Reporting Transactions To Irs

Description

How to fill out Fair Credit Reporting Act FCRA And Fair And Accurate Credit Transactions FACTA Package?

Legal oversight can be overwhelming, even for the most seasoned experts.

When you are looking into Reporting Transactions To Irs and lack the time to dedicate to finding the correct and current version, the process can be challenging.

US Legal Forms meets all your needs, from personal to business paperwork, all in one location.

Utilize cutting-edge tools to complete and manage your Reporting Transactions To Irs.

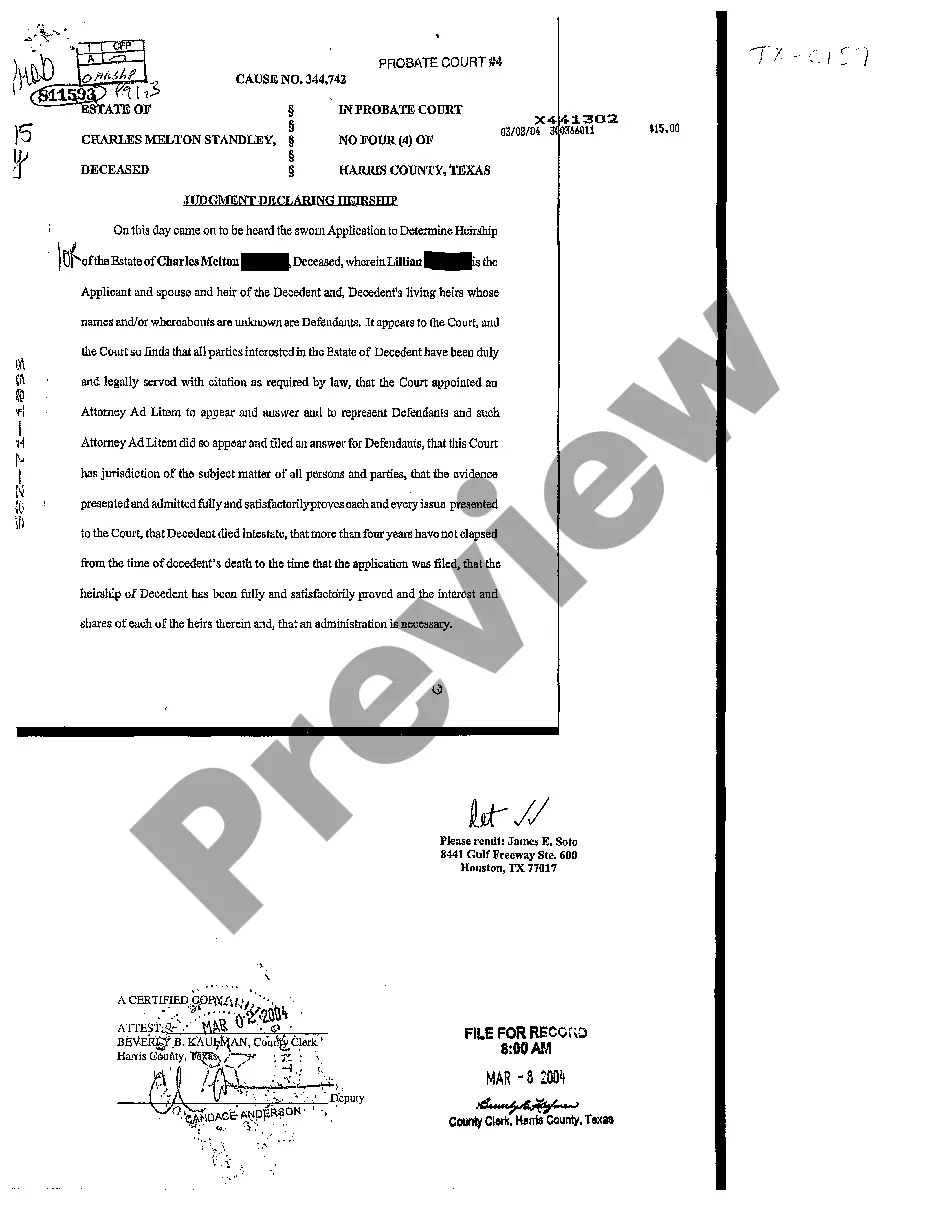

Here are the steps to follow after locating the form you require: Verify it is the correct document by previewing it and reviewing its description. Ensure the template is recognized in your state or county. Click Buy Now when you are ready. Select a subscription plan. Find the format you need, and Download, fill out, sign, print, and send your documents. Take advantage of the US Legal Forms online library, backed by 25 years of experience and reliability. Streamline your routine document management into a simple and user-friendly process today.

- Access a collection of articles, guides, and resources pertinent to your situation and needs.

- Conserve time and effort searching for the documents you require, and use US Legal Forms’ sophisticated search and Preview feature to acquire Reporting Transactions To Irs and download it.

- If you hold a monthly subscription, Log In to your US Legal Forms account, locate the form, and download it.

- Check the My documents tab to discover the documents you have previously saved and manage your folders as needed.

- If it is your initial time with US Legal Forms, create an account and gain unlimited access to all the advantages of the library.

- A robust online form repository can be a transformative asset for anyone looking to navigate these scenarios effectively.

- US Legal Forms is a frontrunner in digital legal documents, offering over 85,000 state-specific legal forms accessible to you at any moment.

- With US Legal Forms, you can access region-specific legal and business documents.

Form popularity

FAQ

Hear this out loud PauseGenerally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file a Form 8300. By law, a "person" is an individual, company, corporation, partnership, association, trust or estate.

Federal law requires a person to report cash transactions of more than $10,000 by filing Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business.

Does a Bank Report Large Cash Deposits? Depositing a big amount of cash that is $10,000 or more means your bank or credit union will report it to the federal government. The $10,000 threshold was created as part of the Bank Secrecy Act, passed by Congress in 1970, and adjusted with the Patriot Act in 2002.

Generally, you must file a separate Form 8886 for each reportable transaction. However, you may report more than one transaction on one form if the transactions are the same or substantially similar.

You must report all income you receive on your tax return. This may include the gross payment amount shown on Form 1099-K and amounts on other reporting documents like Form 1099-NEC or Form 1099-MISC. It should also include amounts not reported on forms, such as payments you receive by cash or check.