S Corporation Form Application With Database

Description

How to fill out Small Business Startup Package For S-Corporation?

Acquiring legal document samples that adhere to federal and state laws is crucial, and the web provides numerous options to choose from.

However, what is the benefit of spending time searching for the accurately formulated S Corporation Form Application With Database sample online if the US Legal Forms digital library already has such templates gathered in one location.

US Legal Forms is the largest online legal repository with over 85,000 fillable templates created by attorneys for any business and personal situation. They are straightforward to navigate with all documents organized by state and purpose of use. Our experts keep abreast of legislative updates, so you can always trust that your documents are current and compliant when obtaining a S Corporation Form Application With Database from our site.

Click Buy Now once you’ve found the appropriate form and select a subscription plan. Create an account or Log In and make a payment using PayPal or a credit card. Choose the most suitable format for your S Corporation Form Application With Database and download it. All documents you discover through US Legal Forms are multi-usable. To re-download and complete previously acquired forms, access the My documents tab in your profile. Experience the most comprehensive and user-friendly legal paperwork service!

- Acquiring a S Corporation Form Application With Database is swift and simple for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document sample you require in the appropriate format.

- If you are unfamiliar with our website, follow the instructions below.

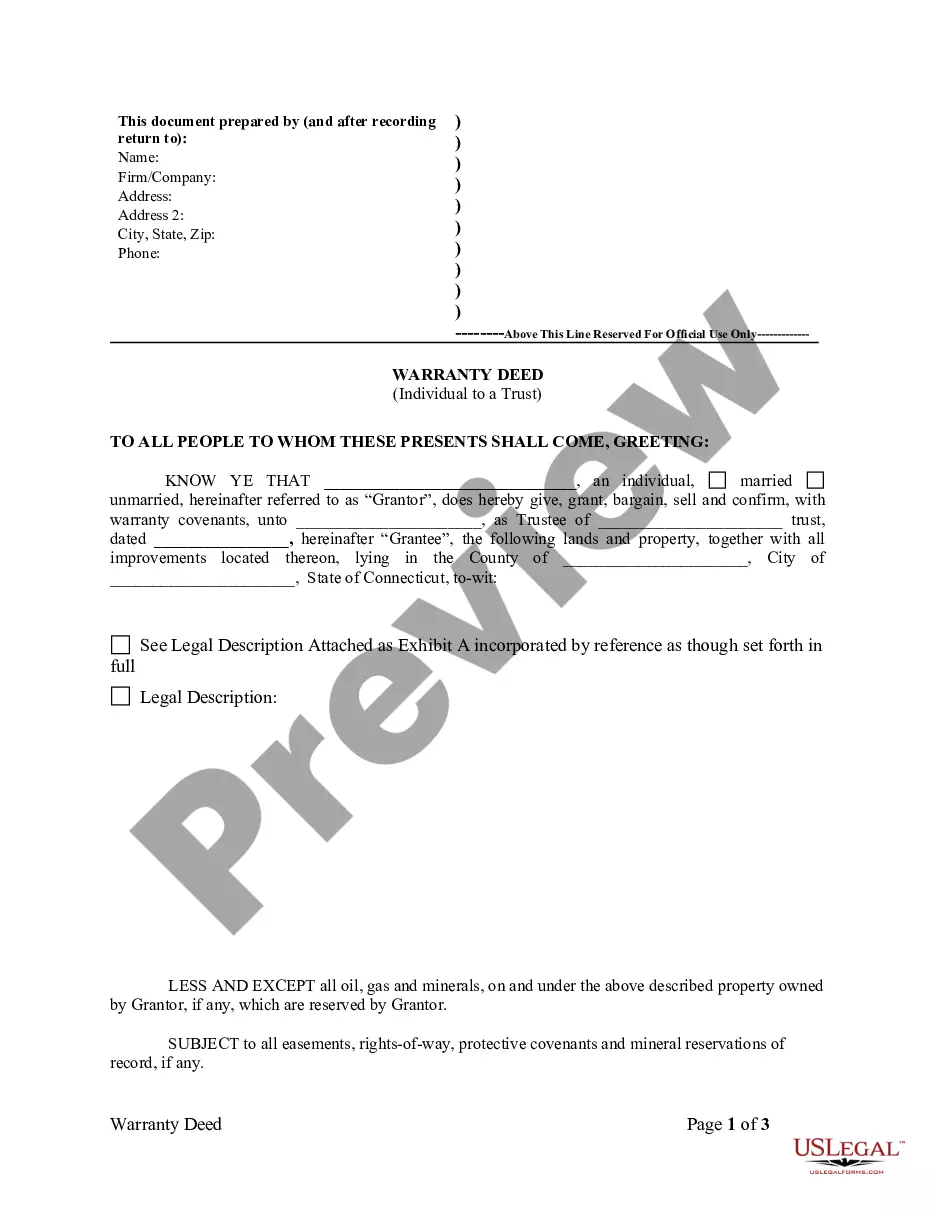

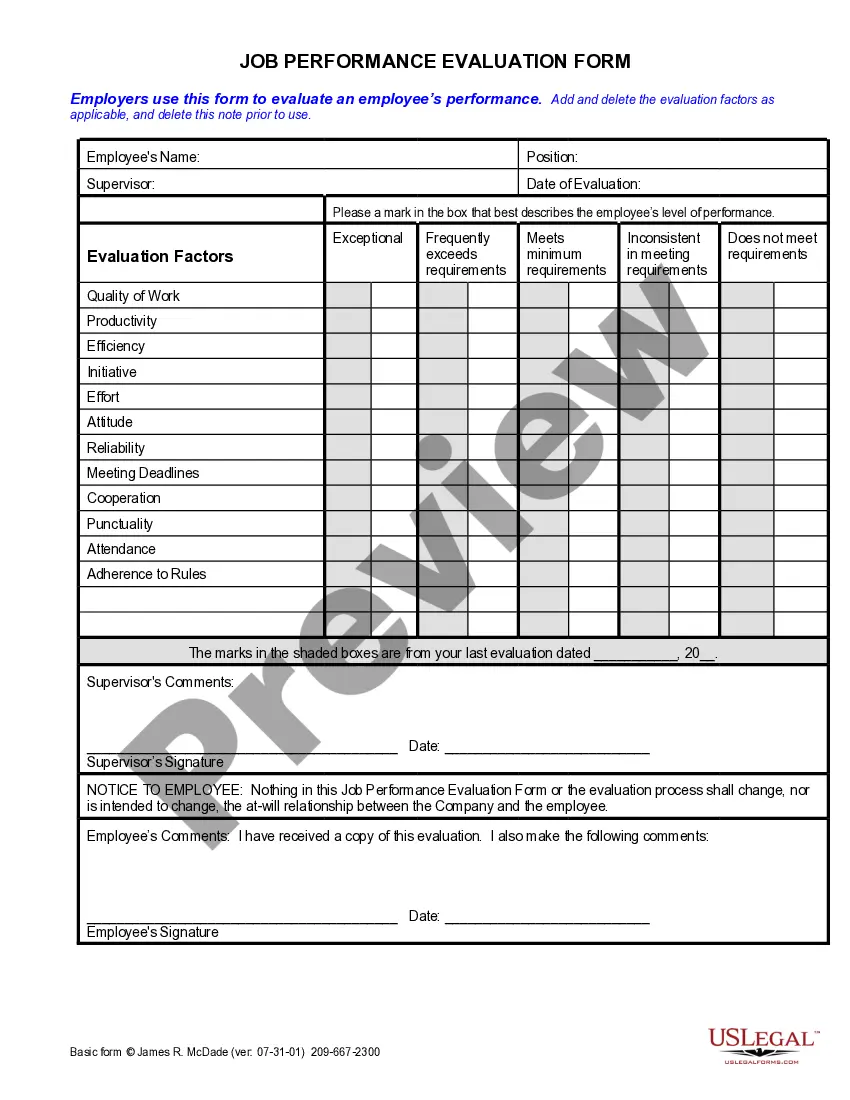

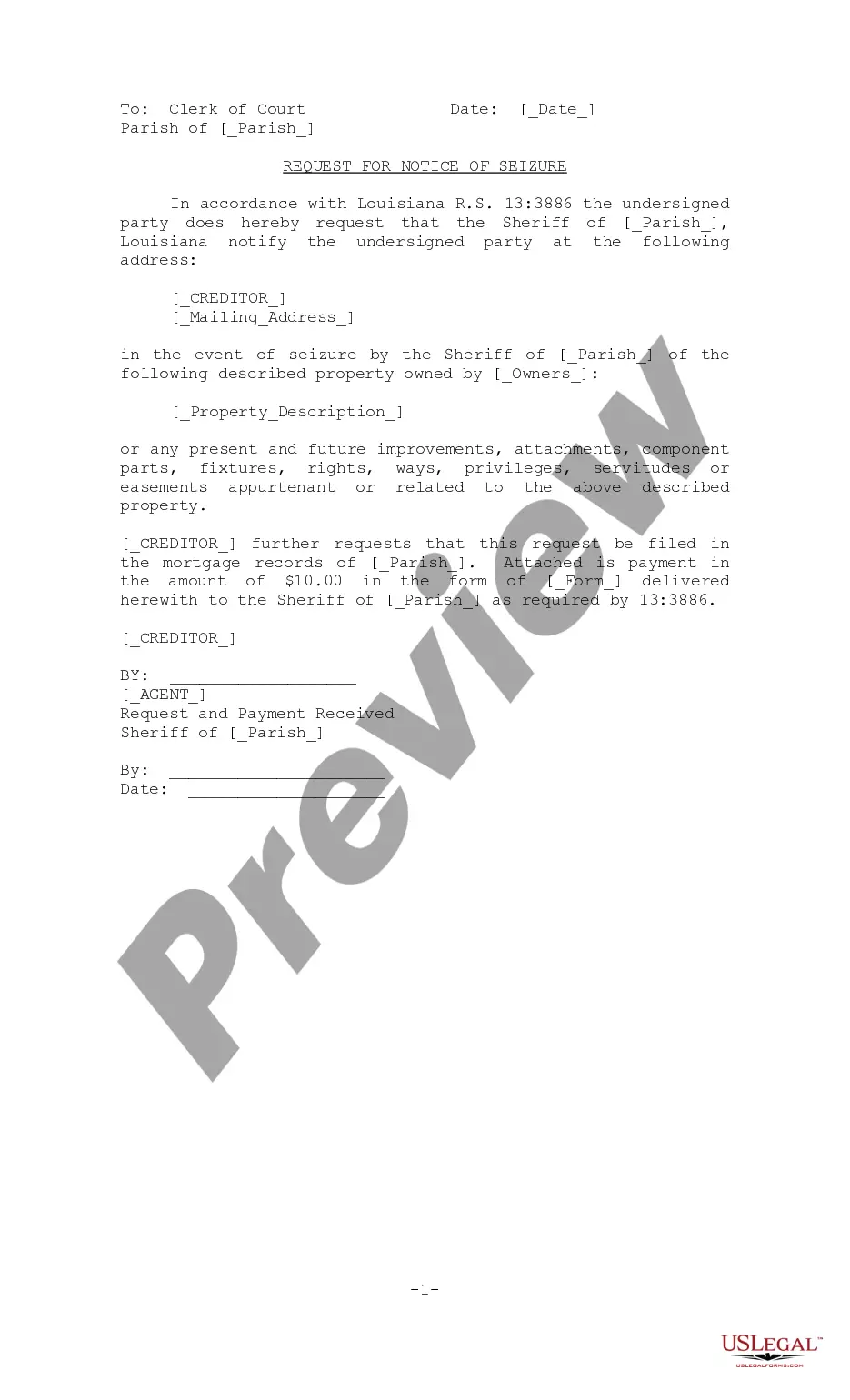

- Examine the template using the Preview feature or through the text description to ensure it fulfills your needs.

- Search for an alternative sample using the search tool at the top of the page if necessary.

Form popularity

FAQ

Disadvantages of S corporation types include legal barriers that prevent them from having more than 100 owners or having shareholders that are non-U.S. persons. S corporations are also handicapped by requirements to hold annual meetings and appoint a board of directors.

Shareholders may only be individuals, certain trusts, estates, and certain exempt organizations (such as a 501(c)(3) nonprofit). Shareholders may not be partnerships or corporations. Shareholders must be US citizens or residents. The business may have no more than 100 shareholders.

The main tax difference between sole proprietors and S Corps has to do with your taxable income. As a sole proprietor, you'll be required to pay income taxes on all income your business makes. But if you file as an S Corp, you will only be responsible for taxes on your set salary (hint: no federal corporate tax).

LLCs can have an unlimited number of members; S corps can have no more than 100 shareholders (owners). Non-U.S. citizens/residents can be members of LLCs; S corps may not have non-U.S. citizens/residents as shareholders. S corporations cannot be owned by corporations, LLCs, partnerships or many trusts.

As a certain type of small business corporation, an S corp offers many advantages in the form of tax benefits, liability protection, increased prestige, and generous retirement contribution limits. The main disadvantages are a fairly involved setup process and requirements that must be carefully followed.