Estate Planning Form Printable With Pictures

Description

How to fill out Estate Planning Questionnaire?

Whether for commercial reasons or for private issues, everyone must confront legal circumstances at some stage in their life.

Completing legal documents requires meticulous care, beginning with selecting the correct form template.

With an extensive US Legal Forms catalog available, you won’t waste time searching for the correct template online. Take advantage of the library’s user-friendly navigation to find the right form for any situation.

- For example, if you select an incorrect version of an Estate Planning Form Printable With Images, it will be denied upon submission.

- Thus, it is crucial to find a trustworthy source of legal documents like US Legal Forms.

- To obtain an Estate Planning Form Printable With Images template, follow these straightforward steps.

- Locate the template you require by utilizing the search bar or catalog navigation.

- Review the form’s details to ensure it corresponds with your circumstances, state, and county.

- Click on the form’s preview to examine it.

- If it is not the correct document, return to the search feature to find the Estate Planning Form Printable With Images version you need.

- Download the file when it fulfills your specifications.

- If you already possess a US Legal Forms account, click Log in to access previously saved templates in My documents.

- If you do not yet have an account, you can acquire the form by clicking Buy now.

- Select the suitable pricing option.

- Complete the account registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the document format you prefer and download the Estate Planning Form Printable With Images.

- Once downloaded, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

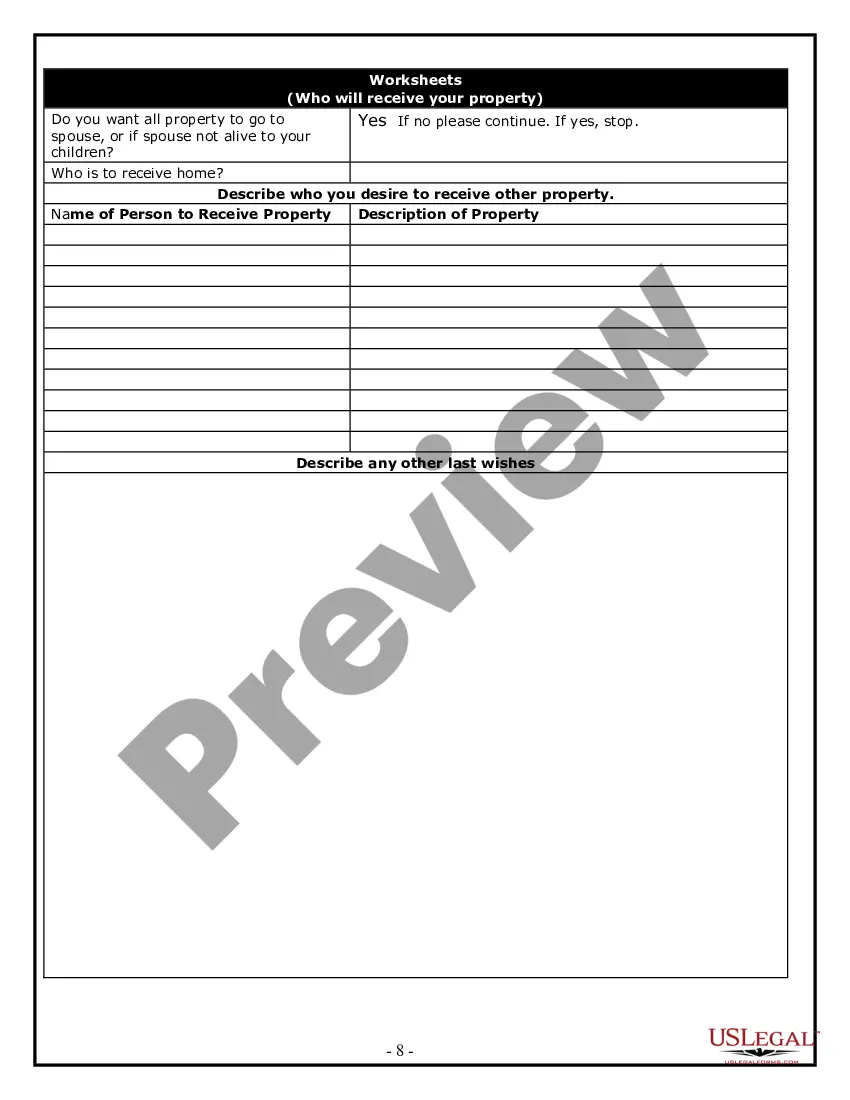

One of the most significant mistakes parents make is failing to communicate their intentions clearly to their children. Without proper understanding, beneficiaries may misinterpret the trust's purpose or the expectations placed upon them. Using an estate planning form printable with pictures can help you articulate your wishes and ensure that your family understands the trust's goals.

The 5 and 5 rule refers to a specific provision that lets beneficiaries withdraw a combination of $5,000 or 5% of the trust's total value annually. This allows beneficiaries to access funds while ensuring that the trust maintains its integrity. To keep track of these details, utilize an estate planning form printable with pictures that clearly outlines the rules and expectations.

The 5 by 5 rule allows beneficiaries of a trust to withdraw up to $5,000 or 5% of the trust's assets each year without incurring taxes. This rule provides flexibility while ensuring that the trust's overall purpose remains intact. By using an estate planning form printable with pictures, you can easily document these provisions and maintain clarity for all parties involved.

Using a trust can help reduce or even avoid certain inheritance taxes, depending on your situation. Trusts can be structured in various ways to minimize taxable assets. To effectively navigate these complexities, consider utilizing an estate planning form printable with pictures that guides you through the process and helps you identify tax-saving opportunities.

In most cases, a designated beneficiary takes precedence over a trust. This means that if your will states a beneficiary for assets, those assets typically bypass the trust and go directly to the beneficiary. It's crucial to ensure your estate planning form printable with pictures reflects your wishes clearly, so everything aligns with your intentions.

So call us today! Create an Inventory of Your Possessions. ... Consider Your Family's Needs After Your Death. ... Decide Who Your Beneficiaries Will Be. ... Indicate How You Want Your Estate Divided. ... Store Your Documents Properly. ... Update Your Estate Plan Regularly. ... Seek Help from a Trusted Estate Planning Lawyer.

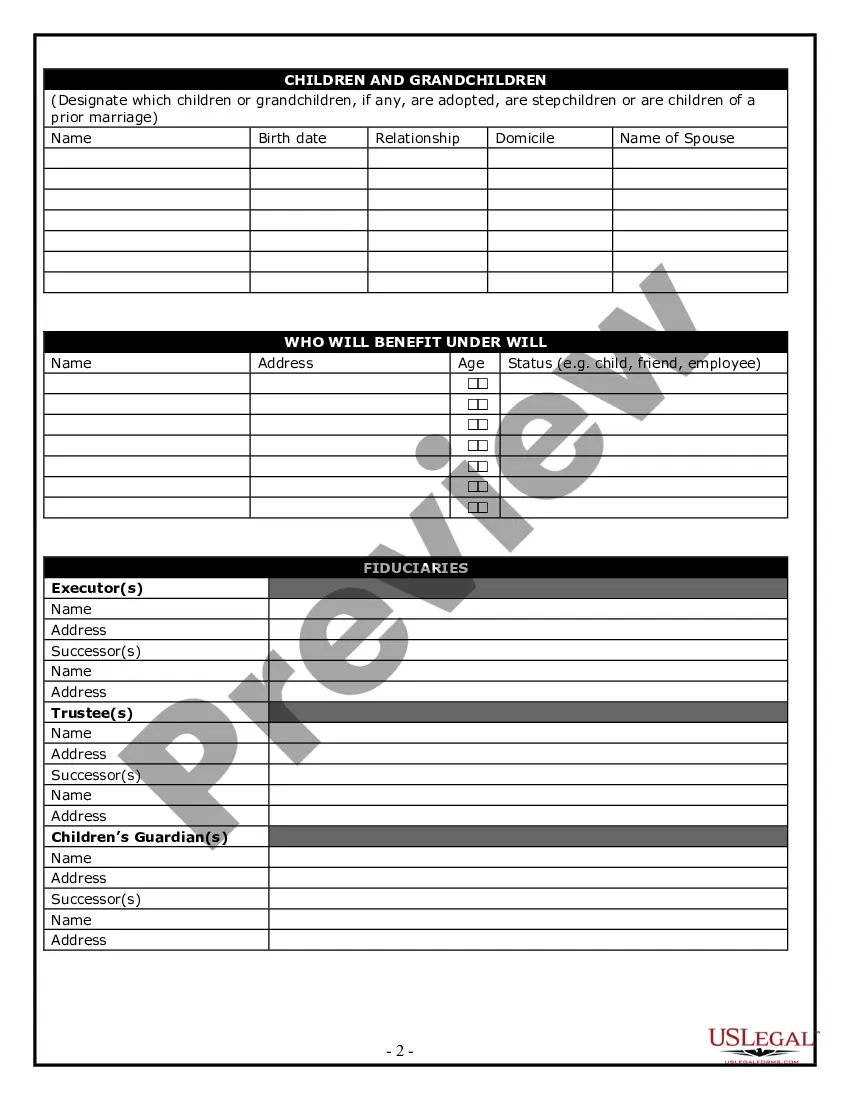

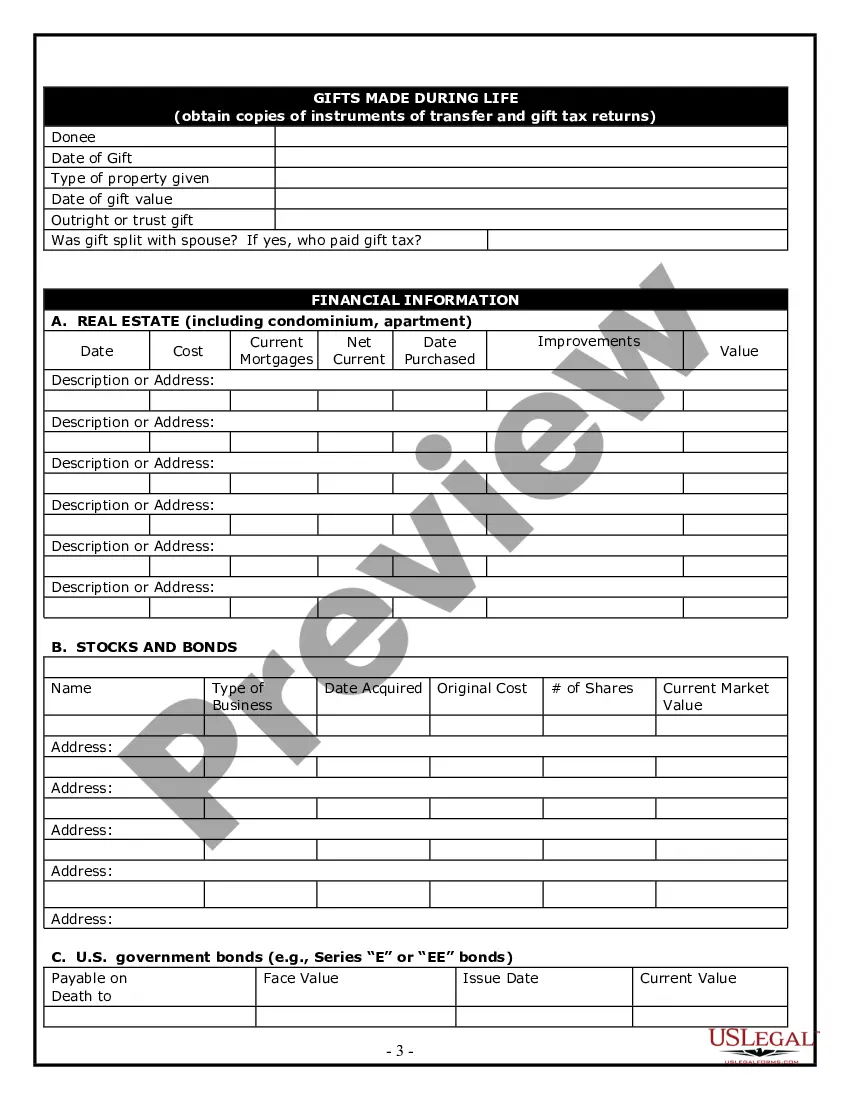

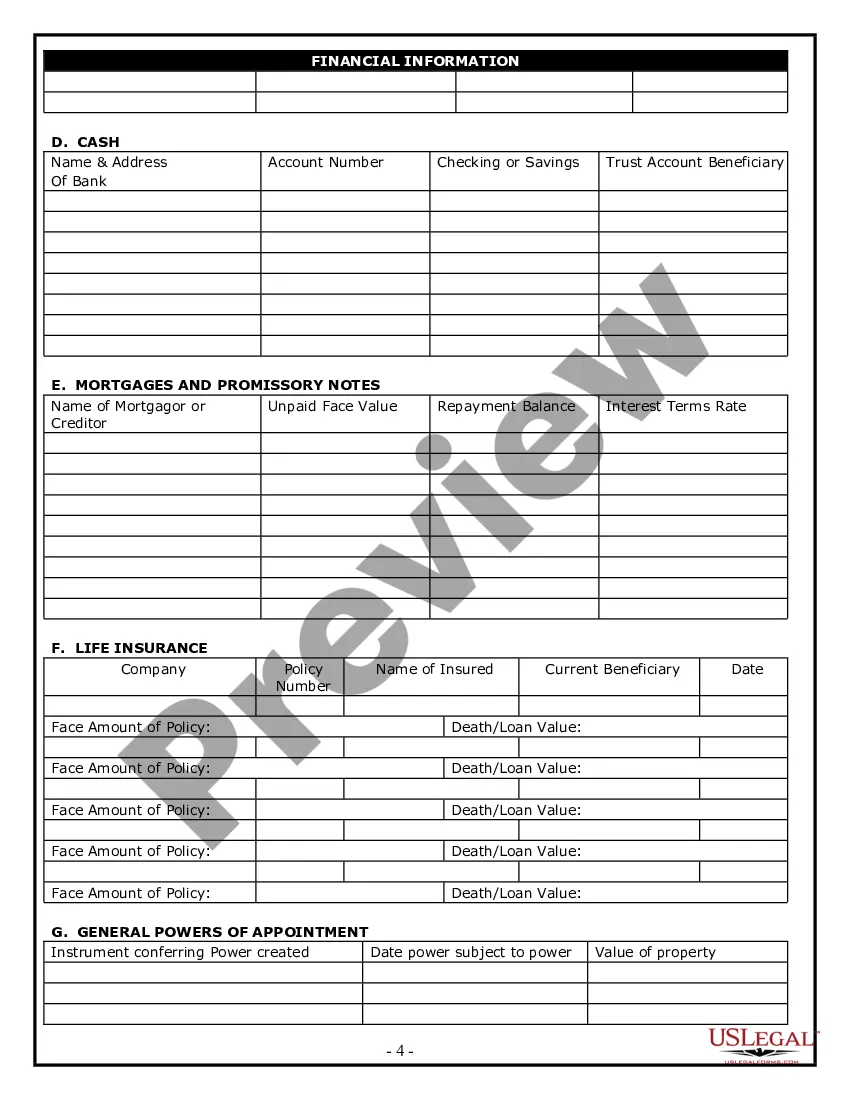

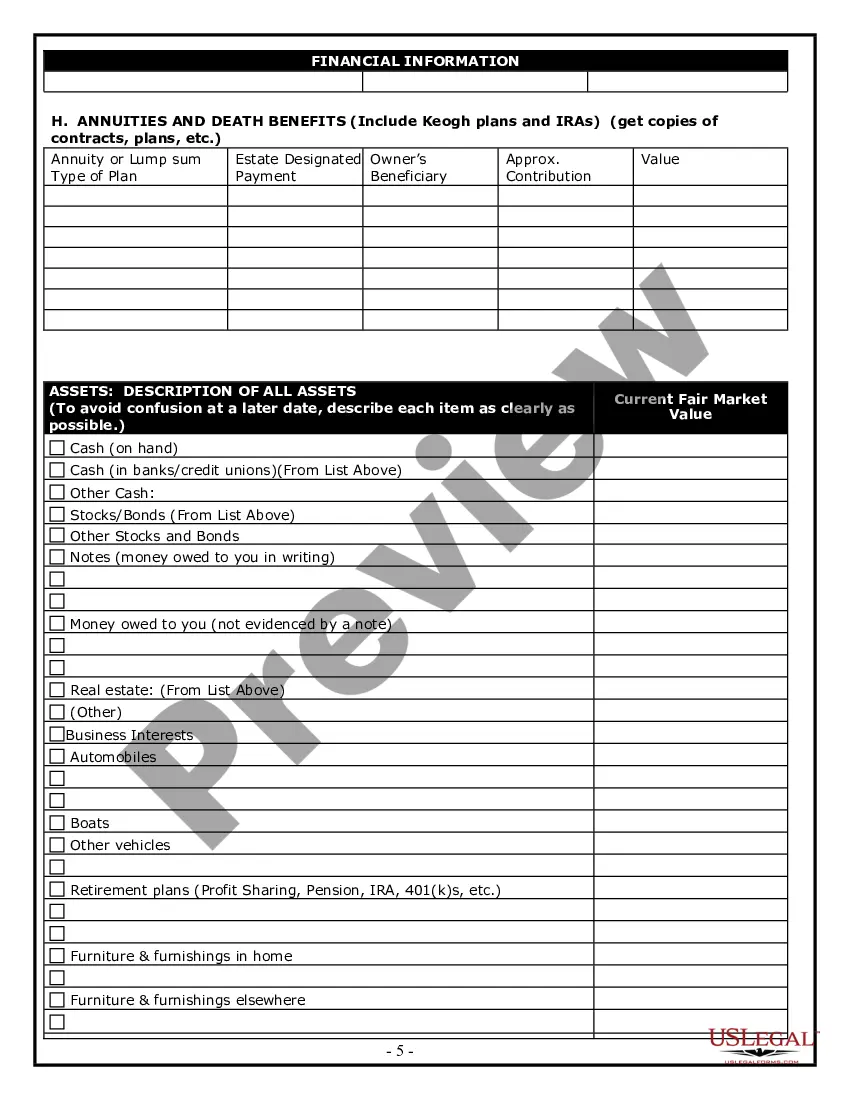

An estate planning checklist is a guide on how to plan an individual's assets and end-of-life health care if they should die or become incapacitated.

Estate planning is the process by which an individual or family arranges the transfer of assets in anticipation of death. An estate plan aims to preserve the maximum amount of wealth possible for the intended beneficiaries and flexibility for the individual prior to death.

4 essential estate planning documents A will distributes assets upon death. A power of attorney manages finances. Advance care directives manage your health. A living trust is an alternative to a last will.

5 Steps to Organize Estate Documents for Your Executor 5 Steps to Organize. ... Step 1: Create a checklist of important documents (and their locations) ... Step 2: List the names and contact information of key associates. ... Step 3: Catalog your digital asset inventory. ... Step 4: Ensure all documents are organized and accessible.