Service Level Agreement For Software Development

Description

How to fill out License Subscription Agreement With Service Level Options?

It’s well-known that you cannot transform into a legal specialist in a day, nor can you comprehend how to swiftly create a Service Level Agreement for Software Development without a particular expertise. Drafting legal documents is a lengthy endeavor that necessitates certain education and capabilities. So why not entrust the development of the Service Level Agreement for Software Development to the experts.

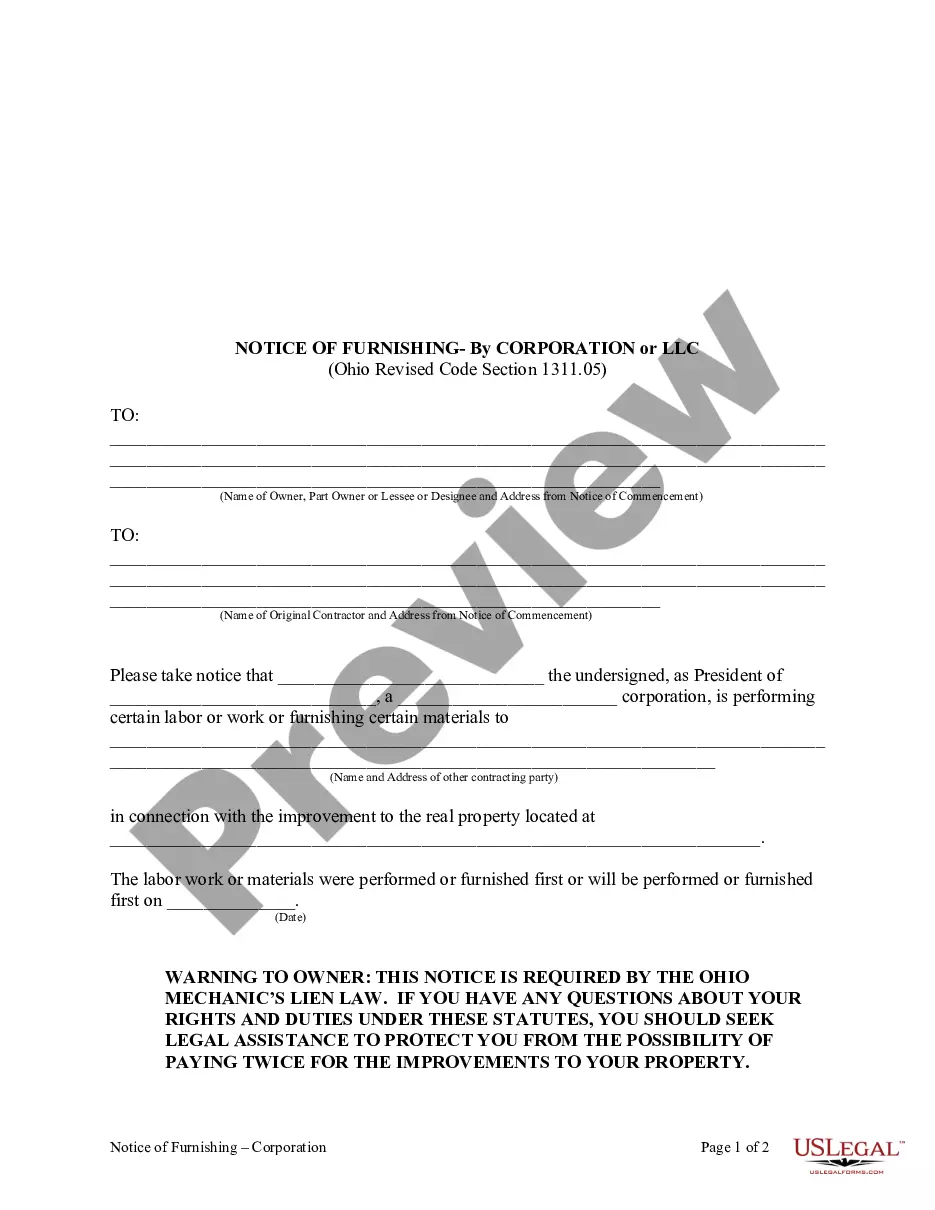

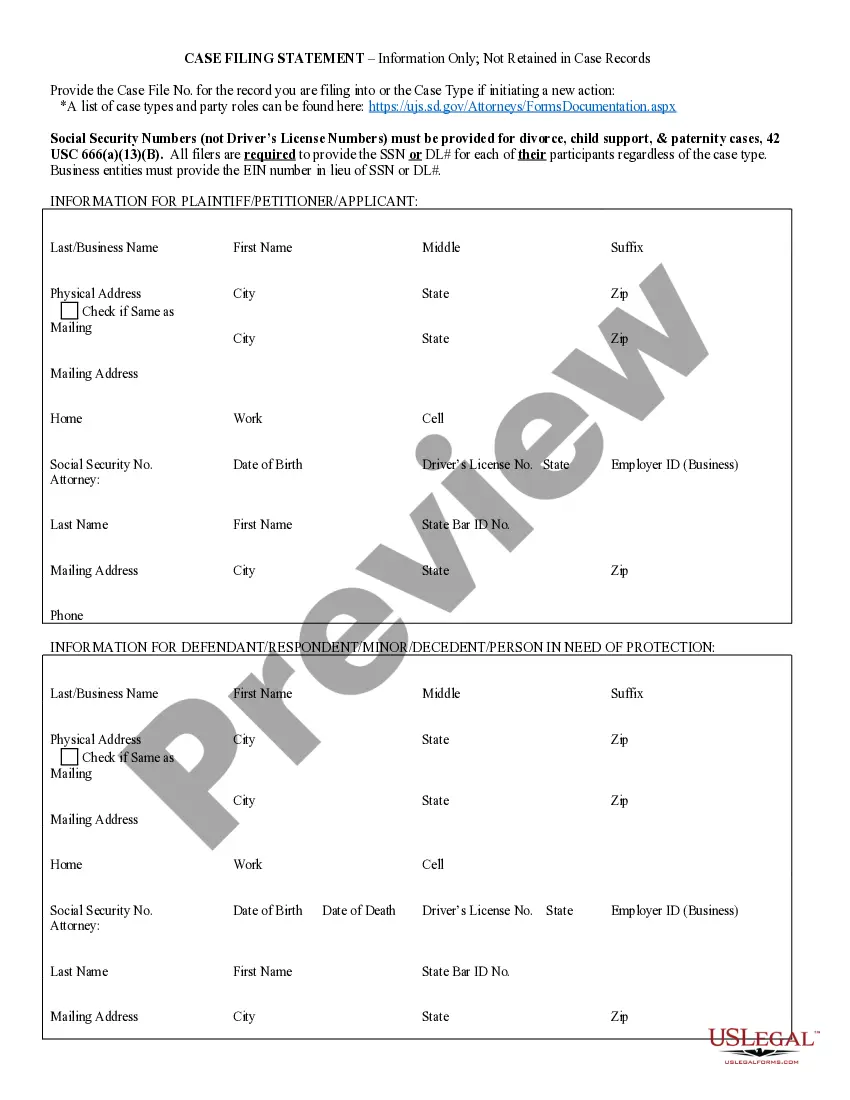

With US Legal Forms, one of the most extensive legal template collections, you can discover everything from court documents to templates for internal business communication. We understand how vital compliance and adherence to governmental regulations are. That’s why, on our website, all templates are location-specific and up-to-date.

Here’s how to get started on our platform and acquire the form you need in just minutes.

You can regain access to your documents from the My documents tab at any time. If you’re a current customer, you can simply Log In, and find and download the template from the same tab.

Regardless of the reason for your documents—be it financial and legal, or personal—our platform has everything you need. Try US Legal Forms today!

- Find the template you require using the search bar at the top of the page.

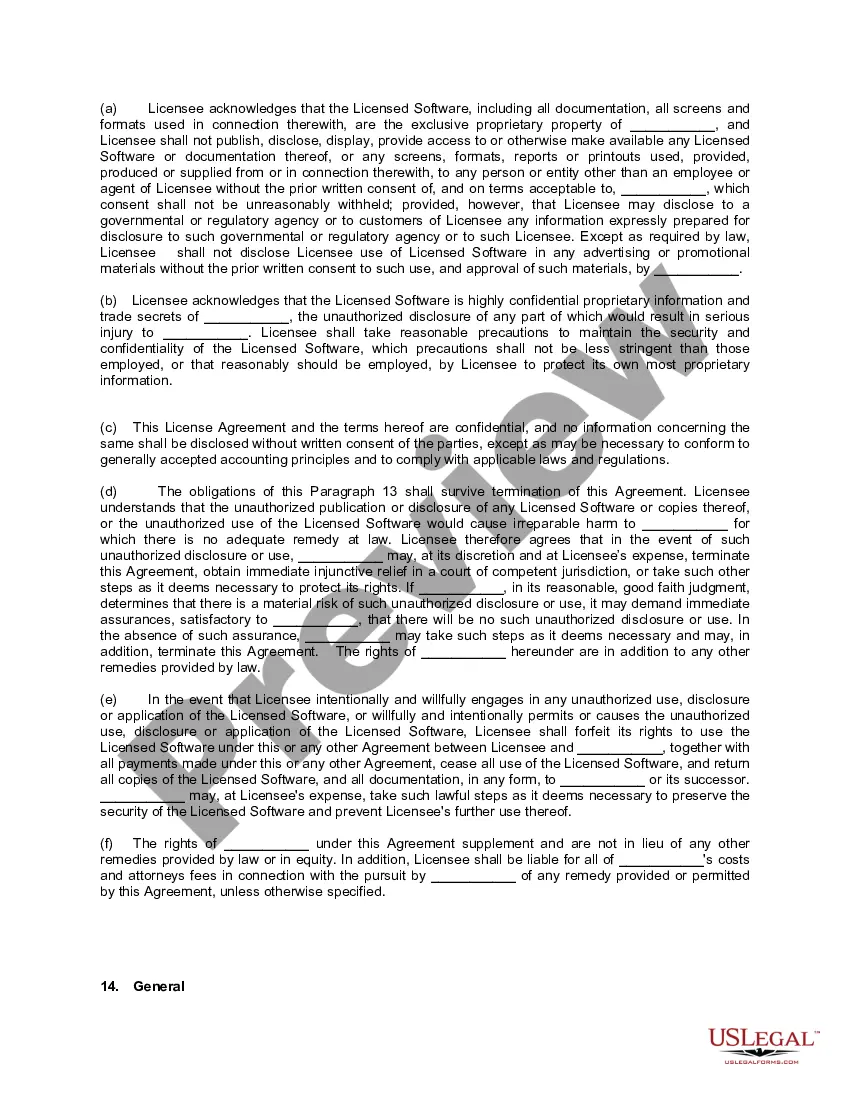

- Preview it (if this option is available) and review the supporting details to determine if the Service Level Agreement for Software Development is what you need.

- If you require another template, start your search again.

- Create a free account and choose a subscription plan to purchase the form.

- Select Buy now. Once the transaction is completed, you can obtain the Service Level Agreement for Software Development, fill it out, print it, and send it or deliver it by mail to the relevant individuals or organizations.

Form popularity

FAQ

The SLA process in the IT industry typically includes stages such as negotiation, agreement, monitoring, and review. Initially, stakeholders negotiate terms to align expectations related to software service delivery. Once finalized, the SLA is monitored for compliance, and regular reviews ensure the agreement continues to meet both parties' needs. Implementing a solid SLA process supports effective service management.

In the new changes to Regulation F, the frequency at which a collections agency can contact a consumer has changed. This change, presented in Section 1006.14B21A, addresses telephone call frequency and restricts agencies to contacting a consumer seven times within seven consecutive days.

New York City's Victims of Gender-Motivated Violence Protection Act permits alleged victims to bring claims within seven years of the alleged physical violation, and CPLR 213-c, which was amended in September 2019, also is used to bring civil claims of sexual assault under a 20-year statute of limitations.

Until 2022, the statute of limitations for debt in New York was six years. However, in January 2021, the New York Senate passed a bill called the Consumer Credit Fairness Act of 2021 that reduced the statute of limitations on most types of debt to just three years. This bill was officially enacted on April 7, 2022.

The New York State Debt Collection Procedures Law prohibits creditors (and their agents) from: communicating the nature of your debt to your employer before obtaining a judgment against you. threatening to take an action that it cannot or would not normally undertake.

Statute of Limitations in New York Thanks to a law passed in 2021, the statute of limitations of debt in New York is three years, which means that's how much time a debt collector has to file a lawsuit to recover the debt through the court system.

The Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using abusive, unfair, or deceptive practices to collect debts from you, including: Misrepresenting the nature of the debt, including the amount owed. Falsely claiming that the person contacting you is an attorney.

Creditors Have Three Years to File a Lawsuit New York has recently updated its statute of limitations for consumer debt. Previously, the statute of limitations was six years. Today, the period is three years. Once three years have passed, a creditor/lender cannot win a lawsuit for an unpaid debt in New York court.

Thanks to a law passed in 2021, the statute of limitations of debt in New York is three years, which means that's how much time a debt collector has to file a lawsuit to recover the debt through the court system.