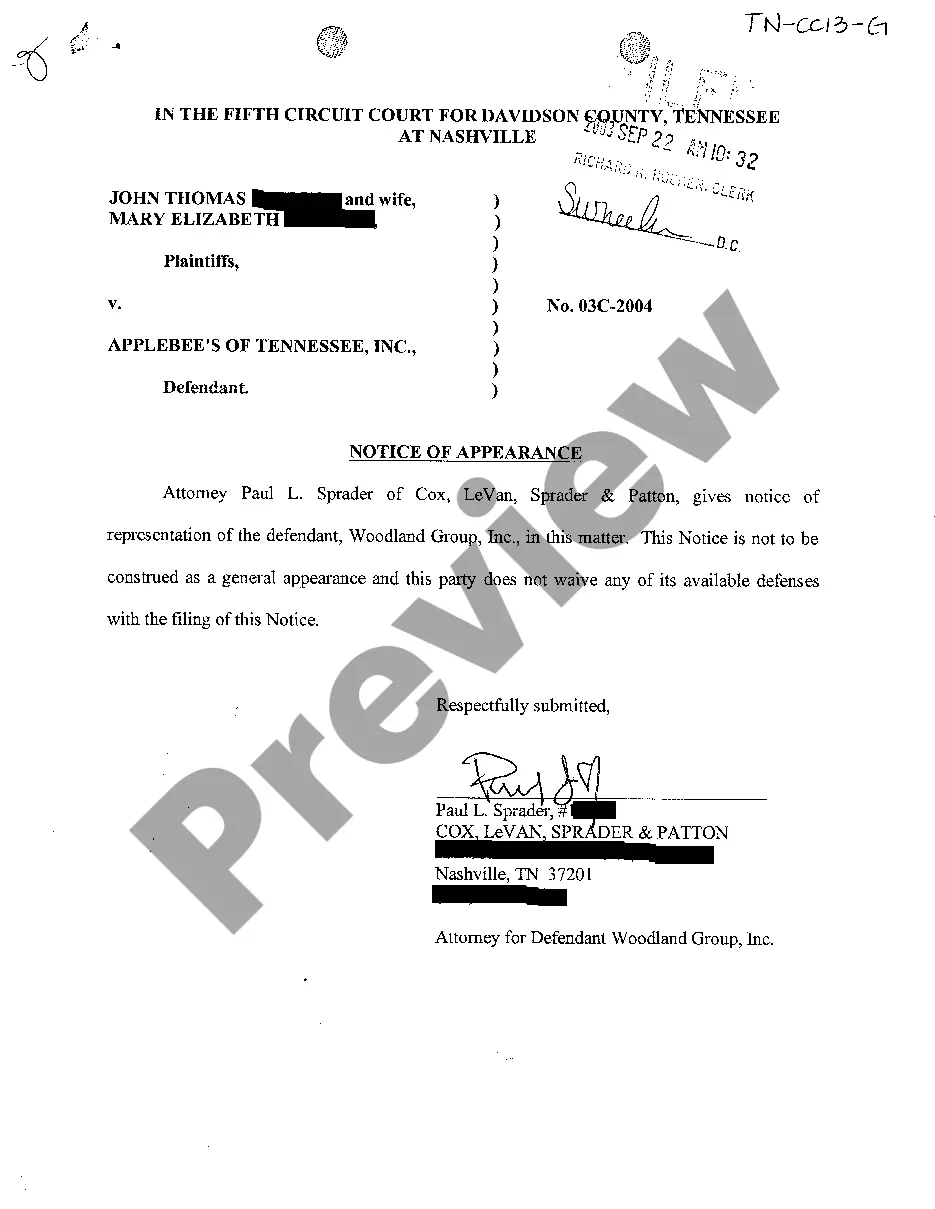

Independent Contractor Not Paid For Work

Description

How to fill out Self-Employed Independent Contractor Payment Schedule?

The Independent Contractor Not Compensated For Labor you see on this page is a versatile legal template crafted by expert attorneys in accordance with federal and state statutes and regulations.

For over 25 years, US Legal Forms has supplied individuals, organizations, and legal experts with more than 85,000 authenticated, state-specific documents for any commercial and personal scenario. It’s the quickest, easiest, and most trustworthy way to obtain the paperwork you require, as the service ensures the utmost level of data security and anti-malware safeguards.

Select the format you prefer for your Independent Contractor Not Compensated For Labor (PDF, DOCX, RTF) and download the example to your device.

- Explore the document you require and examine it.

- Search through the file you specified and preview it or evaluate the form description to confirm it meets your requirements. If it doesn’t, use the search feature to find the suitable one. Click Buy Now when you have found the template you need.

- Register and Log In.

- Choose the pricing option that fits your needs and create an account. Utilize PayPal or a debit/credit card to make an immediate payment. If you're already a member, Log In and review your subscription to proceed.

- Obtain the editable template.

Form popularity

FAQ

The Federal Fair Debt Collection Practices Act (FDCPA) and the Alaska Unfair Trade Practices and Consumer Protection Act prevent debt collectors from using unfair and deceptive practices when collecting a debt. These laws do not, however, forgive any legitimate debt you may owe.

The Fair Debt Collection Practices Act (FDCPA) is the main federal law that governs debt collection practices. The FDCPA prohibits debt collection companies from using abusive, unfair, or deceptive practices to collect debts from you.

Statute of limitations on debt for all states StateWrittenOpen-endedAlaska6 years3Arizona5 years3Arkansas6 years3California4 years446 more rows ? 19-Jul-2023

What are the provisions of the FDCPA? Call Time Restrictions. ... Honoring Workplace Opt-Outs. ... Honoring Home Phone Opt-Outs. ... Restrictions Against Harassment. ... Restrictions Against Unfair Practices. ... Restrictions Against False Lawsuit Threats.

How to Request Debt Verification. To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

The statute of limitations on debt in Alaska is generally three years (i.e., a breach of contract). Collection of medical bills also has a three year statute of limitations, unless the medical provider put a lien against you for the medical bills.