Contingent Forward Contract

Description

How to fill out Attorney Fee Contract - Contingency - 40%?

Having a reliable source for acquiring the latest and most pertinent legal samples is a significant portion of managing bureaucracy.

Obtaining the appropriate legal documents requires accuracy and meticulousness, which is why it's essential to source Contingent Forward Contracts exclusively from reputable providers, such as US Legal Forms.

Eliminate the hassle associated with your legal documentation. Explore the extensive collection at US Legal Forms to discover legal templates, verify their applicability to your situation, and download them immediately.

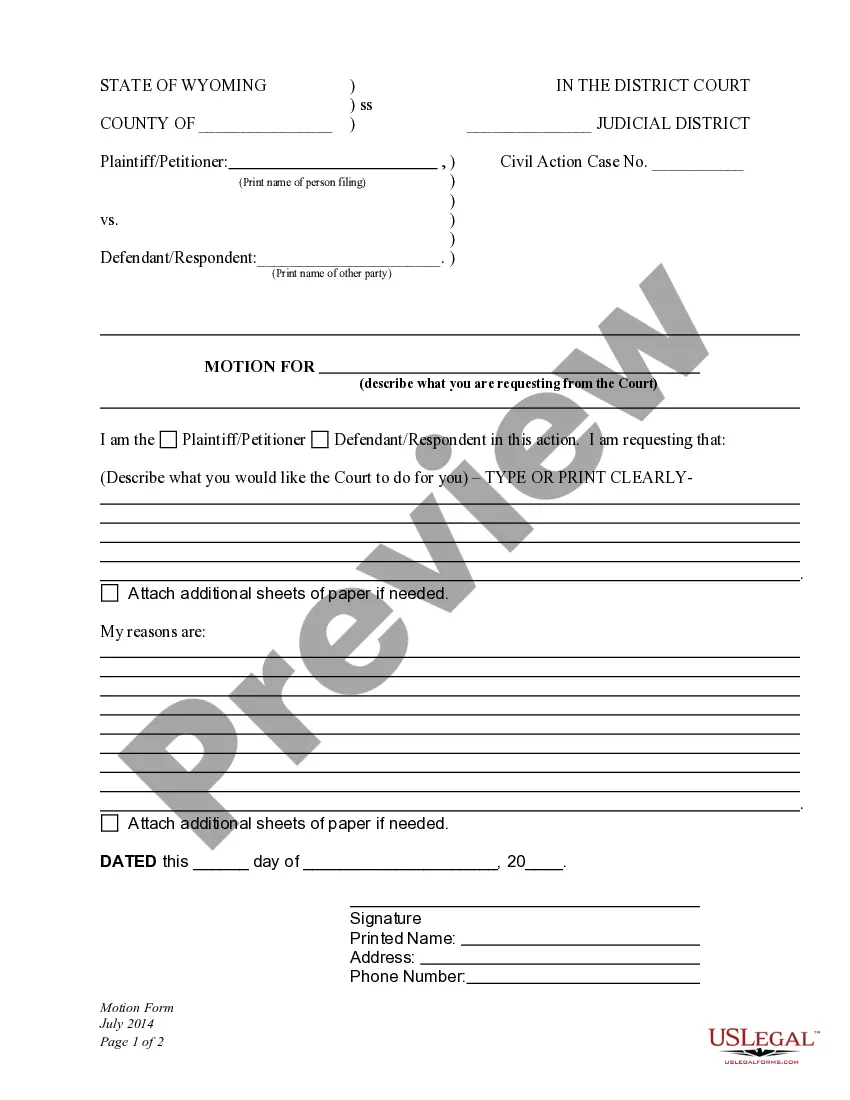

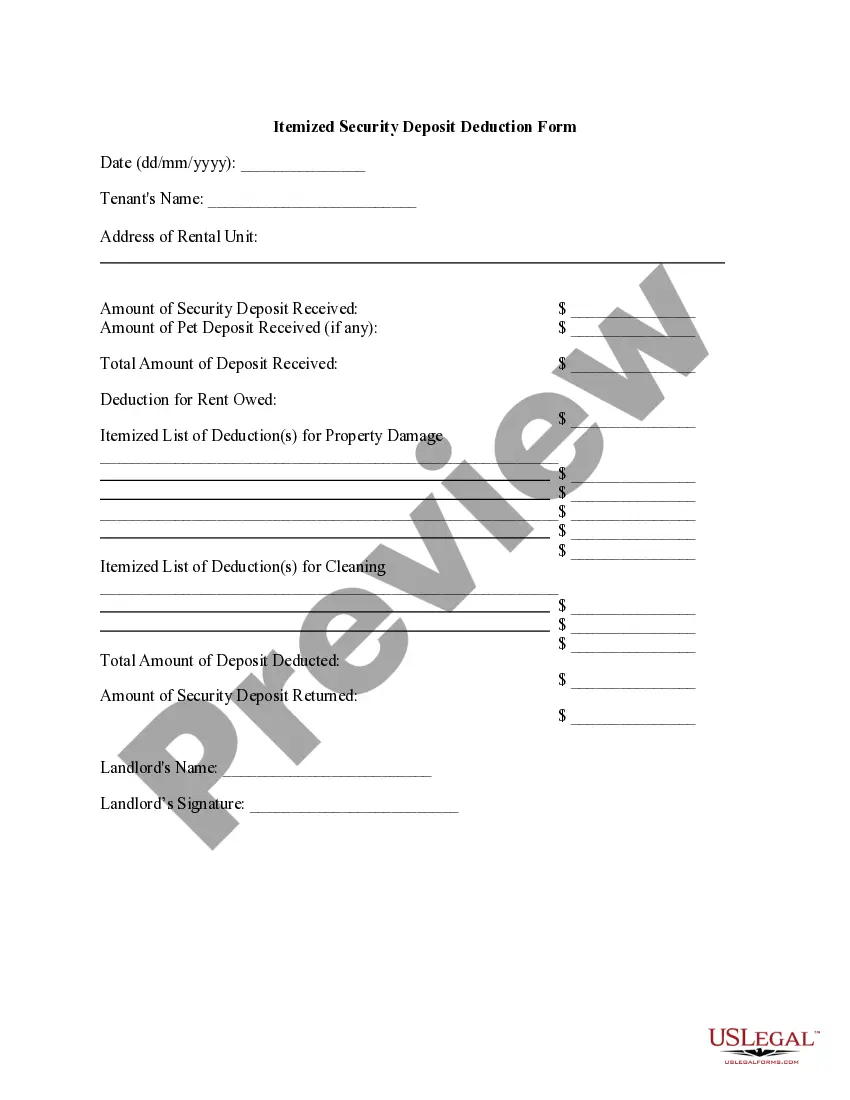

- Utilize the library navigation or search feature to find your template.

- Examine the form’s specifications to verify if it aligns with the regulations of your state and locality.

- Inspect the form preview, if available, to confirm that it is indeed the document you are seeking.

- Return to the search to identify the correct document if the Contingent Forward Contract does not suit your needs.

- Once you are confident about the form’s applicability, download it.

- If you’re a registered user, click Log in to verify and access your selected templates in My documents.

- If you don’t have an account yet, click Buy now to acquire the form.

- Choose the pricing option that meets your preferences.

- Proceed to registration to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading the Contingent Forward Contract.

- After obtaining the form on your device, you can either edit it using the editor or print it to complete it manually.

Form popularity

FAQ

All Rhode Island resale certificates expire four years from the date of their issue. However, before your Rhode Island resale certificate expiration date, you can reapply for a new wholesale license to be issued for another four-year period.

The Division has transitioned from the RI-7004 to the Form BUS-EXT. Details are contained in ADV 2022-38. For Tax Year 2022, if an extension is being filed for the RI- 1065, RI-1120S, RI-1120C, RI-PTE or RI-1120POL, the extension must be filed using the Form BUS-EXT.

What's the difference between Form W-2 and Form W-3? Employees use the information provided by their employer on the Form W-2 to complete and file their personal income tax returns. Employers use Form W-3 to report employee income to the IRS and Social Security Administration.

Form RI-W3 - Transmittal of Wage and Tax Statements. INFORMATION FOR EMPLOYERS FILING TRANSMITTAL OF WAGE AND TAX STATEMENTS. 1. The employer's name and address should be pre-printed on the form. If incorrect, any necessary changes may be made directly on the form.

To order official IRS information returns such as Forms W-2 and W-3, which include a scannable Copy A for filing, go to IRS' Online Ordering for Information Returns and Employer Returns page, or visit .irs.gov/orderforms and click on Employer and Information returns.

Tax Form W-3 tends to show total earnings, Medicare wages, Social Security wages, and withholdings for all employees encompassing the entire year. Form W-3 includes: Employee's total income and salary paid by an employer. The part of a payroll that's subject to Social Security and Medicare taxes.

All forms supplied by the Division of Taxation are in Adobe Acrobat (PDF) format. Most forms are provided in a format allowing you to fill in the form and save it. To have forms mailed to you, please call 401.574. 8970 or email Tax.Forms@tax.ri.gov.

Form W-3 is a tax form used by employers to report combined employee income to the Internal Revenue Service (IRS) and the Social Security Administration. Employers who send out more than one Form W-2 to employees must complete and send this form to summarize their total salary payment and withholding amounts.