Transfer Of Interest Agreement With Negative Capital Account

Description

How to fill out Assignment Of Member Interest In Limited Liability Company - LLC?

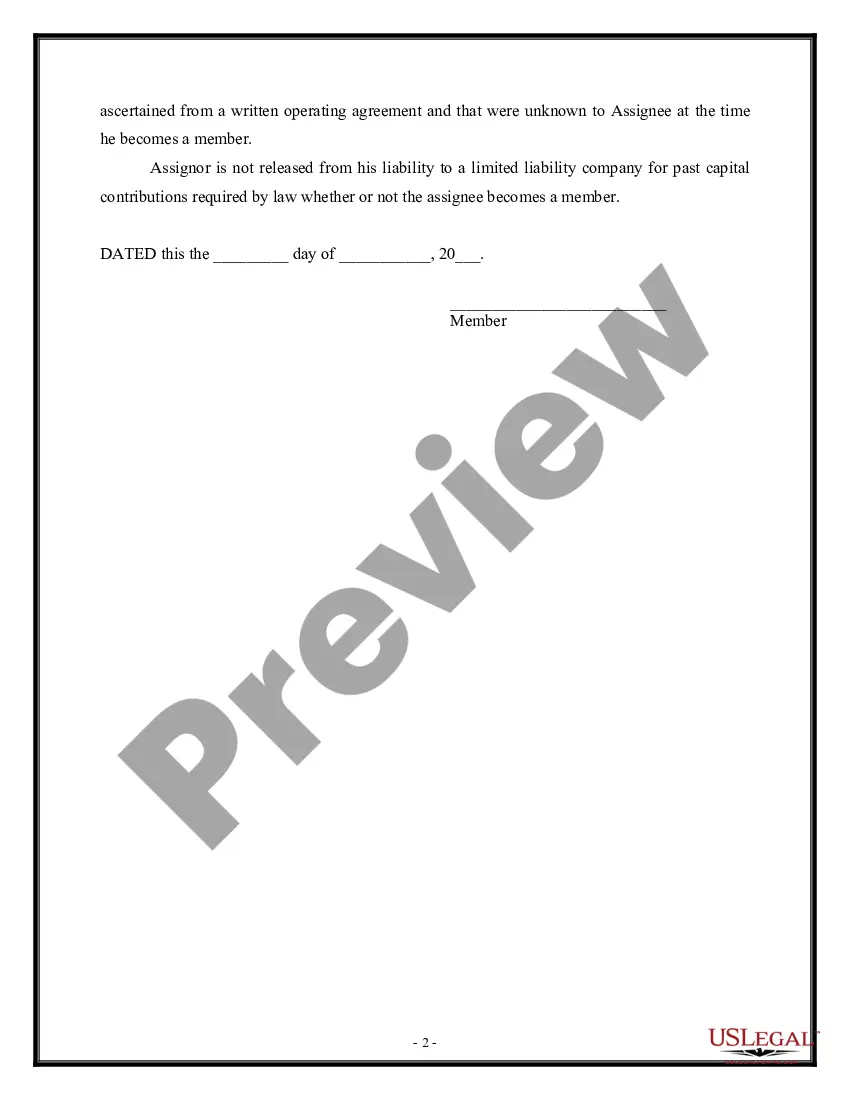

The Agreement for Transfer of Interest Involving a Deficit Capital Account displayed on this site is a reusable legal framework prepared by expert attorneys in alignment with federal and state laws and regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal experts with more than 85,000 validated, state-specific documents for any commercial and personal situation. It’s the fastest, simplest, and most trustworthy method to obtain the necessary paperwork, as the service ensures the utmost level of data security and anti-malware measures.

Reuse your documentation as needed. Access the My documents tab in your profile to redownload any previously saved documents.

- Search for the document you require and examine it.

- Browse through the document you searched and preview it or read the form description to ensure it meets your needs. If it doesn’t, use the search function to find the correct one. Click Buy Now when you have located the template you need.

- Select a pricing plan that works for you and create an account. Use PayPal or a credit card for a swift payment. If you already hold an account, Log In and check your subscription to continue.

- Obtain the editable template. Select the format you prefer for your Agreement for Transfer of Interest Involving a Deficit Capital Account (PDF, DOCX, RTF) and download the file to your device.

- Fill out and sign the document. Print the template to complete it manually. Alternatively, use an online versatile PDF editor to swiftly and accurately fill in and sign your form with a legally-binding electronic signature.

Form popularity

FAQ

If your K-1 shows a negative amount, it indicates a loss or excess withdrawals compared to your investment in the partnership. This can have tax implications, as you may not be able to claim losses exceeding your investment. Considering a transfer of interest agreement with negative capital account may be beneficial, as it can help structure your future dealings with the partnership and mitigate associated risks. It’s advisable to speak to a tax professional for tailored advice.

The final K-1 with ending capital provides a summary of a partner's ownership and share of profits or losses for the tax year. It also reflects any changes in the partner’s capital account, especially if it is negative. When reviewing the final K-1 in relation to a transfer of interest agreement with negative capital account, it is crucial to ensure that the document accurately reflects each partner’s contributions and withdrawals. This clarity helps in tax reporting and financial planning.

A final K-1 with a negative capital account shows your share of the partnership's income, deductions, and credits, along with any remaining negative balance. This document is essential for tax reporting purposes, as it reflects the financial dynamics of your partnership. Understanding your K-1 in the context of a transfer of interest agreement with a negative capital account is crucial for tax compliance and future financial planning.

The tax implications depend a great deal on the ending capital account that is reflected on the K-1. If the capital account is negative, then there is recapture tax associated with a sale. In most circumstances, we can provide an amount in terms of an offering price that will more than cover these associated taxes.

If a partnership is liquidated where a partner has a negative capital account, the partner with the negative capital account is expected to pay back the amount owed to the partnership within 90 days of the partnership termination or by the end of the year, whichever comes first.

A negative capital account implies a disinvested position on the underlying assets of the partnership, so the IRS requires assurance that the partner with a negative capital account provides restitution to cover its deficit position in the event of liquidation.

Follow these steps to correct each partner's ending capital: Add up the ending capital for all the partners' Schedule K-1s. ... Determine the increase and decrease to enter to zero out the capital. ... Go to the Input Return tab. From the left of the screen, select Balance Sheet, M-1, M-2 and choose Sch M-2 (Capital Account).