Employee Retirement Form With Decimals

Description

How to fill out Employee Retirement Agreement?

Whether for business purposes or for individual affairs, everyone has to deal with legal situations sooner or later in their life. Completing legal papers needs careful attention, starting with selecting the correct form template. For example, when you select a wrong edition of the Employee Retirement Form With Decimals, it will be declined when you submit it. It is therefore important to have a trustworthy source of legal papers like US Legal Forms.

If you need to obtain a Employee Retirement Form With Decimals template, follow these simple steps:

- Get the template you need by utilizing the search field or catalog navigation.

- Look through the form’s description to make sure it fits your situation, state, and region.

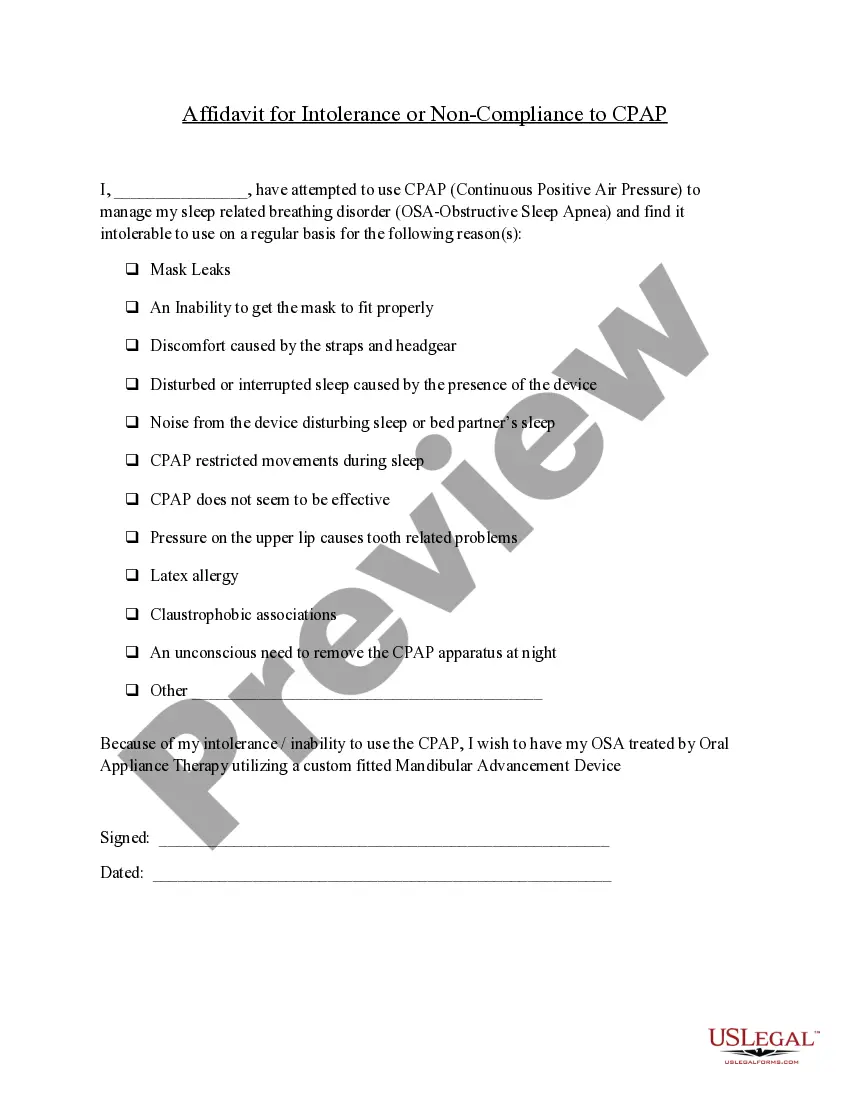

- Click on the form’s preview to examine it.

- If it is the wrong form, go back to the search function to locate the Employee Retirement Form With Decimals sample you need.

- Get the file if it matches your needs.

- If you have a US Legal Forms account, simply click Log in to access previously saved templates in My Forms.

- If you don’t have an account yet, you may obtain the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Pick your payment method: use a credit card or PayPal account.

- Select the file format you want and download the Employee Retirement Form With Decimals.

- After it is downloaded, you can complete the form by using editing software or print it and finish it manually.

With a vast US Legal Forms catalog at hand, you do not need to spend time looking for the appropriate template across the internet. Utilize the library’s easy navigation to find the proper form for any occasion.

Form popularity

FAQ

On line 5c, multiply taxable Medicare wages and tips by 0.029. You and your employee must both contribute 1.45% each paycheck for Medicare taxes.

The W-2 box 12 codes are: A ? Uncollected Social Security tax or Railroad Retirement Tax Act (RRTA) tax on tips. Include this tax on Form 1040 Schedule 2, line 13. B ? Uncollected Medicare tax on tips.

Ing to the IRS, ?fractions-of-cents? adjustments refer to the rounding differences related to the employee portions of Social Security and Medicare taxes.

Code DD is only information to you to tell you how much your employer spend for health coverage - you do nothing with it. Code D is the amount of salary deferrals to a 401(k) plan. You do nothing with than either other than enter it on the W-2 screen in box 12 just like it is on the paper W-2.