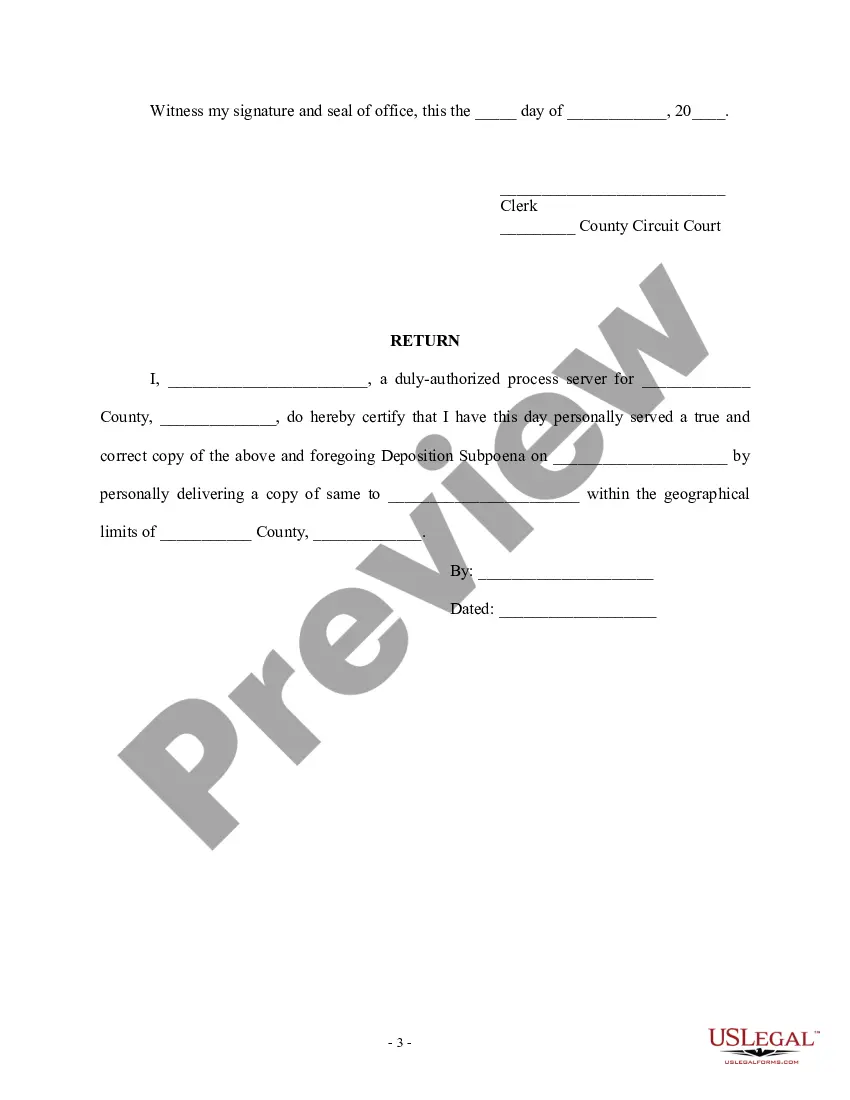

Cross Notice Deposition For Car Accident

Description

Form popularity

FAQ

These are tax deed states: Alaska, Arkansas, California, Connecticut, Delaware, Georgia, Hawaii, Idaho, Kansas, Maine, Michigan, Missouri, Nevada, New Hampshire, New Mexico, New York, North Carolina, North Dakota, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Dakota, Tennessee, Texas, Utah, Virginia, Washington, ...

Arkansas Real Estate Transfer Tax Homebuyers in the majority of the country ? minus 13 states ? need to account for ?real estate transfer taxes? in their closing costs, including Arkansas. Transfer taxes are local and state government taxes that are paid as the seller transfers the home to the buyer.

Arkansas charges a real property transfer tax for real estate transfers involving more than $100.00 in payment. The total transfer tax rate is $3.30 per $1,000.00 of consideration?two-thirds of which is expressly the new owner's responsibility.

The Entry of Appearance tells the circuit clerk's office to make sure that the attorney receives notice of all documents filed with court by either side in that particular case and it also lets the clerk know that any decisions made by the judge in the case need to be sent to the attorney who filed the Entry of ...

Homebuyers in the majority of the country ? minus 13 states ? need to account for ?real estate transfer taxes? in their closing costs, including Arkansas. Transfer taxes are local and state government taxes that are paid as the seller transfers the home to the buyer.

The Real Property Transfer Tax is levied on each deed, instrument, or writing by which any lands, tenements, or other realty sold shall be granted, assigned, transferred, or otherwise conveyed. The tax rate is $3.30 per $1,000 of actual consideration on transactions that exceed $100.