Agreement Self Employed Form With Example

Description

How to fill out Dietitian Agreement - Self-Employed Independent Contractor?

The Contract Self Employed Document With Sample you observe on this site is a reusable official template created by experienced attorneys in accordance with federal and state statutes and regulations.

For over 25 years, US Legal Forms has supplied individuals, entities, and legal practitioners with more than 85,000 authenticated, state-specific documents for any commercial and personal circumstance. It’s the quickest, most uncomplicated, and most dependable method to acquire the paperwork you require, as the service ensures bank-grade data security and anti-malware safeguards.

Choose the format you prefer for your Contract Self Employed Document With Sample (PDF, Word, RTF) and download the example onto your device.

- Search for the document you require and examine it.

- Browse through the example you looked for and view it or go over the form description to ensure it meets your needs. If it does not, utilize the search bar to locate the correct one. Click Buy Now when you have discovered the template you need.

- Register and Log In.

- Select the pricing option that fits you and set up an account. Utilize PayPal or a credit card to make an immediate payment. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the editable template.

Form popularity

FAQ

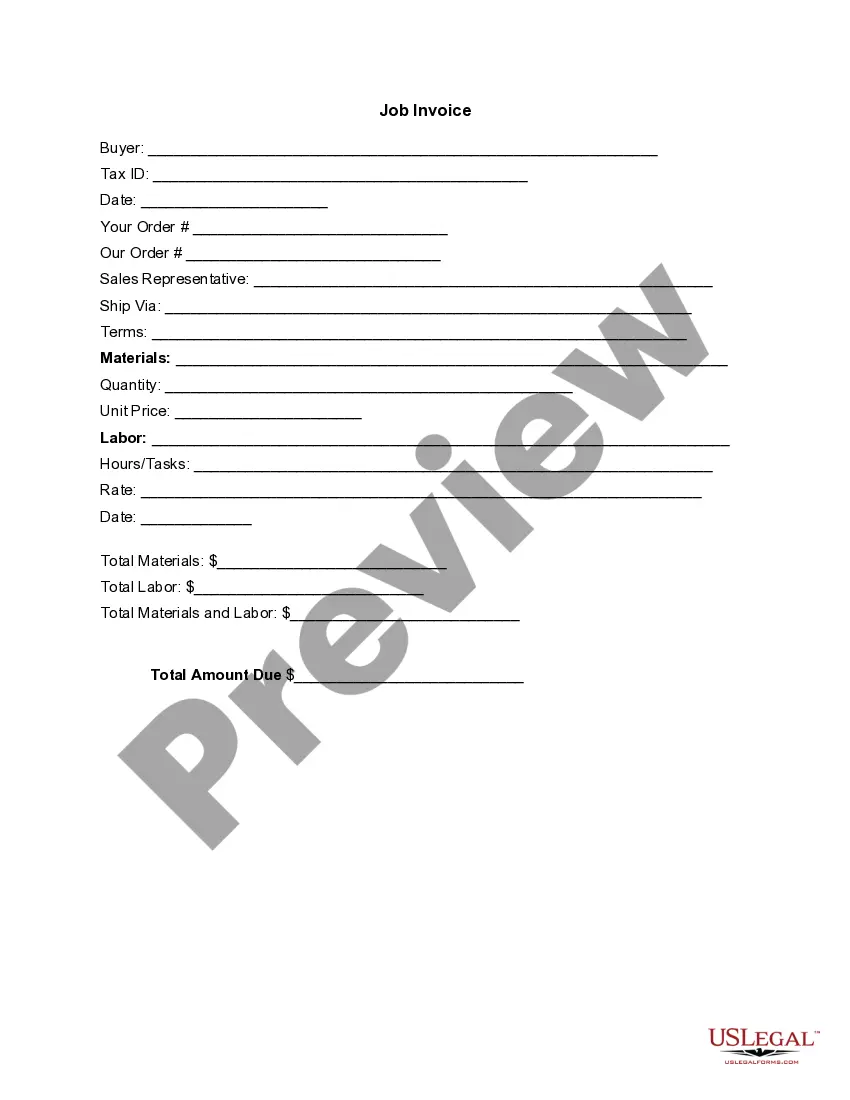

To write a self-employed contract, begin by clearly defining the scope of work and payment structure. It’s important to specify deadlines and responsibilities to avoid misunderstandings. Using an Agreement self employed form with example can help you structure your contract effectively. For added convenience, consider US Legal Forms, where you can find tailored templates that ensure you cover all essential aspects.

A basic 1099 agreement is a document that outlines the terms between a business and a self-employed contractor, typically for services rendered. This agreement often includes payment terms, work scope, and deadlines. An Agreement self employed form with example can guide you in creating a clear and effective contract. By using US Legal Forms, you can access customizable templates that meet your specific needs.

To create an employment agreement, start by outlining the key elements such as job title, responsibilities, compensation, and duration of employment. You can use an Agreement self employed form with example as a template to ensure you include all necessary details. Additionally, consider incorporating clauses related to confidentiality and termination to protect both parties. Utilizing platforms like US Legal Forms can simplify this process, providing you with professionally drafted templates.

You sell your old stuff as a business. You take care of pets. You work in rideshare. You deliver the goods. Rent your room. Earned valuable goods. Kickstart with crowdfunding. IRS documentation.

Service-provider (independent contractor): First name, middle initial, and last name. Social Security number. Address. Start date of contract (if no contract, date payments equal $600 or more) Amount of contract, including cents (if applicable) Contract expiration date (if applicable)

At its most basic, here is how to file self-employment taxes step-by-step. Calculate your income and expenses. That is a list of the money you've made, less the amount you've spent. ... Determine if you have a net profit or loss. Fill out an information return. ... Fill out a 1040 and other self-employment tax forms.

How to fill out a W-9 Enter your name. Write or type your full legal name as shown on your tax return. Enter your business name. ... Choose your federal tax classification. ... Choose your exemptions. ... Enter your street address. ... Enter the rest of your address. ... Enter your requester's information.

9 Form Instructions Line 1 ? Name. This should be your full name. ... Line 2 ? Business name. ... Line 3 ? Federal tax classification. ... Line 4 ? Exemptions. ... Lines 5 & 6 ? Address, city, state, and ZIP code. ... Line 7 ? Account number(s) ... Part I ? Taxpayer Identification Number (TIN) ... Part II ? Certification.