Estate Planning Form Printable With Instructions

Description

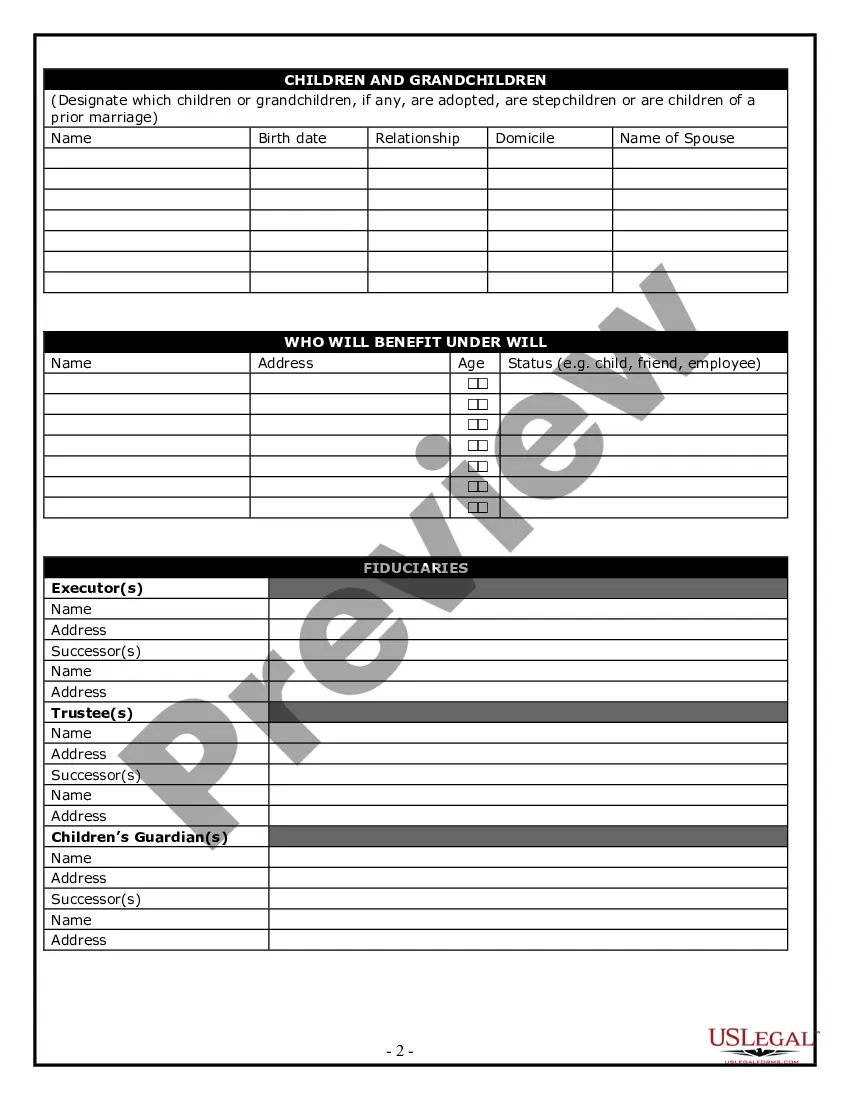

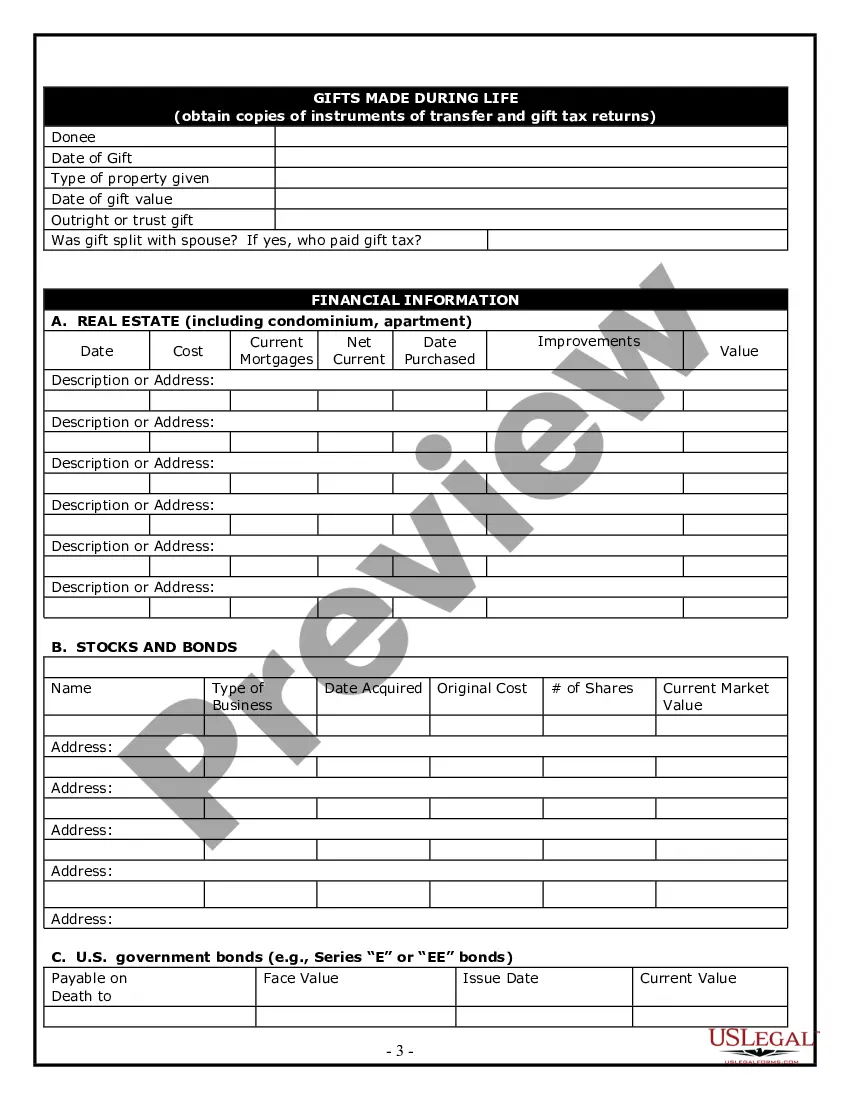

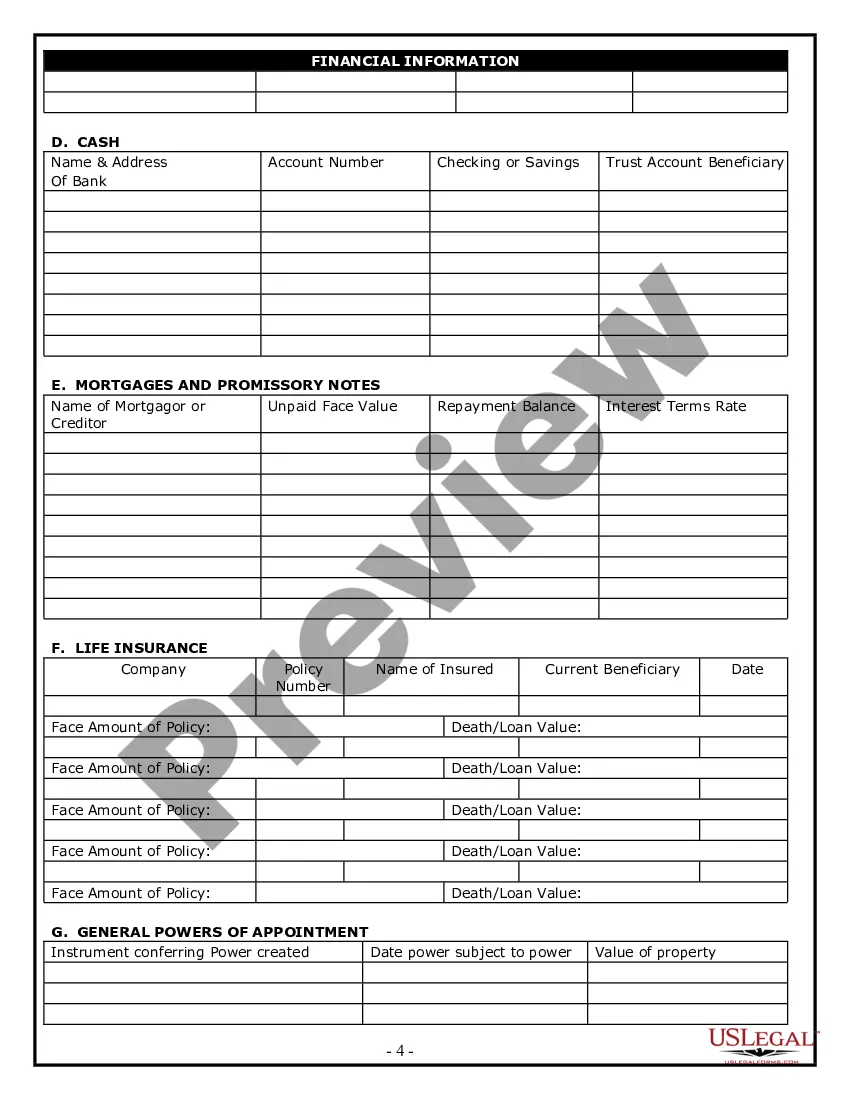

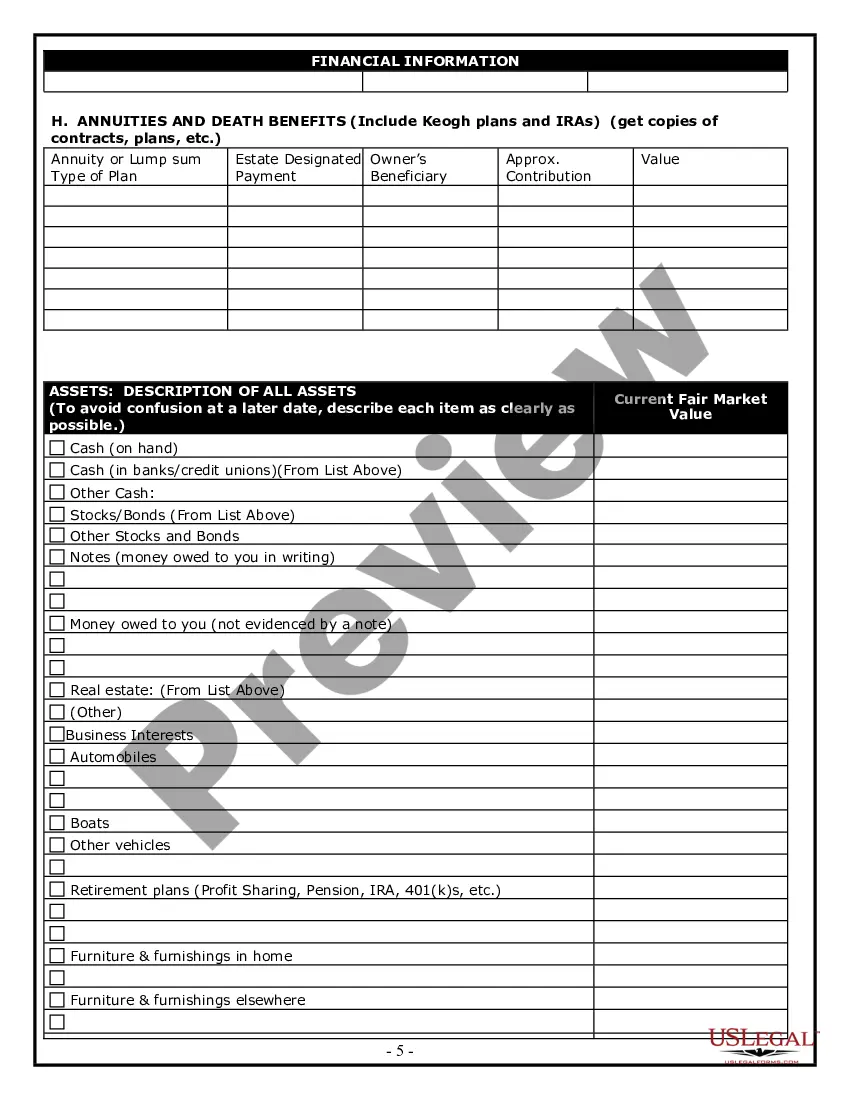

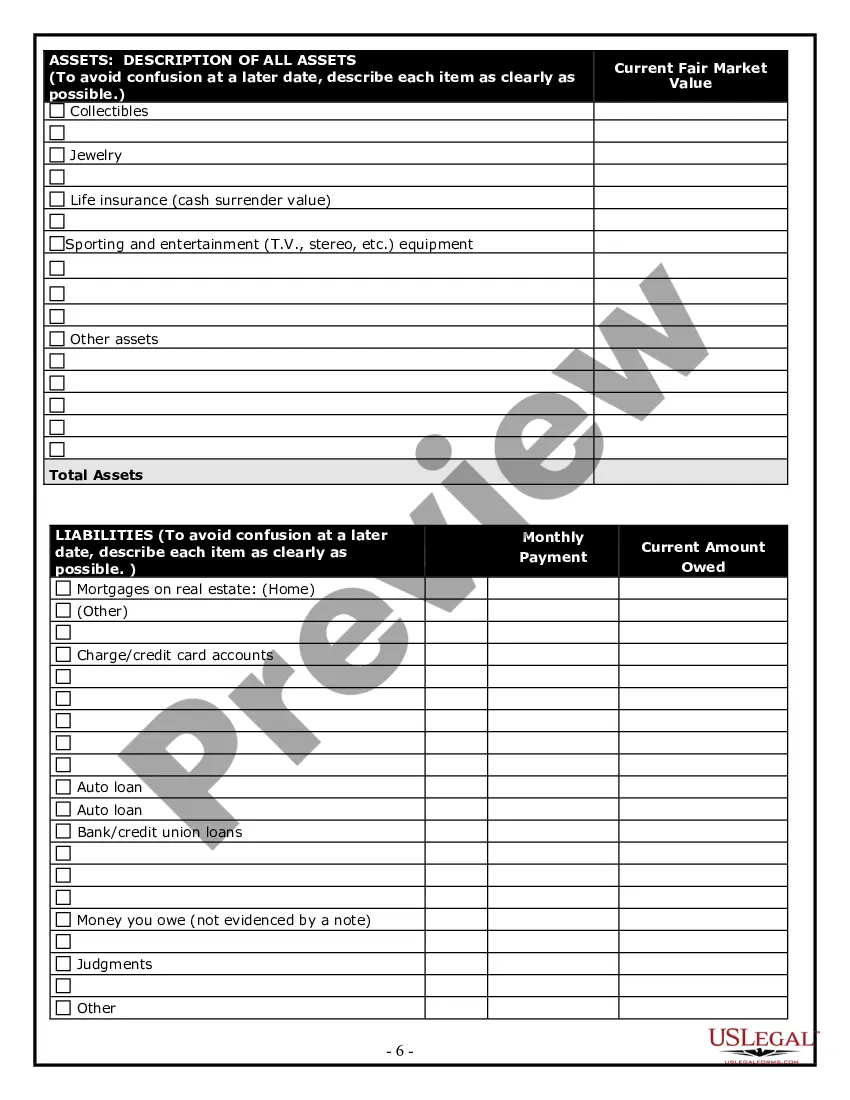

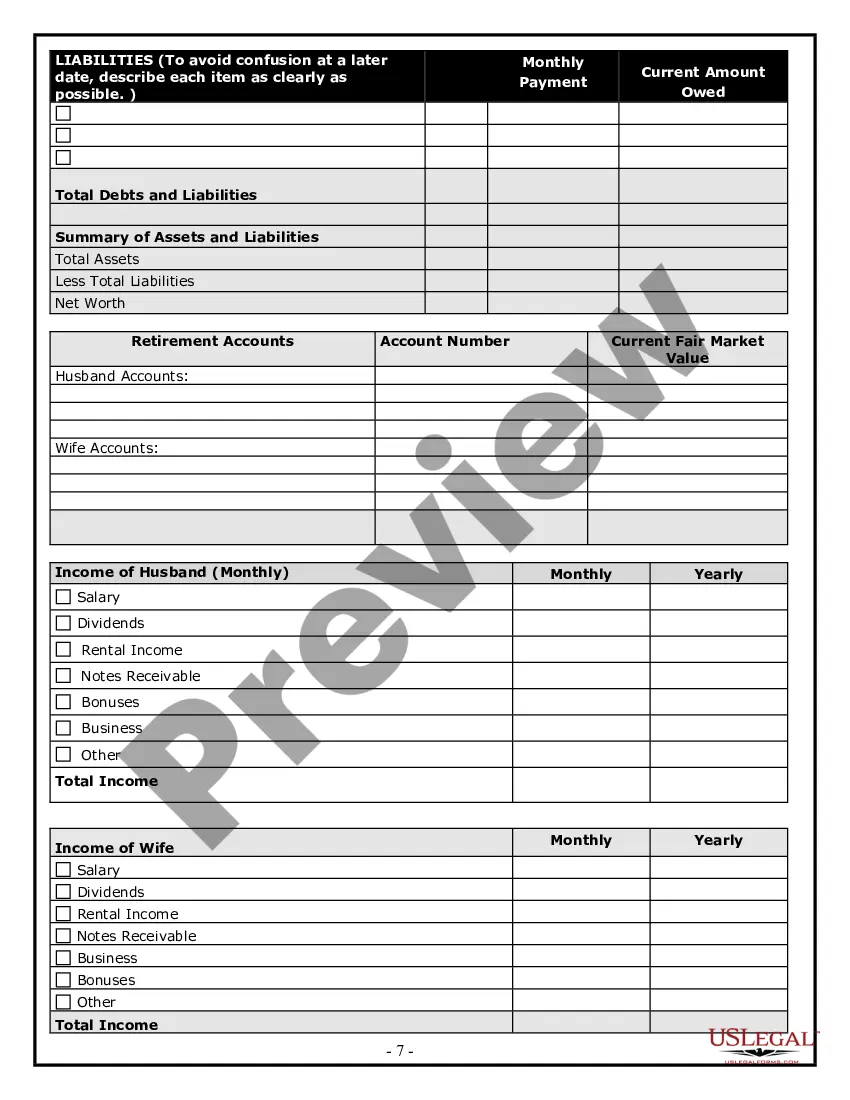

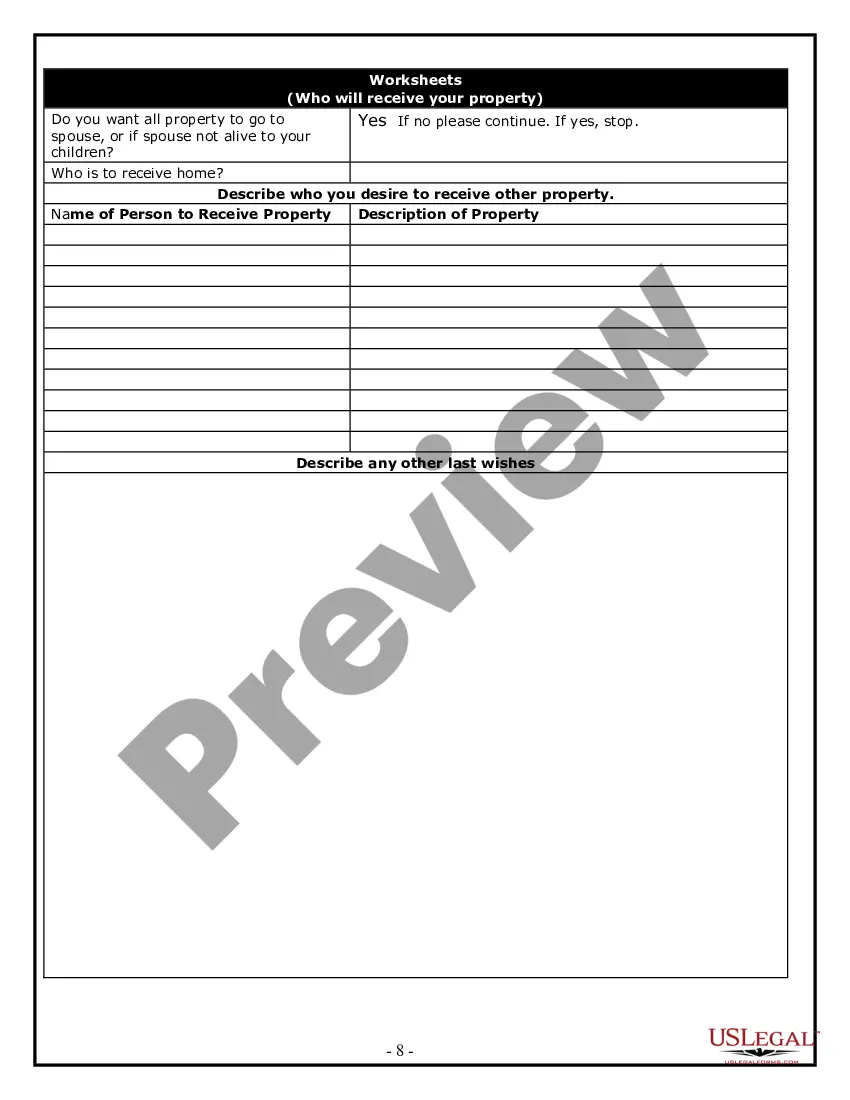

How to fill out Estate Planning Questionnaire?

The Printable Estate Planning Document with Guidelines presented on this page is a reusable legal framework created by expert attorneys in accordance with national and local laws and regulations.

For over 25 years, US Legal Forms has supplied individuals, organizations, and legal practitioners with more than 85,000 authenticated, state-specific documents for any professional and personal circumstance. It’s the quickest, easiest, and most reliable method to acquire the documentation you require, as the service assures bank-level data protection and anti-malware safeguards.

Select the format you prefer for your Printable Estate Planning Document with Guidelines (PDF, DOCX, RTF) and download the document onto your device.

- Search for the document you require and review it.

- Browse the example you searched for and preview it or examine the form description to verify it meets your requirements. If it does not, utilize the search feature to locate the correct one. Click 'Purchase Now' once you have discovered the template you need.

- Register and Log Into your account.

- Choose the payment plan that fits your needs and create an account. Use PayPal or a credit card for a quick transaction. If you already possess an account, Log In and verify your subscription to continue.

- Acquire the editable template.

Form popularity

FAQ

The 5 by 5 rule allows a beneficiary to withdraw up to $5,000 per year from a trust without affecting the overall trust balance. This rule provides flexibility for beneficiaries, ensuring they can access funds for immediate needs while preserving the trust. To better understand how this rule applies to your estate, consider using an estate planning form printable with instructions available on our platform. This resource can guide you in creating a tailored estate plan that meets your unique circumstances.

4 essential estate planning documents A will distributes assets upon death. A power of attorney manages finances. Advance care directives manage your health. A living trust is an alternative to a last will.

The two main components of estate planning are insurance planning and investing. Which pieces of advice would financial planners and estate attorneys generally offer single parents and other single persons? Chapter 19 Personal Finance Flashcards - Quizlet quizlet.com ? chapter-19-personal-finance-flash-c... quizlet.com ? chapter-19-personal-finance-flash-c...

An estate planning checklist is a guide on how to plan an individual's assets and end-of-life health care if they should die or become incapacitated.

A letter of instruction provides a helpful guide for those who will have to settle your affairs once you are gone. As with any other estate-planning document, it should be updated at least annually and kept in a safe place where it is accessible by your relatives or executor.

So call us today! Create an Inventory of Your Possessions. ... Consider Your Family's Needs After Your Death. ... Decide Who Your Beneficiaries Will Be. ... Indicate How You Want Your Estate Divided. ... Store Your Documents Properly. ... Update Your Estate Plan Regularly. ... Seek Help from a Trusted Estate Planning Lawyer.