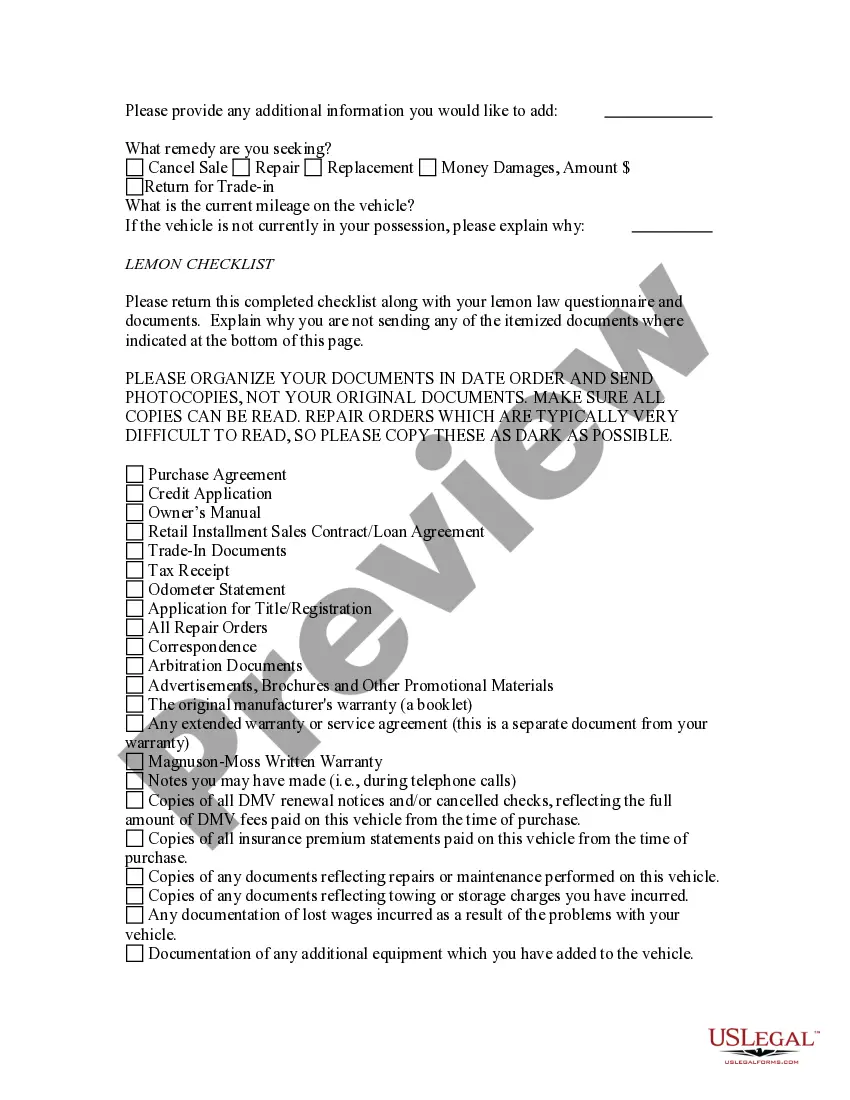

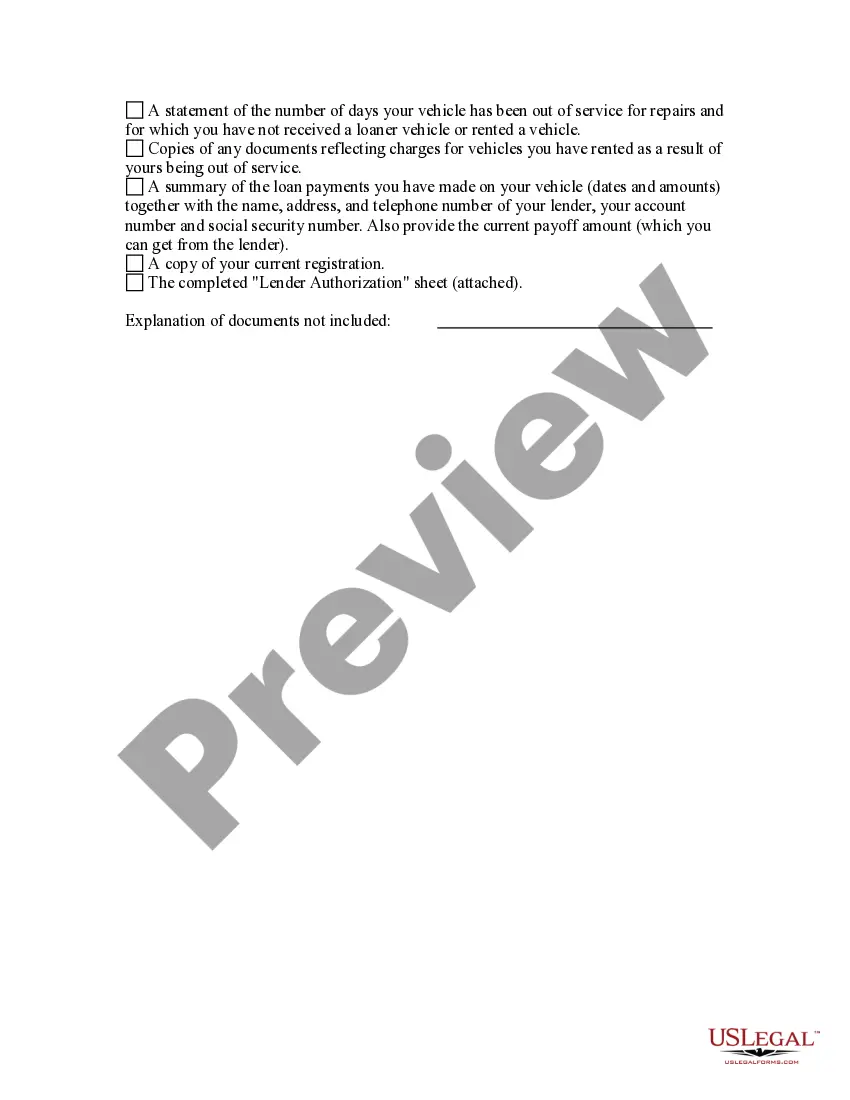

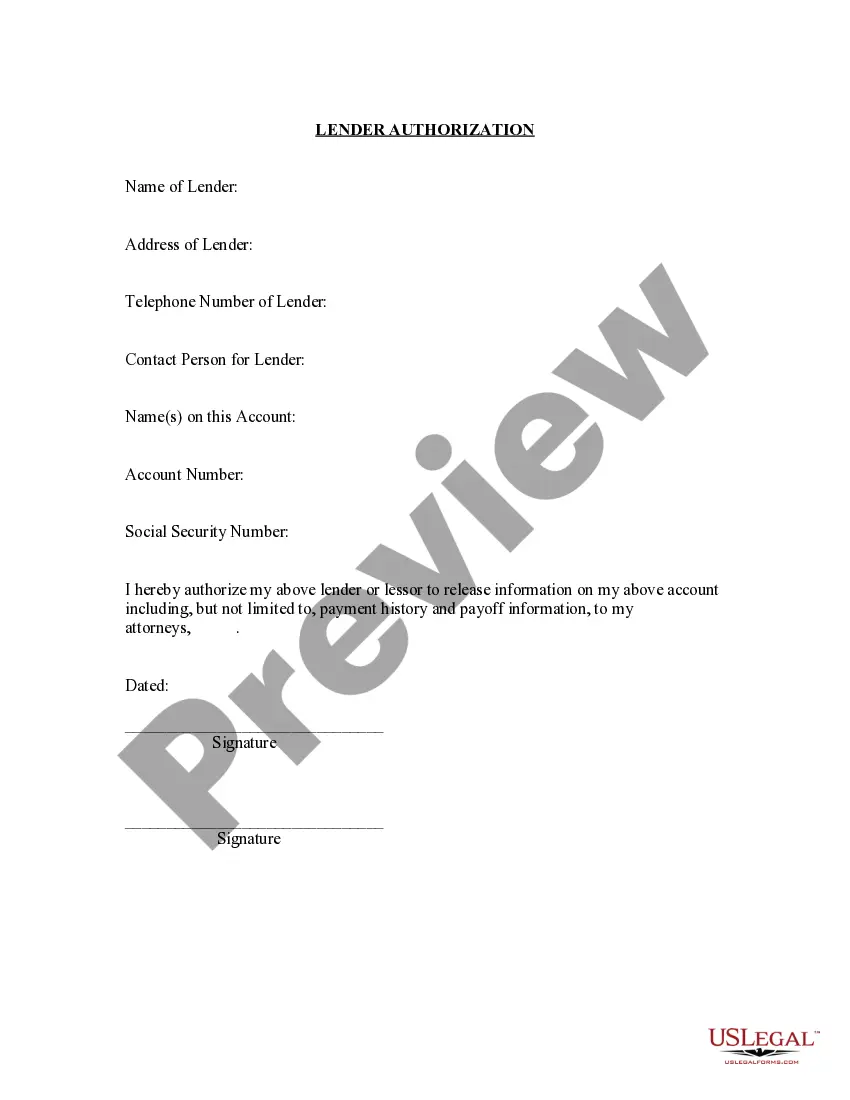

How to fill out Automobile Lemon Law Questionnaire?

It’s widely recognized that you cannot become a legal authority instantly, nor can you learn how to swiftly create a Lemon Law Document With Appliances without possessing a specialized background.

Drafting legal documents is a lengthy endeavor that necessitates particular education and expertise. So why not entrust the creation of the Lemon Law Document With Appliances to the experts.

With US Legal Forms, one of the most extensive legal template repositories, you can obtain everything from court documents to templates for internal communication.

If you need another template, initiate your search once more.

Create a free account and choose a subscription plan to acquire the form. Select Buy now. Once the payment is completed, you will be able to download the Lemon Law Document With Appliances, fill it out, print it, and send or mail it to the required parties or organizations.

- We understand how important it is to comply with and adhere to federal and state laws.

- Therefore, all templates on our platform are specific to your location and are current.

- Begin by visiting our website to get the document you need in just a few moments.

- Find the form you require using the search bar at the top of the page.

- Preview it (if available) and review the accompanying description to confirm if the Lemon Law Document With Appliances fits your needs.

Form popularity

FAQ

Cities and towns in Massachusetts, in an effort to collect back taxes, have the right to file a lien against a property owner in the Registry of Deeds. Municipalities can later foreclose the rights of owners to redeem the property (to get clear title to the property returned to them by paying the taxes).

Vermont Property Tax Breaks for Retirees Vermont offers a property tax credit of up to $8,000 to eligible homeowners.

For the 2022 tax year, the income tax in Vermont has a top rate of 8.75%, which places it as one of the highest rates in the U.S. Meanwhile, total state and local sales taxes range from 6% to 7%. A financial advisor can help you understand how taxes fit into your overall financial goals.

Vermont Tax Rates, Collections, and Burdens Vermont has a 6.00 percent state sales tax rate, a max local sales tax rate of 1.00 percent, and an average combined state and local sales tax rate of 6.30 percent. Vermont's tax system ranks 44th overall on our 2023 State Business Tax Climate Index.

Abatement qualifications Vermont law says that any person may ask their Board of Abatement to abate some or all of their property taxes because they are unable to pay. However, it is up to the city or town where you live to decide whether to grant the request.

The maximum civil penalty is 25% of the unpaid tax due. The penalty for fraudulently or willfully intending to defeat or evade a tax liability is 100% of the unpaid tax. Taxpayers who claim more than the correct amount due to them for the Renter Rebate and Property Tax Adjustment are assessed a one-time penalty of 10%.

There are two types of property taxes in Vermont: local property taxes and the state education tax rate. Local property tax rates are determined by municipalities and are applied to a home's assessed value. The assessed value is determined by local assessors, who are called listers in Vermont.

These are tax lien states: Alabama, Arizona, Colorado, Florida, Illinois, Indiana, Iowa, Kentucky, Maryland, Mississippi, Missouri, Montana, Nebraska, New Jersey, North Dakota, Ohio, Oklahoma, South Carolina, South Dakota, Vermont, West Virginia, and Wyoming. The District of Columbia is also a tax lien jurisdiction.

If you don't pay your real property taxes in Vermont, the tax collector can sell the property to a new owner at a tax sale. Fortunately, you'll have some time to get current on the delinquent amounts before and after a sale.

Please be advised that failure to pay taxes owed by the due date may result in one or more of the following: the Department imposing liens on your property; posting of your name and debt amount on the Top 100 Delinquent Taxpayer Report; court action.