Business Llc Sample Withdrawal

Description

How to fill out Small Business Startup Package For LLC?

The Business Llc Sample Withdrawal displayed on this page is a versatile legal template crafted by experienced attorneys in accordance with federal and local statutes and regulations.

For over 25 years, US Legal Forms has offered individuals, businesses, and lawyers access to over 85,000 authenticated, state-specific documents for various business and personal circumstances. It provides the quickest, most transparent, and most dependable method to secure the necessary paperwork, as the service ensures bank-level data protection and malware prevention.

Register for US Legal Forms to have verified legal templates for every circumstance in life at your fingertips.

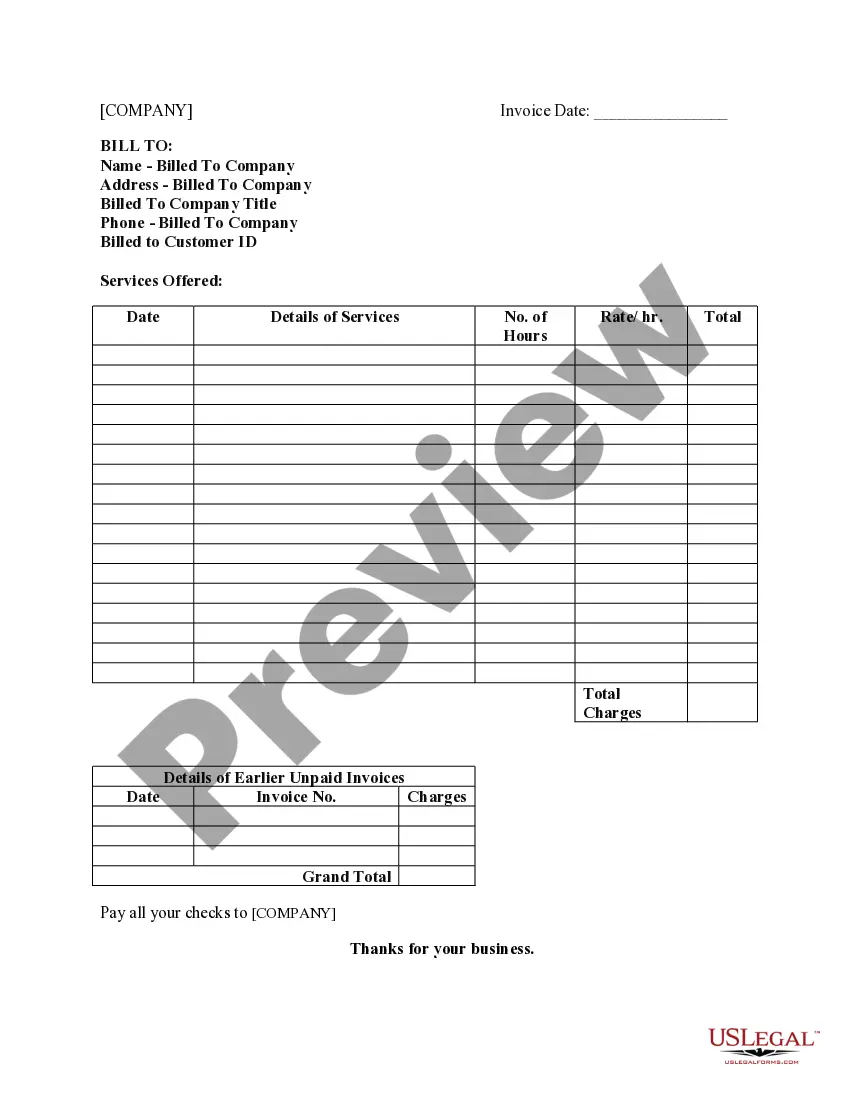

- Search for the document you require and examine it.

- Browse through the file you sought and preview it or read the form description to confirm it meets your requirements. If it does not, utilize the search feature to find the correct one. Click Buy Now once you have found the template you need.

- Register and Log In.

- Choose the pricing plan that fits you and create an account. Use PayPal or a credit card for a swift transaction. If you already have an account, Log In and verify your subscription to continue.

- Obtain the editable template.

- Select the format you desire for your Business Llc Sample Withdrawal (PDF, Word, RTF) and download the template onto your device.

- Fill out and sign the document.

- Print the template to complete it manually. Alternatively, use an online multifunctional PDF editor to quickly and accurately fill out and sign your form with an eSignature.

- Re-download your documents as needed.

- Use the same document again whenever required. Access the My documents tab in your profile to retrieve any previously downloaded forms.

Form popularity

FAQ

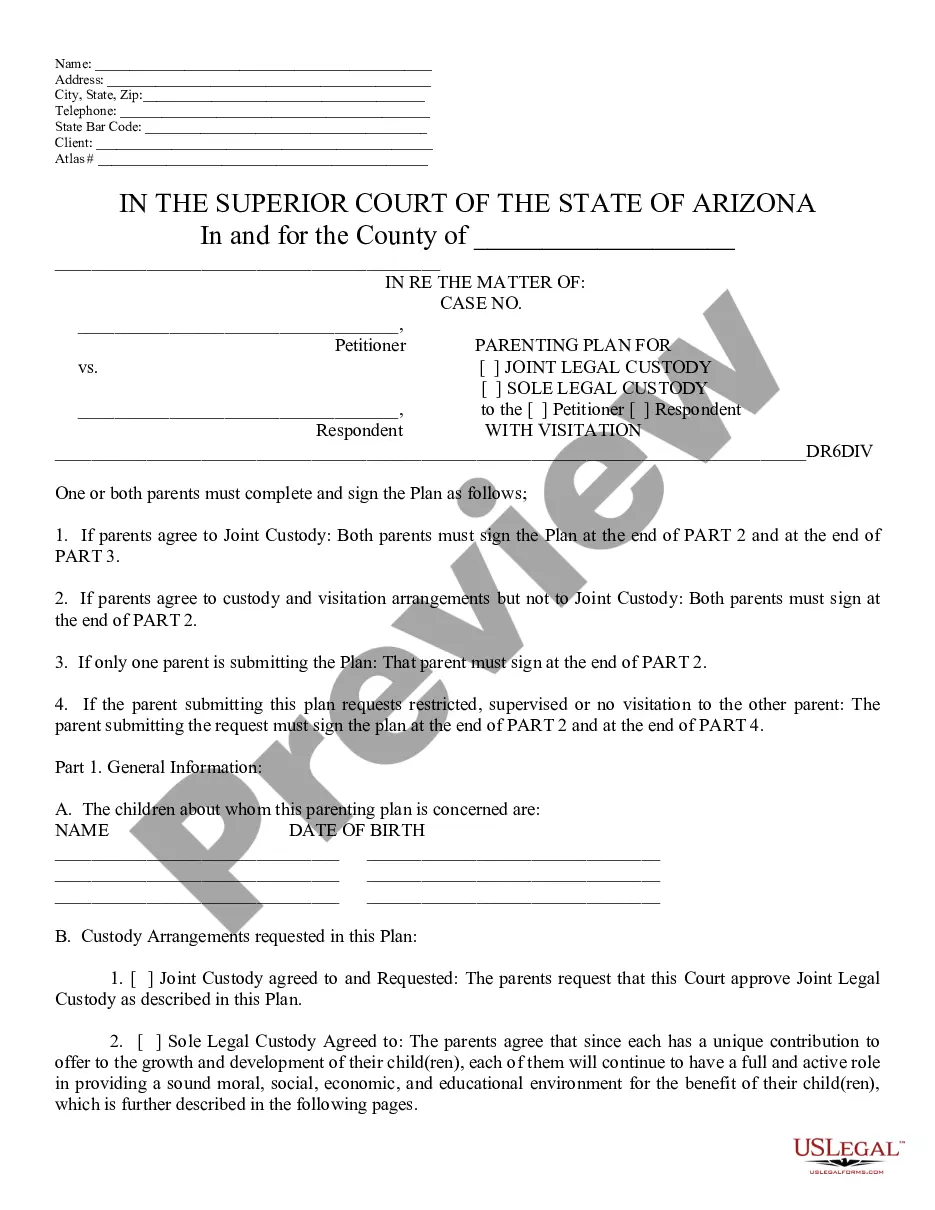

Draft a formal, written notice that states your intention to withdraw and be sure to cite the provisions of the Operating Agreement that pertain to withdrawal. State any desires or demands regarding full payment for any investments you made in the company. Deliver your written notice to every member of the company.

Getting paid as a single-member LLC This means you withdraw funds from your business for personal use. This is done by simply writing yourself a business check or (if your bank allows) transferring money from your business bank account to your personal account.

A withdrawal of a corporation or LLC merely removes your company's right to do business in a particular state but the company may continue to exist and do business elsewhere.

In a multi-member LLC, each member usually has a capital account from which they can take owner draws. Some LLCs set up guaranteed payments to their members by which the owners receive regularly occurring compensation.

To get paid, LLC members take a draw from their capital account. Payment is usually made by a business check. They can also receive non-salary payments or ?guaranteed payments? ? basically a payment that is made regardless of whether the LLC has generated any net income that month or quarter.