Sale Of Llc Interest Form For Tax Return

Description

How to fill out Assignment Of Member Interest In Limited Liability Company - LLC?

Establishing a reliable source for obtaining the latest and most pertinent legal templates is a significant part of navigating bureaucracy.

Identifying the appropriate legal documents requires accuracy and careful consideration, which is why it's essential to source the Sale Of Llc Interest Form For Tax Return exclusively from trustworthy entities, such as US Legal Forms. An incorrect template can mislead you and delay your process.

Once you have the form on your device, you can edit it using the editor or print it to complete manually. Eliminate the stress associated with your legal paperwork. Explore the vast catalog of US Legal Forms where you can locate legal templates, verify their significance to your situation, and download them immediately.

- Utilize the library navigation or search box to locate your template.

- Review the form’s description to verify it meets the criteria for your state and area.

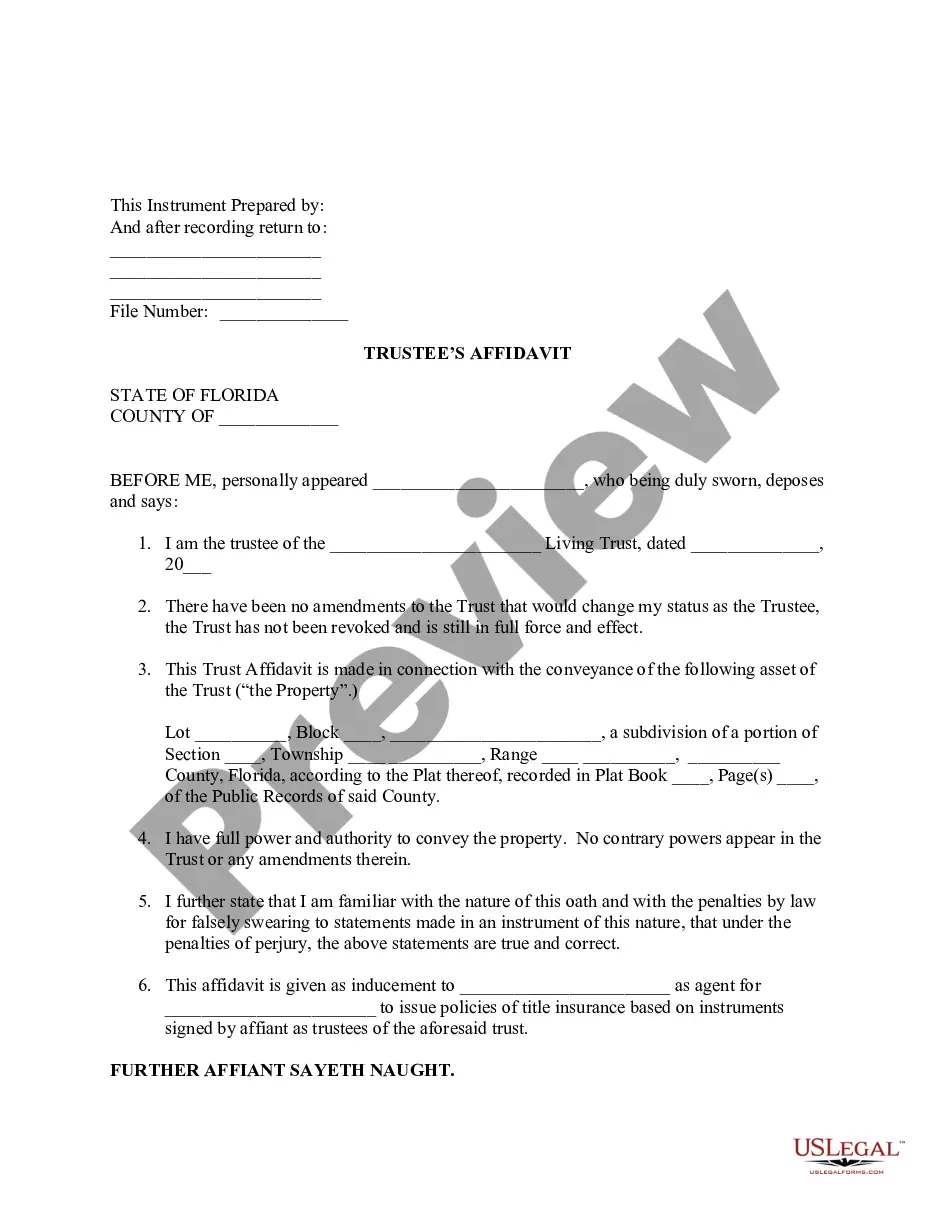

- Check the form preview, if it exists, to confirm the template is what you need.

- Return to the search to find the correct template if the Sale Of Llc Interest Form For Tax Return does not fulfill your needs.

- Once you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your selected forms in My documents.

- If you have not created an account yet, click Buy now to acquire the form.

- Choose the pricing option that best fits your requirements.

- Proceed with registration to complete your purchase.

- Finalized your transaction by selecting a payment option (credit card or PayPal).

- Choose the file format for downloading the Sale Of Llc Interest Form For Tax Return.

Form popularity

FAQ

A Lease Amending Agreement is used when a landlord and tenant wish to change their lease agreement with regard to terms of the lease that do NOT involve the transfer of the lease to another individual.

A modification of lease, also called a lease amendment or lease modification, is an agreement that formally changes the original terms and conditions of a lease. It allows the parties to agree to changes without having to sign an entirely new lease.

A Lease Amendment, also known as a lease amending agreement or lease addendum, is: A formal agreement between a landlord and tenant to modify one or more terms of a Lease Agreement. A written record of the changes or additions made to the original lease.

Tenants may withhold rent or exercise the right to "repair and deduct" if a landlord fails to take care of important repairs, such as a broken heater. For specifics, see Delaware Tenant Rights to Withhold Rent or "Repair and Deduct".

A first amendment lease allows you to make a decision so that you can get the equipment you need and still have the option to buy it down the road. When the lease term expires, you are able to exercise the right to purchase the equipment at a fair market price.

Delaware landlords cannot raise rent during the lease term unless the lease agreement allows for it. Additionally, if the rental property is a mobile home, rent increases are limited to once per year. Landlords must provide 60 days' notice before raising rent, and for mobile homes, a 90-day notice is required.

A lease extension addendum is a legal document extending a lease between a landlord and a tenant. It can also change conditions such as the rent amount, security deposit, utilities, and other provisions. If no changes are made other than the termination date, all other terms of the original lease will remain in place.

(a) If there exists any condition which deprives the tenant of a substantial part of the benefit or enjoyment of the tenant's bargain, the tenant may notify the landlord in writing of the condition and, if the landlord does not remedy the condition within 15 days following receipt of notice, the tenant may terminate ...