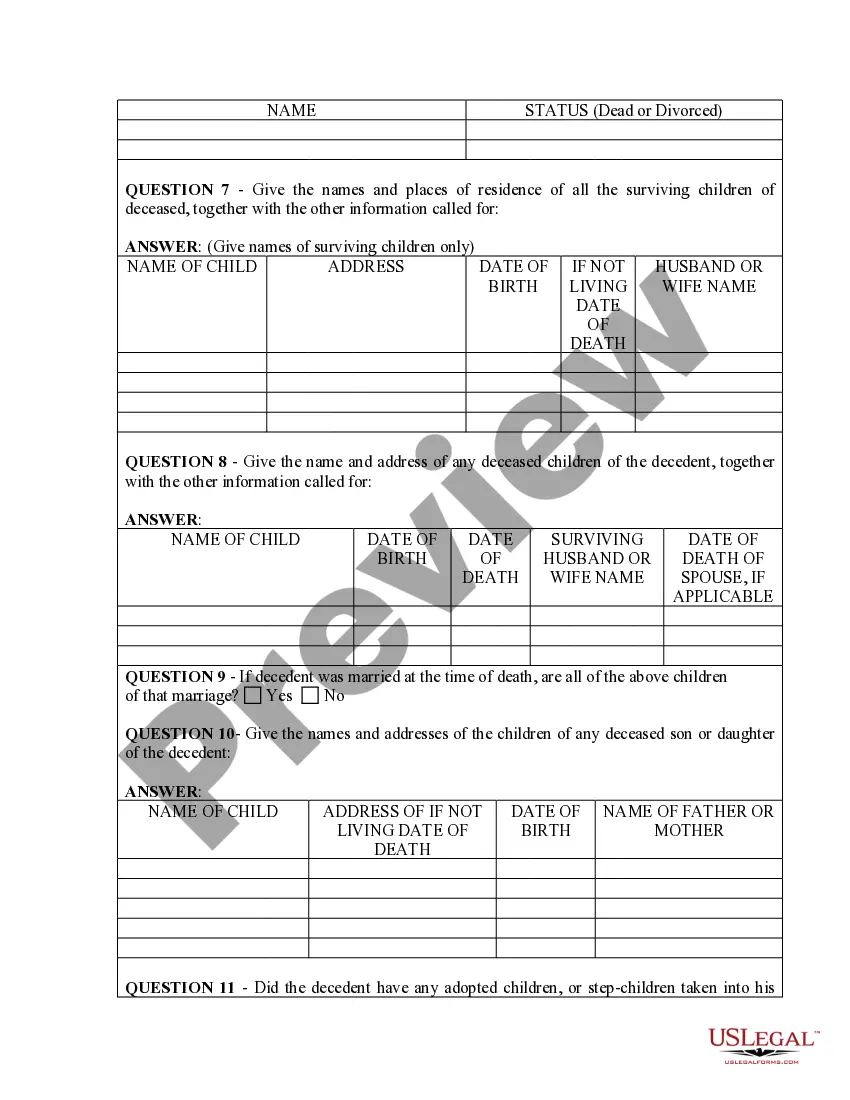

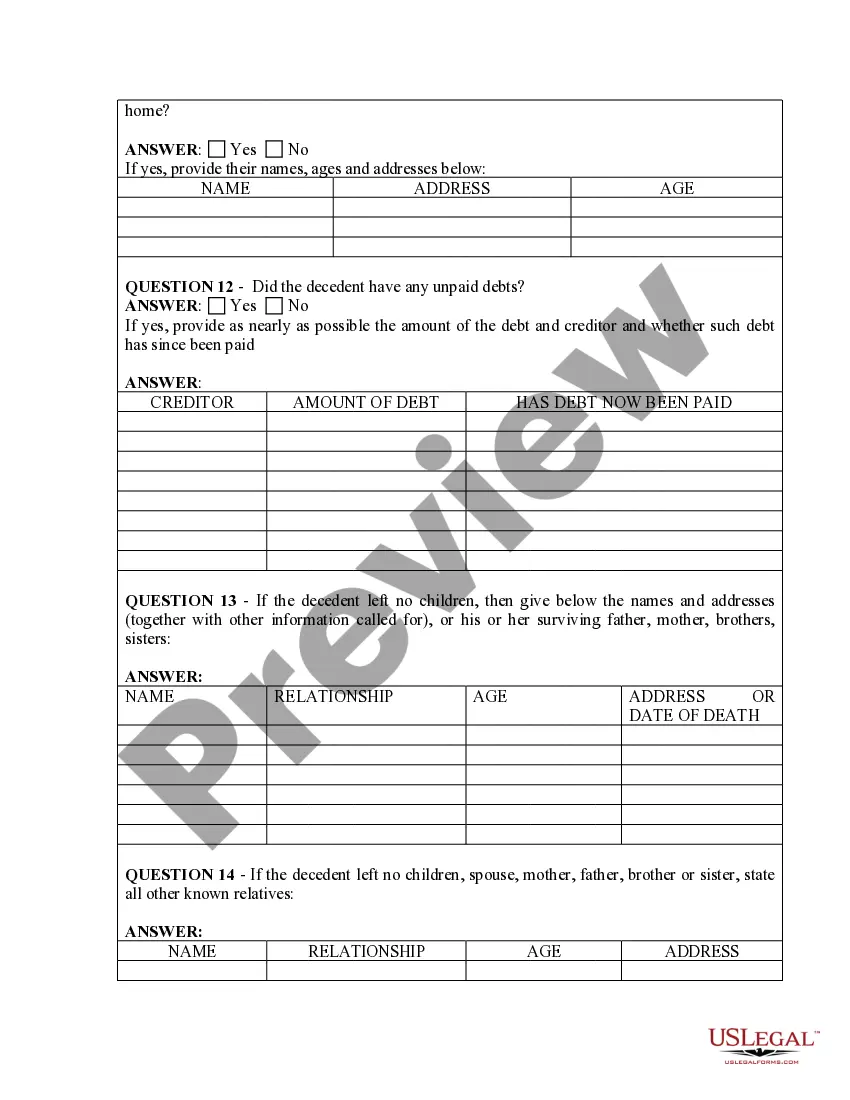

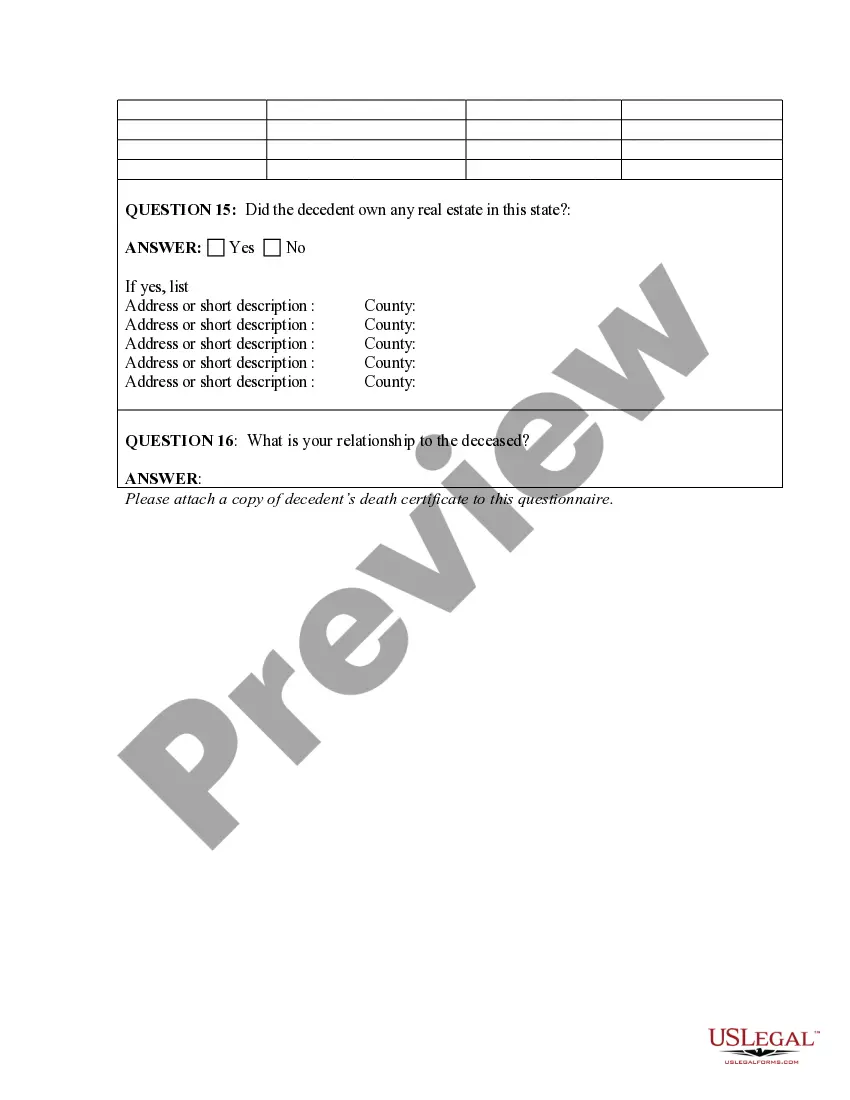

Affidavit Of Heirship Questionnaire Texas Form 53-111-a

Description

How to fill out Heirship Or Descent Affidavit Questionnaire?

The Affidavit of Heirship Questionnaire Texas Form 53-111-a displayed here is a versatile legal document created by experienced attorneys in compliance with federal and state regulations.

For over 25 years, US Legal Forms has offered individuals, companies, and legal professionals more than 85,000 authenticated, state-specific documents for every business and personal need. It’s the quickest, easiest, and most reliable method to obtain the paperwork you require, as the service ensures bank-grade data protection and malware prevention.

Select the format you want for your Affidavit of Heirship Questionnaire Texas Form 53-111-a (PDF, Word, RTF) and download the sample to your device.

- Search for the document you require and examine it.

- Review the file you searched and preview it or verify the form description to make sure it meets your needs. If it does not, use the search feature to find the correct one. Click Buy Now when you have found the template you need.

- Register and Log In.

- Choose the pricing option that fits you and create an account. Use PayPal or a credit card for a swift payment. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the editable template.

Form popularity

FAQ

In intestate succession, spouses inherit first, then children, then parents and siblings. Stepchildren do not automatically receive a share of the estate unless the decedent legally adopted them. Grandchildren only inherit when the decedent's children are not alive to receive their share of an inheritance.

A ballpark fee for preparation of the affidavit is between $750 for a very simple estate with few heirs to several thousand dollars for a more complicated estate with many heirs. The filing fees to record the affidavit in each county where the real property is located usually run about $50 to $75 in Texas.

Ing to the Texas Estates Code, the judgment in a proceeding to decide heirship is final. However, an ?interested person? has the right to contest the heirship by requesting that the probate court appeal or review their previous judgment. Under state law, the interested person must retain licensed legal counsel.

A Texas affidavit of heirship can be contested. This may be done by other heirs who disagree that you should receive the property or believe they should have been listed as an heir on the affidavit.

The Texas affidavit of heirship form must be filled out and filed on behalf of a decedent's heir and can not be completed by the heir. Instead, two disinterested parties who know the necessary details about a decedent's family life need to fill out the form.