Personal Loan Agreement Format In Kannada

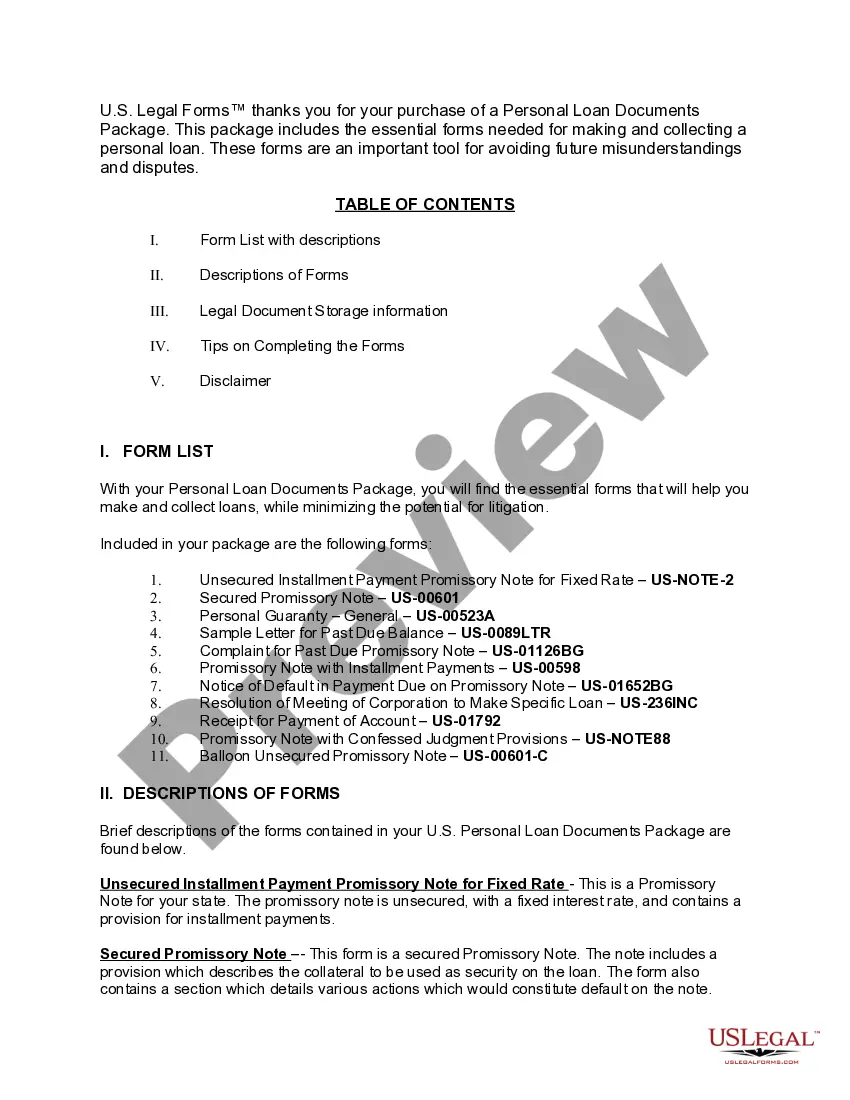

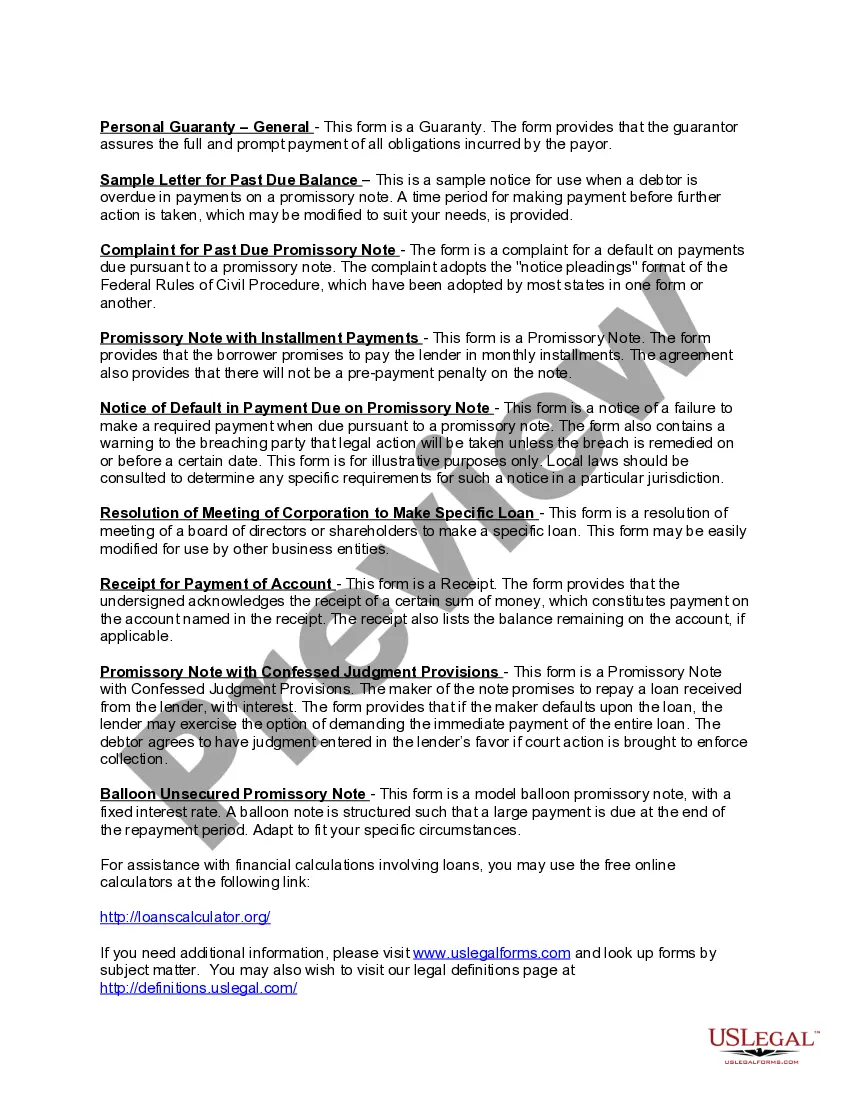

Description

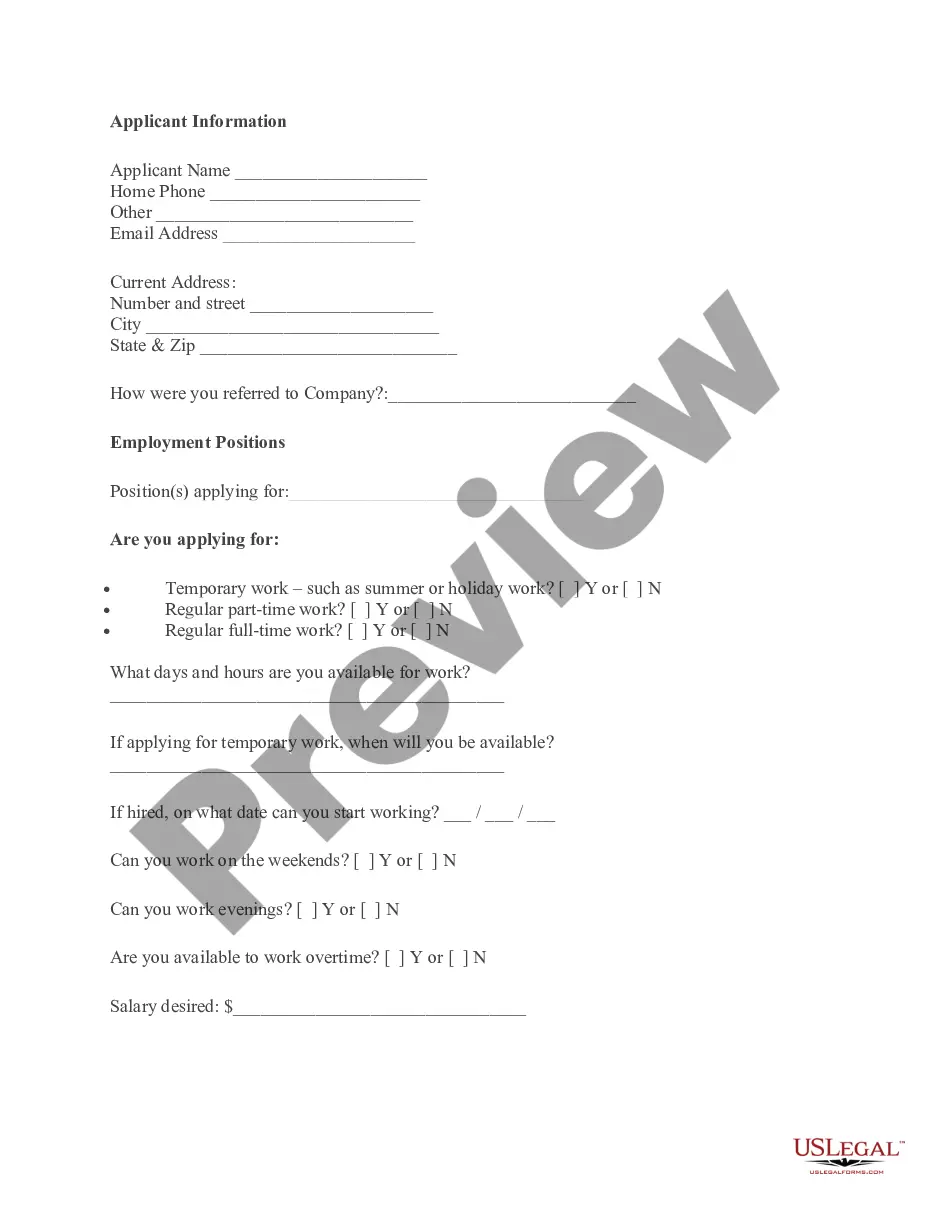

How to fill out Personal Loan Agreement Document Package?

It’s common knowledge that you cannot become a legal specialist instantly, nor can you swiftly acquire the ability to create a Personal Loan Agreement Format In Kannada without a distinct set of expertise.

Assembling legal documents is a lengthy process that demands particular education and abilities. So why not delegate the development of the Personal Loan Agreement Format In Kannada to the experts.

With US Legal Forms, one of the most comprehensive legal document repositories, you can obtain everything from court documents to templates for internal communication.

You can access your documents again from the My documents tab at any time. If you’re a returning client, you can simply Log In, then find and download the template from the same tab.

Regardless of the nature of your documents—be it for financial and legal reasons or personal matters—our website is equipped to assist you. Experience US Legal Forms now!

- Search for the document you require using the search bar at the top of the page.

- View it (if this option is available) and review the accompanying description to ascertain if Personal Loan Agreement Format In Kannada meets your needs.

- If you need additional templates, start your search again.

- Create a free account and choose a subscription plan to buy the form.

- Select Buy now. Once the payment is completed, you can download the Personal Loan Agreement Format In Kannada, complete it, print it, and send it or mail it to the appropriate recipients or organizations.

Form popularity

FAQ

Court fees can be paid by money order, cash, or check. Check with local court administration to see if credit or debit cards are accepted at the courthouse in your county. Make checks payable to District Court Administrator.

When must I file a case in small claims court in Minnesota? You don't have an unlimited amount of time to file a lawsuit. You'll have to bring it within the statute of limitations period for your particular case. For example, you'll have six years for property damage and contract cases, and two years for injury cases.

In order to file a claim against a state, local or municipal government entity in Minnesota, the injured person must first give notice of the claim -- usually to the state's attorney general and also to any employee whose negligence is alleged -- within 180 days of the date of injury.

Considerations Before Filing It will cost you money to file a claim. For claims between $0 - $15,000 the fee is $75. Also, consider if the person the claim is against (the Defendant) has the ability to pay you should you win in conciliation court.

When must I file a case in small claims court in Minnesota? You don't have an unlimited amount of time to file a lawsuit. You'll have to bring it within the statute of limitations period for your particular case. For example, you'll have six years for property damage and contract cases, and two years for injury cases.

The amount of your claim ? The legal reason for the claim & the date the claim occurred o You do not need to hire an attorney to represent you in Conciliation Court, but it may help to consult an attorney for advice on how the law applies to your case before you file.

Each party intending to appear at a contested case hearing shall file with the judge and serve upon all other known parties a notice of appearance which shall advise the judge of the party's intent to appear and shall indicate the title of the case, the agency ordering the hearing, the party's current address and ...