Form Ss-4 For Trust

Description

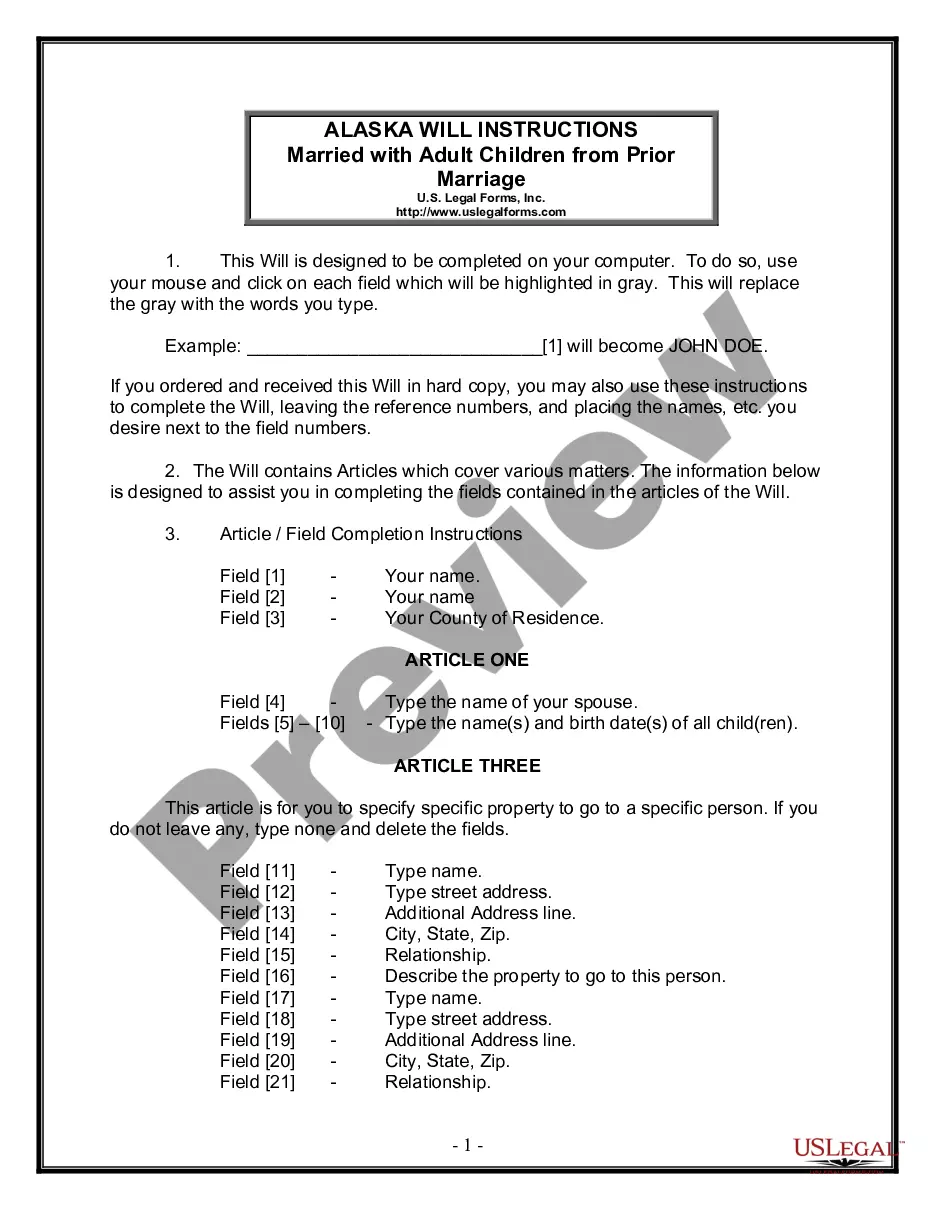

How to fill out I.R.S. Form SS-4 (to Obtain Your Federal Identification Number)?

Obtaining legal document samples that adhere to national and local regulations is essential, and the web provides various choices to select from.

However, what is the benefit of spending time searching for the correct Form Ss-4 For Trust on the internet when the US Legal Forms online repository already houses such templates collected in one location.

US Legal Forms is the largest digital legal directory with more than 85,000 fillable templates created by lawyers for any business and personal situation.

Utilize the most comprehensive and user-friendly legal documentation service!

- They are simple to navigate with all documents categorized by state and intended use.

- Our experts stay updated on legal changes, ensuring you can trust that your form is current and compliant when acquiring a Form Ss-4 For Trust from our site.

- Acquiring a Form Ss-4 For Trust is quick and easy for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the required document sample in your chosen format.

- If you are a newcomer to our website, adhere to the instructions below.

Form popularity

FAQ

You can easily get a copy of your SS-4 form online by visiting the IRS website. Once there, navigate to the EIN application section to request a copy. If you used a service like US Legal Forms, they may also offer features to help you access your previously submitted forms quickly. This convenience can help you manage your paperwork more effectively.

Unfortunately, the IRS does not provide an online search tool for looking up your EIN. However, you can check your original EIN confirmation letter or previous tax returns to find your EIN. If you need further assistance, consider using the resources at US Legal Forms to get insights on how to navigate your EIN inquiries.

To obtain an EIN for a trust, you will need to complete form SS-4 for trust. This form can be submitted electronically or via mail. Using US Legal Forms ensures that you fill out the form accurately, minimizing the chance of errors during the application process, resulting in a smoother experience.

You can obtain a copy of your EIN confirmation letter online by contacting the IRS, as they do not currently offer direct access through their website. However, you can submit a written request citing your EIN and associated details. Using resources available at US Legal Forms can help guide you in preparing this request effectively.

To get a copy of your IRS SS-4 form for trust online, you will need to visit the IRS website and navigate to the necessary section. While you cannot retrieve a copy online directly, you can submit a request for a copy via Form 4506. US Legal Forms provides resources to help simplify this request process.

The processing time for form SS-4 for trust can vary, but it typically takes about four to six weeks. Factors such as volume of requests and specific IRS operations can influence this timeframe. Using services like US Legal Forms can often expedite the completion of your submission, ensuring all details are accurate.

To check your SS-4 form for trust, review your personal files if you have a copy. Alternatively, you can contact the IRS directly for assistance. They can verify your EIN associated with the form and provide necessary details.

You can easily access the SS-4 form for trust online through the IRS website. Simply visit their forms page and download the form as a PDF. By using tools available on US Legal Forms, you can also complete the form conveniently and ensure it meets all IRS requirements.

Typically, the IRS processes Form SS-4 for trust applications within four to six weeks if filed via mail. However, if you submit it online, you might receive your EIN almost instantly. It's always best to apply well ahead of time to ensure all details are finalized before critical deadlines.

The IL 1041 must be filed by all trusts in Illinois that earn income exceeding the state's threshold for taxation. This includes both simple and complex trusts. If your trust carries out its tax obligations properly, it can help you avoid penalties. Reviewing your state's specific requirements will guide you through the filing process.