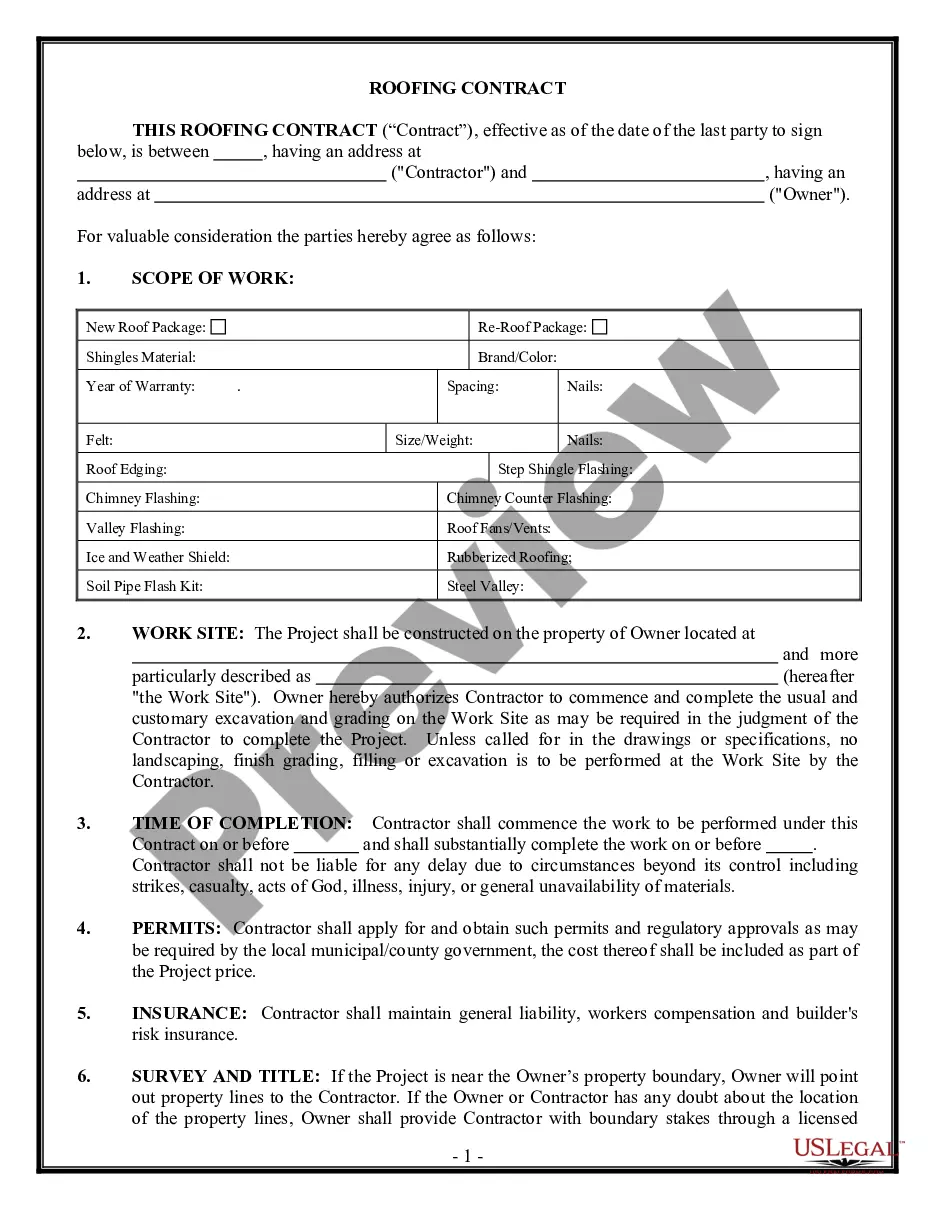

Agreement Level Document For Payment

Description

How to fill out License Subscription Agreement With Service Level Options?

Legal management can be exasperating, even for the most informed professionals.

When you are seeking an Agreement Level Document For Payment and lack the time to search for the suitable and current version, the procedures can be overwhelming.

Access state- or county-specific legal and organizational forms.

US Legal Forms addresses any needs you may have, ranging from personal to business documents, all in one location.

If it is your first experience with US Legal Forms, create a free account and gain unlimited access to all the benefits of the library. Here are the steps to follow after obtaining the form you need: Confirm it is the correct form by previewing it and reviewing its details. Ensure that the sample is accepted in your state or county. Select Buy Now when you are ready. Choose a monthly subscription plan. Pick the format you require, and Download, complete, eSign, print, and send your document. Take advantage of the US Legal Forms online catalog, backed by 25 years of experience and trustworthiness. Improve your daily document management in a smooth and user-friendly manner today.

- Utilize sophisticated tools to complete and manage your Agreement Level Document For Payment.

- Access a valuable resource pool of articles, tutorials, and guides pertinent to your situation and needs.

- Save effort and time searching for the documents you require, and use US Legal Forms’ advanced search and Preview feature to locate Agreement Level Document For Payment and download it.

- If you possess a membership, Log In to your US Legal Forms account, look for the form, and download it.

- Check your My documents tab to view the documents you have previously saved and to organize your folders as you prefer.

- A comprehensive online form catalog can be a transformative solution for anyone wanting to handle these situations efficiently.

- US Legal Forms is an industry frontrunner in web legal forms, boasting over 85,000 state-specific legal forms accessible to you at any time.

- With US Legal Forms, you can.

Form popularity

FAQ

Let's look at a quick example to illustrate the nature of a payment agreement. Person A (the debtor) borrows $5,000 from person B (the creditor). Both parties agree that person A must pay person B $1,000 a month over five months to repay the debt.

Here are the steps to write a letter of agreement: Title the document. Add the title at the top of the document. ... List your personal information. ... Include the date. ... Add the recipient's personal information. ... Address the recipient. ... Write an introduction paragraph. ... Write your body. ... Conclude the letter.

State what each side agrees to do. Clearly write out the terms of the loan. Include information about the date of the loan, the payment terms, interest, schedule of payments, late charges, default, and any other details in the agreement. Explain that the contract represents the entire agreement.

Setting up the payment plan Calculate the total amount due and the payment schedule. Determine the payment amounts, due dates and payment method. Write the agreement, detailing the payment plan. Include the date of the agreement and the parties involved. Get both parties to sign the agreement.

What is a Payment Arrangement? A Payment Arrangement allows a balance, which includes a past due amount, to be split over a three month period.