Membership Certificate For Llc With Multiple Owners

Description

How to fill out Assignment Of Member Interest In Limited Liability Company - LLC?

Acquiring legal document examples that comply with federal and local laws is vital, and the internet provides numerous choices available.

However, what is the purpose of spending time looking for the correct Membership Certificate for LLC with multiple owners sample online when the US Legal Forms online database already has those templates gathered in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates created by attorneys for any business and personal situation. They are easy to navigate with all documents categorized by state and intended use. Our experts stay updated with legal modifications, ensuring that your form is current and in compliance when you acquire a Membership Certificate for LLC with multiple owners from our site.

Click Buy Now once you've located the suitable form and select a subscription option. Create an account or Log In and make a payment via PayPal or credit card. Choose the best format for your Membership Certificate for LLC with multiple owners and download it. All documents you find through US Legal Forms are reusable. To re-download and complete previously acquired forms, access the My documents tab in your account. Enjoy the most comprehensive and user-friendly legal documentation service!

- Obtaining a Membership Certificate for LLC with multiple owners is straightforward and speedy for both existing and new users.

- If you already have an account with an active subscription, Log In and download the required document sample in the appropriate format.

- If you are new to our site, follow the steps below.

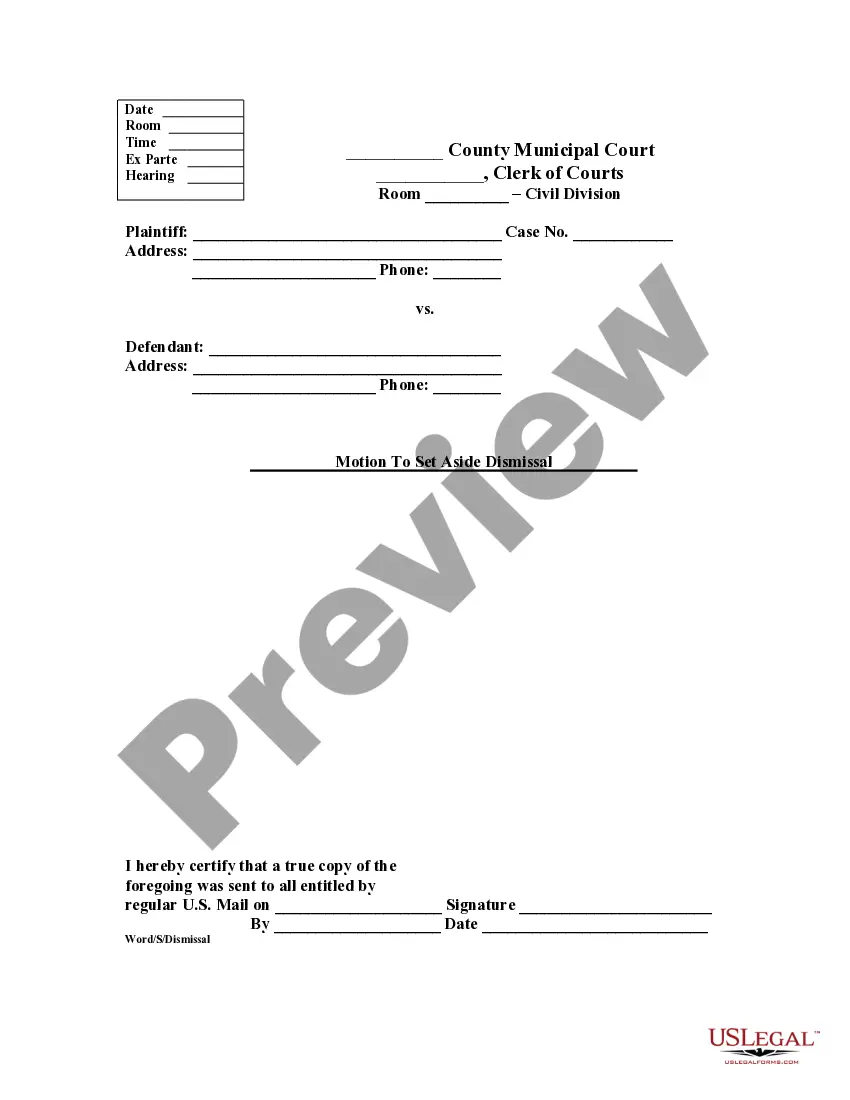

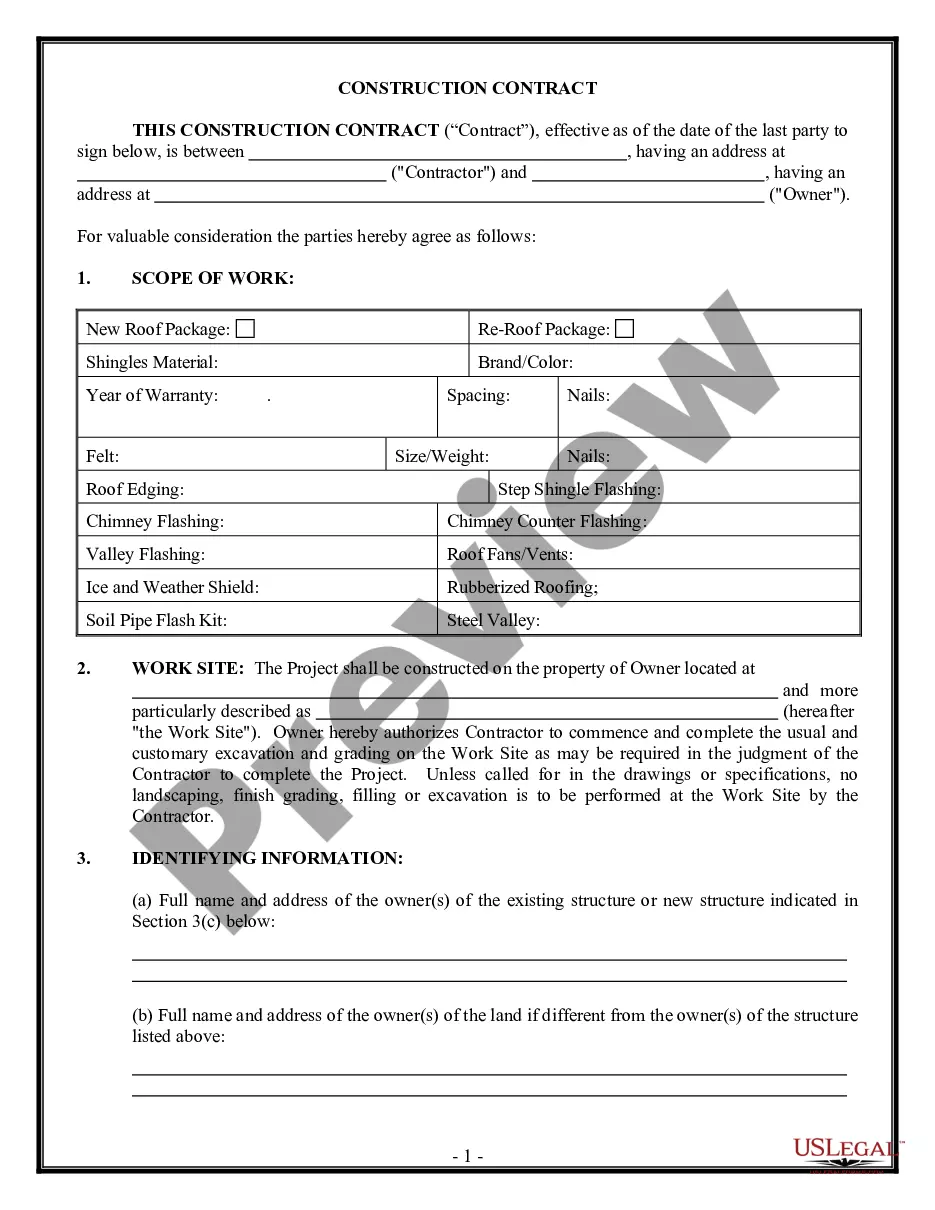

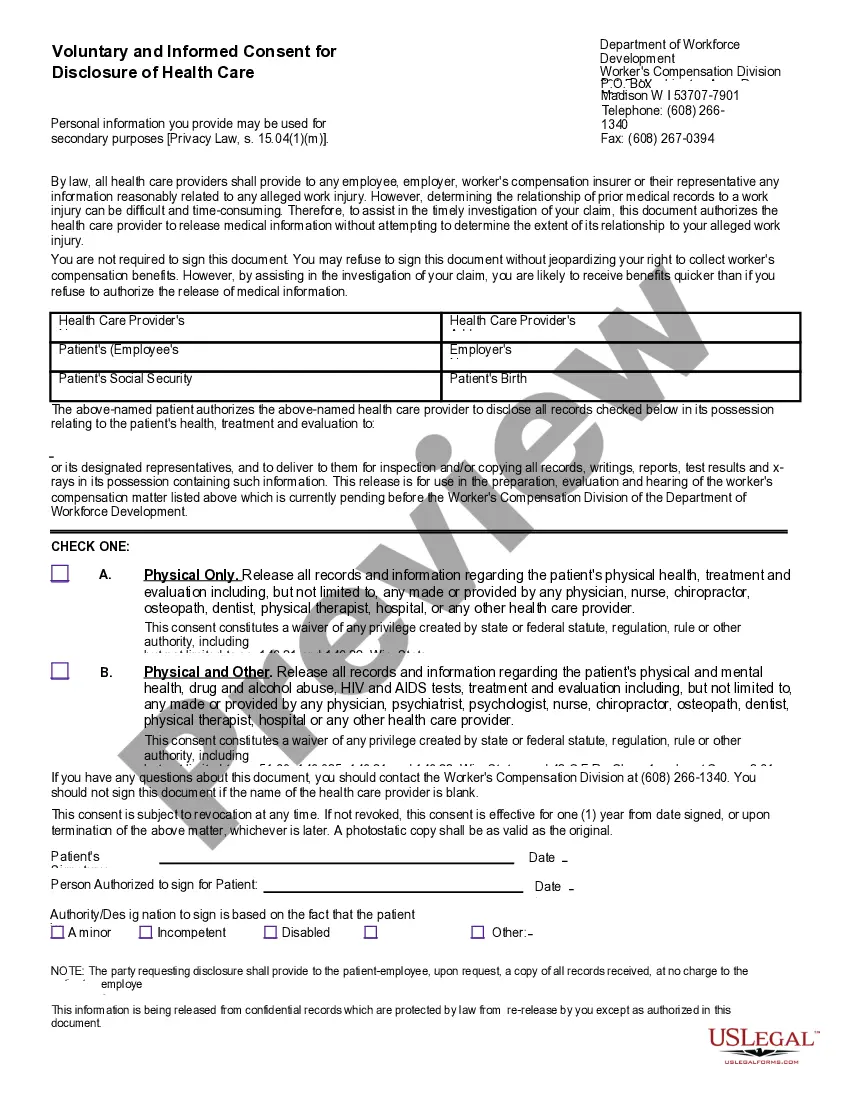

- Review the template with the Preview feature or through the text outline to confirm it meets your requirements.

- Search for another sample using the search function at the top of the page, if needed.

Form popularity

FAQ

In Arizona, a will must be created by someone of sound mind who is 18 years of age or older in order to be valid. In addition, a will must be written and signed by two competent witnesses as well as the testator. The validity of the will can be further bolstered by ?self-proving? the will.

Does a Pour-Over Will Avoid Probate? Just like any other type of will, a pour-over will must be signed by yourself and two witnesses in order to be considered valid in Arizona. However, it must still go through probate and be validated by the court before your assets can be distributed to the living trust.

The average cost of a will in Arizona is generally between $200 and $1,000, depending on the attorney's fees and the complexity of the estate. A trust's average cost in Arizona typically ranges from $1,000 to $3,000, with more complex trusts potentially costing more.

You can make your own will in Arizona. You do not need an attorney to create a will. But, because your will is such a crucial legal document, you want it to meet state-specific requirements. Therefore, it's best to use an estate planning service, such as FindLaw Legal Forms and Services.

There are grounds which, if proven, are typically considered sufficient to invalidate a will or a portion of a will. Those grounds include: The decedent lacked mental capacity when the will was made. There is fraud involved with the will or its creation.

There are Ten Simple Steps to Draft a Will in Arizona: Gather your assets. List personal bequests. List your legal heirs. Name your beneficiaries. Plan to distribute your assets. Appoint an executor. Draft your will. Sign and date the will.

No, in Arizona, you do not need to notarize your will to make it legal. However, Arizona allows you to make your will "self-proving" and you'll need to go to a notary if you want to do that. A self-proving will speeds up probate because the court can accept the will without contacting the witnesses who signed it.