S Corporation Vs C Corporation

Description

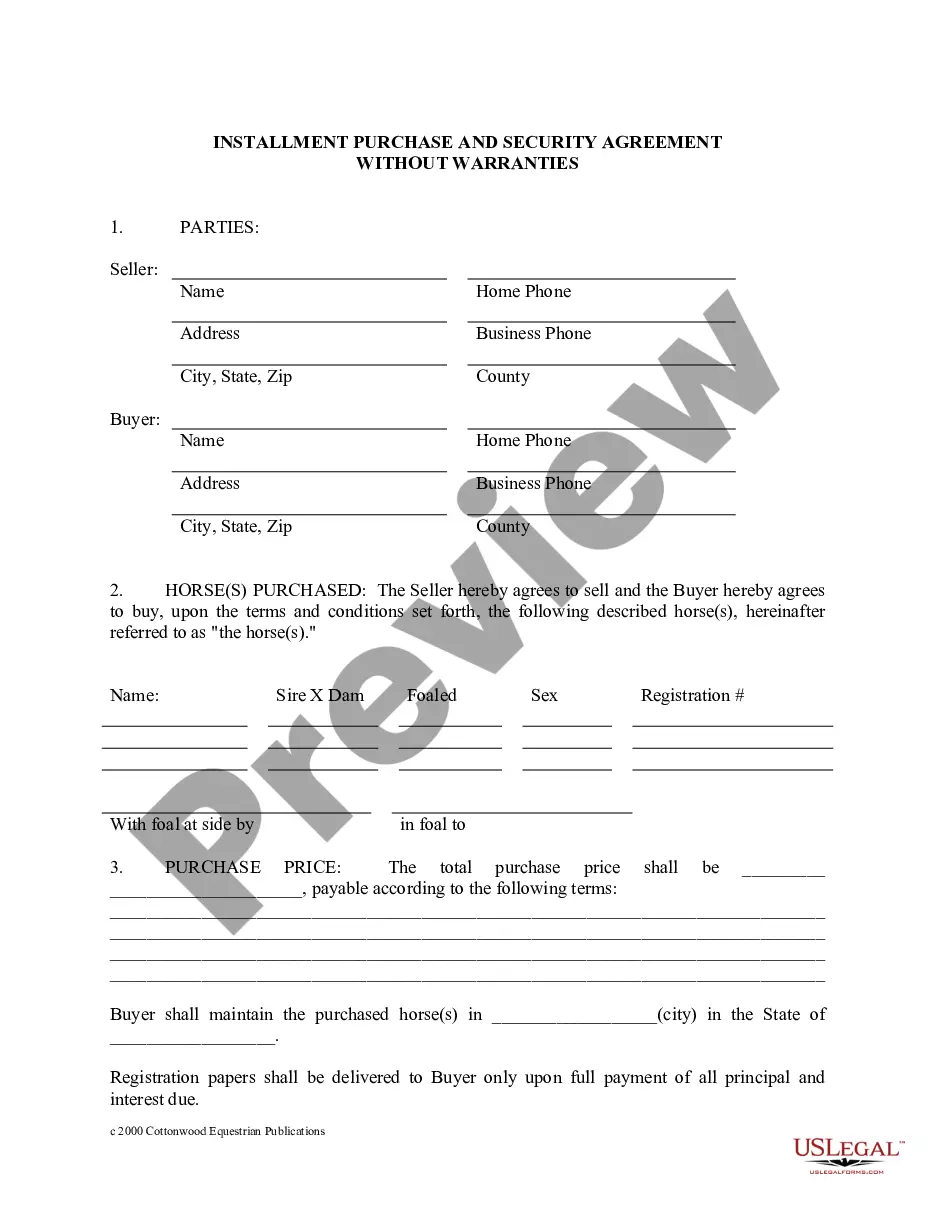

How to fill out Small Business Startup Package For S-Corporation?

- If you're a returning user, log in and navigate to the Download button to acquire your desired form. Ensure your subscription is active; renew if necessary.

- For new users, begin by exploring the Preview mode to confirm that the form meets your specific requirements and complies with local regulations.

- If you find the form unsuitable, utilize the Search feature to find an alternative template that perfectly fits your needs.

- Select the desired document by clicking the Buy Now button, and choose a suitable subscription plan while setting up your account for full access.

- Complete your purchase by providing your payment information via credit card or PayPal.

- Once your transaction is successful, download the form directly to your device. You can easily access it anytime through the My Forms section.

By using US Legal Forms, individuals and attorneys gain access to a robust collection of legal documents, featuring over 85,000 customizable templates. This empowers users to execute necessary legal paperwork efficiently.

Don't hesitate! Start exploring the extensive library of forms today and ensure your business structure is legally sound.

Form popularity

FAQ

You should consider filing as an S corporation when your business begins to generate significant profits and you want to take advantage of pass-through taxation. This status provides potential income tax savings, especially if you plan to distribute earnings to shareholders. It's wise to consult with a tax professional to determine the best time for your unique financial situation.

Choosing between an S corporation and a C corporation depends on your specific situation and objectives. S corporations typically offer advantages like avoiding double taxation and enhanced tax benefits for self-employment. However, C corporations may be preferable for businesses aiming to reinvest profits or attract investors. Consider your future plans when making this choice.

An LLC can elect to be taxed as either an S corporation or a C corporation, depending on your business needs. If you choose S corporation status, your LLC may benefit from pass-through taxation, reducing double taxation on profits. Knowing the differences between an S corporation and a C corporation will help you make an informed choice that fits your goals.

The primary difference between an S corporation and a C corporation lies in their taxation. An S corporation allows profits and losses to pass through directly to shareholders to avoid double taxation, while a C corporation is taxed at both the corporate level and again as dividends to shareholders. Additionally, S corporations have restrictions on the number and type of shareholders. By understanding these differences, you can better position your business; US Legal Forms provides tools and information to assist you in making the best choice.

To find out if your LLC is classified as an S corporation or a C corporation, you should review your tax election forms filed with the IRS. If you submitted Form 2553, you elected S corporation status; otherwise, if there's no election on file, your LLC defaults to C corporation treatment unless it is a single-member LLC. This decision affects your income tax, shareholder distribution, and other finance-related considerations. For detailed guidance, US Legal Forms offers helpful resources to navigate this classification.

An LLC is not inherently a partnership or an S corporation; instead, it can be structured in various ways for tax purposes. If an LLC has more than one member, it typically functions as a partnership unless it opts for S corporation tax treatment. Conversely, a single-member LLC is treated as a sole proprietorship by default but can choose S corporation status. Understanding these distinctions can significantly impact your tax obligations and benefits, so consider checking tools on the US Legal Forms platform for clarity.

To qualify as an S corporation, you must meet specific criteria set by the IRS, including having a maximum of 100 eligible shareholders, being a domestic corporation, and only having one class of stock. Additionally, you need to file Form 2553 and obtain unanimous consent from all shareholders. Ensuring compliance with these requirements is vital for your S corporation vs c corporation decision-making process.

One drawback of an S corporation is the limitations on the number and type of shareholders. An S corporation can have no more than 100 shareholders, and they must be U.S. citizens or residents. This restriction may hinder your ability to grow if you plan to have many investors. Weighing these limitations against benefits is crucial in your S corporation vs c corporation analysis.

To choose between an S corporation and a C corporation, consider your business's size, projected revenue, and long-term expansion plans. Analyze the tax implications and rostering of shareholders for both types. Additionally, if you are unsure, consulting a tax advisor or using a platform like US Legal Forms can provide clear guidance tailored to your situation. This informed approach will streamline your decision-making process.

Choosing between an S corporation and a C corporation largely depends on your business strategy and financial goals. An S corporation allows for pass-through taxation, which may benefit small business owners looking to minimize tax liabilities. On the other hand, a C corporation can attract more investors and facilitate growth, making it ideal for larger companies. Assessing your future needs will guide your decision.