Servicing Transfer Requirements

Description

How to fill out Notice Of Assignment - Sale Or Transfer Of Servicing Rights - Mortgage Loans?

Creating legal documents from the ground up can frequently feel overwhelming.

Some situations might require extensive research and significant financial investment.

If you’re looking for a more straightforward and cost-effective approach to drafting Servicing Transfer Requirements or any other documents without unnecessary complications, US Legal Forms is readily available.

Our online repository of over 85,000 current legal forms covers nearly all aspects of your financial, legal, and personal needs. With just a few clicks, you can swiftly obtain state- and county-specific templates carefully prepared by our legal experts.

US Legal Forms boasts an impeccable reputation and over 25 years of experience. Join us now and make document completion a simple and efficient process!

- Utilize our site whenever you need a dependable and trustworthy service to quickly locate and download the Servicing Transfer Requirements.

- If you're familiar with our services and have previously registered an account, simply Log In, choose the template, and download it or re-download it at any moment in the My documents section.

- Don’t have an account? No issue. Setting it up takes just a few minutes, allowing you to browse the library.

- Before proceeding to download the Servicing Transfer Requirements, keep these suggestions in mind.

- Review the document preview and descriptions to ensure you are selecting the document you need.

Form popularity

FAQ

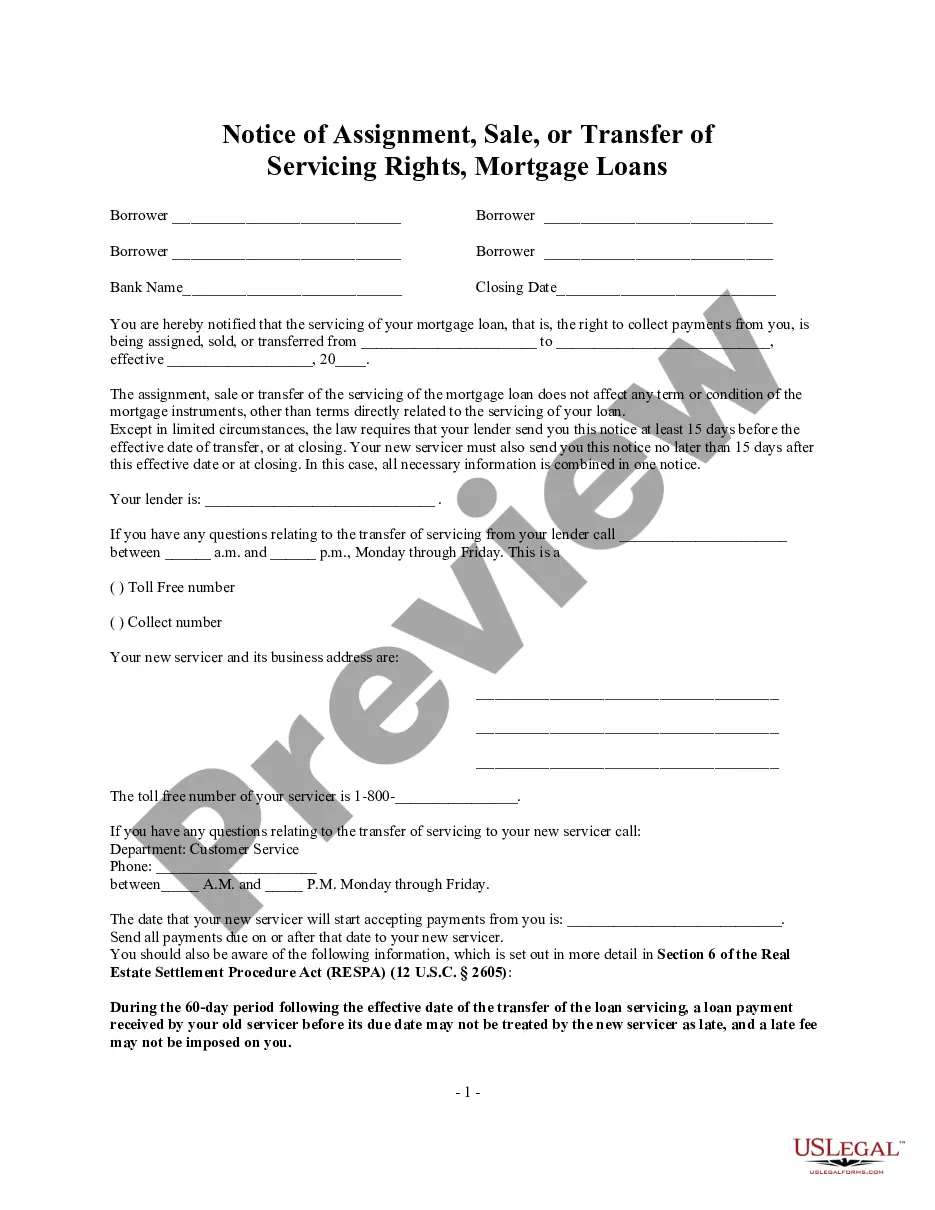

A service transfer refers to the process of moving servicing responsibilities from one entity to another. This can occur for various reasons, such as changes in management or a decision to outsource services for efficiency. Understanding the servicing transfer requirements is essential to ensure compliance and smooth transition during this process. At US Legal Forms, we provide resources and templates to help you navigate these requirements effectively.

A lender typically has 15 days to send a servicing transfer notice after they have transferred your mortgage to another company. This notice is crucial as it informs you about where to send your payments and any changes in servicing transfer requirements. By staying updated with this timeline, you can avoid potential disruptions in your mortgage payments. If you need help understanding these requirements, US Legal Forms offers resources to ensure you're well-informed throughout the process.

The $100,000 loophole for family loans allows you to lend or borrow up to this amount without facing gift tax implications. Understanding this can simplify financial arrangements among family members, especially when you comply with specific servicing transfer requirements. Using this loophole can help you provide assistance without incurring heavy tax liabilities. For detailed guidance, platforms like US Legal Forms can help you navigate these requirements.

Recent changes in mortgage servicing rules aim to enhance borrower protection and promote fair practices among servicers. These new rules address the servicing transfer requirements, making it necessary for servicers to provide timely and accurate information. They also emphasize communication standards, ensuring that you receive clear guidance during any transfer process. Utilizing tools from US Legal Forms can help you stay informed about these regulations and how they impact your mortgage servicing.

A servicing transfer statement is a document you receive when your mortgage servicing changes hands. This statement outlines the transfer details and identifies the new servicer, adhering to servicing transfer requirements. It’s essential to keep this document for your records, as it ensures you have the necessary information for future payments.

When mortgage servicing is transferred, your payment details and customer service will shift to a new company. This process must comply with servicing transfer requirements, meaning you will receive notifications regarding your new servicer. Make sure to review any changes to ensure your payment methods remain accurate and timely.

During a mortgage transfer, your escrow account should move to the new servicer without significant changes. The new servicer will continue to manage your escrow payments for taxes and insurance according to servicing transfer requirements. However, you should confirm that your previous payments are accounted for, ensuring a smooth transition.