Lemon Law Document For Refrigerators

Description

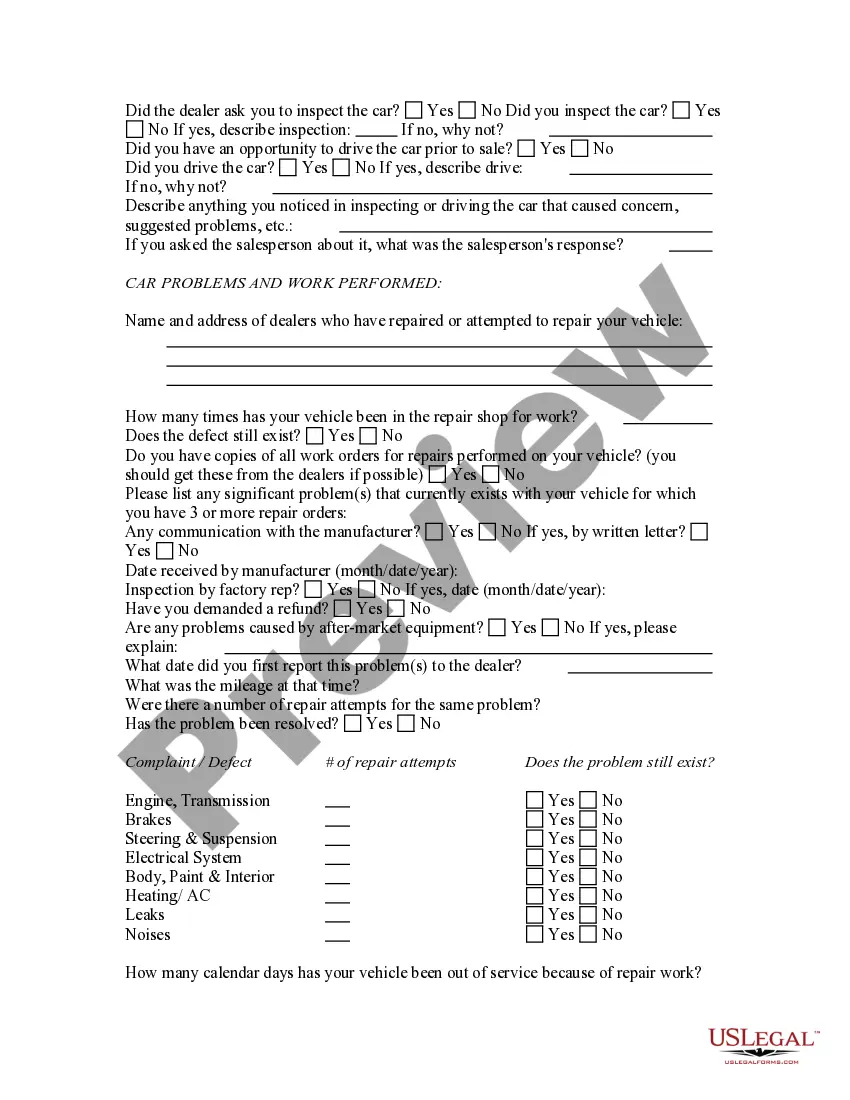

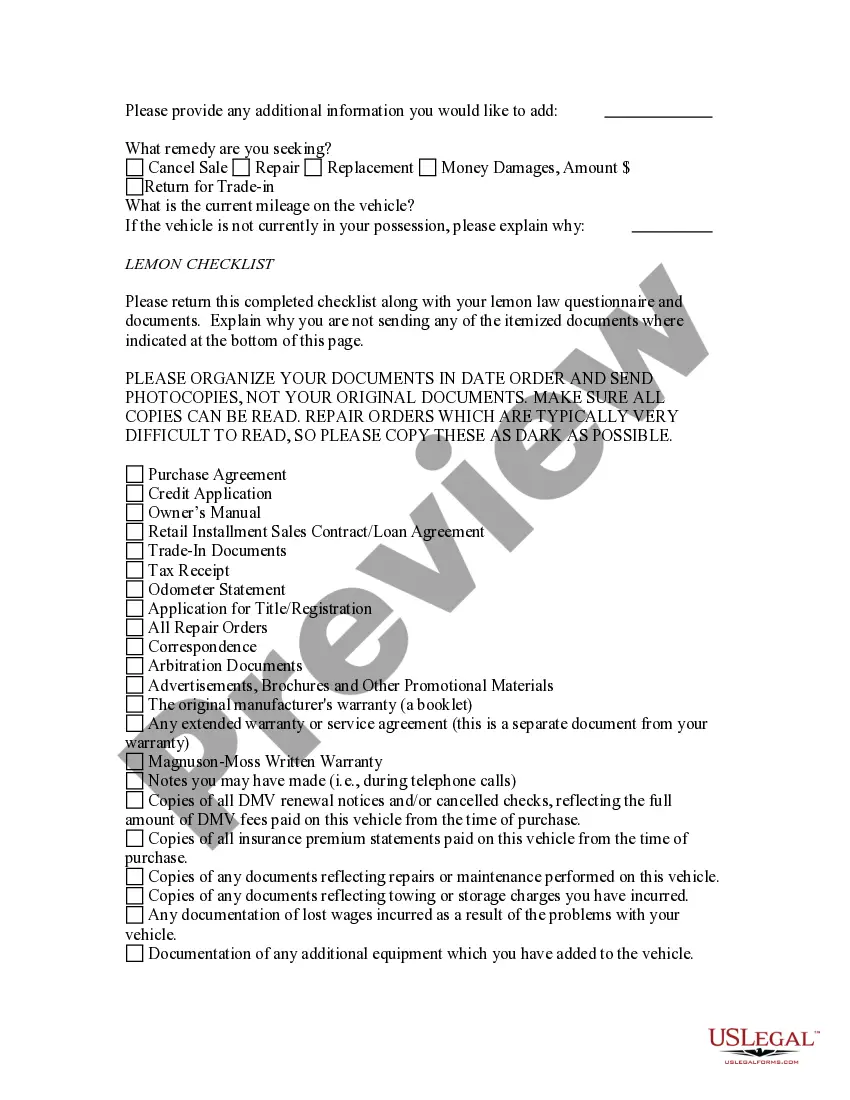

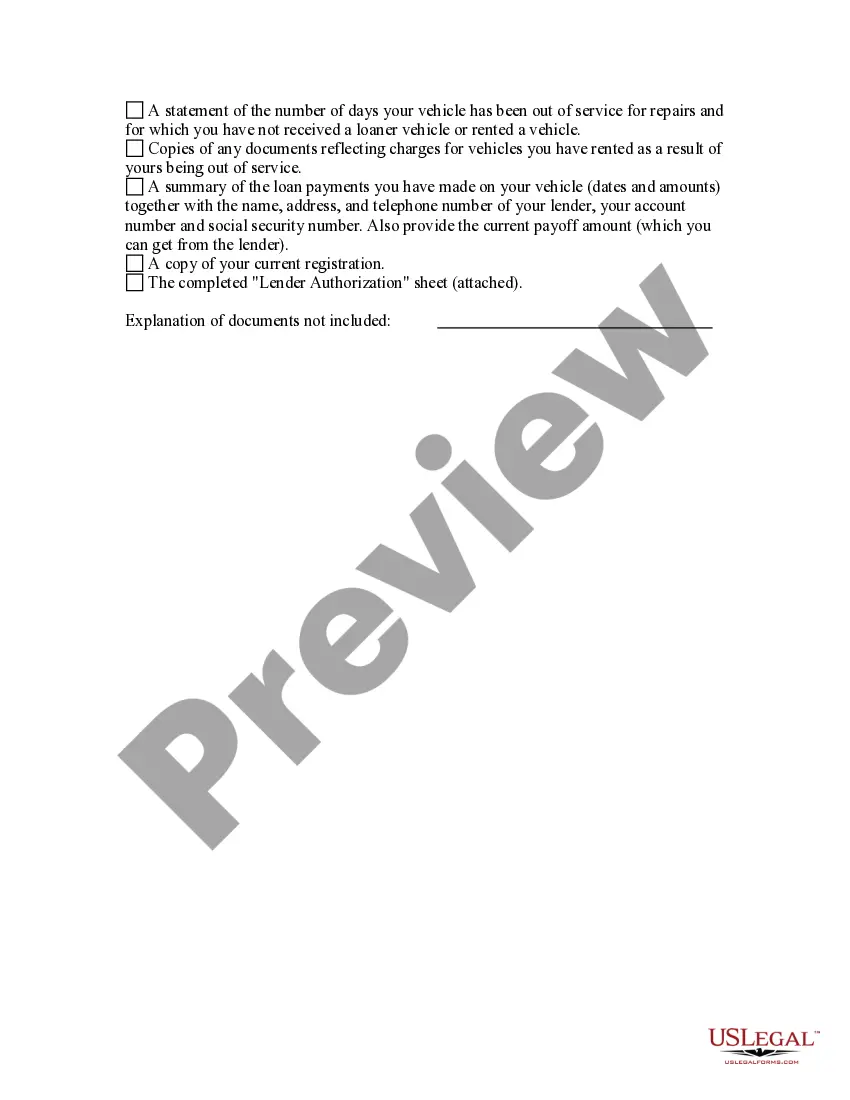

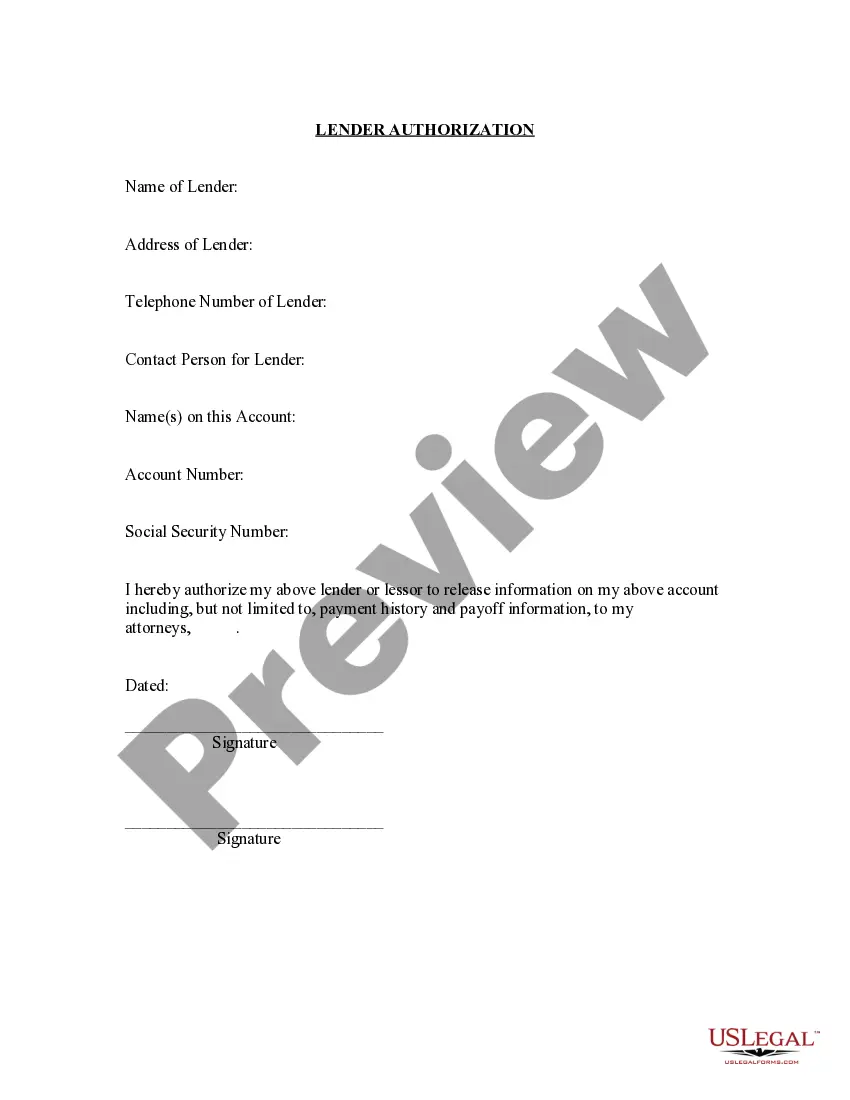

How to fill out Automobile Lemon Law Questionnaire?

Legal documentation handling can be perplexing, even for experienced professionals.

If you are searching for a Lemon Law Document For Refrigerators and don't have the opportunity to spend time locating the right and current version, the process can be challenging.

Access a repository of articles, guides, handbooks, and resources pertinent to your situation and needs.

Save effort and time searching for the documents you require and use US Legal Forms’ advanced search and Preview feature to find and acquire your Lemon Law Document For Refrigerators.

Select Buy Now when you are ready.

- If you possess a subscription, Log In to your US Legal Forms account, search for the form, and obtain it.

- Check your My documents section to view the documents you’ve previously downloaded and to organize your files as desired.

- If it is your first time with US Legal Forms, create an account and enjoy unlimited access to all platform benefits.

- Confirm it is the correct form by previewing it and reviewing its description.

- Ensure the template is valid in your state or county.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses any needs you may have, from personal to business paperwork, all in one place.

- Utilize innovative tools to complete and manage your Lemon Law Document For Refrigerators.

Form popularity

FAQ

Chittenden County It has among the highest property taxes in the state. The median annual property tax homeowners in Chittenden County pay is $6,376, highest in the state and more than double the national average. In the city of Burlington, the total municipal tax rate is 0.7082, and that applies to assessed value.

Use Vermont Form IN-111, Vermont Income Tax Return to file your amended return. Verify you are using the form for the correct year and that you are including all schedules (IN-112, IN-113, IN-153, etc.) submitted with your original filing even if the information on these schedules has not changed.

Vermont Property Tax Breaks for Retirees Vermont offers a property tax credit of up to $8,000 to eligible homeowners. Homeowners must meet all of the following requirements to qualify for the credit in 2023.

Elderly or Permanently Disabled Tax Credit This is a tax credit to assist seniors and persons who are disabled with minimal tax-exempt retirement or disability income. If you qualify for the federal Credit for the Elderly or the Disabled, then you may qualify for the Vermont credit, which is 24% of the federal amount.

You meet the ?household income? criteria (up to $136,900 for calendar year 2021).

Form SUT-451, Sales and Use Tax Return, together with payment, are due on the dates indicated.

You may complete Form PVR-317, Vermont Property Tax Public, Pious, or Charitable Exemption application to present to the lister. The application will help you gather the necessary information the lister needs. It is important that you provide clear and detailed information about the property and its uses.

Eligibility. To file a property tax credit, you must meet ALL of the following eligibility requirements: Your property qualifies as a homestead, and you have filed a Homestead Declaration for the current year's grand list. You were domiciled in Vermont for the full prior calendar year.