Land Property Use For Rent

Description

Form popularity

FAQ

Whether property rent is tax deductible depends on your specific situation. If you are a business utilizing rented property for operations, you may be able to deduct rent expenses when calculating taxable income. However, personal rent expenses are generally not deductible. Consulting with a tax expert can clarify any deductions related to your land property use for rent.

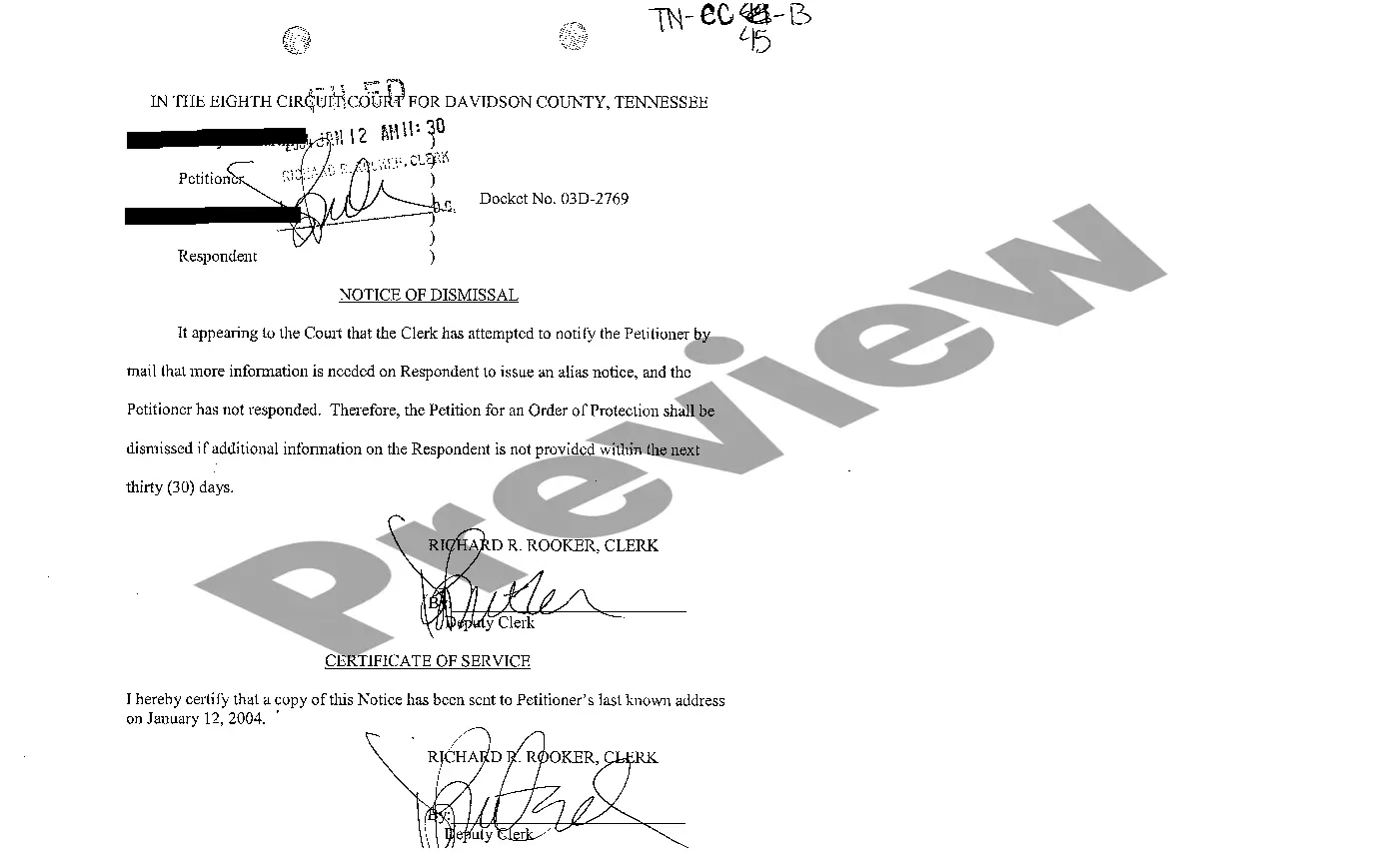

Land rent involves an agreement where a landowner allows another party to use their land property for a specified period, typically in exchange for payment. The terms of this arrangement can vary, including duration and payment structure. It’s crucial to have a written lease to clearly define obligations for both parties. Utilizing professional services, like those that uslegalforms offers, can help ensure your rental agreements are clear and legally binding.

You report farmland rental income on Schedule F of your federal tax return if it arises from farming operations. If your income comes from other sources, such as non-farming activities, you may need to report it on Schedule E. Accurate reporting of land property use for rent is essential for compliance. Keeping organized records can help streamline this reporting process.

Land rent itself is typically not tax deductible for the landowner. However, if you're a tenant paying rent for land property use for rent, you may have deductibles related to your business operations, depending on how the land is used. It’s crucial to keep precise documentation of all rental payments and operational costs. A tax advisor can assist in maximizing any eligible deductions.

Yes, farmland rent is generally considered taxable income. When you earn income from renting out land property for use, you need to report it on your tax return. It's essential to maintain accurate records of your rental agreements and payments to ensure you comply with tax regulations. Consulting with a tax professional can help clarify nuances related to farmland rental income.

To document rental property expenses, keep detailed records of all transactions related to land property use for rent. This includes receipts for repairs, maintenance, utilities, and property management fees. Additionally, using accounting software or a dedicated spreadsheet can simplify the tracking process, allowing you to categorize expenses easily. These records are vital for tax purposes and financial planning.

Yes, you can write off expenses associated with a vacant rental property, as long as it is available for rent. This includes costs like property insurance and maintenance. Keeping the property prepared for potential tenants maximizes your chances of earning income from your land property use for rent.

Typically, you can deduct certain rental expenses even if your property is vacant. Expenses such as mortgage interest, property taxes, and maintenance costs are often deductible, provided your property is held for land property use for rent. Always consult a tax professional to understand what qualifies as a deductible expense.

The length of time a rental property can remain vacant does not have a strict limit. However, it’s crucial to have a strategy in place to minimize vacancy rates, as prolonged vacancies can affect your overall income from land property use for rent. Utilize effective marketing techniques to attract tenants quickly.

You may face limitations when deducting your rental property losses due to IRS regulations. Typically, these restrictions depend on your income level and whether you actively participate in managing the property. Understanding these guidelines can help you navigate your land property use for rent more effectively.