Agreement Self Employed Form With Gst

Description

How to fill out Dietitian Agreement - Self-Employed Independent Contractor?

Whether for commercial objectives or personal matters, everyone must confront legal circumstances at some point in their life.

Completing legal documents requires meticulous care, beginning with selecting the correct form template.

With a comprehensive US Legal Forms catalog available, you do not need to waste time searching for the suitable template across the web. Utilize the library’s user-friendly navigation to find the correct form for any situation.

- For example, if you select an incorrect version of the Agreement Self Employed Form With Gst, it will be denied upon submission.

- Thus, it is crucial to have a reliable source of legal documents like US Legal Forms.

- If you need to obtain an Agreement Self Employed Form With Gst template, follow these straightforward steps.

- Acquire the template you need by using the search bar or catalog navigation.

- Review the form’s details to ensure it suits your situation, state, and county.

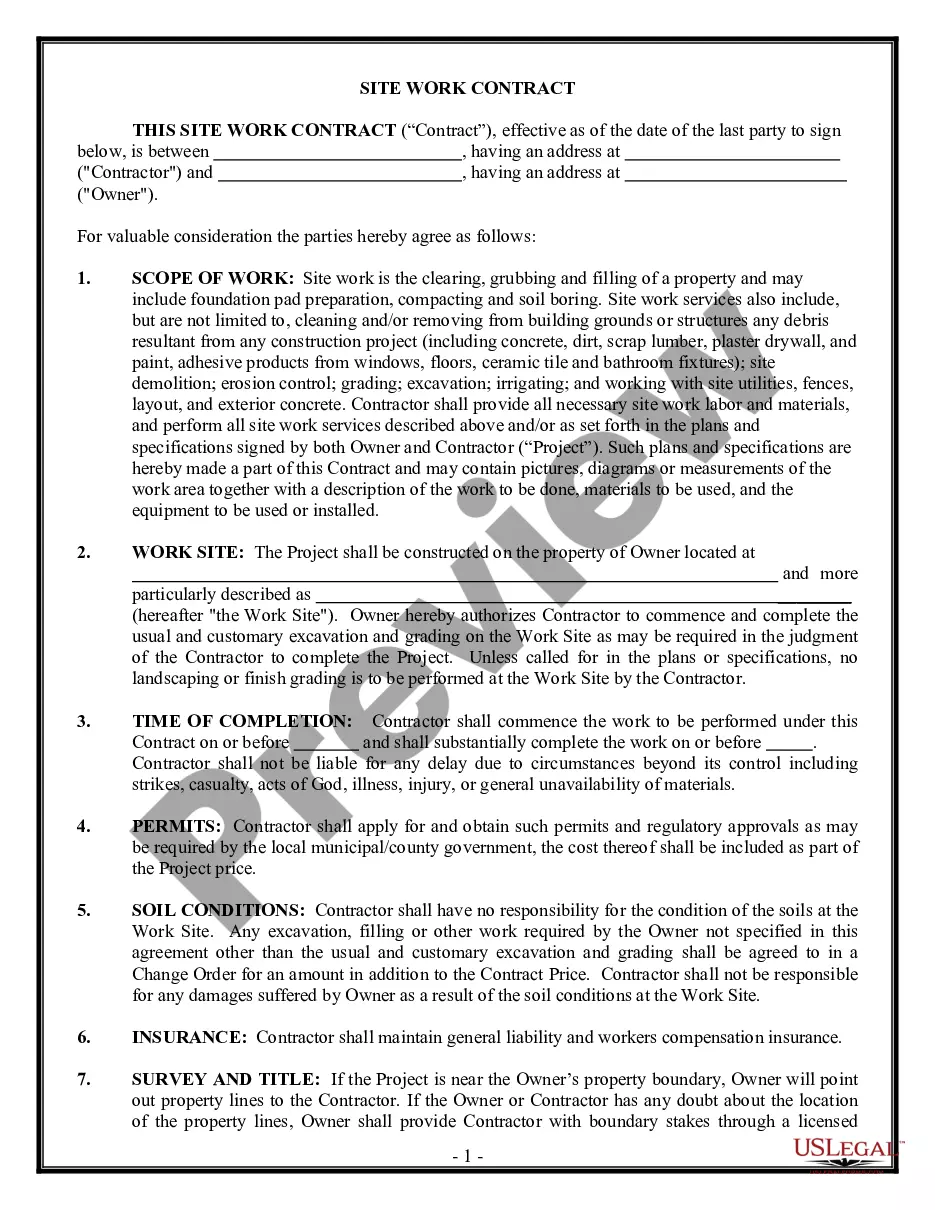

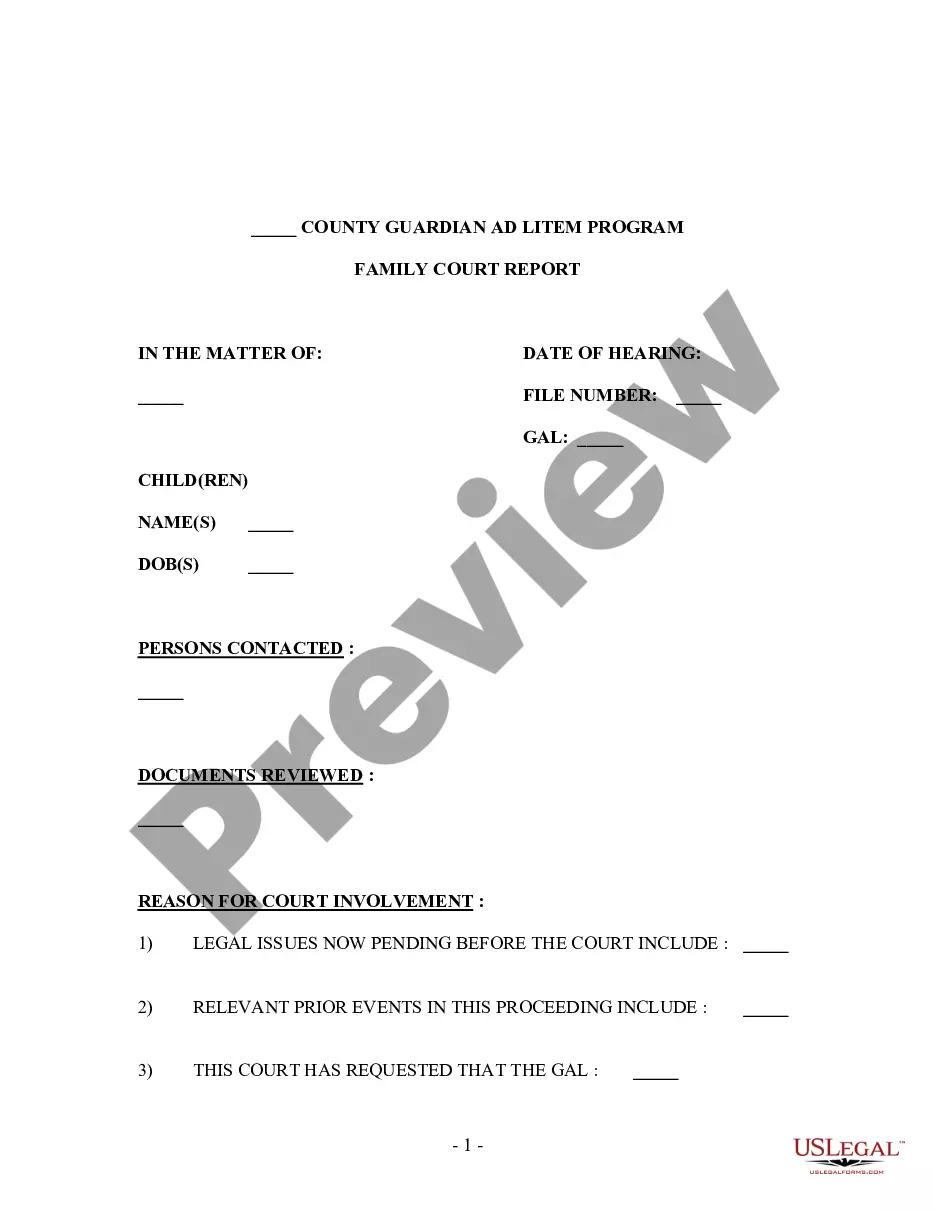

- Click on the form’s preview to inspect it.

- If it is the wrong document, return to the search feature to locate the Agreement Self Employed Form With Gst template you require.

- Obtain the file when it satisfies your requirements.

- If you have a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the document format you desire and download the Agreement Self Employed Form With Gst.

- Once it is downloaded, you can fill out the form with the aid of editing software or print it and complete it by hand.

Form popularity

FAQ

The GST limit for self-employed people typically hinges on their total annual revenue. If your earnings surpass this limit, you must register for GST and collect tax on your sales. It's crucial to stay informed about local regulations, as they can differ. Utilizing an Agreement self-employed form with GST can help you manage these aspects effectively.

Filing a self-employment form involves several straightforward steps. First, gather all relevant income and expense documentation. Next, complete the necessary forms, ensuring you include your GST details if applicable. Platforms like US Legal Forms provide templates, including the Agreement self-employed form with GST, making this process easier and more efficient.

The GST limit for self-employed individuals generally depends on the annual turnover. If your revenue exceeds a specific threshold, registration for GST becomes mandatory. To clarify, this limit varies by jurisdiction, so it's essential to check your local regulations. Using the Agreement self-employed form with GST can help ensure you comply with these requirements.

At its most basic, here is how to file self-employment taxes step-by-step. Calculate your income and expenses. That is a list of the money you've made, less the amount you've spent. ... Determine if you have a net profit or loss. Fill out an information return. ... Fill out a 1040 and other self-employment tax forms.

The goods and services tax (GST) is a tax of 10% on most goods and services sold in Australia. If you run a business, you are likely to have some GST obligations. your purchases for your business. This means, if your business is registered for the GST, your customers pay the cost you charge plus 10% extra.

GST calculation formula example: Say you are selling a commodity from Mumbai and sending it to Kolkata for Rs. 10,000, and the rate of GST applied on it is 12%. The GST amount applicable for it will be (10,000 x 12) / 100 = Rs. 1,200; and the net price will be Rs. 10,000 + Rs. 1,200 = Rs. 11,200.

Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more.

To calculate the net GST/HST to remit, multiply the amount from your taxable supplies (including the GST/HST) made during the reporting period by the applicable quick method remittance rate(s). The quick method remittance rates are less than the GST/HST rates of tax that you charge.