Stock Options Example

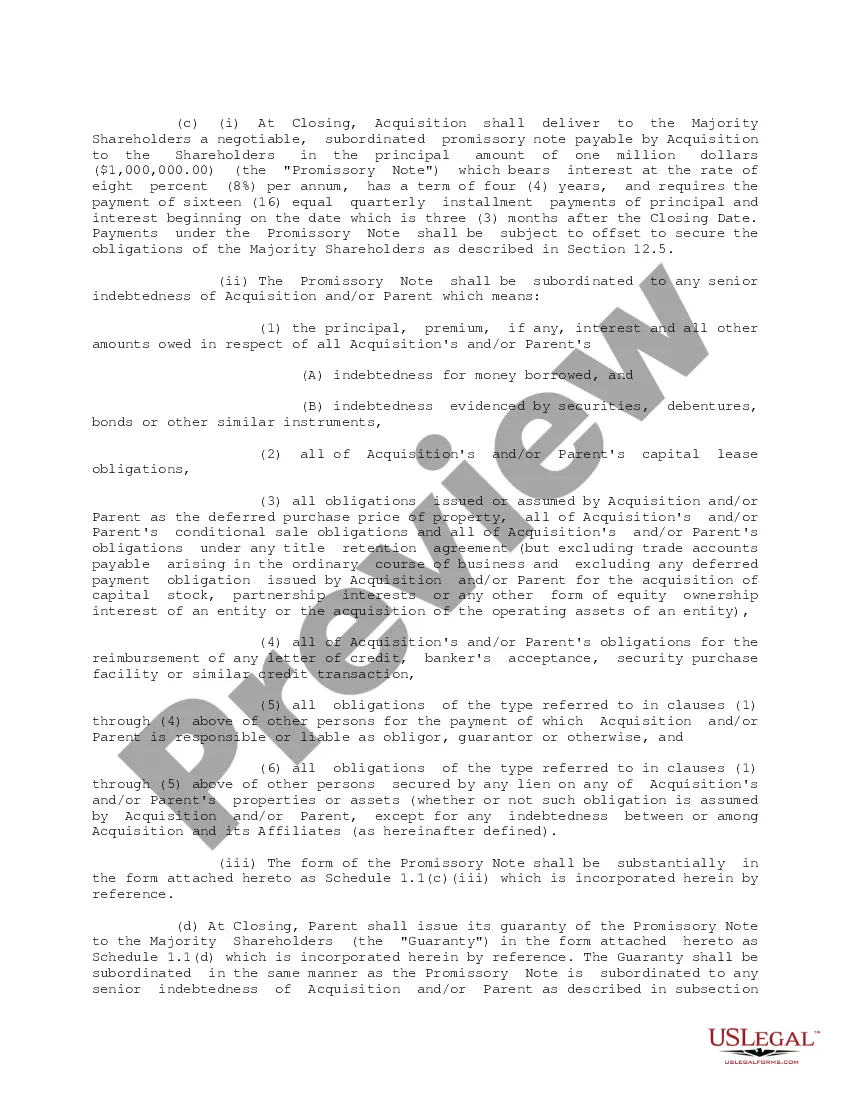

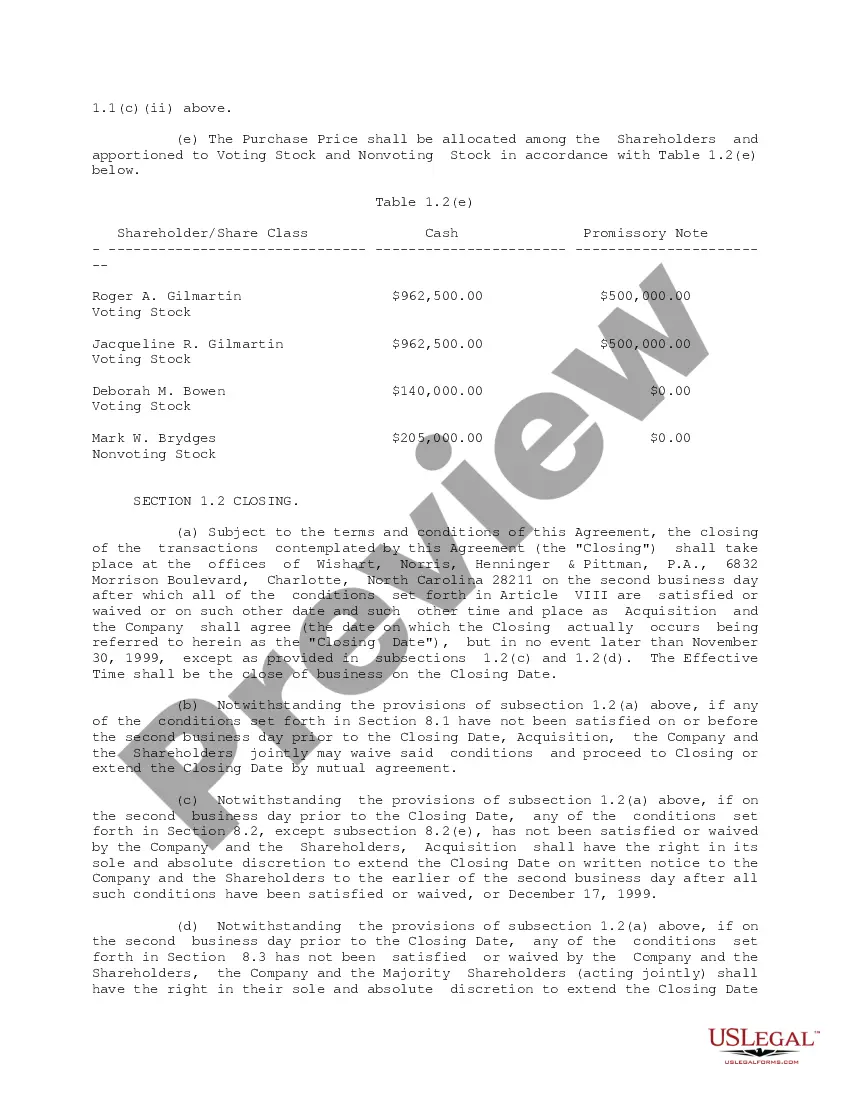

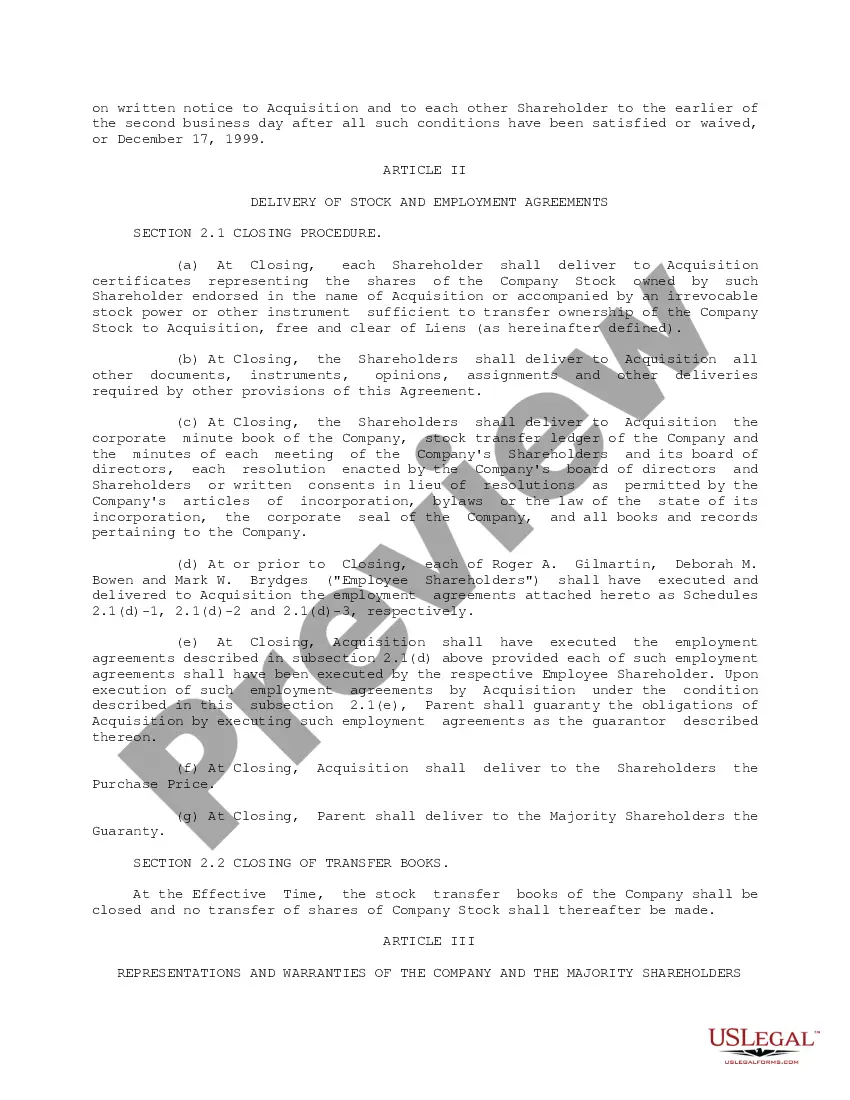

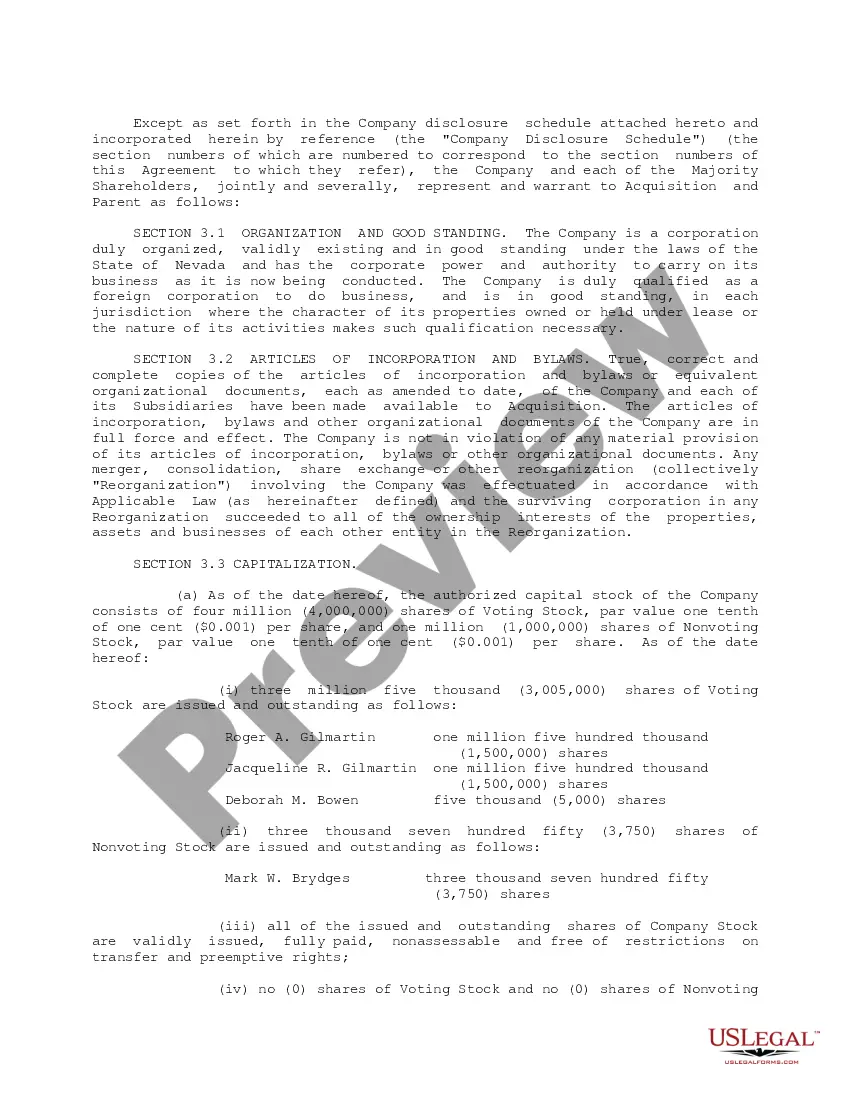

Description

How to fill out Sample Purchase And Sale Agreement Purchase And Sale Of Stock Between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp.?

- Log into your US Legal Forms account. If you're not a member yet, simply create a new account to get started.

- Browse through the Preview mode and review the form descriptions. Ensure that the selected form aligns with your local jurisdiction's requirements.

- If needed, utilize the search functionality to locate another template that meets your criteria.

- Once you've identified the correct document, click on the 'Buy Now' button. Choose a subscription plan that suits your needs.

- Complete your purchase by entering your payment details or opting for PayPal.

- Finally, download your completed form to your device. You can also access it in the 'My Forms' section anytime you require it.

By leveraging US Legal Forms, you're equipped with a robust collection of more than 85,000 forms, far exceeding what competitors offer. Plus, the ability to connect with premium experts ensures your documents are not only completed but also legally sound.

Take control of your legal needs today. Sign up for US Legal Forms and experience the ease of managing your documentation!

Form popularity

FAQ

A common stock option strategy is the covered call, which involves owning underlying shares while selling call options against them. This approach generates income from option premiums while potentially allowing for capital appreciation. Investors can leverage this strategy in their portfolio to enhance returns, making it a popular addition in stock options examples. It blends income generation with risk management effectively.

The 7% rule in stocks refers to a guideline suggesting that investors should not risk more than 7% of their total portfolio on a single investment. This strategy helps to manage risk while allowing for potential growth in your stock investments. By adhering to this rule, investors can maintain a balanced approach in their stock options examples. Diversifying investments also supports long-term financial health.

Typically, you will receive a Form 1099 when you sell stock acquired through options, as this form details your earnings. However, you may not receive one if you do not sell or exercise your options in the tax year. Keeping track of your transactions and utilizing a stock options example can guide you through the reporting process.

While stock options can offer considerable benefits, they also come with downsides. Market fluctuations can lead to losses, and there's always the risk that options may expire worthless. Understanding these risks through a stock options example will help you make informed decisions and weigh the pros and cons effectively.

To report income from stock options, you typically include it on your tax return in the year you exercise the options or sell the shares. In many cases, your employer will provide you with a Form 1099-B, which outlines the details of the transaction. Using a stock options example can clarify the calculations you need to make regarding gains and losses.

Determining the amount of stock options to grant employees depends on various factors, including company size, industry standards, and employee roles. It's crucial to assess both market practices and the value you want to deliver as incentives. A well-structured stock options example can guide you in making this strategic decision. Consider consulting with uslegalforms to develop compensation plans that align with your business goals.

Filing stock options usually involves reporting them on your tax return, particularly on Form 1040, based on the type of options you have. Ensure to gather records of option grants, exercise dates, and the fair market value at the time of exercise. Many people find that using a stock options example is helpful to determine which forms to complete. Seeking assistance from a compliant tax platform like uslegalforms can streamline this process.

Yes, stock options can be reported as income, but timing matters based on the type of options you hold. For non-qualified stock options, the income is typically recognized at exercise. In contrast, incentive stock options may not immediately result in taxable income until shares are sold. Keeping a stock options example at hand can shed light on when and how you would report such income.

The $100,000 rule refers to the limit set by the IRS on the amount of incentive stock options (ISOs) that can be granted to an employee in a calendar year. If the total value exceeds this limit when options are exercised, the excess will be taxed as ordinary income. Employees should know this limit when planning to exercise stock options. A good stock options example can illustrate how to manage this financial cap correctly.

When companies issue stock options, they must record them as expenses on financial statements using a method known as fair value accounting. For instance, a company might use the Black-Scholes model to calculate the market value of stock options. This amounts to the total expense being reflected over the vesting period. A proper stock options example clarifies how this impacts both financial performance and reported profits.