Questionnaire For Estate Planning

Description

How to fill out Estate Planning Questionnaire?

It’s widely recognized that you cannot instantly become a legal authority, nor can you swiftly learn how to craft a Questionnaire For Estate Planning without possessing a specialized education.

Creating legal documents is a lengthy process that demands specific knowledge and expertise. So, why not entrust the preparation of the Questionnaire For Estate Planning to the experts.

With US Legal Forms, featuring one of the largest collections of legal templates, you can discover anything from court papers to templates for office communication. We understand the significance of compliance and adherence to federal and state laws and regulations.

Sign up for a free account and select a subscription plan to acquire the form.

Click Buy now. Once the purchase is completed, you can download the Questionnaire For Estate Planning, complete it, print it, and send or mail it to the specified individuals or organizations.

- That’s why, on our website, all forms are location-specific and current.

- Here’s how to begin with our platform and obtain the document you require in just minutes.

- Locate the document you need by utilizing the search bar at the top of the page.

- Review it (if this option is available) and read the accompanying description to ascertain whether the Questionnaire For Estate Planning is what you’re looking for.

- Initiate your search again if you require any other form.

Form popularity

FAQ

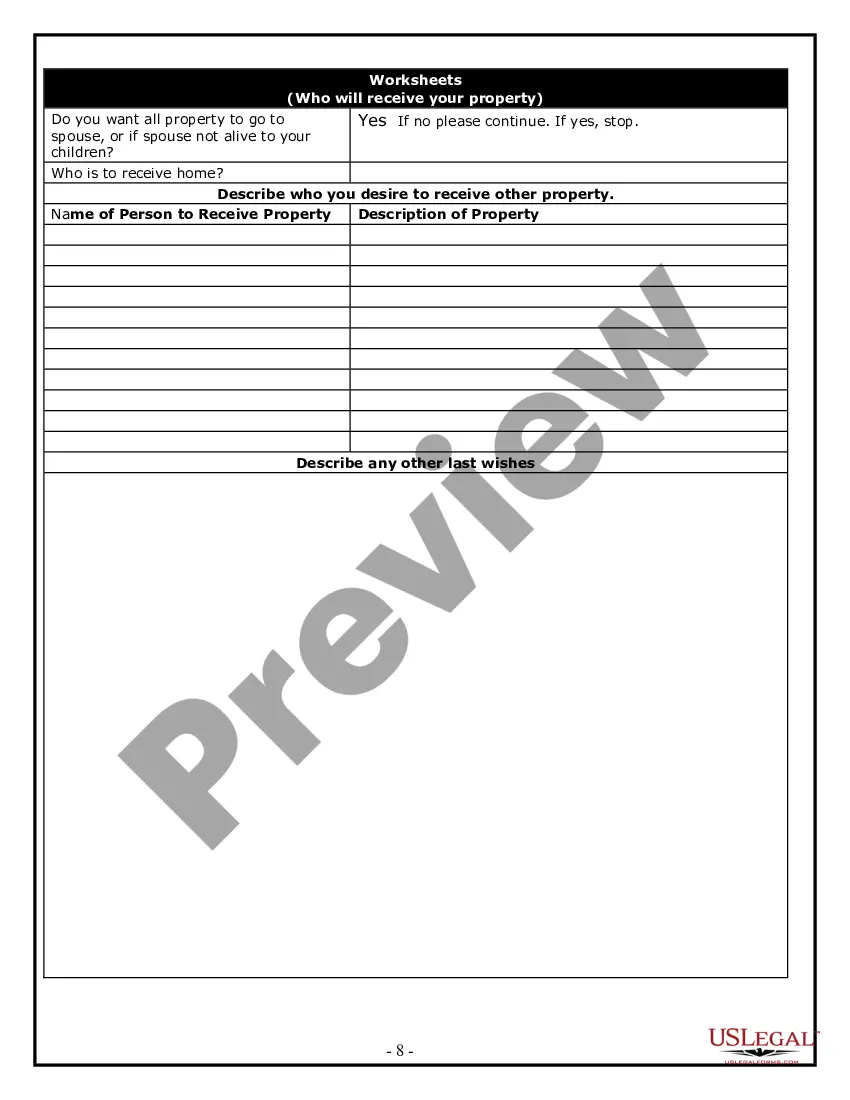

One of the biggest mistakes parents make when setting up a trust fund is failing to communicate their intentions clearly with their children. Parents often assume that their kids will understand the purpose and benefits of the trust, but this is not always the case. By using a comprehensive questionnaire for estate planning, parents can outline their goals and ensure everyone is on the same page. Additionally, platforms like US Legal Forms provide valuable resources to help you navigate the complexities of trust funds effectively.

Common inheritance mistakes include failing to update your estate plan after major life events, not communicating your wishes to family members, and neglecting to properly fund trusts. These errors can lead to disputes and unintended outcomes. To avoid these pitfalls, regularly review your questionnaire for estate planning and consider using platforms like US Legal Forms for reliable tools and templates.

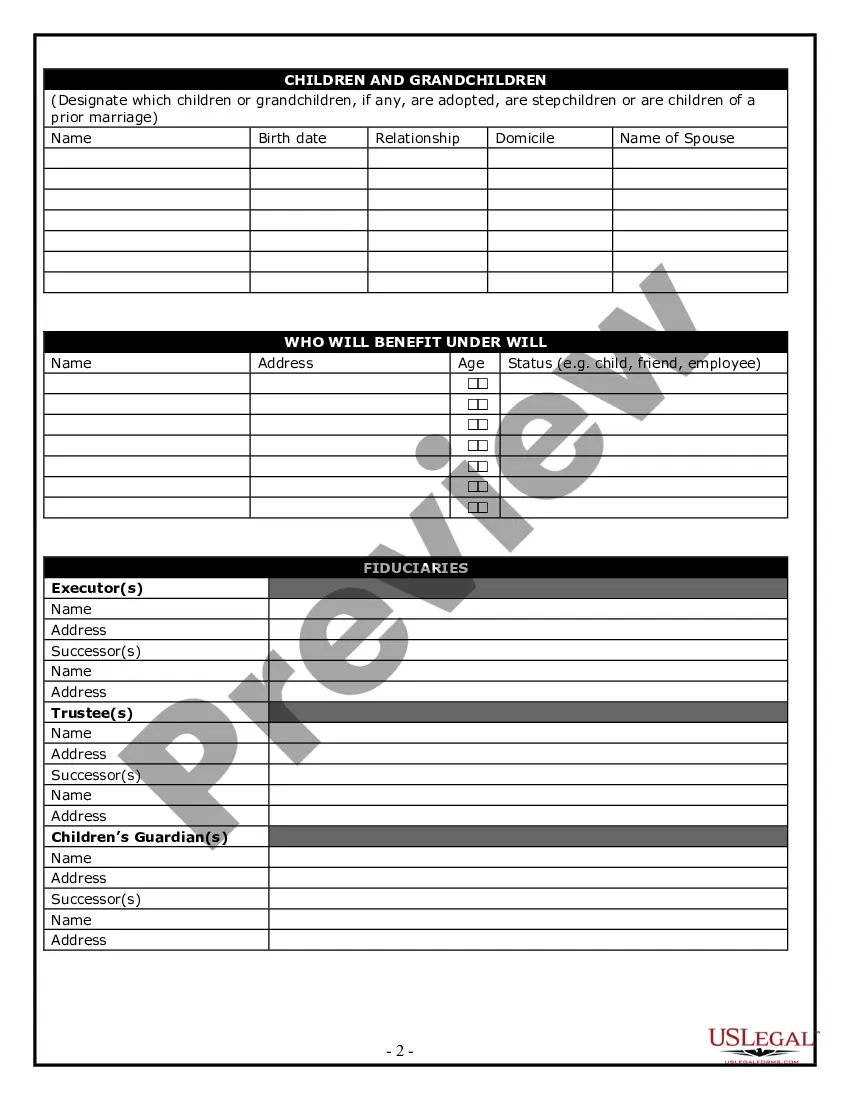

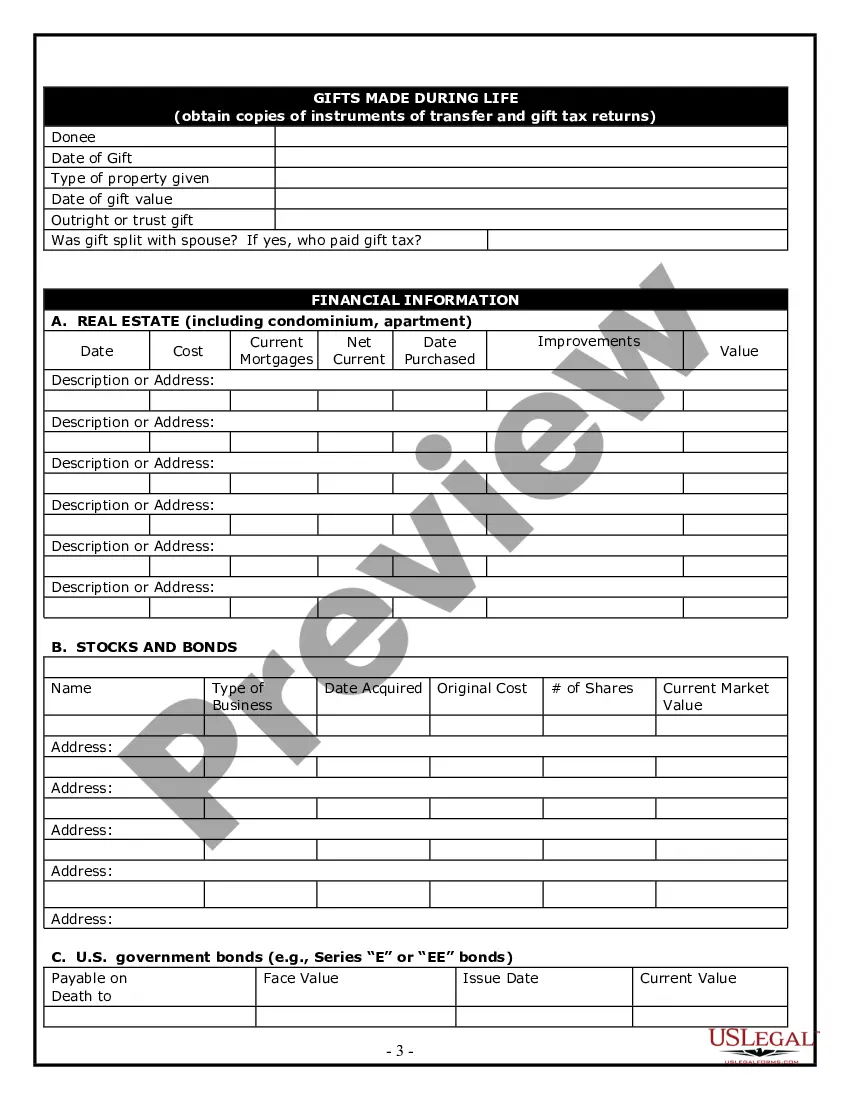

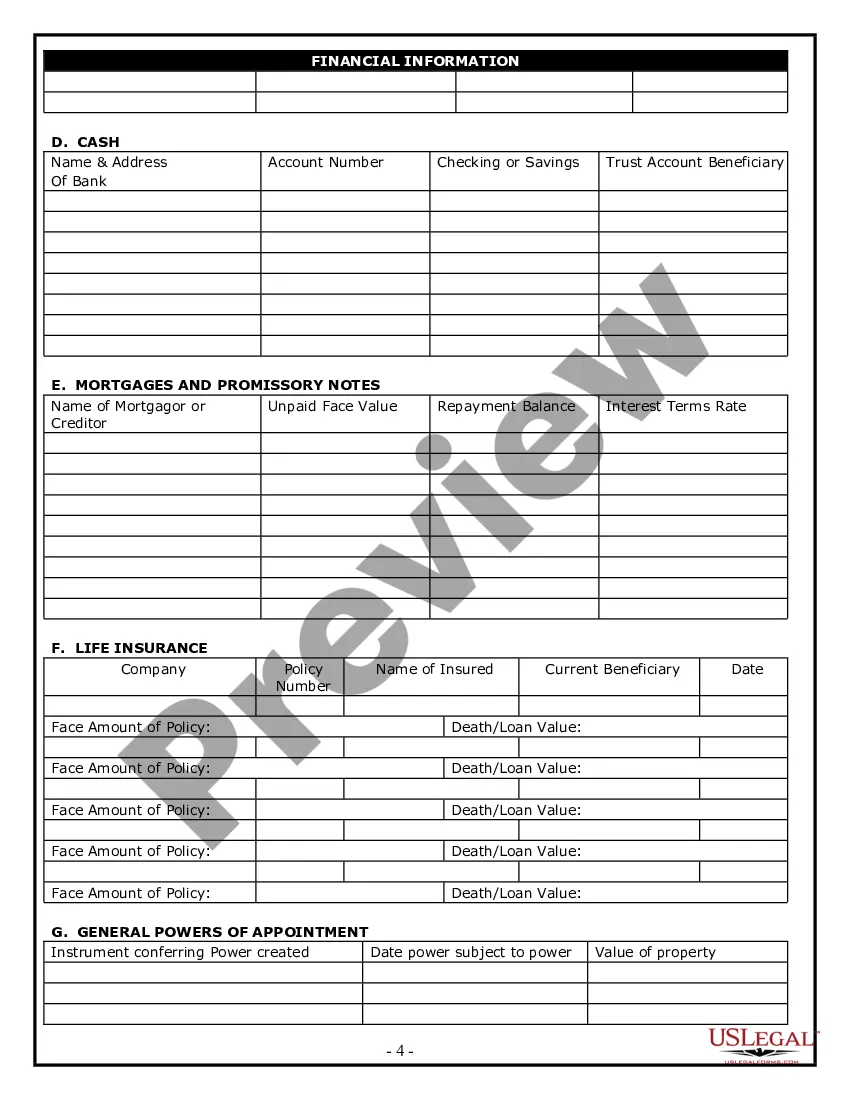

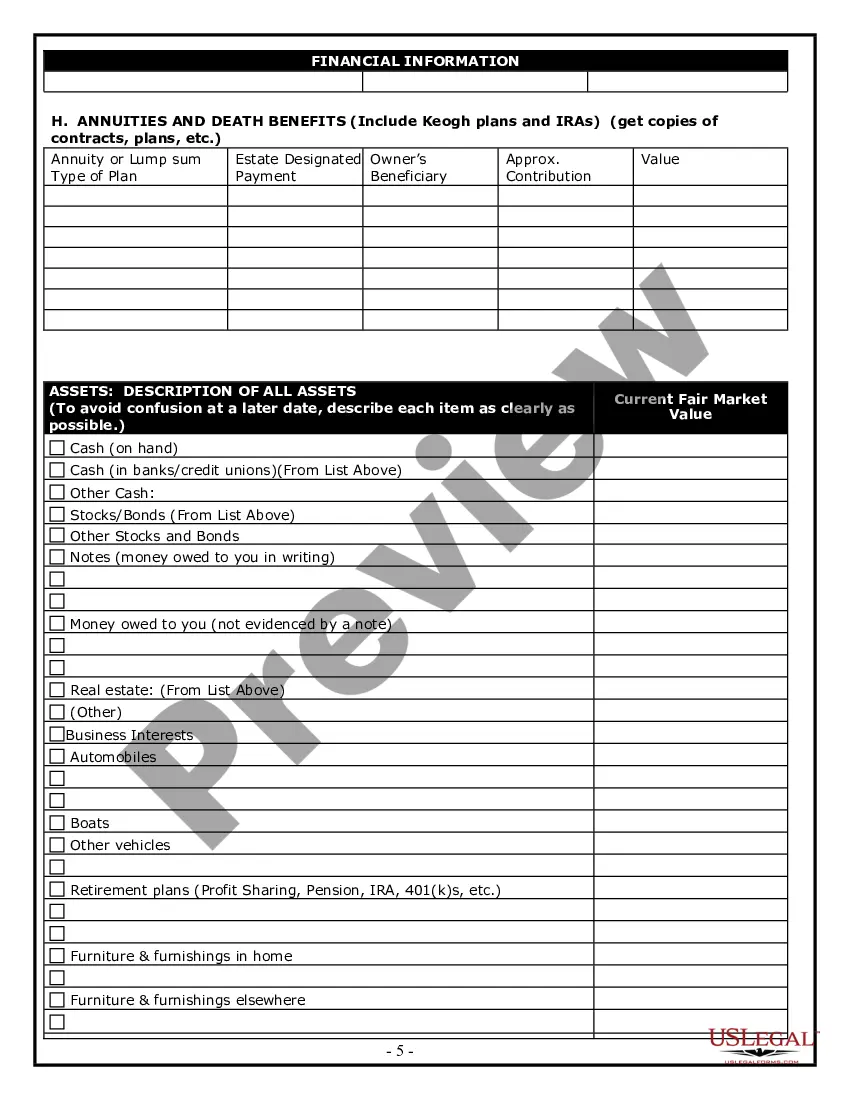

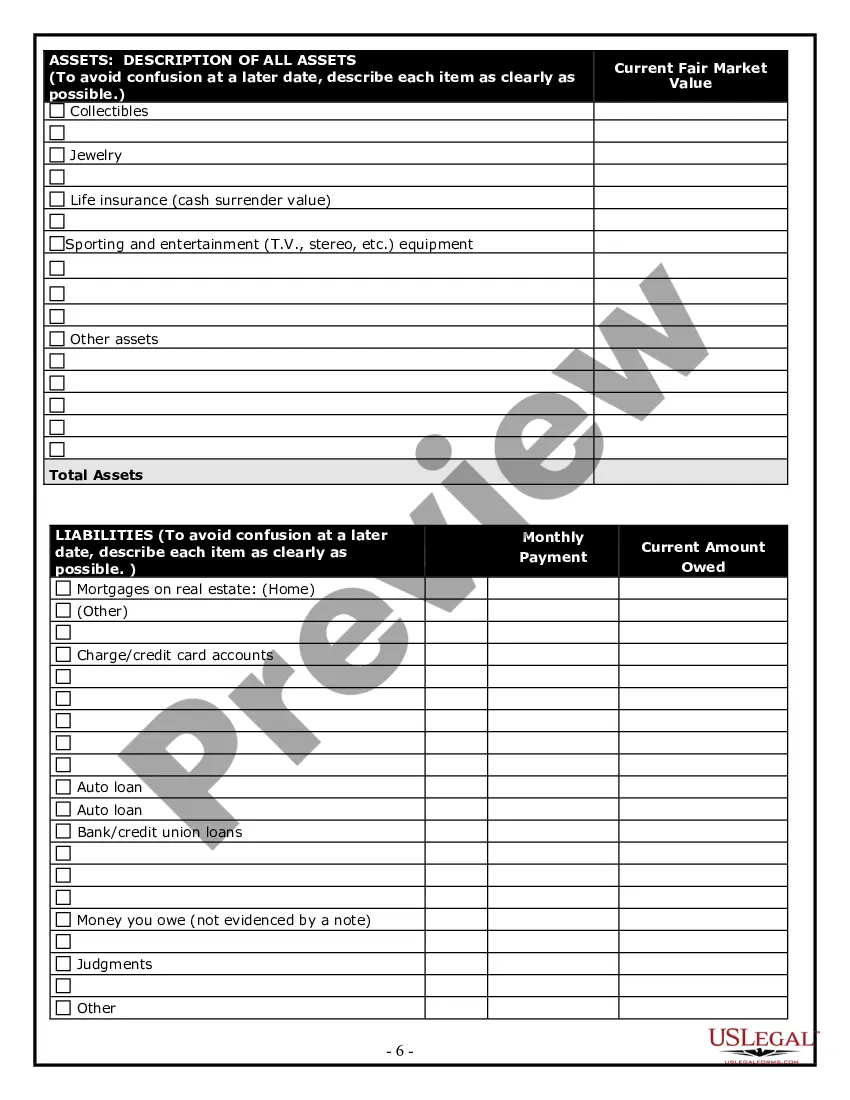

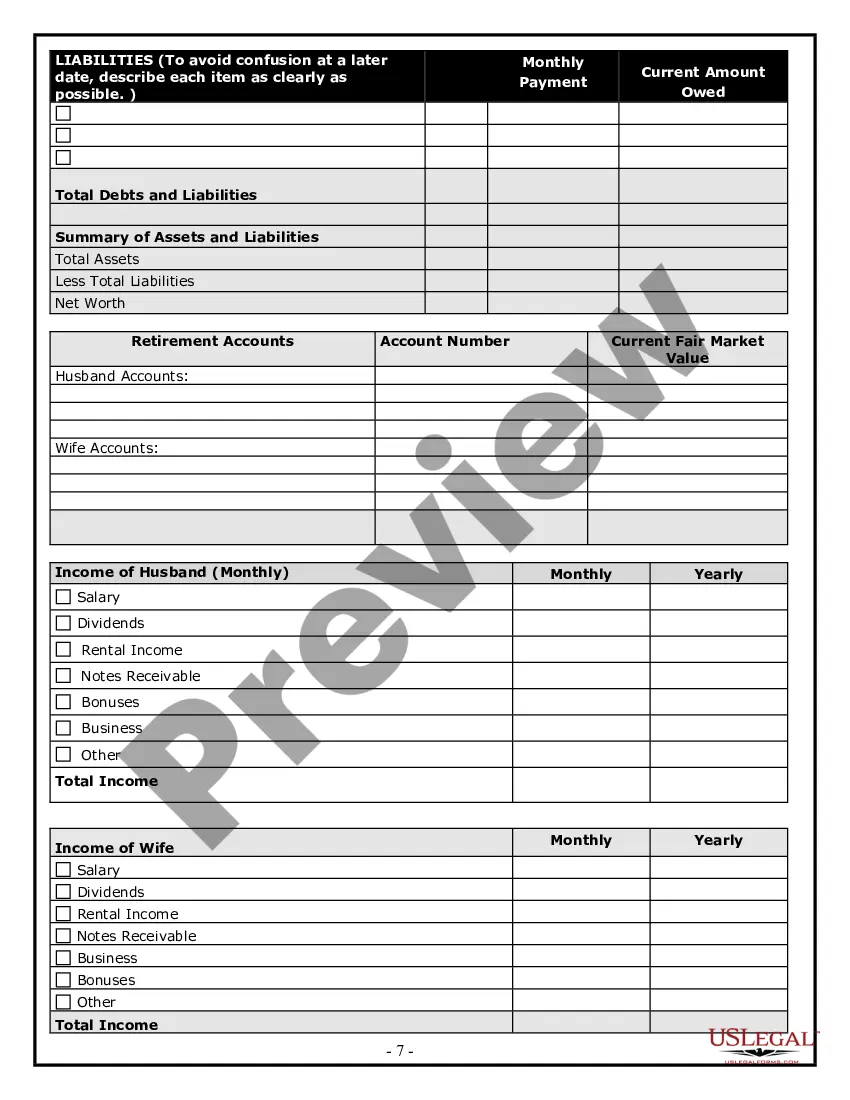

An estate questionnaire is a comprehensive document designed to collect information about your financial situation, family structure, and wishes regarding asset distribution upon your death. This questionnaire for estate planning helps ensure that your estate plan reflects your intentions accurately. Utilizing a well-structured questionnaire can simplify discussions with your attorney and prevent potential conflicts later.

The 5 by 5 rule in estate planning refers to a strategy that allows a trust beneficiary to withdraw up to $5,000 or 5% of the trust's assets each year without triggering tax consequences. This rule helps beneficiaries access some funds while maintaining the integrity of the trust. Understanding this rule can be beneficial when completing your questionnaire for estate planning, as it impacts how you structure your trust.

During an estate planning meeting, you should ask about the key elements of your estate plan, including wills, trusts, and powers of attorney. Inquire about the implications of your decisions on your heirs and how to minimize taxes. Additionally, ask about the best practices for updating your questionnaire for estate planning to ensure it reflects your current situation.

To fill out a questionnaire for estate planning, start by gathering your personal information, including assets, debts, and family details. Carefully read each question and provide clear, concise answers. If you encounter any uncertainty, consider seeking assistance from a legal professional or using resources from platforms like US Legal Forms to guide you through the process.

Certain assets do not pass through a will, including life insurance policies, retirement accounts, and properties held in joint tenancy. These assets often have designated beneficiaries that override the will. Utilizing a questionnaire for estate planning can help you identify which assets are subject to your will and ensure everything is organized according to your preferences. USLegalForms can assist you in understanding how to handle these assets effectively.

Cashing an estate check can pose risks, especially if it is done before the estate is settled. Doing so might create confusion among heirs or beneficiaries and could lead to legal challenges later. A well-prepared questionnaire for estate planning can clarify the distribution of assets and help prevent disputes. Always consider consulting with a professional or using services like USLegalForms to navigate these situations safely.

There is no specific net worth that triggers the need for estate planning, as it varies from person to person. Generally, if you own significant assets or have dependents, a questionnaire for estate planning can help you organize your wishes. It is wise to start planning before your net worth exceeds any particular threshold to ensure your assets are distributed according to your desires. Platforms like USLegalForms provide resources to help determine when to start.

Yes, estate planning can be done without a lawyer, but it requires careful consideration. Many people use a questionnaire for estate planning to gather necessary information and create their documents. However, if your estate is complex or if you have specific concerns, consulting a lawyer may be beneficial. Tools like USLegalForms can guide you through the process and help you feel confident in your choices.