Parent Privilege For Students

Description

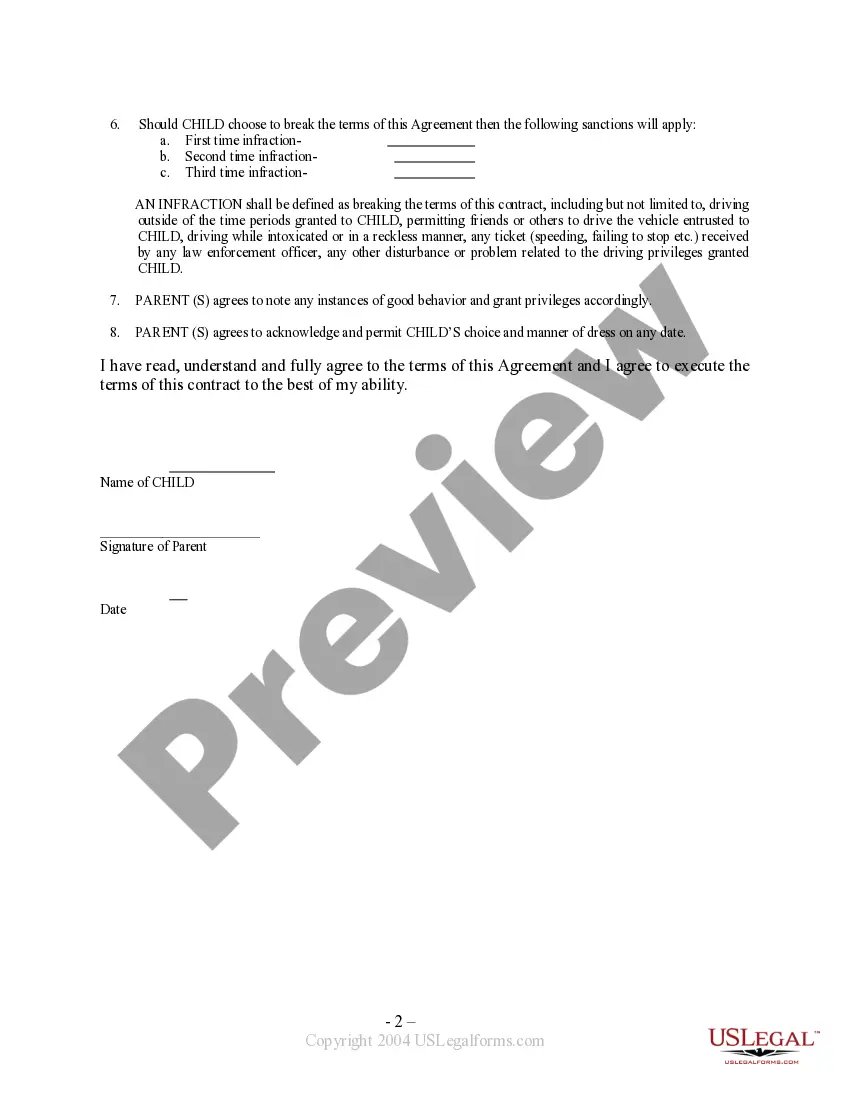

How to fill out Parent - Child Driving Privilege Contract?

Whether for corporate objectives or personal issues, everyone has to confront legal circumstances at some stage in their life.

Filling out legal documents demands meticulous attention, starting from selecting the suitable example form.

With a comprehensive US Legal Forms catalog available, you do not need to waste time searching for the suitable example throughout the internet. Utilize the library’s user-friendly navigation to find the correct form for any occasion.

- Find the example you require using the search bar or catalog navigation.

- Review the form’s details to confirm it fits your circumstance, state, and county.

- Click on the form’s preview to view it.

- If it is the incorrect document, return to the search feature to locate the Parent Privilege For Students example you need.

- Download the template when it satisfies your criteria.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- In case you do not have an account yet, you can obtain the form by clicking Buy now.

- Select the appropriate pricing choice.

- Complete the account registration form.

- Choose your payment method: you can utilize a credit card or PayPal account.

- Select the document format you prefer and download the Parent Privilege For Students.

- Once downloaded, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

You can form an LLC in Nevada even if your business will not be located in Nevada and/or no LLC members will live there. But you will probably still need to qualify your LLC to do business in your home state?and this means you'll have to file additional paperwork and pay additional fees.

The initial cost to set up an LLC in Nevada is $425. Then, the annual costs are $350 per year. In most states, you just have to file a single LLC formation document. However, in Nevada, you have to file an Articles of Organization as well as a State Business License and Initial List of Managers or Managing Members.

The Nevada Advantage Tax Breaks. Nevada has some of the most favorable tax laws in the United States. ... Asset Protection. One of the primary benefits of an LLC is its ability to protect the personal assets of its owners from business debts and liabilities. ... Flexibility. ... Ease of formation. ... Proximity to major markets.

You can get an LLC in Nevada in 1 business day if you file online (or 5-6 weeks if you file by mail).

Everything You Need to Know About Nevada LLCs: Name Your LLC. Designate a Registered Agent. Submit LLC Articles of Organization. Write an LLC Operating Agreement. Get an EIN. Open a Bank Account. Fund the LLC. File State Reports & Taxes.

It costs $425 to start a Nevada LLC. This is a one-time filing fee for the LLC Articles of Organization ($75), State Business License ($200), and Initial List of Managers or Managing Members ($150).

Nevada LLC fees for registering a new business are $425, consisting of $75 for articles of organization, $150 for a list of members, and a $200 business license. The LLC must submit an annual list of members and pay $150. These fees are roughly the same for an LP or LLP.

Everything You Need to Know About Nevada LLCs: Name Your LLC. Designate a Registered Agent. Submit LLC Articles of Organization. Write an LLC Operating Agreement. Get an EIN. Open a Bank Account. Fund the LLC. File State Reports & Taxes.