Mortgage Loan with Navy Federal: A Comprehensive Overview Navy Federal Credit Union, one of the largest credit unions in the United States, provides a variety of mortgage loan options tailored to meet the diverse needs of its members. Offering competitive interest rates, flexible terms, and exceptional customer service, Navy Federal's mortgage loans are designed to help individuals and families achieve their dream of homeownership. Let's delve into the details of what a Navy Federal mortgage loan entails, including an overview of the different types available. 1. Fixed-Rate Mortgage Loan: A fixed-rate mortgage loan from Navy Federal allows borrowers to secure a stable interest rate and predictable monthly payments over a selected term, typically 15 to 30 years. This loan is ideal for those seeking long-term stability and predictable payments, as the interest rate remains constant throughout the loan term, regardless of market fluctuations. 2. Adjustable-Rate Mortgage (ARM) Loan: The Navy Federal ARM loan offers a lower introductory interest rate for an initial fixed period (e.g., 3, 5, 7, or 10 years), followed by periodic adjustments based on prevailing market rates. This loan type is suitable for individuals who plan to stay in their home for a shorter period or those seeking lower initial payments. Navy Federal provides comprehensive information and resources to help borrowers understand the potential adjustments and choose the ARM option that best suits their goals. 3. VA Home Loan: As a credit union founded by members of the military, Navy Federal is dedicated to serving those who've served. Therefore, they offer VA home loans, a benefit extended to qualified military service members, veterans, and eligible surviving spouses. With a VA home loan, borrowers can potentially secure 100% financing, without the need for a down payment or private mortgage insurance (PMI). Navy Federal guides their members through the VA loan process, ensuring they take full advantage of the benefits available to them. 4. Jumbo Loan: For those seeking to finance a high-value property above conforming loan limits, Navy Federal provides jumbo loans. These loans offer the necessary flexibility and competitive interest rates to support the purchase or refinance of high-cost properties. Borrowers can choose from fixed-rate and adjustable-rate jumbo loans depending on their preferences and financial situation. 5. Home Affordable Refinance Program (HARP): In an effort to assist homeowners with refinancing their mortgages, Navy Federal participates in the Home Affordable Refinance Program (HARP). This program helps borrowers who have remained current on their mortgage payments but are unable to refinance due to a decrease in home value or other financial challenges. The HARP program allows eligible members to refinance their existing loans to potentially achieve more favorable terms and lower monthly payments. Navy Federal Credit Union's mortgage loan options aim to accommodate the unique requirements and financial situations of its diverse membership base. Whether members are first-time homebuyers, military personnel, or homeowners seeking refinancing opportunities, Navy Federal provides extensive guidance, competitive rates, and exceptional customer service to ensure a smooth and successful homeownership journey.

Mortgage Loan With Navy Federal

Description

How to fill out Mortgage Loan With Navy Federal?

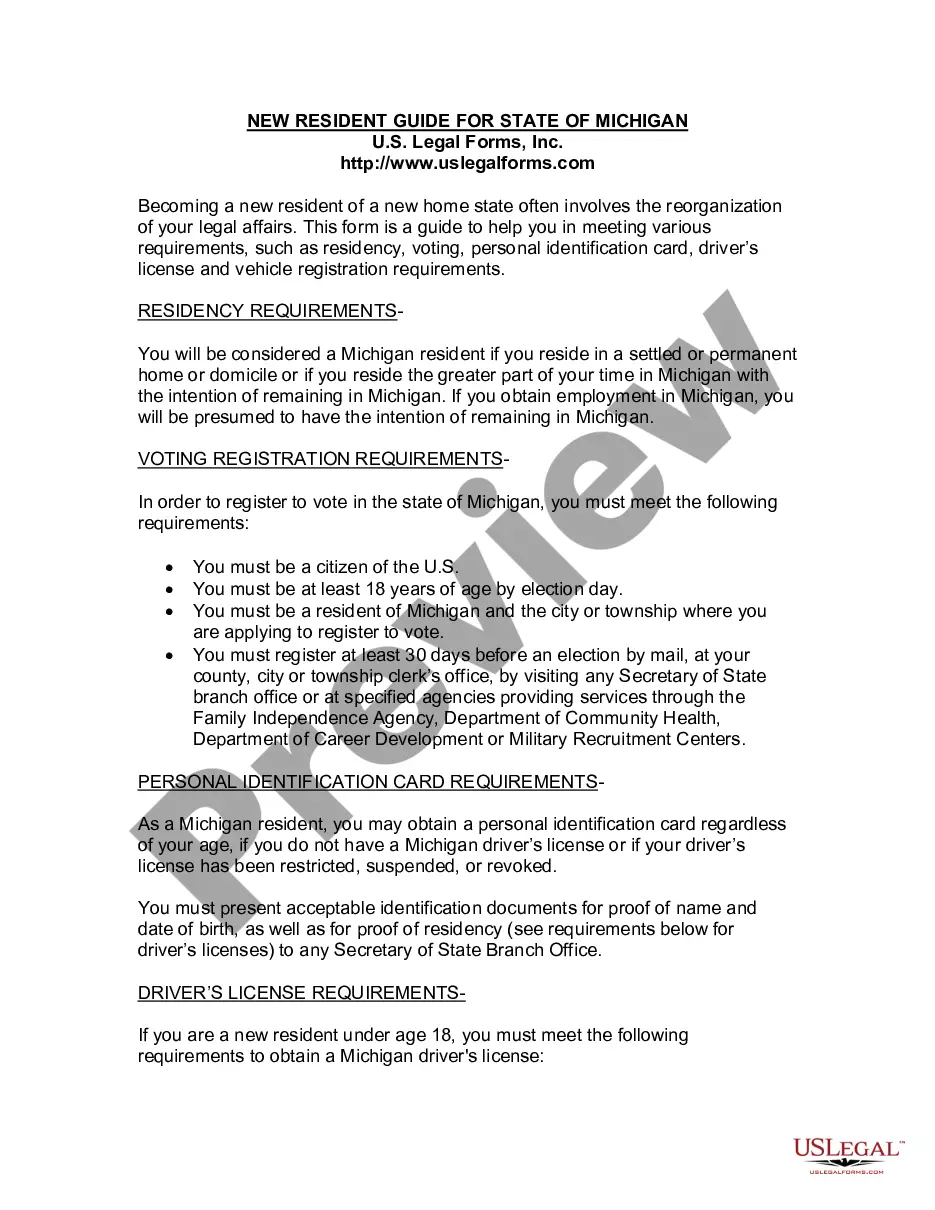

Locating a reliable source for the latest and suitable legal templates is half the battle in managing bureaucracy.

Identifying the correct legal documents necessitates accuracy and meticulousness, which is why it's essential to obtain Mortgage Loan With Navy Federal templates solely from credible sources, such as US Legal Forms. A faulty template may squander your time and postpone your urgent matters.

Eliminate the stress that comes with your legal documentation. Explore the expansive US Legal Forms catalog where you can discover legal templates, assess their applicability to your situation, and download them instantly.

- Use the library navigation or search function to find your template.

- Examine the form’s details to verify if it meets the criteria of your state and county.

- View the form preview, if available, to confirm that the template is indeed the one you wish to acquire.

- Return to the search to locate the appropriate template if the Mortgage Loan With Navy Federal does not fulfill your requirements.

- Once you're confident in the form’s relevance, download it.

- If you are a registered user, click Log in to validate and access your chosen forms in My documents.

- If you haven't created an account yet, click Buy now to purchase the form.

- Choose the pricing plan that caters to your needs.

- Continue to the registration to complete your acquisition.

- Conclude your purchase by selecting a payment option (credit card or PayPal).

- Choose the document format to download Mortgage Loan With Navy Federal.

- After acquiring the form, you can edit it with the editor or print it and fill it out manually.

Form popularity

FAQ

Every charitable corporation, unincorporated association, charitable trustee and other legal entities holding property for charitable purposes, must file with the Attorney General an initial registration form and other documents required by law.

California Nonprofit Filing Requirements IRS Form 990N. ... CA Franchise Tax Board Form 199N. ... CA Attorney General Form RRF-1. ... CA Secretary of State's Statement of Information.

Corporate bylaws are legally required in New York. ing to NY Bus Corp L § 601, corporate bylaws ?shall be adopted? by an organization's incorporator(s) at the initial organizational meeting. That means that in New York, you'll need to adopt bylaws to comply with the law.

The ?by? in bylaw is an old Norse word that means ?town.? A bylaw is simply a town, or local, law. Bylaws can't be created out of thin air. Canadian municipalities don't have constitutional status of their own, so they can only pass laws authorized by other levels of government.

Code 5056(a). A member is any person with governance rights. If there is no pressing reason for members, a corporation should avoid the additional hassle and choose not to have members. Note that if there are no members other than the directors, the corporation will be treated as having no members.

In California, you create a nonprofit by filing "articles of incorporation" with the Secretary of State's office and paying a filing fee. You'll also need corporate bylaws signed by the board of directors, though this document doesn't need to be filed with the Secretary of State.

Bylaws are laws that formalize rules made by a council or board. Local governments may use bylaws for various purposes, especially to regulate, prohibit or impose requirements. Bylaws are laws passed by municipal councils and regional district boards to exercise their statutory authority.

Nonprofit bylaws are legally required in California. Code § 5151 describes the information you should include when creating your initial bylaws.