Serve Subpoena On Wells Fargo

Description

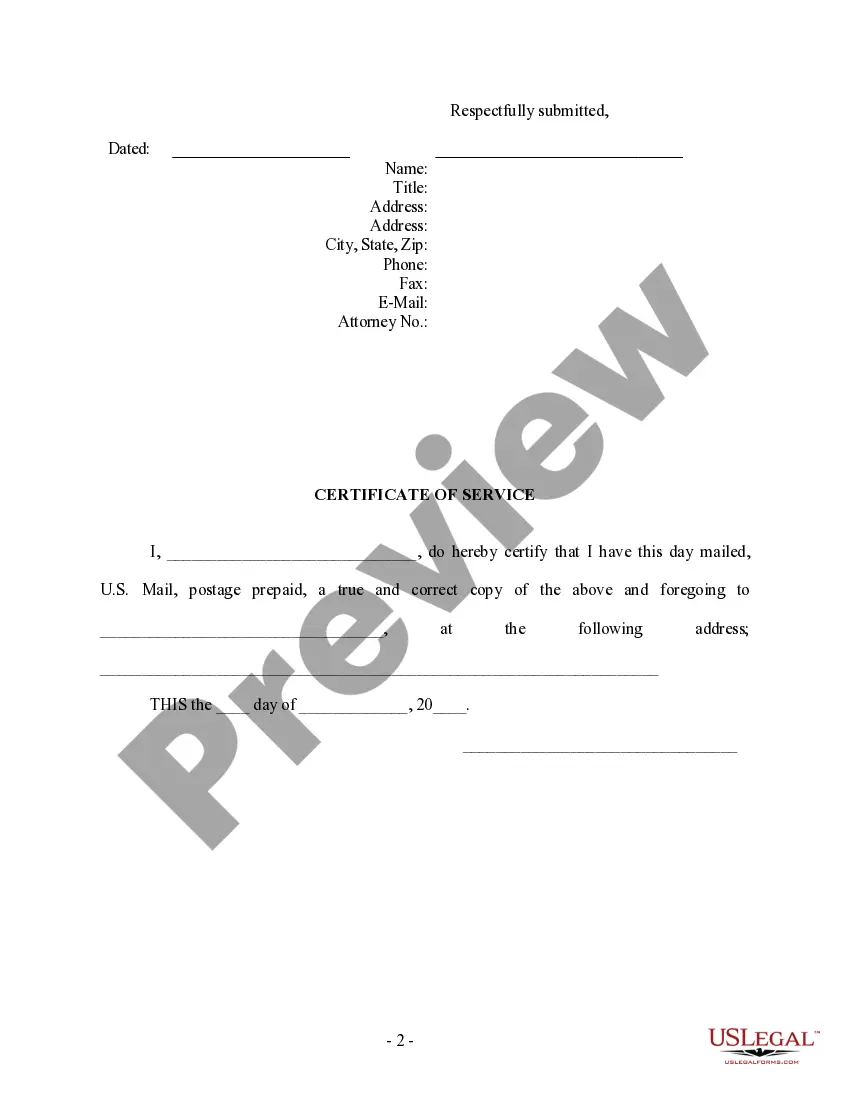

How to fill out Notice Of Intent To Serve Subpoena On Nonparty - Personal Injury?

Legal documents handling can be daunting, even for the most experienced experts.

If you are looking to Serve Subpoena On Wells Fargo and cannot spare time to search for the correct and current version, the procedures can be overwhelming.

You can leverage modern tools to complete and oversee your Serve Subpoena On Wells Fargo.

Gain access to a valuable repository of articles, guides, and materials pertinent to your situation and necessities.

Confirm that the template is valid in your state or county, choose Buy Now when ready, select a subscription plan, find your preferred format, then Download, complete, eSign, print, and submit your documents. Take full advantage of the US Legal Forms online catalog, backed by 25 years of experience and reliability. Transform your routine document management into a straightforward and user-friendly experience today.

- Reduce time and effort spent looking for the forms you need by utilizing US Legal Forms’ sophisticated search and Preview feature for the Serve Subpoena On Wells Fargo.

- If you hold a monthly membership, Log In to your US Legal Forms account, search for the necessary form, and obtain it.

- Visit the My documents tab to review the documents you have previously downloaded and organize your folders as desired.

- If this is your initial engagement with US Legal Forms, create a free account to enjoy unlimited access to all the resources available in the library.

- After locating the desired form, ensure it is the correct one by previewing and reviewing its details.

- Utilize a comprehensive online form directory to transform your approach to managing these circumstances effectively.

- US Legal Forms is a frontrunner in online legal documentation, offering over 85,000 state-specific legal forms accessible whenever you require them.

- With US Legal Forms, you gain access to various legal and business documents that are tailored to your state's or county's requirements.

Form popularity

FAQ

If you want to stop a subpoena for bank records, consult with a lawyer who specializes in this area of law. They can help you understand your options and the legal grounds for quashing the subpoena. Filing a motion to quash or seek a protective order can be effective depending on the circumstances surrounding your request. Utilizing a platform like UsLegalForms can provide you with necessary documents and guidance to address this issue appropriately.

When you need to serve a subpoena on a bank, the first step is to identify the bank’s legal department or registered agent. Serving the subpoena directly at one of the bank's branches may not fulfill legal requirements. Many banks list their legal addresses online, making it easier for you to find the proper place for service. Using the right address assists in smoothly processing your legal documents.

The legal address for Wells Fargo can vary depending on your location and the type of legal matter. It is essential to verify the correct address applicable to your situation, as using an incorrect one may delay your process. You can find reliable information through the Wells Fargo corporate website or legal databases. This ensures that you serve subpoena on Wells Fargo accurately.

To effectively serve a subpoena on Wells Fargo, you should send it to their registered agent or legal department. You can typically find this information on their official website. Ensure you follow the relevant state laws to guarantee that your service meets all legal requirements. This way, you can confidently proceed with your legal matters.

Wells Fargo Rule 606 primarily pertains to the brokerage side of the bank, ensuring transparency around order execution and routing. This rule requires broker-dealers to disclose their practices when handling your order, allowing consumers a clearer view into the process. If you ever need to serve subpoena on Wells Fargo regarding their practices, this rule can be a relevant point of reference.

When you receive a subpoena, there are several ways to respond, including compliance, challenging the subpoena, or seeking clarification. You can also negotiate the scope, especially when serving a subpoena on Wells Fargo if certain requests seem excessive. Consulting legal experts can provide guidance on the best approach tailored to your situation.

Ignoring a subpoena can lead to severe legal consequences, including fines or even jail time. Courts take compliance seriously, and if you choose to serve subpoena on Wells Fargo or any other entity, they are expected to respond. It is usually best to address subpoenas promptly to avoid complications, such as additional legal actions.

The settlement amounts in the Wells Fargo lawsuit can vary, often reaching millions to billions of dollars, depending on the case specifics. Many individuals impacted by the bank's practices may receive compensation, but the total varies based on factors such as the nature of the claims and the agreement reached. If you want to serve subpoena on Wells Fargo as part of this process, ensuring the right legal steps is crucial.

Yes, banks generally must comply with subpoenas, including those requesting to serve subpoena on Wells Fargo. When a court issues a subpoena, financial institutions like Wells Fargo are legally obligated to provide requested documents or information. However, they may also have to assess the legal validity and scope of the subpoena before compliance.

To obtain a bank verification letter from Wells Fargo, you should start by visiting your local branch or contacting their customer service. Provide your account details and the purpose of the request, as this information will facilitate the process. If you need to serve a subpoena on Wells Fargo, ensure that you follow all the legal requirements so they can assist you effectively. Additionally, using the US Legal platform can guide you on how to properly serve a subpoena on Wells Fargo, making your task more manageable.